Get the free Broker Fee Agreement

Get, Create, Make and Sign broker fee agreement

How to edit broker fee agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broker fee agreement

How to fill out broker fee agreement

Who needs broker fee agreement?

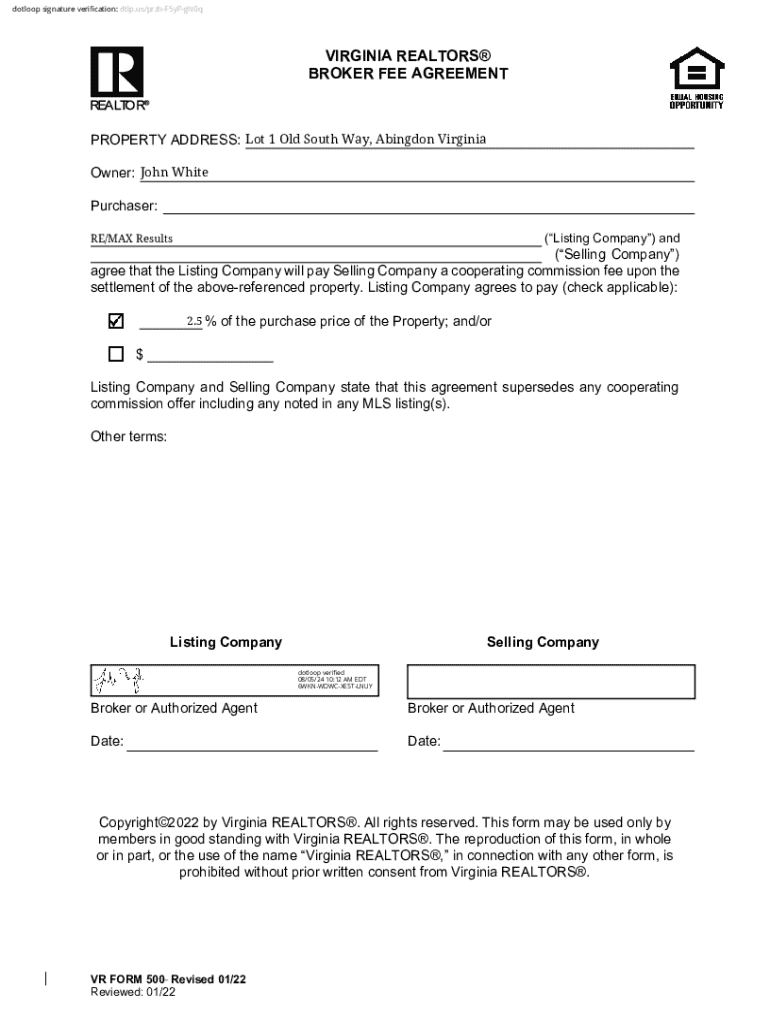

Understanding and Utilizing the Broker Fee Agreement Form

Understanding broker fee agreements

A broker fee agreement is a crucial document in real estate transactions, detailing the terms under which a broker will be compensated for their services. This agreement not only outlines the commission structure but also establishes the relationship between the broker and the client, ensuring both parties are on the same page regarding expectations and responsibilities. Without a clear broker fee agreement, misunderstandings can arise, leading to disputes or dissatisfaction.

The importance of broker fee agreements cannot be overstated. They serve as a legal safeguard for both brokers and clients by providing a written record of the agreed-upon terms. This minimizes the potential for disagreements over payment or scope of work. Key components of a broker fee agreement may include the commission rate, payment terms, representation details, and termination clauses.

Types of broker fee agreements

Broker fee agreements come in various types, each catering to different transactional needs. A standard commission agreement is the most common, where brokers receive a percentage of the sale price or a flat fee for their services. Alternatively, an exclusive agency agreement allows the seller to retain the right to sell, while still paying the broker if a buyer is procured through their efforts. The exclusive right to sell agreement grants the broker full rights to market and sell the property, ensuring they are compensated regardless of how the buyer is introduced.

Flat fee agreements charge a set amount for specific services, offering certainty in terms of costs. Each agreement type varies in its implications for compensation, marketing, and seller control over the transaction. Understanding these differences is essential for clients to make informed decisions based on their specific needs.

Essential elements of a broker fee agreement

A comprehensive broker fee agreement form comprises several essential elements to protect both the broker and the client. The first crucial element is the agreement to compensate commission, defining the compensation expectations upfront. This section typically outlines whether the broker's payment will consist of a percentage of the sale or a flat fee, thus providing clarity on earnings.

