Get the free Payroll Employer Provided Vehicle Valuation Form - hr tcu

Get, Create, Make and Sign payroll employer provided vehicle

Editing payroll employer provided vehicle online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll employer provided vehicle

How to fill out payroll employer provided vehicle

Who needs payroll employer provided vehicle?

Comprehensive Guide to the Payroll Employer Provided Vehicle Form

Understanding employer provided vehicle benefits

Employer provided vehicles offer significant perks to employees, enhancing job satisfaction and attracting talent. These vehicles can be used for both work-related tasks and personal use, making them a flexible benefit. For companies, providing vehicles can also streamline operations, as employees can travel for business more efficiently.

From a tax perspective, several implications arise when an employer provides vehicles. For employees, the personal use of these vehicles typically counts as a fringe benefit, potentially qualifying for taxation. Employers, on the other hand, may deduct vehicle expenses, leading to a favorable tax situation when structured correctly.

Key regulations and compliance

Navigating the legal landscape of employer provided vehicles requires understanding both federal regulations and any specific state laws that apply. Employers must adhere to IRS guidelines regarding the valuation of vehicle use and expenses incurred, as mismanagement can lead to penalties.

States may impose additional regulations that need to be checked to ensure compliance, particularly regarding vehicle insurance and emissions standards. Moreover, proper reporting on taxes is vital, making sure that both employees and employers meet their obligations without incurring fines.

Types of employer provided vehicles

Employer provided vehicles typically fall into two categories: company cars and personal-use vehicles. Company cars are primarily used for business activities and are often assigned to specific employees. Personal-use vehicles, however, can be utilized by employees for both work and personal errands, which adds complexity in terms of benefit evaluation.

As the focus on sustainability intensifies, the inclusion of electric and hybrid vehicles in employer provided vehicle programs is on the rise. These environmentally friendly options not only align with corporate social responsibility goals but also may offer additional tax incentives for the employer.

