Get the free Funeral Insurance Claim Form

Get, Create, Make and Sign funeral insurance claim form

Editing funeral insurance claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out funeral insurance claim form

How to fill out funeral insurance claim form

Who needs funeral insurance claim form?

Funeral Insurance Claim Form: Comprehensive Guide

Understanding funeral insurance claims

Funeral insurance is a specialized insurance policy designed to cover the costs associated with a funeral and burial services. It provides peace of mind to policyholders by ensuring that their loved ones aren’t burdened by hefty funeral expenses during an emotionally challenging time. The importance of filing a claim for funeral insurance cannot be overstated, as it allows beneficiaries to access the financial resources needed to manage these costs effectively.

The claim process typically involves several key steps—from gathering necessary documentation to completing and submitting the claim form. Understanding the entire claim process can ease the burden on families during a time of grief, allowing them to focus on honoring their loved one’s memory.

Preparing for the claims process

Preparation is crucial when navigating the claims process. First, gather essential documents, starting with the policy document that outlines the coverage and terms of the funeral insurance. Next, you'll need an official death certificate, which is a fundamental requirement for any death-related claim. Additionally, you should have identification details of the deceased to verify their identity.

Identifying the beneficiary is equally important. The individual designated in the policy is usually responsible for filing the claim. Moreover, take time to review the policy terms and conditions so that you understand any specific requirements that might be necessary for a successful claim.

