Get the free Financial Hardship Unlocking – Form Fhu 2

Get, Create, Make and Sign financial hardship unlocking form

How to edit financial hardship unlocking form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial hardship unlocking form

How to fill out financial hardship unlocking form

Who needs financial hardship unlocking form?

Complete Guide to the Financial Hardship Unlocking Form

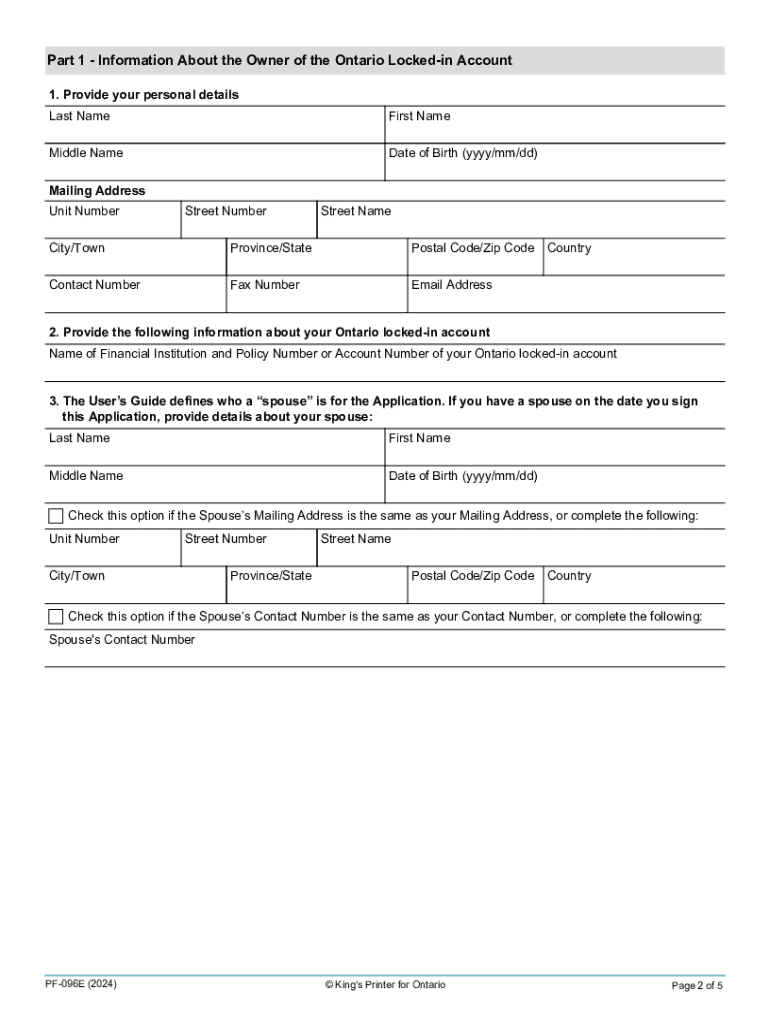

Understanding the financial hardship unlocking form

The financial hardship unlocking form serves as a crucial document for individuals grappling with unexpected financial challenges. This form allows individuals to withdraw funds from their retirement accounts without facing the typical penalties usually associated with early withdrawals. Understanding what this form entails is essential, particularly when the need for financial support arises due to circumstances beyond one’s control.

The purpose of this form is multifaceted. It not only provides access to necessary funds in times of crisis but also emphasizes the importance of financial literacy and planning. During turbulent times, having this form to lean on can alleviate some of the pressures caused by sudden job loss or mounting medical bills.

Eligibility criteria

Individuals looking to apply for a financial hardship unlocking form must meet certain eligibility criteria. Generally, those who can apply include anyone facing financial strain due to specific hardships. Commonly recognized hardships include:

Steps to fill out the financial hardship unlocking form

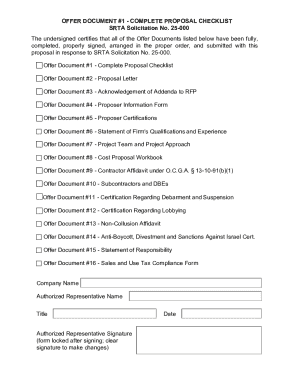

Filling out the financial hardship unlocking form may seem daunting, but following a structured approach can make the process smoother. Start by gathering your necessary documents, which are critical for substantiating your claims.

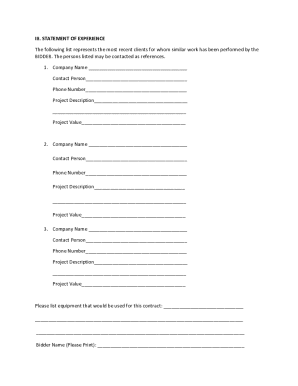

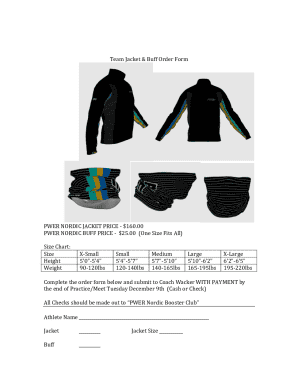

Required documents often include proof of income loss, existing financial obligations, and relevant medical bills. Ensure you have these documents organized to avoid any confusion when filling out the form.

