Natural gas consumption tax form: A complete guide for efficient filing

Understanding the natural gas consumption tax form

The natural gas consumption tax form is an essential document required for reporting taxes related to the consumption of natural gas. This form serves to collect revenue for state and local governments, helping to fund public services and infrastructure. Understanding the nuances of this form is crucial, especially for homeowners and businesses that rely heavily on natural gas.

The natural gas consumption tax is imposed on users of natural gas across various sectors, ensuring that all consumers contribute to the municipal resources they utilize. Accurate reporting through this form is important not only to avoid penalties but also to ensure that consumers can benefit from potential tax deductions or credits.

Purpose of the Natural Gas Consumption Tax: To fund state and local services.

Importance for individuals: Ensures compliance and possible tax benefits.

Importance for businesses: Helps avoid penalties and maintain operations.

Who needs to file?

Filing the natural gas consumption tax form is mandatory for various entities. Homeowners utilizing natural gas for heating, cooking, or other purposes must file this form, as well as commercial establishments such as restaurants and manufacturers that consume significant quantities of gas for their operations.

Additionally, large-scale energy companies are also required to report their natural gas usage. Some individuals or businesses may qualify for exemptions based on specific criteria, which can help reduce their overall tax burden. Understanding who falls under these requirements is key to ensuring compliance.

Homeowners using natural gas for household needs.

Commercial businesses with significant natural gas consumption.

Energy companies and industrial users.

Entities eligible for exemptions due to specific criteria.

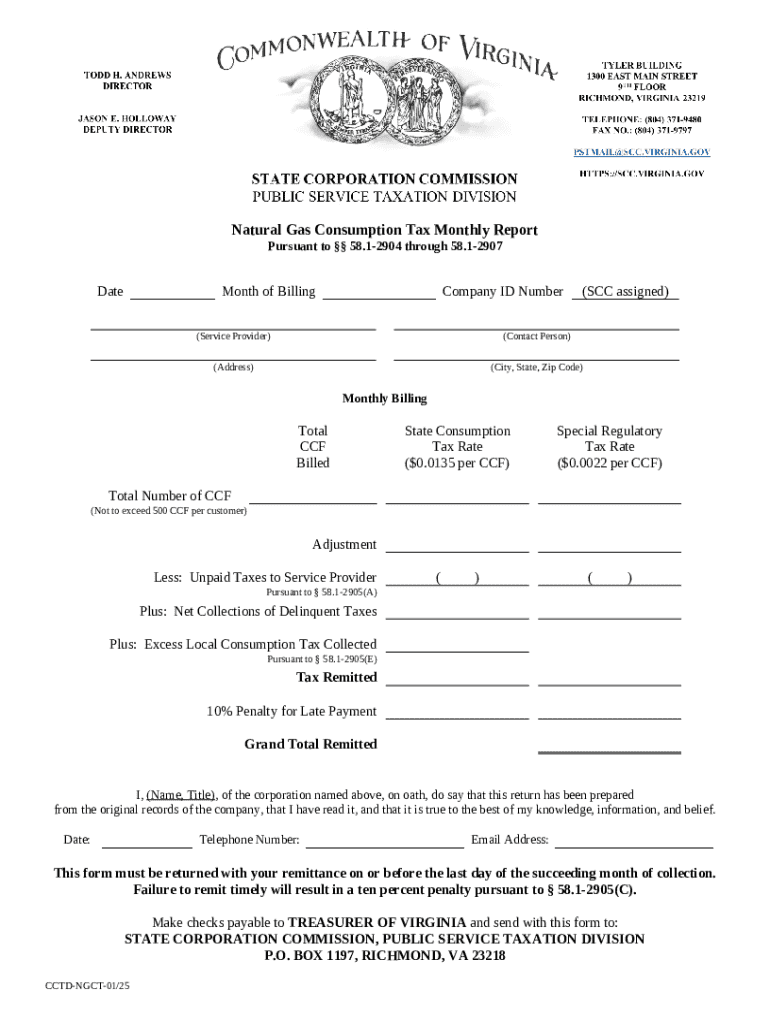

Key components of the natural gas consumption tax form

The natural gas consumption tax form comprises various sections designed to capture essential information about the taxpayer and their natural gas usage. The form begins with identifying information, requiring personal and business details to ensure accurate record-keeping and verification.

