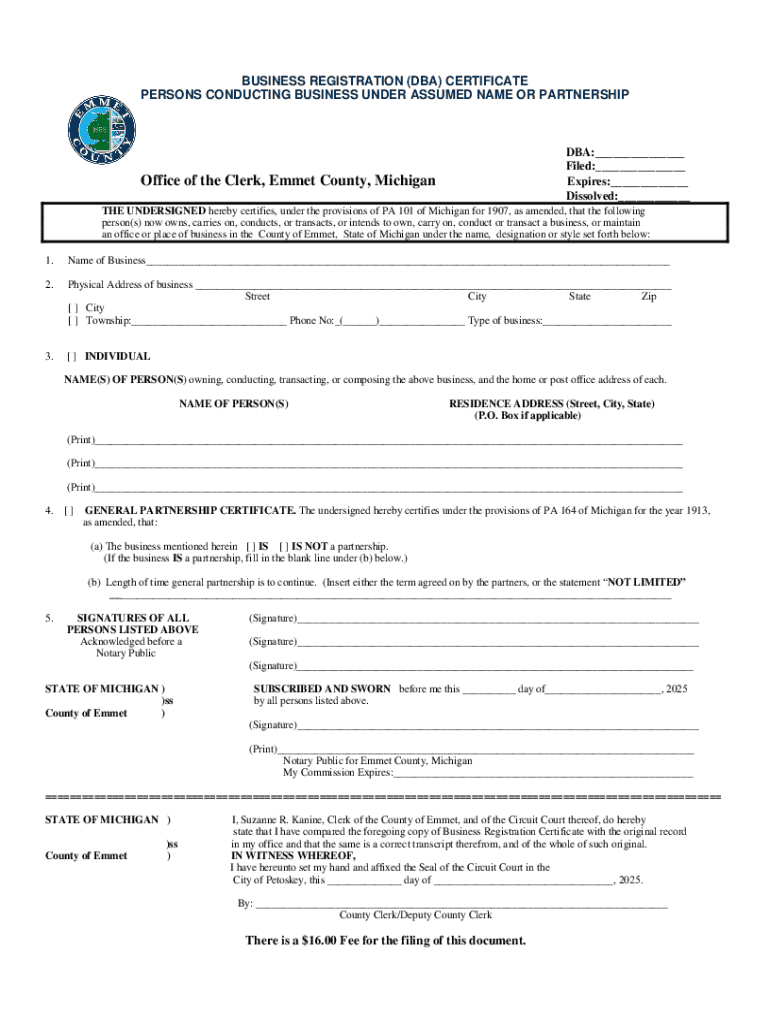

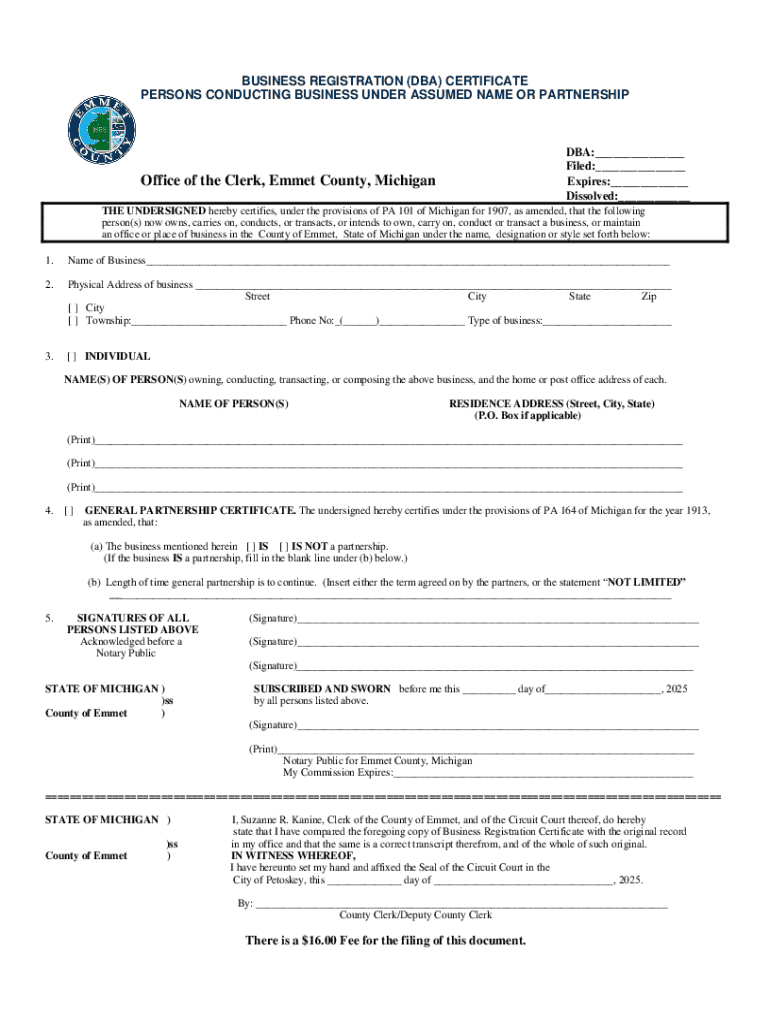

Get the free Business Registration (dba) Certificate

Get, Create, Make and Sign business registration dba certificate

Editing business registration dba certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business registration dba certificate

