Get the free Mortgage Lender and Broker Company Annual Report for Activity During Calendar Year 2...

Get, Create, Make and Sign mortgage lender and broker

How to edit mortgage lender and broker online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage lender and broker

How to fill out mortgage lender and broker

Who needs mortgage lender and broker?

Comprehensive Guide to the Mortgage Lender and Broker Form

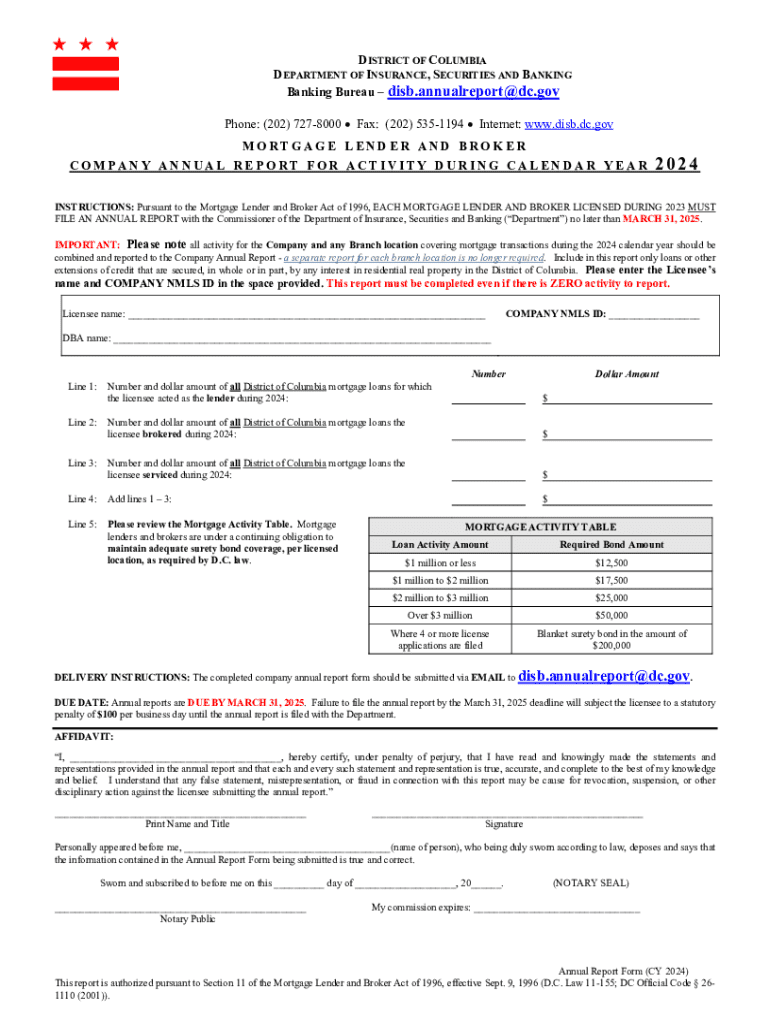

Understanding the mortgage lender and broker form

The mortgage lender and broker form serves as a cornerstone in the mortgage application process, encapsulating essential information about the borrower and the intended property. This form is utilized by lenders to assess a borrower's qualifications for a home loan and streamline the approval process. Without accurate completion of this form, loan approvals can be delayed, or worse, rejected.

Completing the mortgage lender and broker form accurately is crucial because it not only provides lenders with a snapshot of your financial situation but also establishes the foundation for communication between you and your chosen lender or broker. An understanding of this form can significantly enhance your mortgage application experience.

Key components of the form

The mortgage lender and broker form comprises several integral components that collect vital information required for processing a loan application. These components generally include:

Different lenders and regions might introduce variations of this form, adapting it to specific regulatory requirements or company policies. Familiarizing yourself with these components will drastically reduce the likelihood of errors and misunderstandings during the approval process.

Step-by-step instructions for filling out the form

Before diving into the mortgage lender and broker form, preparation is essential. Begin by gathering necessary documentation, including identification, proof of income, and recent financial statements. A clear understanding of financial terminology will also aid the completion process.

