Get the free Business Checking Account Statement

Get, Create, Make and Sign business checking account statement

Editing business checking account statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business checking account statement

How to fill out business checking account statement

Who needs business checking account statement?

Comprehensive Guide to Business Checking Account Statement Forms

Understanding the business checking account statement

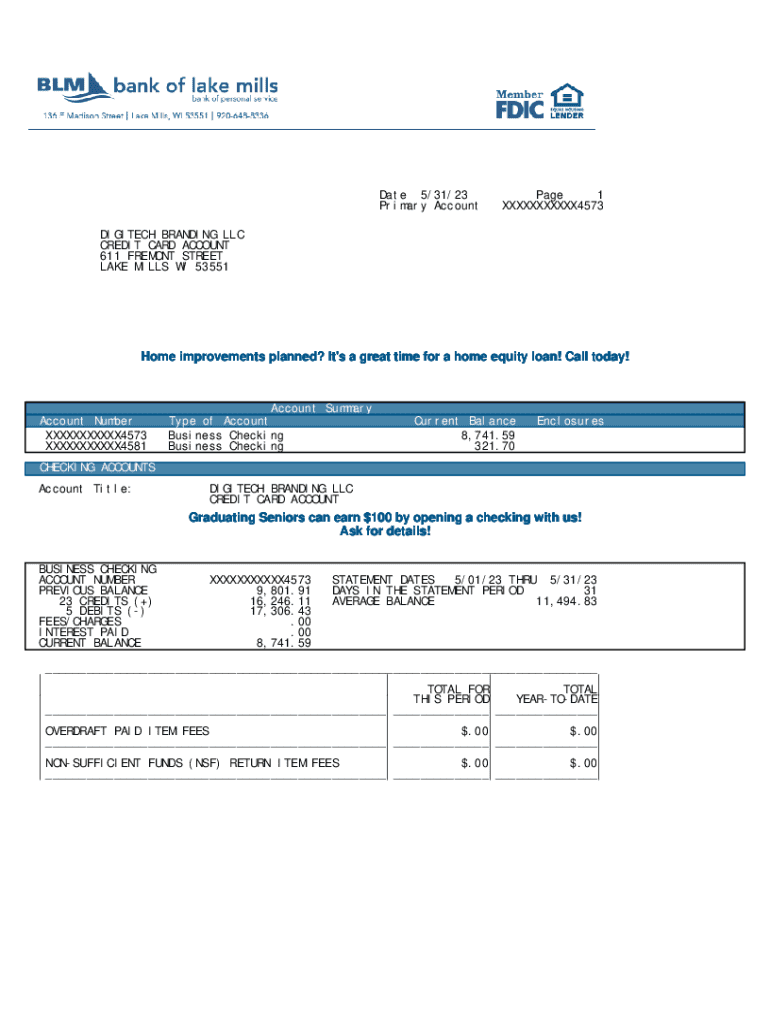

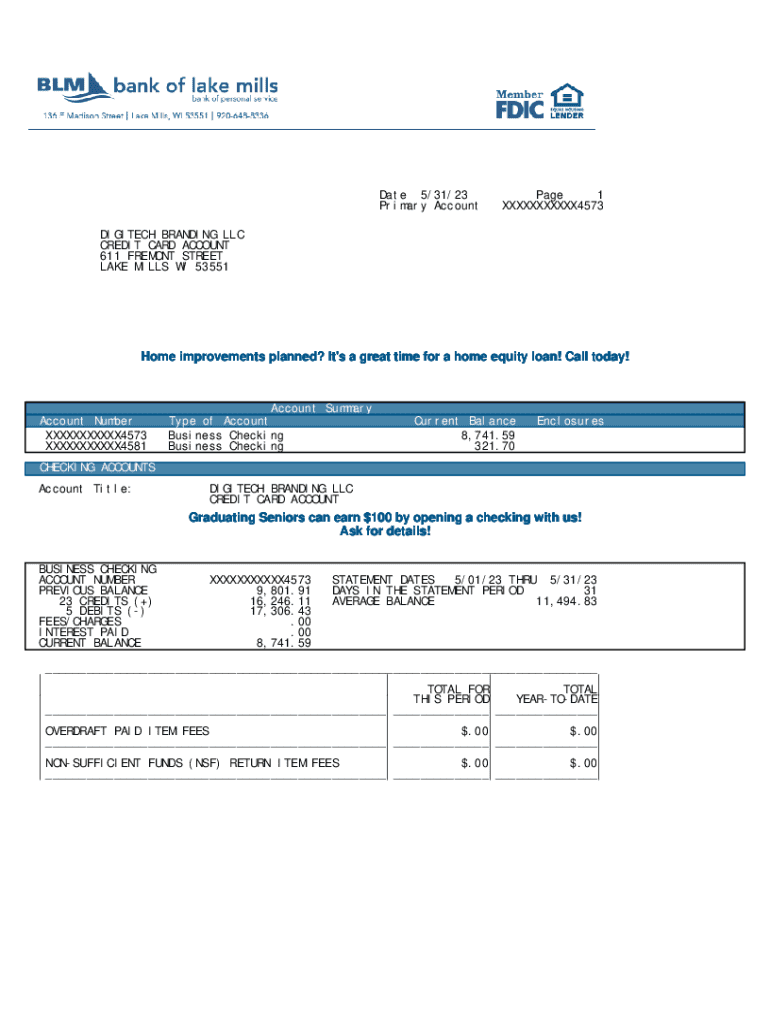

A business checking account statement is a critical document issued by financial institutions summarizing the transactions within a business's checking account over a specific statement period. This document provides insights into the business’s financial activities, including deposits, withdrawals, and any associated fees. Reviewing this statement regularly is essential for maintaining healthy business finances and ensuring accurate accounting.

Understanding the importance of your business checking account statement cannot be overstated. It serves as a financial health report, revealing trends in spending and income, which can inform budgeting and forecasting decisions. Furthermore, discrepancies or fraudulent activities can be detected early by comparing this statement against your internal records.

Business and personal checking accounts differ substantially. A business checking account statement typically encompasses more detailed transaction data, including a breakdown of vendor payments, which are not usually present in personal statements. Moreover, fees associated with business accounts, such as transaction fees or maintenance charges, are often different and may require special attention.

Components of a business checking account statement form

A comprehensive understanding of the components within a business checking account statement form is crucial for effective financial management. The statement typically includes the following key details:

How to access and obtain your business checking account statement

Obtaining your business checking account statement is a streamlined process, thanks to advancements in online banking. Most banks have set up their websites to provide easy access to these vital documents. Here are the steps to access and obtain your business checking account statement:

Filling out the business checking account statement form

Completing the business checking account statement form accurately is vital for proper record-keeping. Here’s a step-by-step guide to ensure you are doing this correctly:

Avoid common mistakes like entering incorrect amounts, failing to include all transactions, or neglecting to verify the overall balance. Double-checking your work ensures an accurate reflection of your business finances.

