Get the free Nominate Your Beneficiaries

Get, Create, Make and Sign nominate your beneficiaries

How to edit nominate your beneficiaries online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nominate your beneficiaries

How to fill out nominate your beneficiaries

Who needs nominate your beneficiaries?

Understanding the Nominate Your Beneficiaries Form

Understanding the nomination of beneficiaries

A nominee designation is a key aspect of financial planning, providing clarity on who will benefit from your assets after your passing. This form essentially serves as a directive, detailing who you wish to receive your belongings, financial accounts, and insurance payouts. The importance of beneficiary designation cannot be overstated — it ensures that your wishes are respected and that your loved ones are protected financially after your death.

Failing to nominate beneficiaries may lead to unintended consequences, such as state laws dictating asset distribution, which may not align with your personal preferences. Each state's probate process varies in complexity and cost, and without a clear beneficiary designation, a significant part of your estate could potentially go through a lengthy and complicated legal process.

Types of beneficiaries

When filling out your nominate your beneficiaries form, it's crucial to understand the types of beneficiaries you can designate. The two primary categories are primary beneficiaries and contingent beneficiaries. Primary beneficiaries will inherit your assets first, while contingent beneficiaries will inherit only if the primary beneficiaries cannot.

Additionally, beneficiaries can be classified as either individuals or organizations. Individual beneficiaries might include family members, friends, or other loved ones. Organizational beneficiaries can encompass charities, foundations, or even educational institutions. If you choose to designate a minor as a beneficiary, consider the implications and possibly consult with a legal professional to set up a trust or similar mechanism to manage those assets until the child is of age.