Let's break down the various sections of the form:

Editable features of the mortgage lender and broker form on pdfFiller

pdfFiller simplifies the process of completing the mortgage lender and broker form by offering robust editing capabilities. Users can customize the form directly within their browser, allowing for effortless updates to information as needed.

The platform enables real-time collaboration, making it easy for teams to work together on the form, share feedback, and ensure all necessary information is present before submission. This enhancement adds considerable efficiency to the application process.

Signing and submitting the form

Navigating the submission process involves understanding electronic signature requirements. Most lenders accept electronic signatures, leading to a more streamlined experience. pdfFiller provides a simple method for eSigning your forms, ensuring they are legally binding without the need for printouts.

After eSigning, there are various methods for submitting the completed form to lenders. This may include uploading the document directly to their portal, emailing it, or even faxing it, depending on the lender’s preferences. To avoid common pitfalls, double-check that all sections are correctly filled and required attachments are included before final submission.

Managing your form after submission

Once you have submitted the mortgage lender and broker form, tracking your application status becomes crucial. Most lenders provide online portals where you can check your application's progression. Familiarize yourself with these systems to stay updated.

Additionally, retaining copies of submitted forms is vital for record-keeping. Should any discrepancies arise, having documentation for reference can simplify resolution processes. Acquaint yourself with methods for accessing and updating submitted forms if necessary.

Interactive tools available on pdfFiller

pdfFiller equips users with valuable interactive tools to improve the experience of completing the mortgage lender and broker form. For instance, built-in calculators allow you to estimate potential mortgage payments, helping you select the right loan terms.

Moreover, interactive checklists ensure that all required information is complete before submission. The platform also features a robust FAQ section and additional resources, providing assistance whenever needed along your journey.

Case studies and user experiences

User experiences highlight the efficiency of using the mortgage lender and broker form to achieve successful loan approvals. For example, one user recounted completing the form within an hour and receiving loan approval in just three days, thanks to thorough preparation and accurate information.

However, challenges can arise, such as misunderstanding specific terms or sections. Many users found that reaching out to industry experts or leveraging online resources helped them overcome these hurdles. Their tips emphasize the value of clarity and diligence in completing the form.

FAQs regarding the mortgage lender and broker form

Many users have questions about filling out the mortgage lender and broker form, especially first-time applicants. Common inquiries involve concerns about required documentation, the meaning of specific terms within the form, and tips for quick completion.

For first-time users, becoming familiar with the form’s layout and terminology can ease the process significantly. Many find it helpful to have a checklist or a guide to refer to while completing each section.

Resources for further guidance

For those seeking additional support in completing the mortgage lender and broker form, pdfFiller offers various resources. Users can access templates, further documentation, and customer service support directly from the platform.

A glossary of mortgage-related terms can also be a handy reference, empowering users to feel more confident and informed during the application process.

Legal considerations and best practices

When filling out the mortgage lender and broker form, data privacy and security should be a top priority. Ensure that you are submitting sensitive personal information through secure platforms and understand the lender's data handling practices.

Compliance with federal and state regulations encompasses an essential understanding of laws like the Truth in Lending Act and the Real Estate Settlement Procedures Act. Adhering to best practices, including reviewing all information for accuracy and keeping abreast of regulatory changes, ensures that your application process unfolds smoothly.

Additional tools and features of pdfFiller

pdfFiller goes beyond simply providing a platform for editing the mortgage lender and broker form. Document management features allow users to categorize, organize, and securely store documents in the cloud, making them accessible from any location.

The platform's integration capabilities enable seamless connections with other software and services, enhancing its utility for solo applicants and teams alike. Adapting to the modern workflow has never been easier with pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mortgage lender and broker directly from Gmail?

Can I sign the mortgage lender and broker electronically in Chrome?

Can I create an electronic signature for signing my mortgage lender and broker in Gmail?

What is mortgage lender and broker?

Who is required to file mortgage lender and broker?

How to fill out mortgage lender and broker?

What is the purpose of mortgage lender and broker?

What information must be reported on mortgage lender and broker?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.