Get the free Nonresident Withholding Allocation Worksheet - California Form 587

Get, Create, Make and Sign nonresident withholding allocation worksheet

How to edit nonresident withholding allocation worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonresident withholding allocation worksheet

How to fill out nonresident withholding allocation worksheet

Who needs nonresident withholding allocation worksheet?

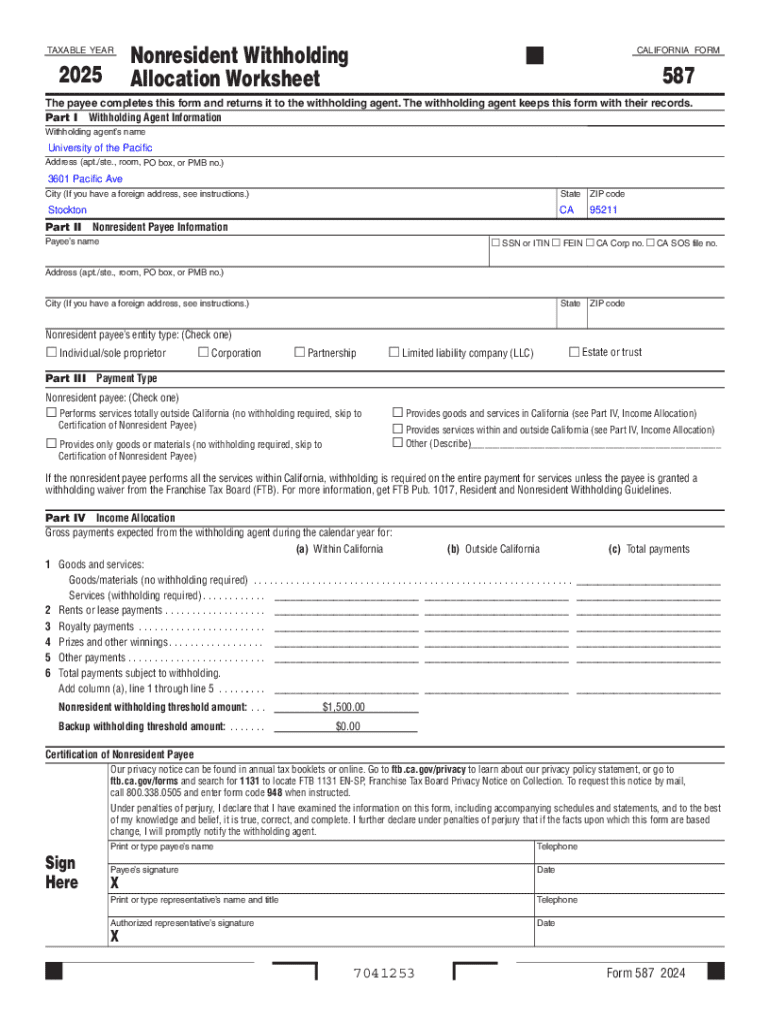

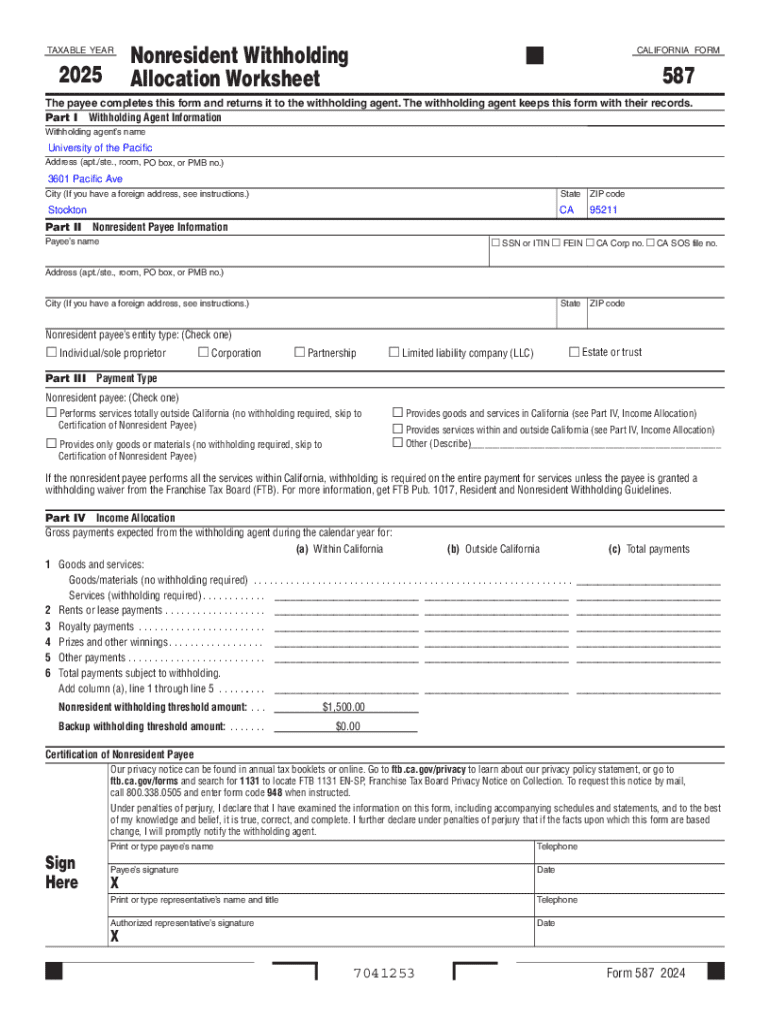

Understanding the Nonresident Withholding Allocation Worksheet Form

Overview of the nonresident withholding allocation worksheet

The nonresident withholding allocation worksheet form plays a critical role in the tax ecosystem for nonresidents who earn income from sources within a specific jurisdiction. This form is primarily designed to allocate the correct amount of withholding tax required from the payments made to nonresidents, ensuring compliance with tax regulations. Its proper completion is pivotal, as it helps both withholding agents and payees mitigate the risk of under-withholding or over-withholding, which can significantly impact tax liabilities.

Understanding key terminology such as 'withholding agent', 'nonresident payee', and 'income allocation' is essential. A withholding agent is typically the entity responsible for making payments that require withholding, while a nonresident payee is an individual or business receiving those payments without being liable to pay taxes in the payer’s jurisdiction. Familiarity with these concepts will aid in completing the worksheet accurately.

When to use the nonresident withholding allocation worksheet

Certain scenarios trigger the necessity for completing the nonresident withholding allocation worksheet. For instance, if a U.S. entity pays a nonresident foreign individual for services performed within the U.S., the entity must use this worksheet to determine the appropriate withholding amount. Additionally, payments for royalties, interest, or dividends to nonresidents would require similar documentation.

Moreover, nonresidents must meet specific eligibility criteria to ensure that their income is subject to proper withholding procedures. This includes establishing their residency status for tax purposes and identifying the type of income they receive. When filing tax documents, these criteria directly influence tax liabilities, making the completion of this worksheet crucial for compliance.