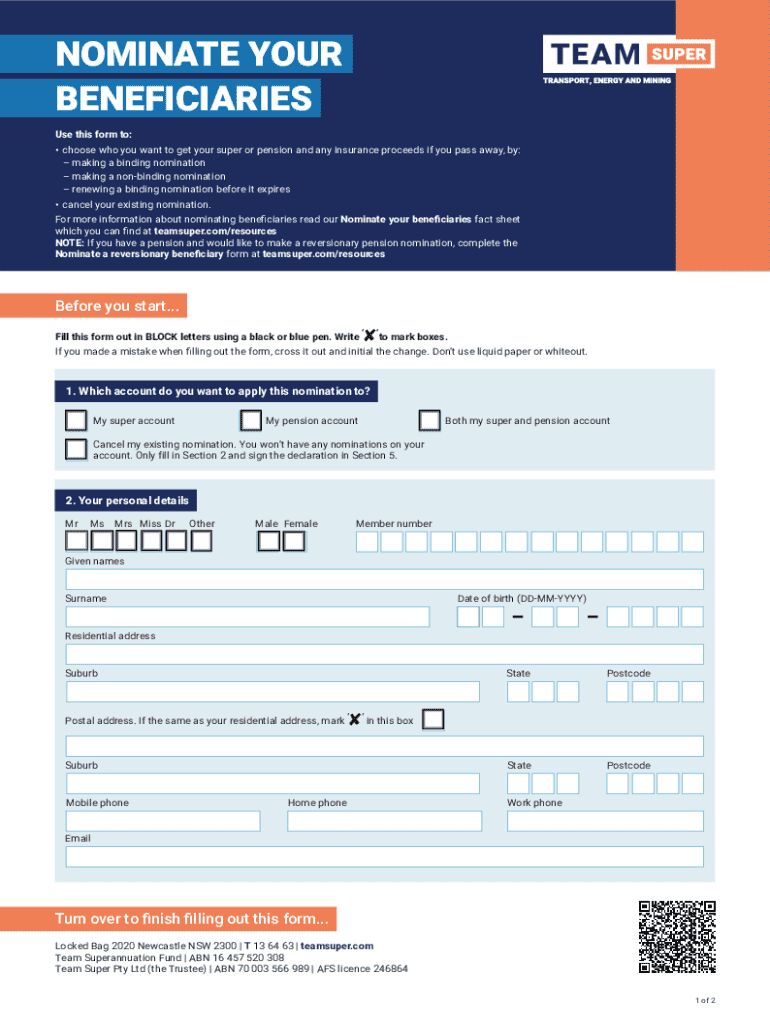

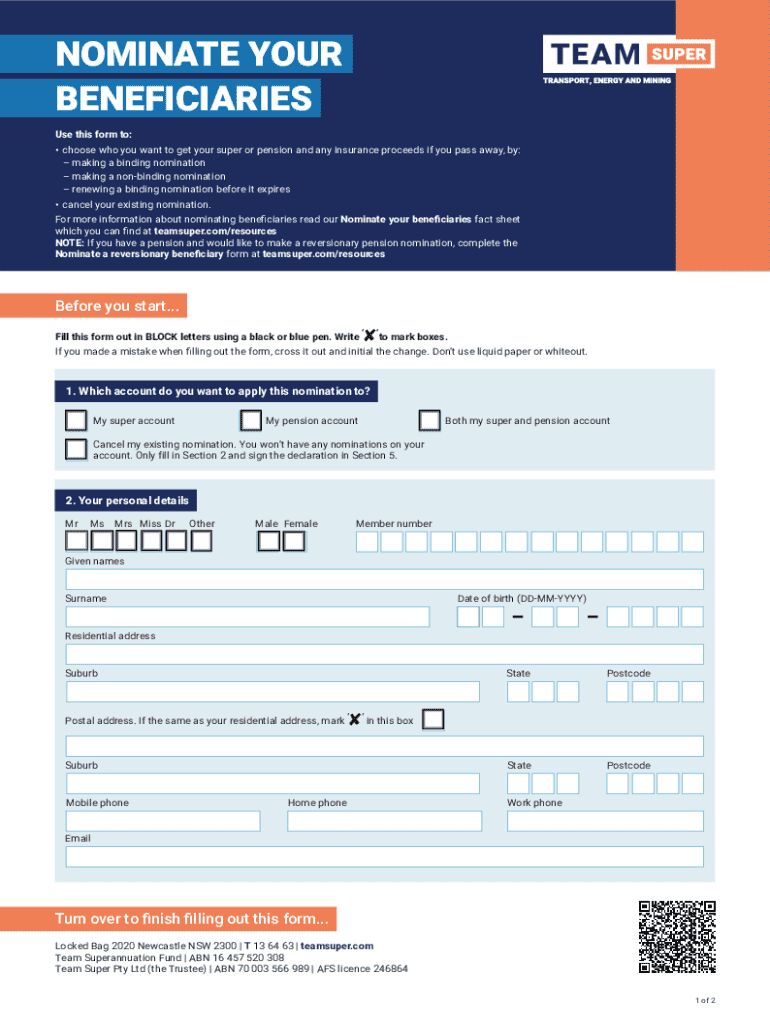

Overview of the nominate your beneficiaries form

The nominate your beneficiaries form is designed to streamline the process of identifying those who will receive your assets. This form is commonly used for life insurance policies, retirement accounts, and estate planning documents. By filling out this form accurately and comprehensively, you are providing key financial institutions with the necessary information to ensure a smooth transition of assets upon your demise.

Key information typically required on the form includes your full name, the names of your chosen beneficiaries, their relationship to you, and the percentage of your assets each will receive. It's essential to be precise, as errors may lead to complications later on. Keep in mind that institutions may have slight variations in their forms — so it's important to be aware of the specific requirements of each institution or plan.

Detailed instructions for completing the nomination form

Completing the nominate your beneficiaries form can be straightforward if you follow a structured approach. Here’s a breakdown of the sections you will encounter:

Common mistakes to avoid

While filling out your nominate your beneficiaries form, it’s easy to make mistakes that could have significant consequences. One prevalent error is failing to update your beneficiaries periodically. Life changes such as marriage, divorce, or the birth of a child can dramatically alter who should receive your assets. It's prudent to review your designations frequently.

