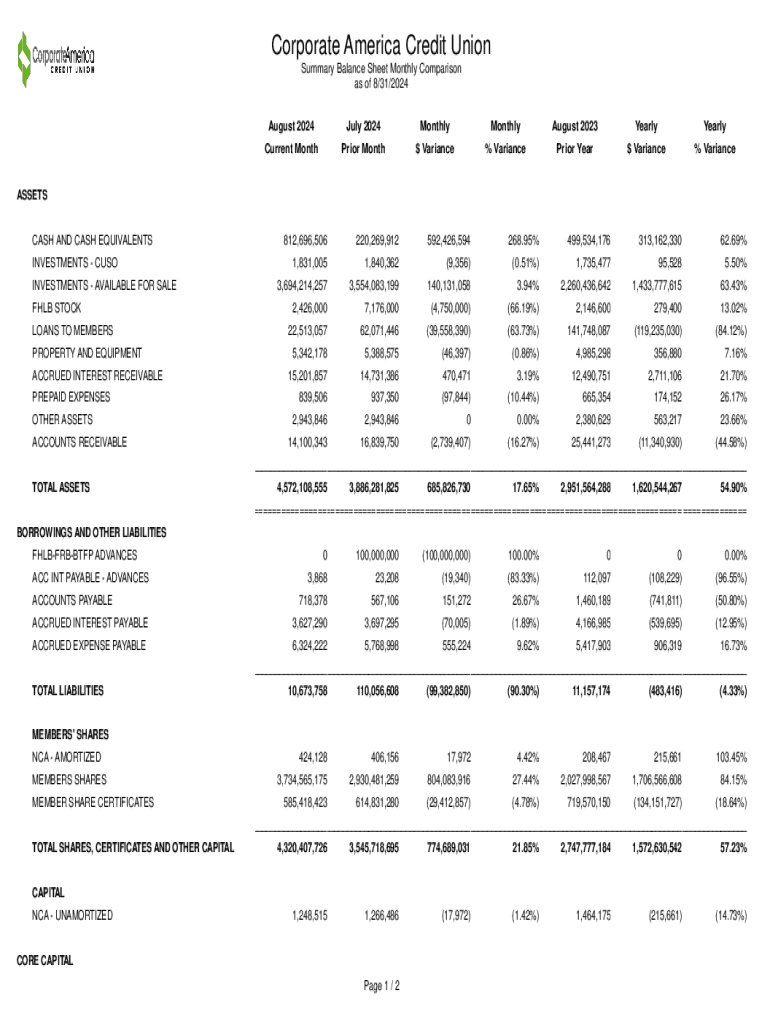

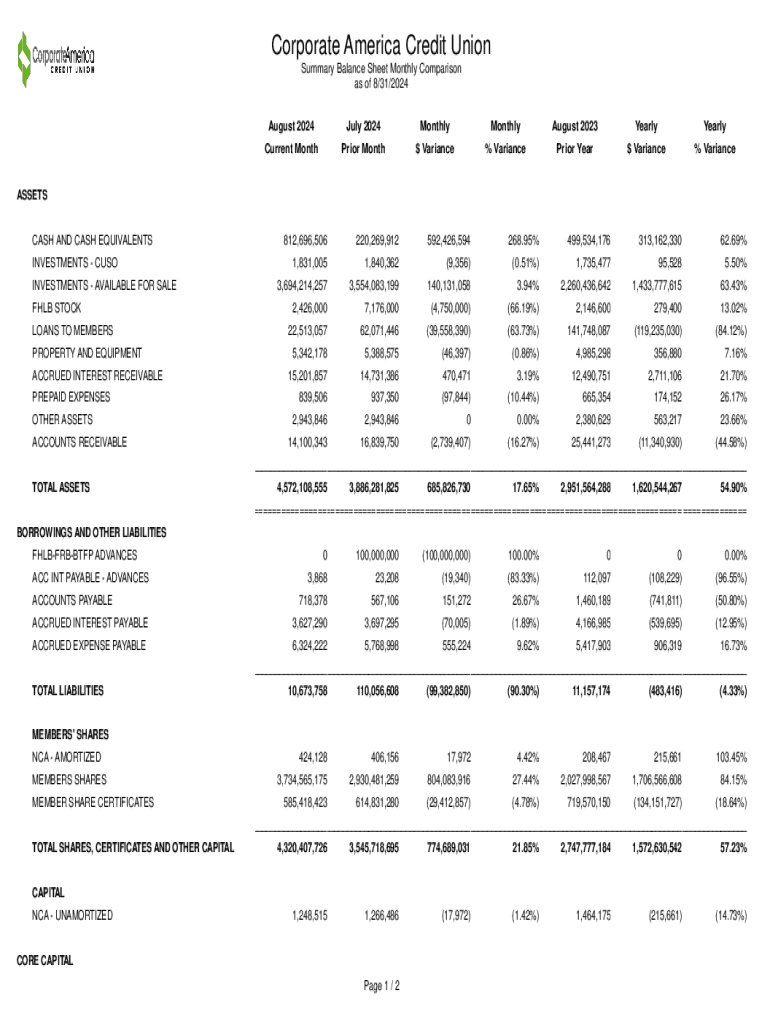

Get the free Corporate America Credit Union Summary Balance Sheet Monthly Comparison

Get, Create, Make and Sign corporate america credit union

Editing corporate america credit union online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate america credit union

How to fill out corporate america credit union

Who needs corporate america credit union?

Corporate America Credit Union Form - How-to Guide

Understanding Corporate America Credit Union Forms

Corporate America Credit Union forms are essential documents used for a range of services, from opening accounts to applying for loans. These forms serve multiple purposes, facilitating the communication of necessary information between individuals and the credit union. Understanding these forms is crucial as they often contain specific requirements and legal implications. Accurate completion of these forms ensures that your applications are processed smoothly and effectively.

Completing forms correctly is not just about conformity; it protects both the individual and the credit union. Errors can lead to delays, outright denial of services, or financial repercussions. Common forms utilized in Corporate America include membership and loan applications, as well as compliance-related documents like Anti-Money Laundering (AML) forms.

Types of Corporate America Credit Union Forms

The landscape of Corporate America credit union forms is diverse, catering to various needs. There are primarily three categories of forms: application forms, reporting forms, and compliance documents. Each serves a specific function and requires particular details.

1. Application Forms: These are foundational in obtaining services from a credit union. The key application forms include: - Membership Application: Initiates your membership with the credit union. - Loan Application: Essential for requesting personal, auto, or mortgage loans. - Account Holder Verification: Confirms the identity of clients in compliance with regulations.

2. Reporting Forms: Credit unions are required to submit various reports to regulatory bodies. Important forms in this category include: - Corporate Call Report: A summary of the credit union's financial condition. - Quarterly Financial Data Submission: Essential for tracking the credit union's performance.