Requirements for completing the worksheet

To adequately fill out the nonresident withholding allocation worksheet, certain information is essential. Gather documentation proving the residency status of the nonresident payee, details of the income types involved, and identification numbers. Failing to provide accurate data can lead to delays or penalties, and nonresidents should disclose all relevant information to avoid common mistakes such as misclassifying income types or neglecting to include all taxable amounts.

Common errors include incorrect identification of income types and failure to update residency information. Nonresidents should frequently review the requirements as tax laws may change, ensuring compliance with the latest directives.

Detailed instructions for each section of the worksheet

Part : Withholding agent information

This section requires the withholding agent's name, address, and taxpayer identification number. Accuracy is crucial here to prevent delays in tax processing. Verify that all information matches official records, as discrepancies can lead to unnecessary complications during compliance checks.

Part : Nonresident payee information

Details from the nonresident payee must include their name, address, and TIN. It's vital to ensure that this information is accurate as any errors could result in improperly withheld taxes and potential penalties for both the payee and withholding agent. Cross-reference identification data with official documents to confirm correctness.

Part : Payment type

Indicate the type of payment being made, as each may be subject to different withholding rates. Examples include compensation for services, royalties, and dividends, each carrying unique tax implications. Declare all types properly to ensure compliance.

Part : Income allocation

This part involves allocating income based on specific guidelines. It's essential to understand the nature of each payment and how it relates to the nonresident to allocate it correctly. For clarity, consider examples: if a nonresident provides consulting services within the jurisdiction, allocate the associated income from those services accordingly. Misallocating income not only impacts compliance but can also lead to financial discrepancies for the payee.

