Get the free Municipal Income Tax Return Preparation Form - germantown oh

Get, Create, Make and Sign municipal income tax return

How to edit municipal income tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out municipal income tax return

How to fill out municipal income tax return

Who needs municipal income tax return?

Municipal Income Tax Return Form - How-to Guide Long-Read

Overview of municipal income tax return

Municipal income tax, levied by local municipalities, is essential for funding community services such as infrastructure, schools, and public safety. Unlike state income taxes, which are implemented at a broader level, municipal income taxes are specific to cities or regions, reflecting local economic conditions and funding needs. Understanding the significance of municipal income tax return forms is crucial for residents and non-residents engaged in employment within those municipalities.

Residents and businesses within the boundaries of a municipality must comprehend their filing obligations. This section outlines who specifically must file based on their residency status and income sources.

Types of municipal income tax returns

Municipal income tax returns are primarily categorized into two types: those for residents and non-residents. Understanding these categories is crucial for accurate reporting. Resident municipal income tax returns apply to individuals living within the municipality, while non-resident municipal income tax returns are meant for those who work in the municipality but maintain residence elsewhere.

It's important to stay informed about yearly updates or changes in regulations, as this can impact eligibility for deductions and filing requirements.

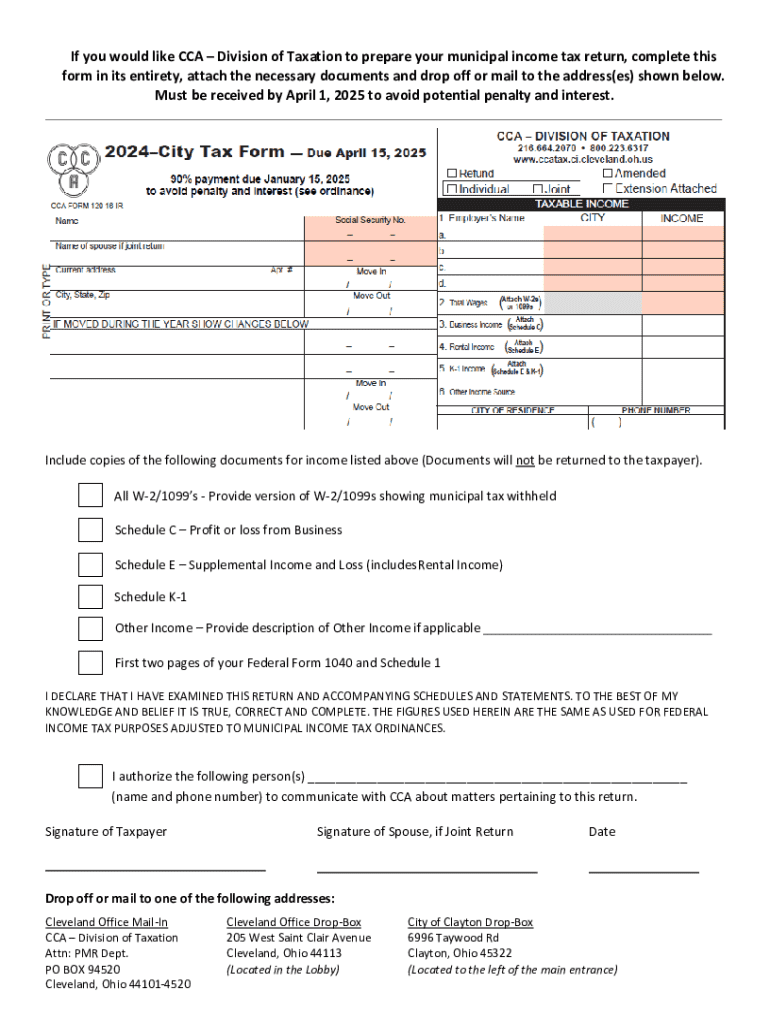

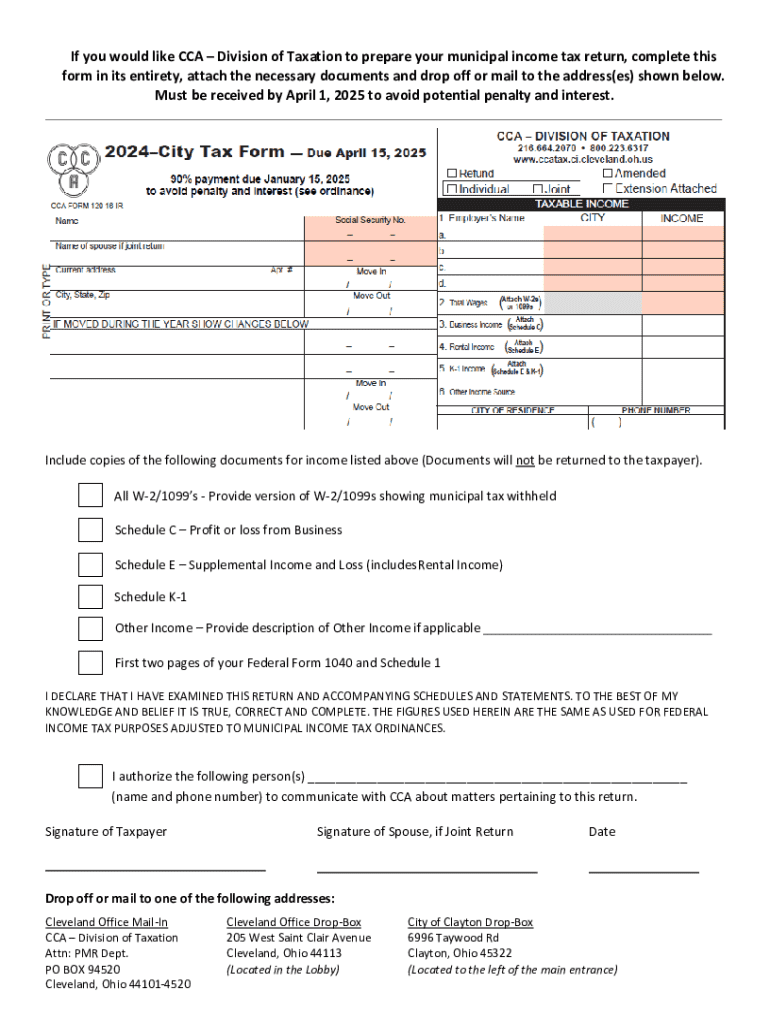

Key components of the municipal income tax return form

The municipal income tax return form includes several critical components that must be accurately filled out. Starting with personal identification information, the form requires basic details such as name, mailing address, and Social Security number to ensure proper identification of the filer.

Next, income reporting includes wages, salaries, and other sources of income. This would also encompass self-employment earnings for freelancers or business owners. Deductions and credits available at the municipal level vary, including options for standard deductions and itemized deductions, allowing filers to maximize their refund or minimize their owed tax.

Lastly, calculation of tax owed or refunds due is straightforward, provided the form is completed accurately, ensuring that filers receive what they are entitled to from their tax payments.

Step-by-step instructions for filling out the municipal income tax return form

Before diving into the filling out process, gather all necessary documents. This includes W-2 forms and 1099s indicating any income received in the municipal area. Accurate documentation is the backbone of a successful filing experience.

Common mistakes often stem from incorrect calculations or failing to include all necessary income. Double-checking entries can prevent future audits or penalties, ensuring that the payment process is smoother.

Tools and resources for managing your municipal income tax return

pdfFiller offers a suite of tools to streamline your municipal income tax return experience. With interactive document features, users can e-sign their returns quickly, making submission a breeze. The platform also supports collaborative efforts when filing as a team, allowing multiple contributors to work seamlessly.