3. Compliance Documents: Critical for adhering to laws and regulations, - Anti-Money Laundering (AML) Forms: Helps monitor suspicious activities. - Know Your Customer (KYC) Documentation: Ensures the identification of clients to mitigate risks.

Accessing Corporate America Credit Union Forms

Accessing Corporate America credit union forms is straightforward. Most credit unions provide downloadable forms directly from their websites, often accompanied by user-friendly instructions. Alternatively, users looking for versatile format options can utilize tools like pdfFiller.

To find and download forms: - Visit the respective credit union's website where forms are often listed under 'Resources' or 'Forms'. - Use pdfFiller’s document creation tools by searching for templates specific to Corporate America forms, such as membership and loan applications.

Step-by-step instructions for filling out forms

Completing a membership application requires precision. Basic information such as your name, contact details, and employment information are pivotal to the process. - Gather necessary documents like IDs and proof of residence. - Follow the filing and submission guidelines, which usually include providing hard copies via mail or online uploads.

For loan applications, start by understanding the loan terms and requirements provided by the credit union. Most credit unions require: - Credit history details to assess eligibility. - Financial documents like income statements and tax returns to validate your financial capacity.

Additionally, submitting compliance documents involves ensuring that all information adheres to regulatory standards. These include AML and KYC documentation, which necessitates thorough review for accuracy before submission. Always check with the credit union's compliance guidelines to avoid delays.

Editing and managing your forms with pdfFiller

One significant advantage of using pdfFiller is its robust editing features, which allow users to modify forms seamlessly. Users can easily edit text, add images, or insert signatures directly onto their documents. This flexibility ensures that customizations can be made on the fly, catering to particular needs or preferences.

