Get the free P.e.o. Annual Reports Instructions Roster and Dues for Local Chapter Treasurer

Get, Create, Make and Sign peo annual reports instructions

How to edit peo annual reports instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out peo annual reports instructions

How to fill out peo annual reports instructions

Who needs peo annual reports instructions?

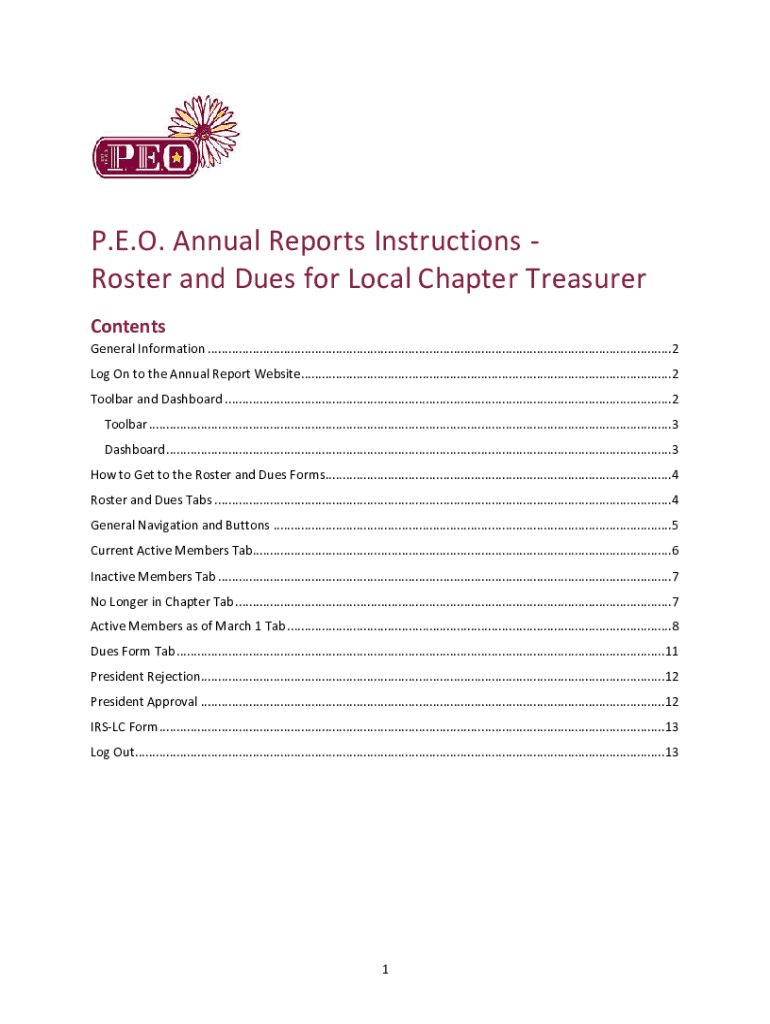

Comprehensive Guide to the PEO Annual Reports Instructions Form

Understanding the PEO annual reports

A Professional Employer Organization (PEO) annual report serves as a critical document for companies utilizing PEO services. Its primary purpose is to summarize employment practices, financial performance, and compliance with legal obligations over the year. This report not only meets regulatory requirements but also plays a vital role in informing stakeholders about the company's operational health.

The importance of PEO annual reports cannot be overstated; they are essential for maintaining transparency with clients, aiding in strategic decision-making, and ensuring compliance with various state and federal regulations. By compiling comprehensive data pertaining to staffing, payroll, and employment law adherence, businesses can safeguard their interests and foster trust with their partners.

Key components of a PEO annual report

PEO annual reports typically consist of several key components that provide a holistic view of the organization's operations. These may include:

Preparing to fill out the PEO annual reports form

Before beginning the actual filling process, it’s crucial to gather all required documents. This includes financial statements, employee payroll records, and compliance certifications. Ensuring that you have all necessary documentation will streamline the completion of the PEO annual reports instructions form.

Organizing this information effectively can reduce delays and errors. Consider creating a checklist of documents to provide a visual cue on what's available. Common documents required often include:

Common challenges and solutions

Filling out the PEO annual reports form can present several challenges. One common issue is sourcing accurate data from different departments. To mitigate this, establish a timeline for gathering information and designate responsible individuals for each section.

Another challenge may be understanding specific compliance requirements. Regularly consulting with legal or financial advisors can help clarify any doubts regarding what data needs to be included.

