Get the free Nh-1041-es

Get, Create, Make and Sign nh-1041-es

Editing nh-1041-es online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nh-1041-es

How to fill out nh-1041-es

Who needs nh-1041-es?

NH-1041-ES Form: A Comprehensive Guide

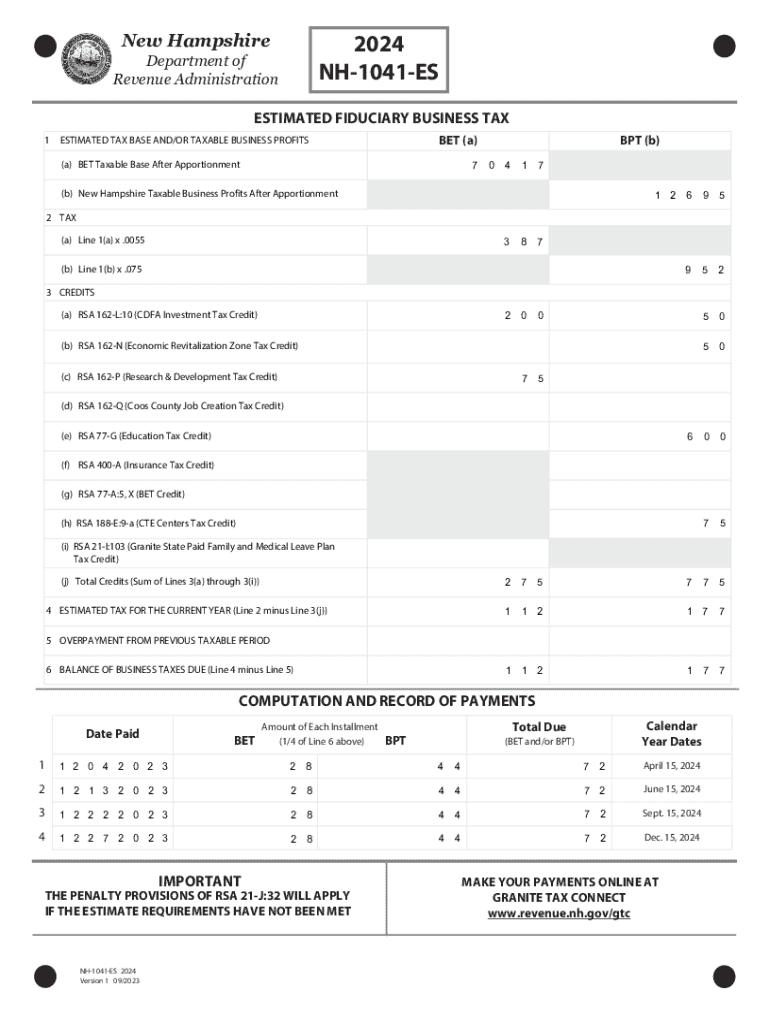

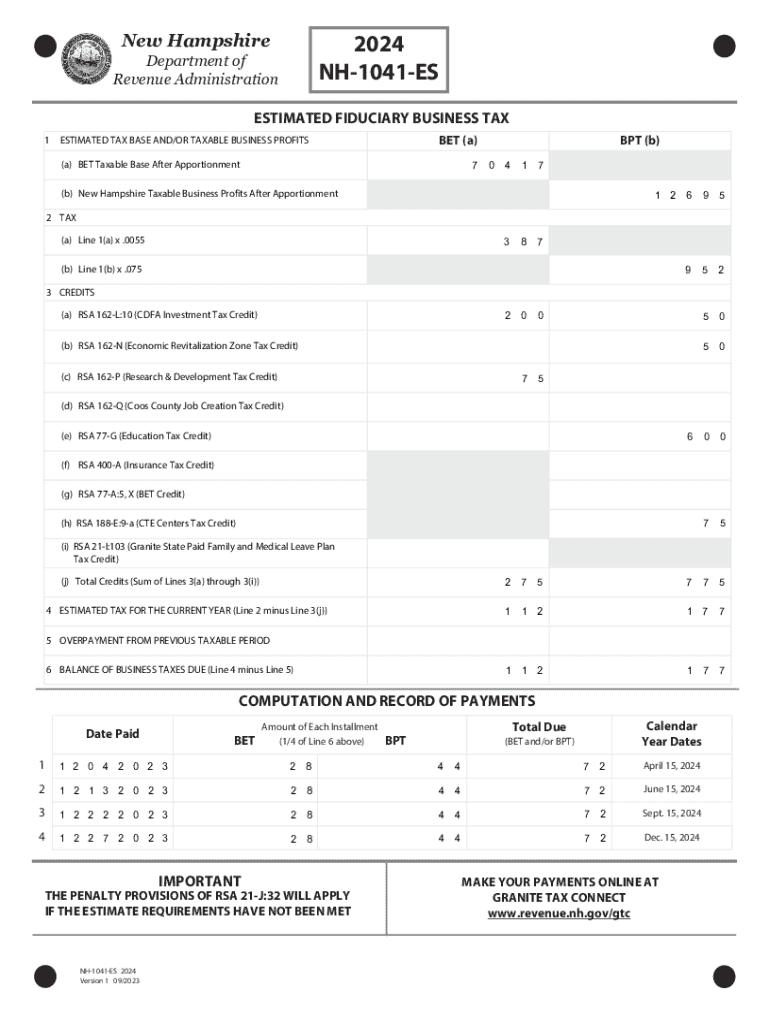

Overview of the NH-1041-ES Form

The NH-1041-ES Form is a crucial document for individuals engaged in self-employment or those who receive income not subject to withholding. It serves as a notice for estimated tax payments and is required to ensure that tax obligations are met throughout the year. This form allows taxpayers to pay their estimated tax liability in increments, thus avoiding a large payment come tax season.

Understanding the purpose and importance of the NH-1041-ES Form is vital for financial management. It helps avoid penalties associated with underpayment and ensures compliance with state tax laws. Typically used by freelancers, business owners, and investors, anyone expecting to owe more than a certain amount in taxes at the end of the year needs to file this form.

Authored by the New Hampshire Department of Revenue Administration, the NH-1041-ES Form not only helps taxpayers manage their finances but also assists in budgeting throughout the year. By understanding who requires this form, individuals can pinpoint their tax responsibilities more accurately, contributing to financial stability.

Understanding the NH-1041-ES Form details

The NH-1041-ES Form has several key sections that need attention. Each part of the form is designed to collect specific information necessary for accurate tax calculations. One of the primary components includes personal identification information, where individuals must enter their name, address, Social Security Number, and other identifying specifics.