Next are commission payment terms, which specify the payment due dates and accepted methods of payment, including any conditions under which the agreement might be rescinded. The inclusion of a successors and assigns clause is beneficial for future transactions, ensuring the agreement remains valid even if ownership or representation changes. It also establishes the roles and responsibilities of both tenants and owners, further enhancing the clarity of the business relationship.

Filling out the broker fee agreement form

Filling out the broker fee agreement form can seem daunting, but a structured approach helps ensure accuracy. Start by gathering all necessary information, such as the names and addresses of involved parties, property details, and any relevant terms agreed upon verbally or in previous communications. Using tools like pdfFiller can streamline this process by allowing you to complete forms digitally.

When completing the form, be diligent to avoid common mistakes, such as failing to sign or date the document, leaving sections incomplete, or misunderstanding terms. Clearly defining roles and agreements can prevent delays and complications. Take your time during this process, as each detail matters in formalizing your broker agreement.

Editing and customizing your broker fee agreement

Editing and customizing your broker fee agreement is essential to suit your unique needs. pdfFiller offers tools for easy customization, allowing you to add specific clauses or adjust terms to reflect your situation accurately. While customization is vital, you must maintain the agreement’s integrity and ensure it still adheres to legal standards.

Incorporating interactive elements within your agreement, such as checkboxes or drop-down lists for easy selection of terms, enhances usability. Best practices for customization include reviewing templates to ensure they comply with local relevancies and general industry practices while still accommodating your specifications.

eSigning your broker fee agreement

Incorporating eSignatures into your broker fee agreement simplifies the signing process and increases efficiency. The process of eSigning with platforms like pdfFiller allows both parties to review documents digitally before signing, which can save time in real estate transactions. This is especially useful when parties are geographically separated, as it ensures that the agreement can be signed without the need for in-person meetings.

The legal validity of eSignatures is recognized in many jurisdictions, making them a reliable alternative to traditional signatures. It's important to ensure that the eSigning platform complies with relevant laws to bolster the agreement's enforceability.

Managing your broker fee agreement

Proper management of your broker fee agreement is vital for ongoing success in real estate transactions. Safekeeping and organization of agreements can prevent misunderstandings and conflicts as terms are revisited. Utilizing a platform like pdfFiller not only helps in immediate access to documents but also facilitates collaboration with other stakeholders involved in the transaction.

Setting reminders for critical dates—from payment deadlines to renewal dates—ensures that no important commitments are overlooked. This proactive approach can improve relationships with brokers and clients alike, ensuring smooth transactions within the real estate market.

Common questions about broker fee agreements

Prospective clients often have questions about broker fee agreements. For instance, they might ask, 'What is a broker service agreement?' A broker service agreement provides a comprehensive outline of the relationship between the client and the broker, typically including terms like fees and scope of services. Another common inquiry is, 'How do I write a commission agreement?' Clients should start by clearly outlining the specific services to be provided and the compensation structure.

Understanding the implications of exclusive contracts is also crucial. An exclusive contract means the broker is given primary rights to sell the property, which can affect the client’s flexibility when evaluating potential buyers. Addressing these questions directly helps establish clear expectations and can even prevent disputes later in the process.

Related templates and resources

Accessing relevant templates and resources can considerably ease the process of completing broker fee agreements. pdfFiller provides downloadable broker fee agreement templates tailored to various scenarios, ensuring users have a solid starting point. Additionally, these resources encompass additional forms and templates related to real estate transactions, enhancing the flexibility and efficiency of document handling.

Latest industry trends impacting broker fee agreements

The real estate market continuously evolves, leading to trends that impact broker fee agreements. One significant influence is the shifting market dynamics, where fluctuating property values can alter commission structures, compelling brokers and clients to adapt. Legal changes, such as new regulations governing commission disclosure, also require brokers to stay informed, ensuring compliance and upholding ethical standards.

Emerging practices and technology play a crucial role in shaping how broker fee agreements are executed. With platforms like pdfFiller, transactions can be handled more efficiently, increasing transparency in documentation and improving communication between all parties involved. Keeping abreast of these trends and their implications can provide significant advantages in navigating real estate transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my broker fee agreement directly from Gmail?

How can I send broker fee agreement for eSignature?

How do I execute broker fee agreement online?

What is broker fee agreement?

Who is required to file broker fee agreement?

How to fill out broker fee agreement?

What is the purpose of broker fee agreement?

What information must be reported on broker fee agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.