Get the free in Re Estate of Barbara Jean Huff

Get, Create, Make and Sign in re estate of

How to edit in re estate of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out in re estate of

How to fill out in re estate of

Who needs in re estate of?

In re estate of form: A comprehensive guide to estate documentation

Understanding the "In Re Estate of" concept

The term 'In re estate of' refers to court proceedings concerning someone's estate after their passing. It establishes the jurisdiction of the state over the decedent's estate matters, ensuring that their debts are settled and assets distributed according to the law or the deceased’s wishes. This process is crucial because it provides a legal framework for handling sensitive and often complex issues related to inheritance.

Legal contexts often trigger the use of 'In re estate of' forms when initiating probate, validating wills, or addressing claims against the estate. Courts need to confirm that all legal processes related to the estate are handled correctly. For many, the nuances of estate law can be overwhelming, particularly when emotions are high, making clear definitions and procedures all the more vital.

Key components of the "In Re Estate of" form

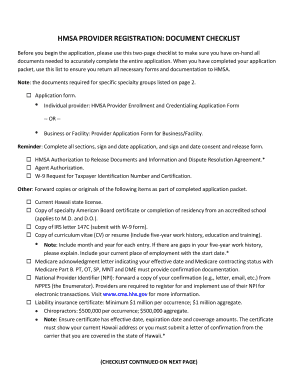

Completing the 'In re estate of' form correctly is essential to ensure a smooth probate process. This form typically requires detailed information about the decedent, including their full name, date of birth, and date of death. Additionally, the executor or administrator assigned to manage the estate must provide their contact details and relationship to the deceased.

Supporting legal documents play a pivotal role in completing the form. Essential attachments often include death certificates, which validate the passing of the individual, as well as any wills or trusts that detail the deceased's wishes. Proper submission of these documents is crucial for the approval of the 'In re estate of' filing.

Step-by-step guide to completing the "In Re Estate of" form

Completing the 'In re estate of' form can seem daunting, but a structured approach makes the task manageable. Start with gathering all necessary documentation to ensure you have what you need to fill out the form accurately. Having a list of required documents can streamline this process.

Once you have all your documents, proceed to fill out the form meticulously. Pay close attention to each section, making sure not to leave any blanks, as incomplete forms can lead to significant delays. Use resources like pdfFiller to access helpful tips on avoiding common errors, such as typos or misidentifying the executor.

Interactive tools available

The rise of digital solutions has transformed the way individuals manage estate documentation. pdfFiller offers a variety of customizable templates for 'In re estate of' forms, enabling users to create forms that cater to their specific needs. With user-friendly interfaces, navigating these templates is both intuitive and efficient.

Moreover, collaborative features on pdfFiller allow users to work alongside legal advisers or family members, facilitating real-time editing and feedback. This collaboration ensures that all concerned parties are on the same page, thereby reducing misunderstandings and ensuring thorough documentation.

Legal considerations and common pitfalls

Navigating the legal landscape surrounding 'In re estate of' forms can be challenging, especially given the state-specific requirements that vary significantly across the U.S. It is crucial to understand the particular regulations and forms required by your jurisdiction, as failing to do so can result in a denied application or delayed proceedings.

Another important consideration is the timeframe for filing. Each state has specific time limits within which the 'In re estate of' must be submitted. Additionally, inaccuracies or incomplete forms can lead to complications, possibly delaying the probate process and creating additional stress during an already difficult time.

Advanced management of estate documentation

Once the 'In re estate of' form is submitted, the work doesn’t end there. Efficient estate management involves staying organized with all related documentation. Tools offered by pdfFiller enable users to categorize related files using folders and tags, making retrieval straightforward when additional documentation is needed. This organization can significantly reduce stress and prevent oversights in what can be a complicated process.

Moreover, securely sharing documents with stakeholders is a vital aspect of estate management. pdfFiller prioritizes security, which means that sensitive estate documents can be shared without fear of unauthorized access, maintaining privacy and confidentiality throughout probate proceedings.

Real-life case studies: Successful management of an "In Re Estate of" process

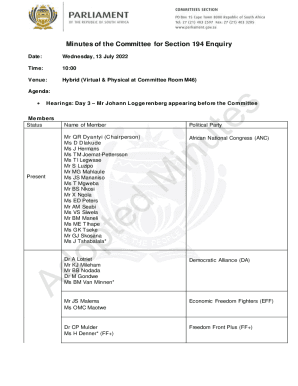

Consider the case of the Smith family, who faced the daunting task of managing their father's estate after his passing. Using the 'In re estate of' forms correctly, they were able to submit all necessary documentation without delay. However, they found themselves struggling with disputes among siblings. By leveraging pdfFiller’s collaborative features, they could work together more effectively, sharing feedback and revisions with their legal advisor seamlessly.

These collaborative practices not only simplified the process for the Smiths but also helped ease emotional tensions. By focusing on documentation and clear communication facilitated by technology, they successfully navigated their father's estate matters with minimal friction.

Frequently asked questions about "In Re Estate of" forms

Many individuals find themselves asking whether they need to file a separate 'In re estate of' form for multiple estates. The answer typically depends on the jurisdiction and the specific circumstances of the estates involved. For example, if the decedent owned real estate in different states, it may be necessary to initiate probate proceedings in each state where the property exists.

Additionally, managing disputes among heirs can be a contentious issue. Families often grapple with differing interpretations of the decedent's wishes. Clear documentation and communication, supported by tools like pdfFiller, can help clarify matters and ensure that everyone understands their rights and responsibilities.

The future of document management in estate planning

The evolution of technology plays a crucial role in estate documentation, offering users more efficient ways to manage paperwork. Innovations in software, like those provided by pdfFiller, drive improvements in how individuals create, edit, and share estate documentation. The goal is to simplify the burdensome process of paperwork and ensure compliance with legal standards.

As pdfFiller continues to refine its offerings, users can expect enhancements that further streamline the process, foster collaboration, and ultimately lead to a more intuitive experience when managing estate documents. The emphasis remains on delivering user-friendly solutions that empower individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send in re estate of to be eSigned by others?

Can I sign the in re estate of electronically in Chrome?

How can I fill out in re estate of on an iOS device?

What is in re estate of?

Who is required to file in re estate of?

How to fill out in re estate of?

What is the purpose of in re estate of?

What information must be reported on in re estate of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.