Cloud-based features of pdfFiller mean that users can access and edit their forms from anywhere, at any time. This can be particularly useful for busy professionals or teams managing multiple returns. Additionally, pdfFiller hosts an extensive FAQ section tackling common queries regarding municipal income tax.

Filing your municipal income tax return

Once completed, it’s vital to understand the submission methods available for your municipal income tax return. Options typically include electronic filing for convenience, and paper filing, which may be preferred by some individuals. Each municipality may have its specific instructions and requirements, often found on their tax office website.

Deadlines can vary; typically, municipal returns follow the same timeline as federal or state returns. Late filings can incur significant penalties, so awareness of the due date is essential.

Post-submission actions

After filing, taxpayers should track their submission status to ensure that it has been received and processed correctly. Municipal tax offices often offer online tracking for this purpose. In cases where mistakes arise or adjustments are needed, knowing how to file an amended return helps maintain compliance and accuracy.

Expect timely feedback on issues related to refunds or further payments. Keeping documents organized can ease this process.

Understanding municipal tax refunds and audits

Understanding the municipal tax refund process can ease concerns about filing correctly. Generally, refunds are issued after the municipality has confirmed the submitted return's accuracy. Proper filing and timely submission usually result in quicker refunds.

Preparing for potential audits involves organization and clarity in your filings, ensuring that all provided information can be supported by appropriate documentation.

Assistance and support

Employing various resources for assistance can be invaluable during the filing process. Contacting your local municipal tax office can provide insight into specific questions or concerns regarding your returns. Most municipalities now have dedicated resources to assist taxpayers, streamlining the information gathering process.

Additionally, utilizing the comprehensive support features from pdfFiller, such as step-by-step video tutorials and immediate chat options, can significantly enhance your filing experience. These tools guide users through complex processes while providing real-time feedback.

Conclusion: simplifying your municipal income tax journey

Efficiently managing your municipal income tax return begins with leveraging platforms like pdfFiller. Utilizing cloud solutions ensures that documents can be created, edited, and shared effortlessly. With proper understanding and tools at your disposal, your municipal income tax journey can be made significantly less daunting.

Incorporating these modern approaches enhances your filing experience, driving both accuracy and efficiency. Embracing such document management solutions will prepare you not only for this tax season but all future obligations as well.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my municipal income tax return in Gmail?

How do I edit municipal income tax return straight from my smartphone?

How do I fill out municipal income tax return on an Android device?

What is municipal income tax return?

Who is required to file municipal income tax return?

How to fill out municipal income tax return?

What is the purpose of municipal income tax return?

What information must be reported on municipal income tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.