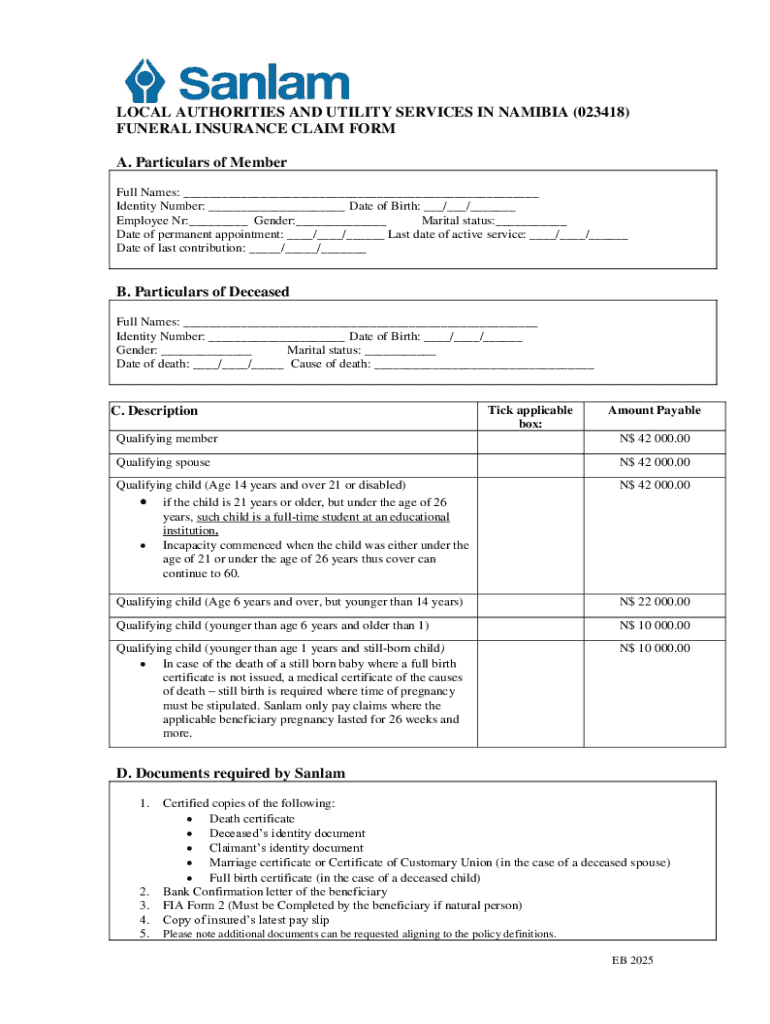

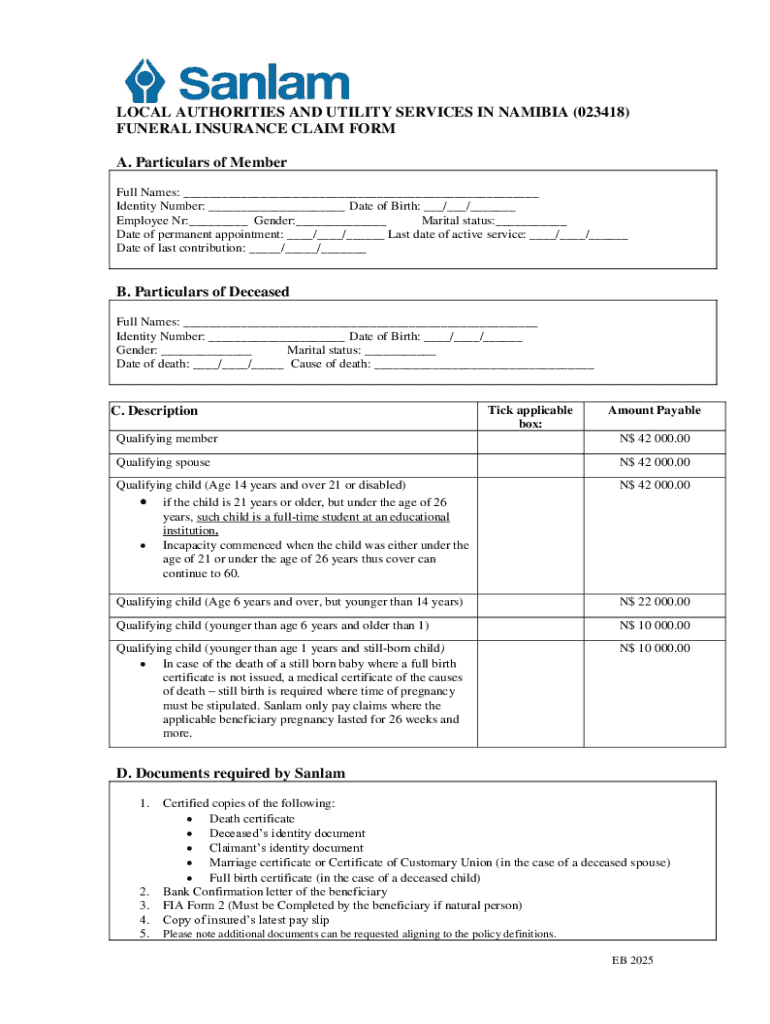

How to complete the funeral insurance claim form

Completing the funeral insurance claim form accurately is vital for a smooth claims process. Begin by entering basic information, which includes the claimant's details—your name, address, and contact information. Subsequently, fill in the deceased’s information such as their full name, date of birth, and date of passing.

Once the basic details are filled out, input your policy information. This includes the policy number and the name of the insurance provider. Finally, provide the claim details, specifying the reasons for the claim and the amount being claimed. Being precise and thorough in these sections will help avoid unnecessary delays.

To ensure accuracy, double-check all entered information and avoid common mistakes such as typographical errors or incomplete sections. This diligence can significantly streamline the claim process.

Submitting your claim

Once the funeral insurance claim form is complete, it must be submitted to the insurance company. There are typically several options for submission. Many insurance providers now allow online submission, where you can use platforms like pdfFiller to conveniently upload your completed form as a PDF document.

Alternatively, you can submit your claim via mail or fax. Be sure to check the submission guidelines specific to your provider, as these may vary. Regardless of the submission method, keeping records and receipts of your submission is essential.

Post-submission process

After submitting your claim, it’s essential to know what to expect during the post-submission phase. Generally, you will receive confirmation from the insurance provider acknowledging receipt of your claim. The timeframe for processing claims can vary, but you should inquire with your provider about anticipated timelines.

Maintaining open lines of communication with your insurance provider is crucial. This allows you to check the status of your claim and address any potential issues quickly. If your claim is denied, review the reason given and understand your options for appeal. This process can be complex, so don’t hesitate to seek assistance if needed.

Frequently asked questions (FAQs)

Understanding common concerns about funeral insurance claims can provide additional clarity. For example, what happens if your claim is not processed on time? Generally, you should follow up with your insurer to determine where the hold-up is. If a claim is denied, reviewing the denial letter closely will help you understand the necessary steps to take for an appeal or resubmission.

Issues like changing beneficiary information can be straightforward, provided that the policyholder has kept records updated. It's also worth noting that pre-need funeral insurance may have different requirements for filing a claim, so always confirm specifics with your insurer.

Additional resources for claimants

Navigating through bereavement can be challenging. Thus, accessing support resources is crucial. Many families may benefit from bereavement support services that offer emotional and counseling options tailored to help during this period. Understanding available government assistance programs and support groups can also provide additional help in managing both emotional and financial stresses.

Taking the time to explore educational articles regarding death benefits and insurance claims can empower recipients with the knowledge they need to make informed decisions regarding their claims. Connecting with local support groups can also offer a network of understanding as you navigate through your loss.

Interactive tools for claim management

Managing documents throughout the claims process can be made significantly easier with the use of interactive tools. pdfFiller offers capabilities for editing and completing forms, ensuring that users can create a seamless experience when filling out their funeral insurance claim form.

The platform’s eSigning capabilities allow you to sign documents digitally, which can expedite the submission while providing a secure method of handling sensitive information. Collaboration features enable multiple users—such as family members or financial advisers—to work on the document together, thus enhancing clarity and coherence.

Sending your claim: final checklist

Before submitting your funeral insurance claim, having a comprehensive checklist can help ensure nothing is overlooked. Confirm that your form is fully completed, all required documents are attached, and you have retained copies of everything for your records. Verifying the documentation can prevent potential issues and expedite the claims process.

Staying prepared for future claims

Looking ahead, it is essential to keep your funeral insurance policies updated and tailored to your needs. Regularly reviewing your coverage ensures that all information remains current, especially regarding beneficiary designations. Engaging actively with your insurers makes it easier to understand available options, coverage limits, and potential modifications as your circumstances change.

An informed policyholder is better equipped to navigate the claims process in the future, making it less stressful for both themselves and their loved ones. Regular communication allows you to stay aware of any changes in policies or new benefits that could impact your funeral insurance claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit funeral insurance claim form online?

How can I edit funeral insurance claim form on a smartphone?

How do I fill out funeral insurance claim form using my mobile device?

What is funeral insurance claim form?

Who is required to file funeral insurance claim form?

How to fill out funeral insurance claim form?

What is the purpose of funeral insurance claim form?

What information must be reported on funeral insurance claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.