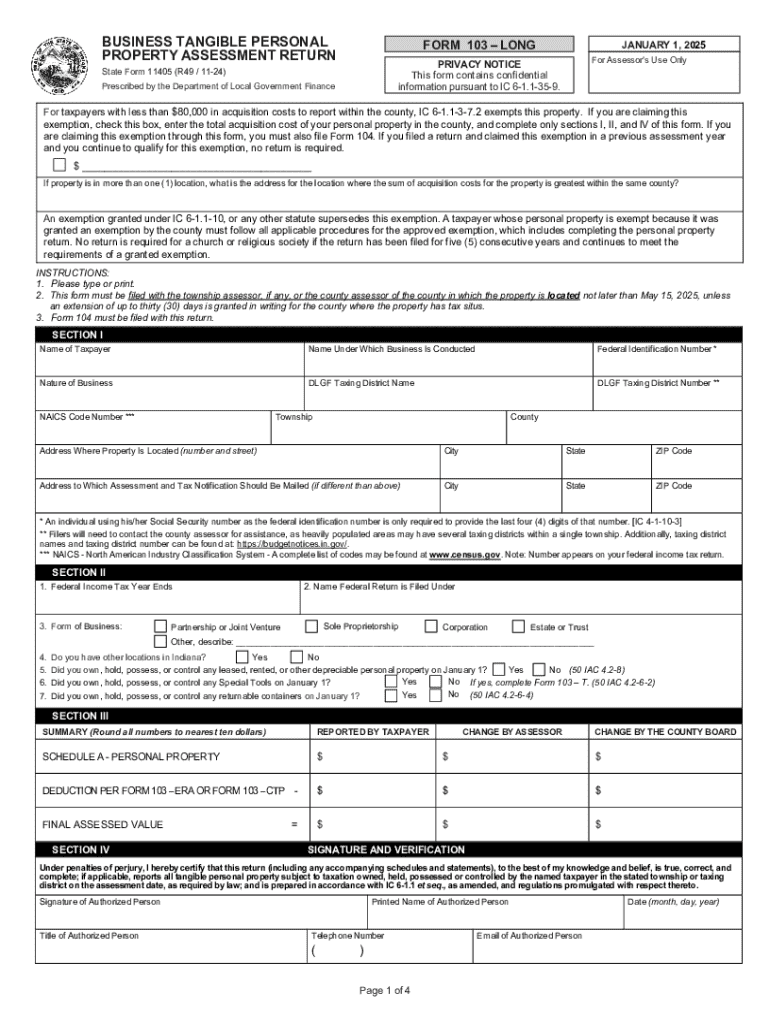

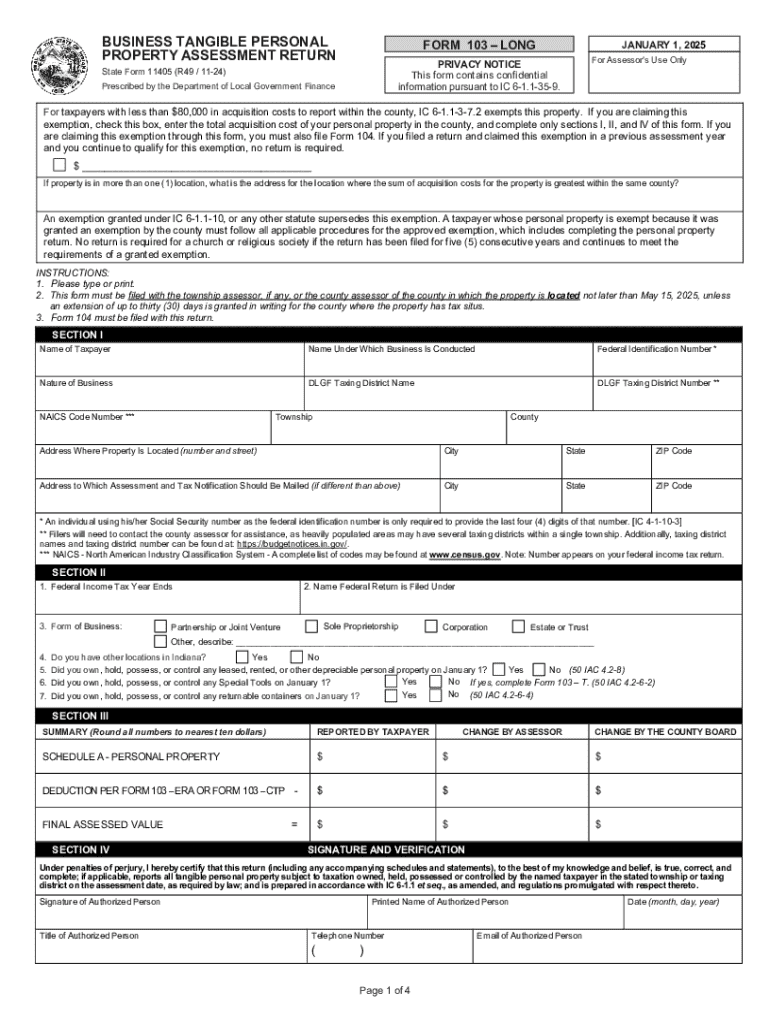

Get the free Business Tangible Personal Property Assessment Return Form 103 – Long

Get, Create, Make and Sign business tangible personal property

How to edit business tangible personal property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tangible personal property

How to fill out business tangible personal property

Who needs business tangible personal property?