Following the identification section is consumption reporting, which necessitates specifying the amount of natural gas used over a reporting period. It's crucial to calculate usage accurately to reflect true consumption and avoid discrepancies. Tax calculation follows, where users must apply the appropriate tax rates to the reported consumption, including provisions for exemptions.

Identifying Information: Personal and business details.

Consumption Reporting: Amount of natural gas used.

Tax Calculation: Rates and applicable exemptions.

How to complete the natural gas consumption tax form

Completing the natural gas consumption tax form requires careful attention to detail. Begin by gathering all necessary documents and data, including previous bills and usage reports, which will help accurately fill in the consumption reporting section.

Fill out each section of the form, being mindful of accuracy and clarity. Common pitfalls include miscalculated usage or incorrect personal details, which could lead to rejected submissions or fines. To avoid issues, double-check calculations and ensure all sections are completed thoroughly.

Gather required documents: Previous bills, usage reports, etc.

Fill out the form ensuring accuracy.

Double-check for common errors to ensure compliance.

Utilizing digital tools can greatly simplify the process of completing the tax form. Platforms like pdfFiller offer features for editing, filling out forms, and adding eSignatures, making it easy to submit forms in compliance with regulations.

Frequently asked questions (FAQs)

When it comes to the natural gas consumption tax form, many questions arise. One of the most common concerns is what to do if you miss the submission deadline. It’s essential to file as soon as possible to minimize potential penalties, and you may need to contact your local tax office for guidance.

Another frequent question involves correcting errors after submission. If you discover a mistake, it’s recommended to file an amended return as soon as possible. Clear documentation should accompany any amendments to support your changes and avoid confusion.

What if I miss the submission deadline? File as soon as possible.

How to make corrections after submission? File an amended return.

Clarifications on tax rates and exemptions should be researched or confirmed with local tax offices.

Managing your natural gas tax documents with pdfFiller

Organizing your tax documents is vital for a stress-free filing process. With pdfFiller, you can create specific folders to categorize different tax files, making retrieval faster during tax season. Document sharing features also facilitate collaborative efforts for teams needing access to shared files.

Once the forms are submitted, it’s essential to track and store these records securely. pdfFiller allows users to save submitted forms in an easily accessible format, and you can export these records for traditional filing or backup. Ensuring that your documents are organized not only saves time but also helps with future filings.

Creating organized folders for quick access to files.

Using sharing features to collaborate with teams.

Saving and managing submitted forms securely.

Utilizing resources for optimal tax management

In navigating the complexities of the natural gas consumption tax form, taking advantage of interactive tools can enhance your experience. pdfFiller, for example, provides quick calculators for estimating tax liabilities and access to templates from prior years. This allows users to be better prepared for upcoming tax obligations.

Also, tapping into the customer support options available can alleviate many filing frustrations. Reach out for assistance through online customer service, and explore the FAQs and community forums for common concerns and solutions. This connectivity ensures that users have help when they need it most.

Use calculators available on pdfFiller for estimating tax.

Access templates and forms from prior years.

Utilize customer support for timely assistance.

Staying informed about natural gas tax changes

The landscape of taxation can change, impacting the natural gas consumption tax process. Keeping abreast of legislative updates at both the state and federal levels is crucial for consumers to understand how new regulations may affect them. Changes to rates or exemptions can mean significant differences in financial responsibilities.

Engaging with local community meetings related to taxes and natural gas consumption can also provide valuable insights into shifts in policy. By staying informed, individuals and businesses can adjust their practices accordingly, ensuring compliance and optimal financial management.

Monitor legislative updates that may affect consumers.

Engage with local community meetings regarding tax changes.

Adjust practices based on updates to ensure compliance.

Conclusion: Simplifying your tax filing process

Efficient management of the natural gas consumption tax form can pave the way for a smooth filing process. By utilizing tools like pdfFiller, users can streamline their document preparation, submission, and archiving, thereby reducing stress during tax season. Emphasizing document organization and leveraging digital functionalities creates an environment conducive to compliance and proactive management.

Encouraging users to stay informed and properly manage their documentation and submissions will not only facilitate adherence to regulations but also empower them to take control of their tax obligations effectively. The ability to edit, eSign, and collaborate on forms from a single cloud-based platform like pdfFiller ensures that professionals and individuals alike can meet their tax responsibilities with confidence.