Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: A Comprehensive Guide for Efficient SEC Reporting

Understanding Form 8-K

Form 8-K is a critical reporting requirement established by the Securities and Exchange Commission (SEC) that public companies must file to disclose any significant events that shareholders should know about. This form serves as a bridge between the regular reporting cycles of quarterly and annual reports, allowing companies to provide timely information to the public and maintain transparency. Timely disclosures via Form 8-K are essential for maintaining investor confidence and complying with regulatory obligations.

The importance of Form 8-K lies in its ability to keep investors informed about major developments that could impact their investment decisions. As such, it enhances the overall market's efficiency and integrity, facilitating informed decision-making by providing up-to-date and relevant information.

Public companies, including foreign companies listed on U.S. exchanges, are required to file Form 8-K. Regardless of the compendium of obligations these companies face, the timely and proper filing of Form 8-K is paramount in fulfilling their legal responsibilities.

When is Form 8-K required?

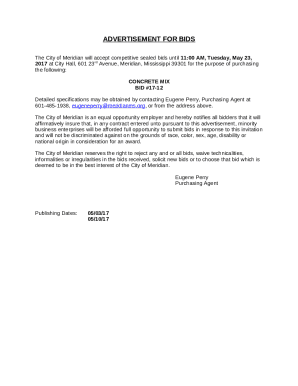

Certain events trigger the need for filing a Form 8-K. These events are carefully categorized to ensure that all significant corporate actions are timely communicated to investors. Some of the common triggering events for filing include:

While these are common scenarios leading to Form 8-K filings, there are various other events, such as changes in accountants and non-reliance on previously issued financial statements, that may also require timely disclosures.

Detailed breakdown of Form 8-K items

Form 8-K is comprehensive, delineated into various items to systematically categorize different types of events and disclosures. Some of the key items include:

Reading and analyzing Form 8-K

Analyzing Form 8-K filings is crucial for understanding a company's immediate circumstances. When reading a Form 8-K, focus on key components. Transaction details can give critical insights into the reasons behind a company’s strategic decisions, impacting future performance.

Equally important are the financial implications associated with the disclosures. Review the context surrounding the events, changes in management, or financial health that could affect your investment. Identifying relevant items based on the company's specific situation enhances the depth of your analysis, allowing for more informed investment choices.

Historical perspective

The requirements for filing Form 8-K have evolved over the years, reflecting changes in the financial landscape and regulatory environment. The SEC has introduced new items and requirements to ensure completeness and transparency. Historical case studies of notable filings, such as major corporate bankruptcies or significant mergers, have illustrated the importance of these disclosures in protecting investor interests.

For example, during the Enron scandal, the lack of timely disclosures via Form 8-K highlighted the need for stricter regulatory frameworks to protect investors. Over time, many companies have also been held accountable for failing to adhere to timely filing requirements, leading to increased scrutiny and the necessity for rigorous compliance programs.

Best practices for filing Form 8-K

Filing a Form 8-K accurately and on time is critical. Companies should adhere to best practices that enhance compliance and reduce risks. First, understanding the timing and deadlines associated with each item is vital. Companies must ensure submissions are made within four business days of triggering events to meet SEC standards.

Common pitfalls include inadequate disclosures or missing deadlines, which could lead to penalties. A cloud-based platform like pdfFiller provides tools to streamline this process, including seamless editing and signing of Form 8-K. The platform also allows for collaboration among team members, ensuring that all necessary perspectives are considered before submission.

Tools for managing Form 8-K filings

Managing Form 8-K filings efficiently is crucial, and utilizing the right tools can greatly aid this process. pdfFiller's interactive features, such as templates for quick filing and documentation storage options, are indispensable for companies to maintain an organized filing system. These tools allow users to access and collaborate on documents in a cloud-based environment, streamlining communication and efficiency.

Moreover, adopting a cloud-based solution enables teams to work collectively regardless of location, ensuring timely compliance with SEC requirements. Such a centralized system can mitigate risks associated with filing, as all team members can contribute, review, and sign documents from any device at any time.

External resources

For further guidance on Form 8-K, the SEC provides comprehensive regulatory guidelines that are available online. These resources can assist companies in understanding their obligations and the specifics of each item on the Form 8-K. Additionally, further reading materials available through academic platforms or finance websites can enhance understanding and compliance strategies related to the Form 8-K filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k to be eSigned by others?

How do I execute form 8-k online?

How do I make edits in form 8-k without leaving Chrome?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.