Get the free Business Property Statement

Get, Create, Make and Sign business property statement

Editing business property statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business property statement

How to fill out business property statement

Who needs business property statement?

Business Property Statement Form: A Comprehensive How-To Guide

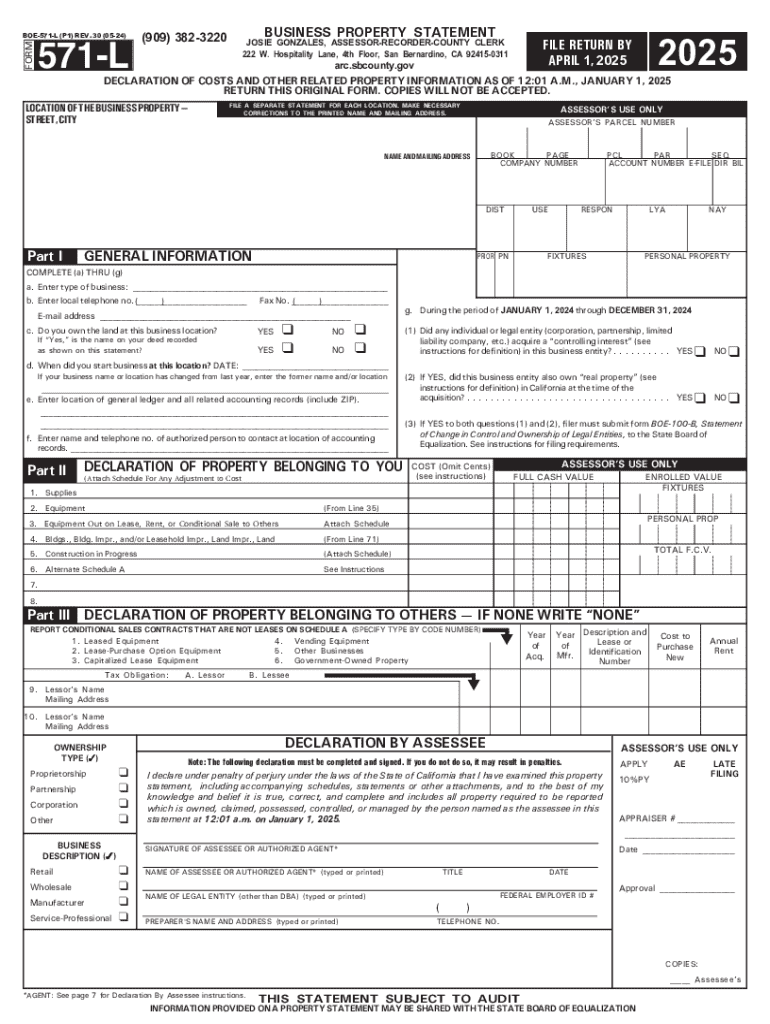

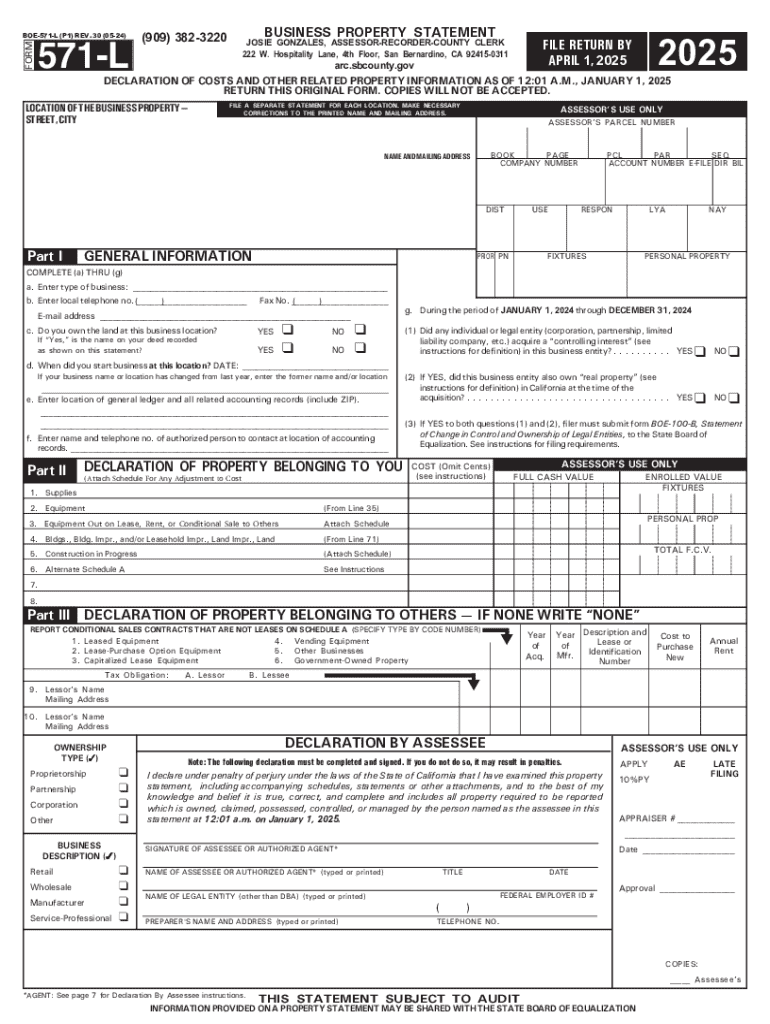

Understanding the Business Property Statement Form

The business property statement form is a key document utilized by jurisdictions to collect data on various business assets held. This form plays an important role in the assessment of property taxes. By properly filing this statement, business owners ensure they meet their tax obligations while providing necessary information to local governments for budgeting and fiscal planning.