Moreover, omitting key information can lead to delays or complications in asset distribution. Be diligent in checking that every required field is filled correctly. Lastly, be cautious with joint designations. While it sounds convenient, having two primary beneficiaries named equally can create confusion about how assets are to be divided if one of them passes away.

Special considerations for different audiences

If you are an active employee, your employer will typically provide specific guidelines on how to fill out the nominate your beneficiaries form as part of their benefits package. Many companies offer online resources or support to assist in ensuring that beneficiaries are designated accurately. Leverage these tools to maximize your understanding of your benefits.

Federal retirees or compensationers also need to be aware of the unique regulations and benefits associated with their forms. The rules governing federal employee benefits are distinct from those in the private sector, and often come with specific forms that must be filled out correctly to take full advantage of the benefits provided.

Keeping your beneficiary designations current

Regularly reviewing and revising your beneficiary designations is essential for effective estate planning. Changes in your personal circumstances, such as marriage, divorce, or the birth of a child, can significantly impact who should inherit your assets. Additionally, existing relationships may change, prompting a reevaluation of your choices.

Schedule routine reviews of your designate lists, ideally annually or after significant life changes. This proactive approach can prevent unintended distribution of assets and ensure that you're protecting the people you care about most.

Tools and resources for managing your nomination

Utilizing tools like pdfFiller can simplify your experience with the nominate your beneficiaries form. This online platform enables you to fill out, edit, and eSign your documents securely and efficiently. With pdfFiller, you'll find features that streamline the process, making it easier to create and manage your beneficiary nominations with confidence.

The platform also offers interactive tools to estimate how much each beneficiary could inherit based on different scenarios, ensuring a more informed decision-making process. The ease of access and friendly user interface means you don’t have to be overwhelmed by paperwork; instead, you can focus on what matters most: securing your family's financial future.

Frequently asked questions (FAQs)

Addressing common questions regarding the nominate your beneficiaries form can help eliminate confusion. A key question often arises concerning how to determine the right percentage split among multiple beneficiaries. This typically hinges on your personal preferences and the relationships you hold with each beneficiary. Open communication can prevent disputes down the line.

Another frequently asked question is, 'What happens if my designated beneficiary passes away before me?' This situation can be easily resolved by having contingent beneficiaries in place. It's always wise to expect the unexpected, and ensuring that alternate beneficiaries are designated can safeguard against future complications. Lastly, many wonder if they can revoke a beneficiary designation at any time, which is generally possible, so long as you follow the required procedures outlined by the institution.

Relevant legal considerations

Navigating the legal landscape surrounding beneficiary designations can be complex. State laws vary significantly regarding the rules that govern who can be a beneficiary and how distributions must occur. For instance, some states may automatically give priority to spouses or children over other heirs, meaning your designated beneficiaries may not receive what you had expected.

Additionally, tax implications can also come into play, as some inheritances might be taxable depending on estate size and other factors. Awareness of your local laws and potential tax ramifications can inform your beneficiary designations and critical planning steps, making it essential to consult legal advice.

Key takeaways

Completing the nominate your beneficiaries form is a powerful step toward ensuring your financial legacy is honored according to your wishes. Periodically reviewing and updating your designations is just as important as making the initial selection. Remember to consider beneficiaries' relationships, understand your state's legal framework, and utilize modern tools like pdfFiller for ease of management.

Secure your family's financial future by taking proactive steps in estate planning. With the right understanding and resources, you can navigate the complexities of beneficiary designation with confidence, ensuring that your wishes are carried out seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nominate your beneficiaries directly from Gmail?

How do I fill out nominate your beneficiaries using my mobile device?

Can I edit nominate your beneficiaries on an Android device?

What is nominate your beneficiaries?

Who is required to file nominate your beneficiaries?

How to fill out nominate your beneficiaries?

What is the purpose of nominate your beneficiaries?

What information must be reported on nominate your beneficiaries?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.