The estimated tax calculation section is vital as it helps determine how much tax a taxpayer is anticipated to owe based on expected income, deductions, and credits. This calculation is essential to avoid both penalties and overpayments. Additionally, the payment methods and deadlines section specifies various options for submitting payments—be it online, by mail, or in person—with respective deadlines to ensure timely submissions.

Familiarizing oneself with common terms and definitions related to the NH-1041-ES Form is equally important. This understanding facilitates smoother communication and comprehension when dealing with tax matters.

Step-by-step instructions for filling out the NH-1041-ES Form

Filling out the NH-1041-ES Form can seem daunting, but a systematic approach can simplify the process. The first step involves gathering necessary information and documentation. Key documents include your recent income statements, prior year tax return, and any relevant financial records.

Once you have the necessary information, proceed to complete the personal information section accurately. This ensures there are no discrepancies in the tax authority’s records. Next, focus on calculating estimated taxes. You must analyze your income, deductions, and previous year’s tax rates, keeping in mind that accurate estimations can prevent post-filing issues.

The explanation of the calculation process is essential for clarity. This can include breakdowns of estimating self-employment tax if applicable, standard deductions one might qualify for, and reviewing specific New Hampshire tax guidelines.

Finally, choosing a payment method involves evaluating all available options; options range from direct bank transfers to credit card payments. Careful consideration of deadlines for payments will ensure adherence to regulations and timely processing.