Step-by-step instructions on completing the form

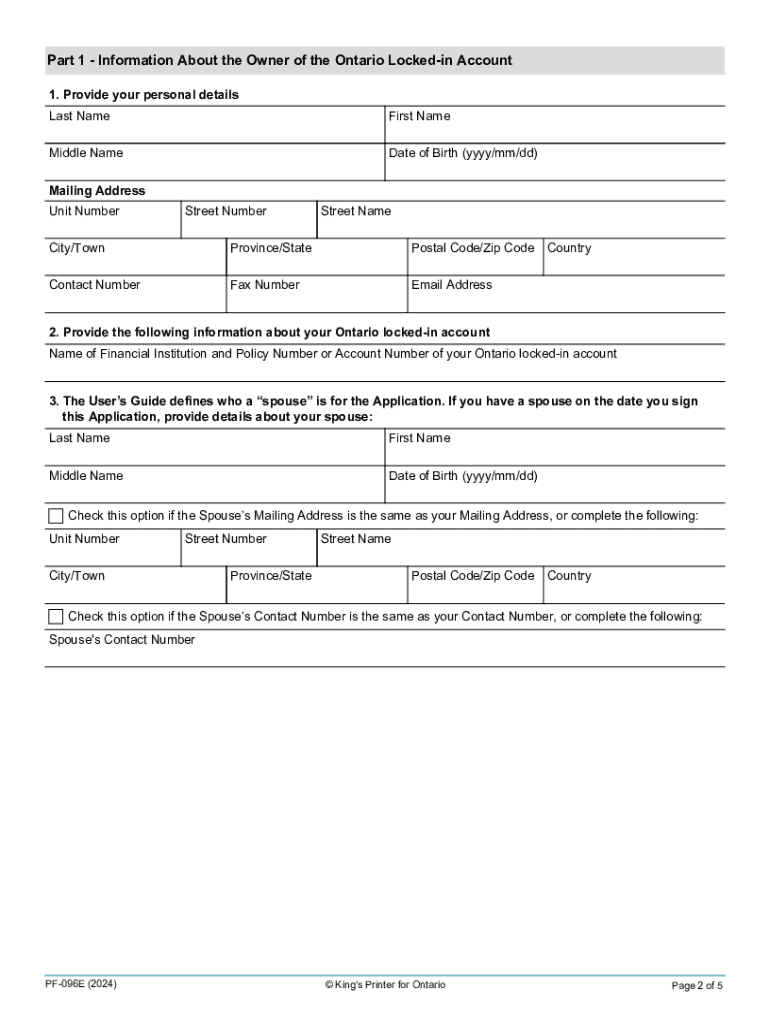

Completing the financial hardship unlocking form involves several sections, each requiring specific information:

Common pitfalls to avoid

When filling out your financial hardship unlocking form, avoiding common mistakes is critical to prevent delays in processing. Here are some pitfalls to watch for:

Digital tools and resources provided by pdfFiller

One of the most effective ways to streamline your application process is by utilizing pdfFiller. This platform offers a suite of document management tools that simplify form completion, editing, and signing.

With pdfFiller, you can edit your financial hardship unlocking form, collaborate with others if necessary, and manage your documents securely in the cloud. The interactive tools allow real-time updates, ensuring that your form is always current and accurate.

How to eSign your document safely

Signing your financial hardship unlocking form online through pdfFiller is both straightforward and secure. The platform provides a step-by-step guide to digitally sign your document, ensuring that both your identity and the integrity of the document are protected.

To eSign your document, follow these steps:

Submitting your financial hardship unlocking form

Once you have completed and signed your financial hardship unlocking form, the next step is submission. Knowing your options can help determine the best method for you.

You typically have two submission options available: online and offline. Each method has its pros and cons.

Understanding the review process

After submitting your financial hardship unlocking form, it undergoes a review process. Typically, you can expect a timeline of a few weeks for processing. During this time, it’s essential to remain patient and check your email or communications from the institution.

What you can expect post-submission includes receiving notifications about the outcome of your application and any additional steps you may need to take.

FAQs about the financial hardship unlocking form

As with any process, questions may arise. Here are some frequently asked questions regarding the financial hardship unlocking form to help guide applicants:

Additional considerations and tips

When completing your financial hardship unlocking form, honesty and transparency are vital. The institution reviewing your application needs accurate information to make a fair assessment.

Understand that a well-prepared application can significantly enhance your chance of approval. Utilize available resources such as financial assistance programs in your community that can provide help during this challenging time.

User success stories

Many individuals have successfully navigated their financial hardships thanks to the financial hardship unlocking form. Hearing about their journeys can provide hope and encouragement for new applicants.

One individual recounted how they accessed their funds to cover medical bills after an unexpected surgery. With the help of the form, they were able to alleviate anxiety and focus on recovery. Testimonials like these highlight the importance of utilizing available resources during challenging times.

Final thoughts and encouragement

If you find yourself facing uncertainty and financial difficulty, remember that seeking help and using tools such as the financial hardship unlocking form can lead you to a path of stability. It takes courage to ask for assistance, and utilizing a comprehensive solution like pdfFiller makes the paperwork easier.

Once you submit your application, consider your next steps. Stay informed about your application status, and prepare to face whatever outcome arises. Maintaining a proactive approach will empower you during this process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial hardship unlocking form in Gmail?

How can I get financial hardship unlocking form?

Can I create an electronic signature for signing my financial hardship unlocking form in Gmail?

What is financial hardship unlocking form?

Who is required to file financial hardship unlocking form?

How to fill out financial hardship unlocking form?

What is the purpose of financial hardship unlocking form?

What information must be reported on financial hardship unlocking form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.