How to fill out business registration dba certificate

Who needs business registration dba certificate?

Comprehensive Guide to Business Registration DBA Certificate Form

Understanding DBA (Doing Business As)

DBA, short for 'Doing Business As,' refers to the trade name under which a business operates, distinct from the legal name of the entity. This name can significantly influence how customers perceive a business and facilitates brand recognition across various markets.

Choosing to register a DBA is crucial for business owners that aim to create a unique identity that resonates with their target audience. It allows individuals and businesses to operate under a name that represents their mission and values, making it easier to market services or products.

Importance of Filing a DBA Registration

Filing a DBA registration offers several legal advantages. First and foremost, it prevents potential market confusion, positioning your brand as a legitimate player in your industry. Moreover, registering a DBA ensures compliance with local business regulations.

Conversely, failing to register can expose a business to several risks, including legal disputes and fines for non-compliance. Unregistered businesses might face challenges in establishing a reliable reputation, leading to consumer mistrust.

Steps to Obtain a DBA Certificate

To successfully obtain a DBA certificate, follow these structured steps:

Fees and Payment Options for DBA Registration

When registering a DBA, various fees may apply depending on the state and jurisdiction. Typically, these can range anywhere from $10 to $100.

Understanding potential additional costs is also critical. Some states require the DBA name to be published in a local newspaper, which may incur extra charges. Payment methods usually include checks, credit/debit cards, or electronic payment platforms.

Managing Your DBA After Registration

Once your DBA is registered, it's essential to be aware of its validity period. Typically, DBAs need to be renewed every three to five years, depending on state regulations.

In the event of changes—such as updating your business name or ownership—be sure to file amendments promptly to keep your registration accurate and compliant.

What Happens After Filing a DBA?

After your DBA registration is successfully filed, you will receive documentation as proof of your registration. It is critical to store this documentation safely, as it may be required for leverage in legal matters and business validations.

Keep track of your DBA registration status and feel free to contact your local business registration office if any inquiries arise.

FAQs About DBA Registration

DBA registration often raises several questions. Here are some common misconceptions clarified:

Considerations for businesses operating statewide or nationally

For business owners engaged in operations that span across multiple states, understanding and adhering to state-specific regulations related to DBA registration is paramount. Each state has its own rules pertaining to whether a DBA must be registered and how long the registration is valid.

Consulting with legal counsel can be advantageous when expanding your DBA across state lines, ensuring compliance and avoiding complications.

Using pdfFiller for your DBA application

pdfFiller provides users with an efficient platform to navigate the DBA registration process. The interface is designed to simplify the form completion process, allowing users to input necessary details with ease.

The interactive tools available through pdfFiller facilitate seamless collaboration for teams filing applications together, and eSignature options make it convenient to finalize submissions.

Final checks before submission

Prior to submitting your DBA application, a thorough review is essential. Examine the entire application for accuracy, confirming that names and details are correct.

Verify that all required documents are attached, including proof of any publication if necessary. Lastly, ensure your payment method is appropriately processed to avoid delays.

Contacting authorities for additional assistance

If you encounter issues or have questions during the DBA process, reaching out to your local business registration office can provide clarity. These offices are equipped to guide you through any challenges or uncertainties you may face.

They typically offer resources and support for your DBA registration needs, including location specifics, contact information, and guidance on related business matters.

Top mistakes to avoid when filing your DBA

Common errors while filing DBA applications can lead to unnecessary delays or outright rejections. One of the most critical mistakes is failing to ensure that your desired name is available, which can cause complications in the registration process.

Additionally, overlooking specific documentation requirements or inaccurately completing the application can also hinder your progress. Double-checking these components before submission is key to a smooth registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business registration dba certificate directly from Gmail?

How do I edit business registration dba certificate straight from my smartphone?

How do I edit business registration dba certificate on an Android device?

What is business registration dba certificate?

Who is required to file business registration dba certificate?

How to fill out business registration dba certificate?

What is the purpose of business registration dba certificate?

What information must be reported on business registration dba certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.