Step-by-step instructions for filling out the form

Accessing the PEO annual reports form is the first step in the completion process. The form can be easily found on pdfFiller’s platform. Simply log in and use the search function to locate 'PEO Annual Reports.' For those who prefer offline access, the form can also be downloaded from the official site.

Filling out the form

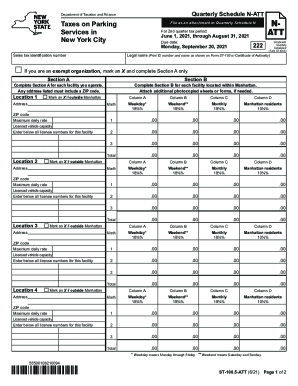

Once the form is accessed, it is essential to understand each section fully. Start with Section 1, which typically asks for basic company information such as the physical address and contact details. Ensuring accuracy here lays a solid foundation for the rest of the report.

Section 2: Financial data inputs

Next, proceed to Section 2, where financial data inputs are required. This may include revenue figures, payroll totals, and operational costs. It's important to double-check these against your accounting records to avoid discrepancies.

Section 3: Compliance-related information

Finally, Section 3 focuses on compliance-related information. Document any audits, compliance training undertaken, and notable protocol changes. Being comprehensive here minimizes the risk of compliance issues later.

After completing the form, utilize proofreading tips to ensure accuracy and completeness before submitting.

Editing the form

pdfFiller’s editing tools offer a user-friendly interface to make necessary changes if errors are discovered post-filling. Easily access the editing mode to make corrections or add additional information before finalizing your report.

Collaborating on the PEO annual reports form

If the form requires input from multiple team members, pdfFiller’s collaborative features make it easy to invite others to contribute. By setting designated roles and permissions, your team can work on the report simultaneously, reducing bottlenecks in the process.

Real-time feedback is another valuable feature. Team members can add comments or suggest changes, making it easy to track all modifications. This ensures that everyone is aligned and that no critical information is overlooked.

Signing and submitting the PEO annual reports form

Once completed, you’ll need to eSign the form. Navigate through pdfFiller’s platform to the eSignature section, where you can securely add your signatures. Various secure options are available for signing, ensuring your documents remain legally binding.

Following the signing process, adhere to submission guidelines to effectively file the report. Always keep copies of submitted forms for your records — not just for immediate needs, but also for reference in future reporting.

Post-submission practices

After submission, ensure the report was received and is being processed. It’s advisable to follow up if you don’t receive any acknowledgment within a set timeframe. Knowing when to cross-check helps prevent any compliance gaps.

In addition to following up, securely storing your completed forms on pdfFiller is vital for future reference. Accessing previous years' reports allows for consistency in reporting and valuable insights into your business's operational trends.

Frequently asked questions (FAQs)

Many users face common challenges with the PEO annual reports form. Typical questions include how to retrieve lost documents or what to do if data input seems invalid. Understanding these issues can significantly ease the stress of reporting.

For troubleshooting, consult pdfFiller's help section. Offering step-by-step solutions for common issues affecting form submission or access can enhance user experience.

Staying informed and updated

Regulatory changes can occur frequently in PEO reporting requirements. It's essential to stay informed about these changes as they can impact your reporting obligations. Regularly checking resources and updates related to PEO regulations can prevent oversights that affect compliance.

Utilizing pdfFiller’s features can assist in maintaining compliance over time. Built-in reminders and notification systems ensure you’re aware of upcoming deadlines and necessary updates in regulatory practices.

Helpful links

For direct access to essential resources related to PEO reporting requirements, consider visiting government and regulatory websites that offer guidelines. pdfFiller also provides ample support resources, including contact information for direct assistance.

Footer

For users seeking related forms and services, pdfFiller’s website contains navigational links to facilitate easy access. Collections of previous forms and templates allow for improved efficiency in completing new reports.

Additionally, for personalized assistance, consider reaching out to pdfFiller’s customer support, where expert team members can provide guidance tailored to your specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in peo annual reports instructions without leaving Chrome?

Can I create an electronic signature for signing my peo annual reports instructions in Gmail?

Can I edit peo annual reports instructions on an Android device?

What is peo annual reports instructions?

Who is required to file peo annual reports instructions?

How to fill out peo annual reports instructions?

What is the purpose of peo annual reports instructions?

What information must be reported on peo annual reports instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.