For those looking to eSign documents, pdfFiller provides user-friendly navigation. Users can select their preferred eSignature options, ensuring signatures are secure and comply with legal standards. eSigning not only hastens processes but also adds an extra layer of assurance.

Collaborating on corporate forms

Collaboration is essential when managing corporate forms, especially for teams tasked with submitting applications or reports. pdfFiller offers robust collaboration tools that facilitate sharing forms with team members, allowing for real-time updates and discussions.

Utilizing notifications and comments within pdfFiller ensures everyone stays informed about changes made to a form or template. Teams can efficiently track changes, and this collective effort significantly reduces the chance of errors that could arise from miscommunication.

Ensuring security and compliance

Data security remains a prime concern in managing Corporate America credit union forms. pdfFiller integrates high-level data security measures, protecting sensitive information through encryption and compliant storage practices. Such security protocols are crucial in ensuring confidentiality and adhering to compliance standards.

Maintaining compliance is paramount, not just for the credit union but for your documentation practices. Understanding regulatory obligations such as data protection laws and ensuring each document reflects these requirements is key. To safeguard client information, consider routinely updating security practices and conducting internal audits on documentation procedures.

Case studies: success stories

Success stories illustrate how effective form management can transform experiences. For example, a small business utilized pdfFiller for a seamless loan application process. By employing its customizable features and eSignature capabilities, they completed their application accurately and promptly, resulting in loan approval within weeks.

Similarly, a corporate team collaborated effectively using pdfFiller to submit their Corporate Call Reports. By leveraging collaboration tools, team members ensured that all necessary data was current and compliant before submission, enhancing their reporting efficiency.

Troubleshooting common issues

Filling out forms can sometimes lead to a few hiccups. Common issues include incomplete sections, misinterpretation of form requirements, or technical problems while using pdfFiller. To avoid these mistakes, carefully review every field, and ensure all necessary documentation is ready before starting.

If you encounter issues while using pdfFiller, there are several support options available. The platform offers a comprehensive help center and customer support, which can assist with technical difficulties and user-guidance inquiries.

Future trends in corporate america credit union forms

The future of Corporate America credit union forms is leaning heavily toward digital document management. As technology evolves, so do the expectations for efficient, secure, and user-friendly forms. Innovations in customization and collaboration features are likely to become standard, enhancing the user experience.

Moreover, incorporating artificial intelligence for form completion prompts and error checks could streamline the process even further. As more entities recognize the need for efficient document management, platforms like pdfFiller will continue to adapt, ensuring they meet client demands.

Frequently asked questions (FAQs)

Many users inquire about the processing speed of membership applications. Typically, processing times can vary, but acknowledgment of receipt is often immediate, with final decisions generally made within a few business days.

Another common question is whether users can save their progress while filling out forms. With tools like pdfFiller, users can indeed save drafts, allowing for easy return to complete the process at a more convenient time.

If you encounter technical issues with pdfFiller, remember that they have dedicated support channels, including live chat options, to resolve your queries swiftly.

Tailored solutions for teams

For corporate teams managing multiple forms, tailored solutions are essential. pdfFiller simplifies the process by allowing team members to work simultaneously on the same document, reducing the turnaround time considerably.

The benefits of using pdfFiller permeate all levels of collaboration among teams, giving them the tools necessary to manage their documentation efficiently. Empowering teams with cloud-based solutions not only boosts productivity but also enhances accuracy in form submission.

Feedback and improvement

User feedback plays a critical role in enhancing the experience of filling out Corporate America credit union forms. Encouraging users to submit insights on forms and processes can unveil areas for improvement and streamline future versions.

Platforms like pdfFiller often integrate user suggestions into updates, enhancing form efficiency continuously. This iterative process is vital for developing a user-centric environment that adapts to the needs of individual users and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify corporate america credit union without leaving Google Drive?

How do I fill out the corporate america credit union form on my smartphone?

How do I edit corporate america credit union on an Android device?

What is corporate america credit union?

Who is required to file corporate america credit union?

How to fill out corporate america credit union?

What is the purpose of corporate america credit union?

What information must be reported on corporate america credit union?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.