Editing and managing the NH-1041-ES Form with pdfFiller

Using pdfFiller provides a flexible and user-friendly means to fill out the NH-1041-ES Form. With features designed for seamless document filling, users can edit fields without worrying about print quality or legibility. The form is accessible from anywhere, making it easy to manage documentation on the go.

Editing involves navigating through the form using simple clicks to enter or modify information. For those who need to make changes at later dates, pdfFiller allows easy updates, ensuring the form reflects the most accurate data. This online tool is not only efficient but also keeps track of your form history and versions, allowing access anytime.

Managing the NH-1041-ES Form effectively with pdfFiller not only saves time but also enhances productivity, allowing taxpayers to focus on other areas of their financial planning.

eSigning the NH-1041-ES Form

eSigning the NH-1041-ES Form using pdfFiller provides significant advantages. Electronic signatures are legally binding and enable a more streamlined submission process. They also eliminate the delays related to printing, signing, and mailing physical documents.

To eSign your NH-1041-ES Form, simply follow step-by-step instructions provided by pdfFiller’s intuitive interface. This process includes entering your name, selecting a signature format, and clicking to apply your eSignature directly on the document. Legal considerations are minimal for eSignatures as they hold the same weight as traditional signatures.

Understanding these benefits helps facilitate compliance and encourages users to embrace modern methods of document handling.

Frequently asked questions (FAQs) about the NH-1041-ES Form

When dealing with the NH-1041-ES Form, numerous questions often arise. One common concern is what to do if you make a mistake on the form. Should this happen, it is advisable to amend the form as soon as possible to avoid discrepancies with tax authorities. Fortunately, this can usually be done easily through the pdfFiller platform.

Another frequent inquiry pertains to deadlines. Knowing the submission date is crucial; the NH-1041-ES Form typically aligns with quarterly estimated tax payments, adding precision to tax management. Additionally, individuals question what happens if they don’t file the form. Non-compliance can lead to penalties, including fines and interest.

Clarifying these concerns ahead of time can alleviate anxiety during tax season, leading to better preparation and compliance.

Related documentation and forms

Familiarizing yourself with forms related to the NH-1041-ES is equally essential for comprehensive tax management. Additional documents may include the NH-1040 for yearly income tax return or NH-1041 for fiduciary tax purposes. Each of these documents serves specific tax obligations and, when utilized correctly, aids in minimizing liabilities.

Using pdfFiller can simplify accessing and managing related documents. The platform allows users to search for and organize various forms under one roof, making it easier to handle multiple tax documents effortlessly.

Being well-informed about related documentation helps taxpayers streamline their filing processes, ensuring nothing falls through the cracks.

Tools for efficient tax management

Utilizing interactive tools available on pdfFiller can significantly enhance tax management efficiency. Such tools offer features for organizing documents, setting reminders for payments, and collaborating with financial advisors or accountants. Maintaining an organized approach to tax season reduces stress and improves accuracy.

Integrating these tools allows users to have real-time access to documents and the ability to track changes. Keeping abreast of deadlines and payments ensures that tax management is as painless as possible, leading to a better overall experience.

Embracing modern tools helps taxpayers navigate their responsibilities effectively, empowering them to stay ahead during tax season.

Additional support and resources

Accessing the right support and resources is critical for ensuring successful management of the NH-1041-ES Form. If you require assistance, pdfFiller offers dedicated customer support that can guide users through various filing processes. This additional support resource can answer queries and provide help with technical issues.

Beyond direct support, other resources such as official state tax websites and financial planning articles can offer invaluable insights into tax obligations. Turning to these sources allows individuals to make informed decisions and better understand their tax responsibilities.

With the right support, managing the NH-1041-ES Form becomes not only feasible but also a strategic advantage when navigating the complexities of tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my nh-1041-es in Gmail?

How can I fill out nh-1041-es on an iOS device?

Can I edit nh-1041-es on an Android device?

What is nh-1041-es?

Who is required to file nh-1041-es?

How to fill out nh-1041-es?

What is the purpose of nh-1041-es?

What information must be reported on nh-1041-es?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.