Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Comprehensive Guide to Form 8-K: Understanding and Managing Your Reporting Obligations

Understanding Form 8-K

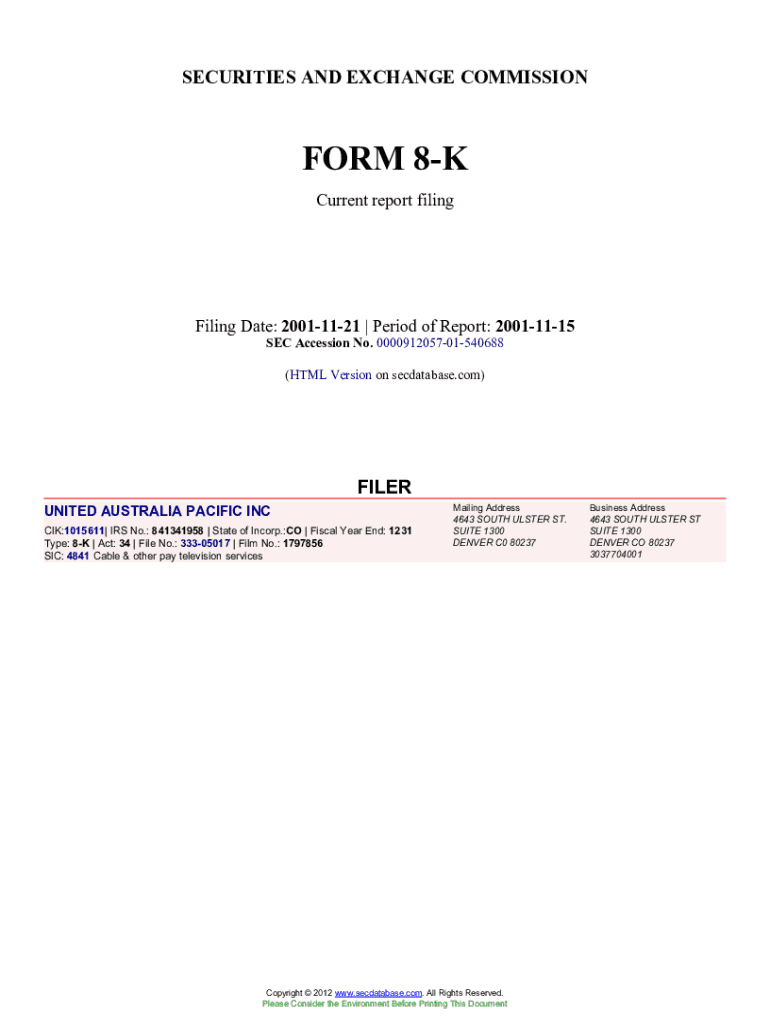

Form 8-K is a crucial report that publicly traded companies must file with the Securities and Exchange Commission (SEC) to disclose important events that shareholders should know. This form serves various purposes, from providing timely updates on significant corporate changes to fulfilling statutory obligations. Timely reporting through Form 8-K enhances transparency and ensures that market participants can make informed decisions.

The significance of Form 8-K extends beyond mere compliance; it plays a pivotal role in maintaining investor trust and market integrity. By mandating companies to report material events, the SEC aims to create a leveled playing field among investors, allowing them to be privy to essential information as it becomes available.

When is Form 8-K required?

Form 8-K filings are mandatory whenever specified triggering events occur. Identifying these events is essential for compliance and involves understanding the materiality of each situation. Events could range from entering into significant contracts to experiencing corporate takeovers or cybersecurity incidents.

Some examples of triggering events include material definitive agreements, significant changes in directorship, or even unexpected bankruptcy scenarios. The SEC's guidelines ensure that only relevant, significant events necessitate a Form 8-K, streamlining the reporting process for companies.

Detailed breakdown of Form 8-K items

The body of Form 8-K is divided into multiple items, each corresponding to different categories of disclosures. Understanding these items helps companies accurately report events and comply with SEC requirements. Here’s a closer look at several key items:

Further items include updates on impairs, unregistered equity sales, modifications to security holders' rights, and more. Each of these items offers a snapshot of the company's operational landscape and is critical for maintaining investor confidence.

Reading and interpreting Form 8-K

Interpreting Form 8-K requires a keen eye to discern relevance and implications from the disclosed information. A well-structured Form 8-K filing should present clear and concise information relevant to shareholders, allowing for easy digestion of the details.

Characteristics of an effective Form 8-K include straightforward language, comprehensive explanations of the events, and proactive acknowledgment of potential impacts. In contrast, poorly written filings may lack clarity and could mislead shareholders.

Filing requirements and process

The file for Form 8-K is generally the responsibility of a designated individual at the company, often the Chief Financial Officer or the General Counsel. Accurate understanding of the filing process is critical to avoid unnecessary penalties or delays. Understanding who can file, the timelines involved, and the allowable submission methods is essential.

Typically, a Form 8-K must be filed within four business days of the triggering event. Companies can file electronically through the SEC's EDGAR system, ensuring rapid dissemination of information. Manual submissions are allowed but not preferred due to potential delays.

Special considerations

Companies must carefully navigate the complexities of Form 8-K regulations, especially regarding confidential treatment requests. If a company believes that disclosing particular information may cause competitive harm, it can request the SEC to keep that information confidential for a specified time.

Non-compliance with filing requirements may lead to severe consequences, including enforcement actions or reputational damage. Companies should stay updated on regulatory changes affecting Form 8-K to reduce compliance risks.

Historical context

The evolution of Form 8-K reflects broader trends in corporate governance and SEC regulatory measures. Since its inception, Form 8-K has adapted to the changing landscape of business, incorporating new categories as issues like cybersecurity have become paramount.

Notable historical filings have set precedents for disclosure, influencing how companies operate and communicate with stakeholders today. Each significant event that necessitated a Form 8-K has contributed to the evolving standards for transparency.

Tools and resources for successful Form 8-K management

Utilizing innovative tools can significantly streamline the process of managing Form 8-K filings. Platforms like pdfFiller empower companies to efficiently create, edit, and manage documents within a single cloud-based interface. These types of tools can facilitate collaboration and secure document management.

Interactive tools enhance the tracking of changes and filing statuses, which is crucial for compliance. Companies can take advantage of technology to ensure that their reporting aligns with SEC requirements while allowing for easy access from anywhere.

Best practices for companies filing Form 8-K

To navigate the complexities of Form 8-K compliance successfully, companies should implement a series of best practices. Regular compliance checks ensure that all filing requirements are met and addressed promptly to mitigate risks.

Moreover, strong communication strategies with stakeholders, including investors and board members, are essential to exhibit transparency and foster trust. Being prepared for potential legal scrutiny requires a proactive approach to managing disclosures.

FAQs on Form 8-K

Frequently asked questions regarding Form 8-K highlight common areas of confusion among companies. This section aims to clarify these queries to assist in compliance and understanding of the reporting obligations.

Topics may include inquiries about when to file, how to submit electronically, and what happens if a filing is late. It's crucial for companies to familiarize themselves with these questions to ensure their reporting aligns with SEC expectations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k for eSignature?

How do I make changes in form 8-k?

How do I edit form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.