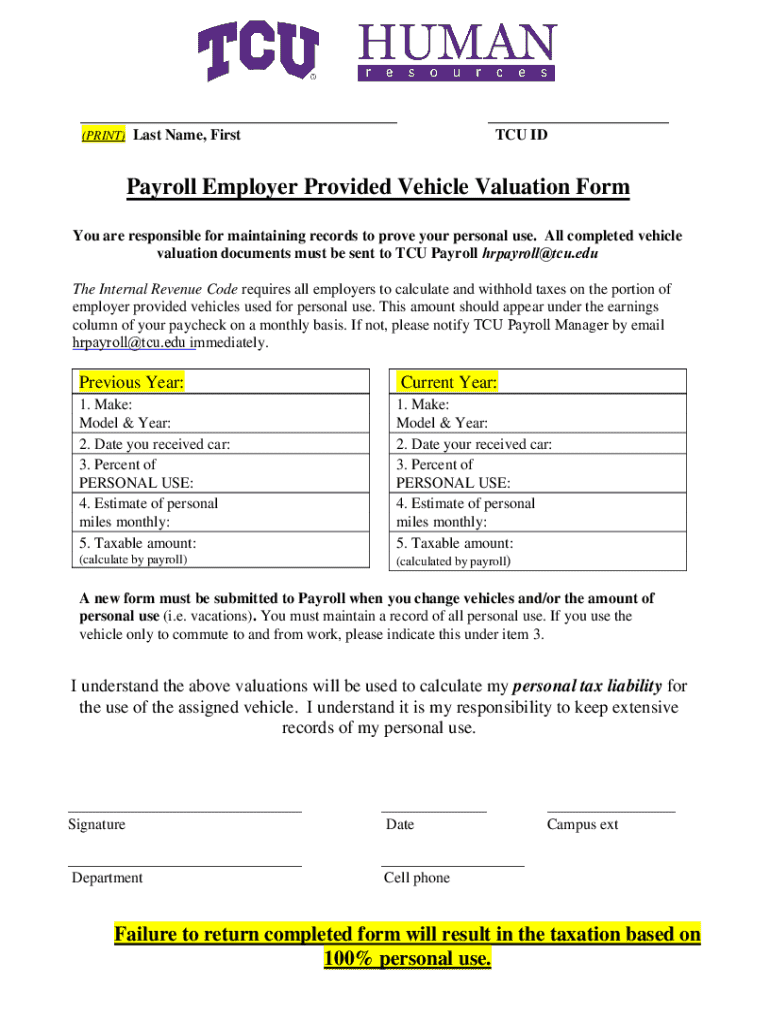

The payroll employer provided vehicle form explained

The payroll employer provided vehicle form is essential in managing the use of vehicles as an employee benefit. This form helps document the specific details regarding vehicle provision, including ownership, usage, and the tax implications of personal use. It is vital for employers to maintain clear records, ensuring compliance with tax regulations while providing a valuable benefit.

Incorporating this form into the payroll process not only facilitates smoother operations but also assists in accurately calculating deductions and taxable benefits associated with the vehicles provided. It ensures that both parties understand their obligations and the benefits they derive from the agreement.

Step-by-step guide to filling out the form

Completing the payroll employer provided vehicle form accurately helps avoid compliance issues down the line. Here’s a step-by-step guide to ensure all necessary sections are covered:

Editing and managing the payroll form with pdfFiller

Utilizing pdfFiller to manage the payroll employer provided vehicle form streamlines the process significantly. The platform empowers users to upload, edit, and share documents efficiently, eliminating the hassles of paper-based processes.

Features such as e-signing and collaboration tools enhance the user experience, ensuring all stakeholders can access the document from anywhere. This cloud-based solution supports real-time updates, making it easier to conform to changing compliance standards efficiently.

Common mistakes to avoid when using the form

When filling out the payroll employer provided vehicle form, errors can lead to compliance issues and potential tax liabilities. Awareness of common pitfalls can significantly mitigate risks. One frequent mistake is leaving sections incomplete; all fields must be filled to provide a clear picture of vehicle usage.

Another mistake involves miscalculating the percentage of vehicle use; this can skew tax implications, leading to audits. Additionally, failing to report changes, such as vehicle replacement or changes in employee usage, can complicate tax reporting. Regular reviews of vehicle provision policies help keep systems accurate.

Frequently asked questions (FAQs)

Many questions arise regarding employer provided vehicles, particularly concerning tax and compliance. For example, the treatment of leased vehicles can differ from purchased ones, affecting expense deductions and fringe benefits tax. Understanding how to navigate these differences is crucial for employers.

Employees may wonder about opting out of the vehicle program; typically, policies will dictate availability based on job requirements. Furthermore, the method of taxation on fringe benefits derived from employer provided vehicles can vary significantly, depending on usage estimates and vehicle classification, emphasizing the need for clarity in reports.

Enhancing your form management practices

Tracking employer provided vehicle usage effectively is essential for compliance and optimizing benefits. Best practices include maintaining an organized log of business vs. personal mileage and conducting regular reviews of vehicle usage to align with corporate policies.

Integrating document management solutions like pdfFiller into your practices ensures that you remain compliant while efficiently handling necessary documentation. This can reduce the chances of audits and penalties, as consistently updated records help substantiate reports and provide a clear audit trail.

The future of employer provided vehicle policies

The trend toward flexible work environments and remote working arrangements is shifting how employer provided vehicle policies are structured. As telecommuting becomes mainstream, the necessity for employer provided vehicles may diminish for some sectors while increasing in others.

Furthermore, with continued emphasis on sustainability, more companies are likely to incorporate electric and hybrid vehicles into their fleets, potentially leading to further regulatory changes. Adapting policies proactively to these emerging trends ensures businesses remain competitive and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get payroll employer provided vehicle?

How do I edit payroll employer provided vehicle in Chrome?

How do I fill out payroll employer provided vehicle using my mobile device?

What is payroll employer provided vehicle?

Who is required to file payroll employer provided vehicle?

How to fill out payroll employer provided vehicle?

What is the purpose of payroll employer provided vehicle?

What information must be reported on payroll employer provided vehicle?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.