Exceptions and special cases

There are various exceptions to withholding requirements that users should be aware of. For example, payments to foreign governments or international organizations may be exempt from withholding tax. Additionally, some treaties can provide exemptions or reduced rates for specific types of income, depending on the nonresident's country of origin.

In special situations, it’s essential to document the basis for claiming an exception. This might involve obtaining certifications from the payee or referencing tax treaties. It’s advisable to retain copies of all supporting documents, as they may be required during audits or inquiries from tax authorities.

Waivers and reductions

Nonresidents may qualify for waivers or reductions on withholding based on certain criteria. To claim these, applicants must submit required documentation to the tax authority, detailing the basis for the request. It's critical to ensure that all waivers are documented correctly, as errors or missing information can lead to denial of the waiver request.

Considerations such as the nature of the income, the residency status, and any relevant tax treaties should be fully explored before submitting a request for a waiver. Understanding these factors can significantly streamline the process and enhance the likelihood of approval.

Requirement to file a California tax return

Nonresidents who have received payments subject to withholding might also be required to file a California tax return. For example, if a nonresident has income exceeding a certain threshold from California sources, they must file a return, regardless of withholding. This is particularly relevant during tax season, where understanding one’s obligations can impact overall tax liability.

Impact on tax liability can be contingent upon the amount withheld versus the total income. Nonresidents must assess their total tax situation, factoring in any credits or deductions available. Accurate withholding serves as a prepayment of taxes but does not eradicate the obligation to file if thresholds are crossed.

How to claim nonwage withholding credit

To claim the nonwage withholding credit, nonresidents must file specific forms along with their tax return. Proper documentation of the withholding amounts is essential, reflecting what was withheld and the corresponding income types. Using these documents ensures accuracy in claiming credits, preventing potential disputes with tax authorities.

Common mistakes include missing documentation or over-reporting amounts withheld. Nonresidents should approach this process meticulously, as errors in credit claims may raise red flags with auditors.

Internet and telephone assistance

Accessing additional resources is critical for users working through the nonresident withholding allocation worksheet. Several agencies provide guidance and can assist with any uncertainties involved in form completion or tax obligations. Through relevant tax authority websites and dedicated helplines, individuals can seek clarity.

A robust FAQ section can also be invaluable, addressing common concerns and misconceptions about filing obligations and the withholding process.

Certification of nonresident payee

The certification process for a nonresident payee is crucial for establishing the proper withholding rate. Obtaining a completed W-8 series form from the nonresident payee serves this purpose, confirming their status and enabling the correctly withheld amounts. Certification ensures that both parties are aligned on tax obligations and helps prevent any potential disputes down the line.

Completing and submitting the certification should be treated with diligence. It's essential that the nonresident pays attention to the details filled in and understands their ramifications. Inaccuracies or omissions can lead to serious tax implications, making it vital to adhere to all guidelines.

Interactive tools and resources on pdfFiller

pdfFiller offers a range of interactive tools designed to simplify the completion of the nonresident withholding allocation worksheet. Users can access step-by-step guidance through the platform, ensuring that each section is filled out correctly without missing essential details. These resources empower individuals and teams to manage their documentation efficiently, reflecting the cloud-based solutions provided by pdfFiller.

Editable versions of the form are readily available, allowing users to type directly into the document. Furthermore, eSigning features expedite processing, enabling rapid submission once all fields are accurately filled. This ensures that all stakeholders can interact with documents in real-time, facilitating collaboration and adherence to deadlines.

Help us improve our website

Feedback mechanisms are integrated into pdfFiller’s platform, allowing users to communicate their experiences and suggestions. This is essential as user input drives continuous improvement, ensuring that the platform evolves to meet the needs of its diverse user base. Engaging with the pdfFiller community not only enhances user experience but also fosters a collaborative environment for document management solutions.

By sharing insights and experiences, users play a vital role in shaping the future of the platform. Active participation in feedback loops can lead to enhancements that directly benefit the functionality and ease of use for all pdfFiller users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nonresident withholding allocation worksheet from Google Drive?

How do I edit nonresident withholding allocation worksheet on an iOS device?

How do I edit nonresident withholding allocation worksheet on an Android device?

What is nonresident withholding allocation worksheet?

Who is required to file nonresident withholding allocation worksheet?

How to fill out nonresident withholding allocation worksheet?

What is the purpose of nonresident withholding allocation worksheet?

What information must be reported on nonresident withholding allocation worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.