Understanding Business Tangible Personal Property Form

Understanding business tangible personal property

Business tangible personal property refers to physical assets used in the operation of a business and is essential for accounting and taxation purposes. The significance of accurate reporting cannot be overstated, as these assets often determine a business’s valuation for tax assessments. Moreover, categorizing business property correctly can influence tax obligations and compliance.

It's crucial to differentiate between tangible and intangible property. Tangible personal property includes physical items like machinery, equipment, and furniture, whereas intangible property encompasses non-physical assets like patents, trademarks, and goodwill. Understanding this distinction aids businesses in proper reporting and taxation.

Key characteristics of business tangible personal property

Tangible personal property can be classified by various criteria, making it easier to recognize what constitutes tangible assets. Examples of such property include:

Businesses must meet specific criteria, such as physicality, durability, and use in the business to classify their assets as tangible property. These guidelines help maintain consistency in valuation and reporting.

Business property statement (Form 571-)

The Business Property Statement, commonly referred to as Form 571-L, plays a vital role in tax assessments for businesses. Its primary purpose is to report all tangible personal property for tax purposes, ensuring compliance with state regulations. All business owners are required to file this form annually with their local assessor’s office.

Key fields on Form 571-L typically include sections for identifying property, asset valuation, and reporting leased equipment. Each section has specific directives that assist businesses in accurate reporting.

Filing your business property statement

Filing your Business Property Statement is not just a formal duty, but a necessary step in maintaining compliance with tax laws. Each jurisdiction has set deadlines for submission, often aligned with the end of the tax year.

To streamline your filing process, utilizing online resources is beneficial. One such tool is pdfFiller, which allows easy e-filing of documents like the Business Property Statement. This technology not only simplifies form completion but also offers numerous benefits, including ease of access and reduced chances of error.

What to do if you miss the filing deadline

Missing the filing deadline can lead to penalties, including fines or additional interest on owed taxes. Business owners should act quickly to rectify any late filings by contacting their local assessor to discuss potential remedies. Implementing timely record-keeping practices can help mitigate these situations in the future.

Common FAQs about tangible personal property and filings

Understanding business tangible personal property also involves clarifying common questions surrounding its implications. Notably, tax obligations arise for most tangible property reported on Form 571-L. However, exemptions may apply based on jurisdiction and the specific type of asset.

Handling leased equipment

Leased equipment presents unique challenges during reporting. The tax implications may differ significantly between lessors and lessees. Lessees typically need to recognize the asset in their records to comply with reporting standards.

Reporting and valuing business assets

Valuation methods for tangible personal property can vary, primarily between acquisition cost and fair market value. The choice of method impacts the reported value and, consequently, the tax liability.

Several factors impact depreciation calculations, such as usage rates and industry standards. Business owners should be aware of common mistakes, like underreported values, which can lead to complications during assessment.

Interacting with your county assessor

Effective communication with your county assessor can lead to smoother transactions and clearer understanding of requirements. Understanding how assessments are conducted is crucial for accommodating any discrepancies.

Utilizing pdfFiller for document management

pdfFiller offers a comprehensive suite of solutions for document management, especially for forms like the Business Property Statement. It facilitates editing, signing, and collaborating on documents, making the process more streamlined for businesses.

Case studies and real-world examples

Exploring case studies can yield valuable insights into effective and problematic filing practices. For instance, businesses that meticulously adhered to filing requirements often noticed a smoother assessment process, reinforcing the importance of diligence in reporting.

Conversely, cases of inaccurate reporting reveal lessons on the consequences of failure to comply. Analyzing these examples can prepare current and future businesses to approach their property statements with caution and thoroughness.

Types of business tangible personal property by industry

Different industries can possess unique attributes when it comes to tangible personal property too. For example:

Each sector’s tangible personal property can influence how businesses file their statements, necessitating tailored reporting approaches.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business tangible personal property for eSignature?

How do I fill out the business tangible personal property form on my smartphone?

Can I edit business tangible personal property on an Android device?

What is business tangible personal property?

Who is required to file business tangible personal property?

How to fill out business tangible personal property?

What is the purpose of business tangible personal property?

What information must be reported on business tangible personal property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.