Organizing supporting documentation, such as invoices or receipts, can provide additional clarity during transactions review. This can simplify future reconciliations and audits, allowing for smooth transitions in your financial reporting.

Editing and managing your business checking account statement

Once you have your business checking account statement form in hand, it is vital to manage and edit this document effectively. With tools like pdfFiller, you can easily edit and interactive manage your financial statements. Here’s how to make the most out of this platform:

Using pdfFiller can greatly simplify managing your financial documents, facilitating easier collaboration and providing a secure, accessible way to track your business finances.

Examples of business checking account statements

Visual examples of business checking account statements can clarify how to interpret these documents. Typically, a well-laid example includes sections and entries that highlight key information such as total deposits, withdrawals, and fees. Understanding these fields helps in making informed financial decisions.

Practical uses for your business checking account statement

Your business checking account statement is not just a record; it’s a strategic tool for various business applications. Here are several practical uses:

Frequently asked questions about business checking account statements

Understanding your business checking account statement can prompt a range of questions. Here’s a compilation of common queries and their answers to clear up any uncertainty:

Enhancing financial literacy through statement reviews

Regular reviews of your business checking account statement are not only about verifying transactions; they play a pivotal role in understanding broader financial trends. By examining expenses and revenues over time, business owners can identify patterns that may impact future business strategies.

Reconciliation of your statements adds another layer of accuracy. This process involves comparing your bank statement with internal financial records to catch errors and ensure alignment. By practicing regular reconciliations, you enhance trust in your financial systems, leading to informed strategic decisions that can foster growth and stability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business checking account statement online?

How do I edit business checking account statement in Chrome?

How do I fill out the business checking account statement form on my smartphone?

What is business checking account statement?

Who is required to file business checking account statement?

How to fill out business checking account statement?

What is the purpose of business checking account statement?

What information must be reported on business checking account statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.