Understanding the parameters and requirements outlined in the business property statement is vital for compliance. Key terms such as 'assessed value', 'business personal property', and 'reportable assets' should be familiar to every business owner as they directly relate to the filing process.

Who needs to file a business property statement?

Not all businesses are required to file a business property statement. Generally, any business that owns taxable personal property exceeding a specific threshold set by the state or local government must submit this form. Common business types include retail stores, manufacturing companies, and service providers that maintain significant assets like machinery or office equipment.

It is also crucial to check local variations, as some jurisdictions may have different definitions or requirements regarding filing. For instance, certain states may exempt small businesses or specific industries from filing based on the total value of property owned.

Preparing to file: Essential information and documentation

Preparation is key before filing the business property statement. Several documents and pieces of information are essential. Business identification details, including legal names and addresses, play a crucial role in the filing process.

Moreover, having prior year’s property values helps in assessing growth or changes over time. A comprehensive list of inventory and equipment used in business operations is necessary for accurate filing. Familiarity with the valuation process also assists in understanding how local assessors appraise property, ensuring your reported values are realistic and defensible.

Step-by-step guide to completing the business property statement form

Completing the business property statement form can be straightforward if you break it down into smaller sections. The form generally consists of separate schedules, like Schedule A for equipment costs and Schedule B for building improvements and land costs. Each section requires detailed inputs based on the assets owned.

When filling out each section, accuracy is paramount to avoid common pitfalls. Double-check values, ensure all assets are accounted for, and be meticulous with details, as errors may lead to penalties or increased scrutiny from assessors.

Filing methods for the business property statement

Filing your business property statement can be done through various methods. The most convenient of these is online filing through the e-File portal, which many jurisdictions now support.

Deadlines for filing can vary by jurisdiction, so confirming when to submit your application is crucial to avoid late fees or penalties. Timely submission is essential to ensure compliance with tax regulations.

Navigating the online filing process

If you opt for online filing, knowing how to navigate the e-File portal is essential. Accessing it typically requires creating an account with identifying details linked to your business.

The online filing system often includes features like auto-save, document upload, and instant submission confirmation, which can enhance your experience. However, be prepared for common technical issues, such as website downtime or lost passwords. Solutions usually involve reaching out to the technical support team associated with your local jurisdiction.

Special considerations and exceptions in filing

There may be special cases that affect how you file the business property statement. If you no longer own a business, you typically still need to submit a form, indicating that the business is inactive. This keeps your records updated in the eyes of the tax authorities.

Leased equipment, such as machinery or office furnishings, requires specific instructions in the filing process. Properly reporting leased assets can ensure that you receive any necessary deductions or avoid penalties associated with incorrectly declared assets.

Post-filing: What happens next?

Once submitted, the assessment process begins, where local assessors evaluate the property value and ensure compliance with regulations. You might receive questions or requests for further information if there are discrepancies or lack of clarity.

If you disagree with the assessed value, knowing the methods to appeal or contest this decision is important. Follow your local jurisdiction's guidelines to ensure that appeals are filed properly and timely.

Frequently asked questions about business property statements

New filers often have specific questions, such as what to do if this is their first filing. It's beneficial to consult resources provided by local assessors or use platforms like pdfFiller to obtain the forms and additional guidance.

Resources and support for filers

Accessing resources and support can ease the filing process significantly. Familiarizing yourself with contact details for your local assessors' offices gives you direct access to assistance. Many jurisdictions have partner agencies that help business owners navigate their obligations.

Understanding the implications of incorrect filing

Filing inaccuracies can lead to potential penalties that range from fines to increased scrutiny or audits. Understanding how audits work and being prepared for possible inquiries is critical for any business operating with assets. It is also key to know the steps for correcting any filing errors to mitigate repercussions.

Addressing errors in your filings promptly ensures your business remains compliant and minimizes financial repercussions. Engaging professionals may sometimes be necessary if complexities arise.

Conclusion: Streamlining your filing experience with pdfFiller

Using pdfFiller for managing your business property statement form simplifies the entire process. With powerful tools for document management and e-signing, business owners can easily edit and collaborate on forms as needed.

Accessing your documents from anywhere ensures that you can file timely without hassle. Furthermore, pdfFiller offers innovative solutions that help streamline not only the current filing but also future document needs, making it a vital asset for any business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business property statement online?

Can I edit business property statement on an Android device?

How do I fill out business property statement on an Android device?

What is business property statement?

Who is required to file business property statement?

How to fill out business property statement?

What is the purpose of business property statement?

What information must be reported on business property statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.