Get the free National Flood Insurance Elevation Certificate

Get, Create, Make and Sign national flood insurance elevation

How to edit national flood insurance elevation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out national flood insurance elevation

How to fill out national flood insurance elevation

Who needs national flood insurance elevation?

Understanding the national flood insurance elevation form: A how-to guide

Understanding the national flood insurance elevation form

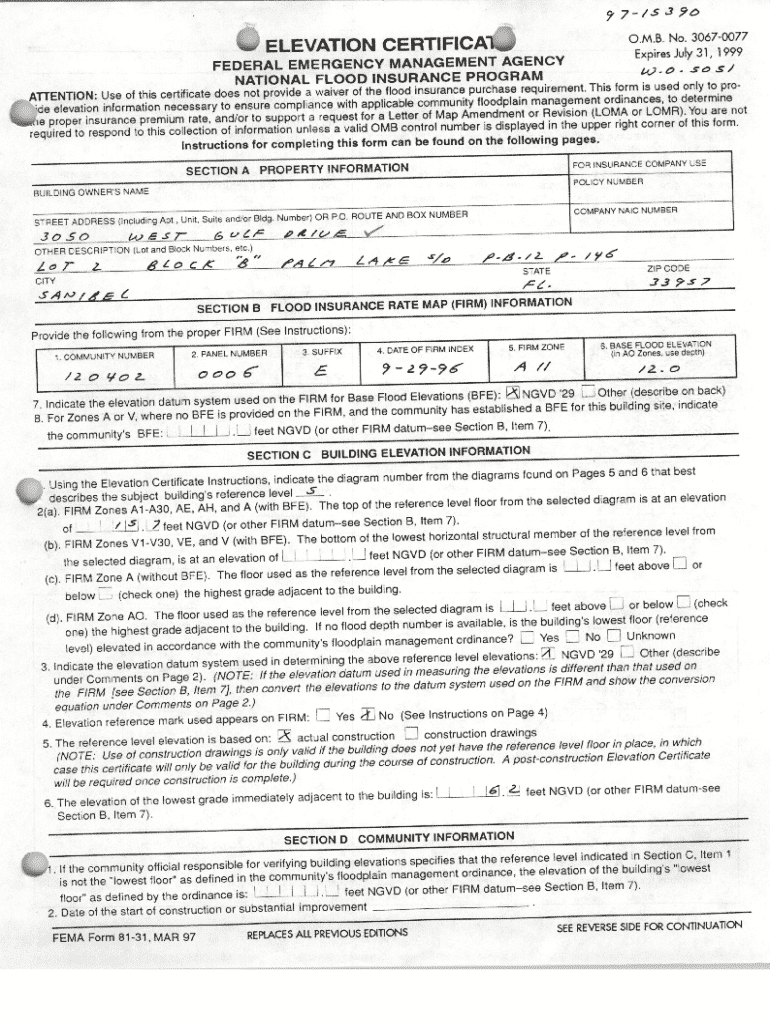

The national flood insurance elevation form is a critical document for property owners in flood-prone areas. This form helps establish the elevation of the insured structure concerning the base flood elevation (BFE). If your property is located in a Special Flood Hazard Area (SFHA) and you’re seeking flood insurance, this elevation data is essential for accurately assessing your flood risk and determining your premiums.

Filling out the elevation form correctly is paramount because it directly impacts flood insurance claims. Inaccuracies can lead to higher premiums or challenges in the event of a claim. Key terms associated with the elevation form include ‘BFE’, which refers to the base flood elevation, and ‘Lowest Floor’, which denotes the lowest enclosed area of the building.

Purpose and benefits of completing the elevation form

Completing the elevation form has significant implications for flood risk assessment. Correctly reporting elevation data not only allows property owners to comply with insurance requirements but also helps in understanding the actual flood risk. By clearly establishing how high your building sits above the BFE, you provide insurance underwriters with essential information that can greatly influence your flood insurance policy.

Key components of the elevation form

The elevation form comprises several essential sections that must be filled accurately. The property information section requires details such as the property address, the names of the owners, and the flood insurance policy number. This ensures that the elevation data is correctly associated with the appropriate property.

Additionally, the elevation data section involves reporting specific measurements. You’ll need to provide the elevation of the lowest floor of the structure, any relevant attachments (like decks and garages), and notes on whether the property is elevated above the BFE. Finally, the certification requirements require a signature from a licensed land surveyor, engineer, or architect, validating the provided information.

Step-by-step instructions for filling out the elevation form

Before diving into the completion of the elevation form, gather all necessary documents. These should include your current flood insurance policy, the property's most recent survey, and any relevant photographs of the property for better clarity. Collaborating with a licensed surveyor or engineer is highly recommended, as they will help ensure the precision of the elevation data.

Common mistakes often arise from misreported elevations or incomplete sections. Double-check each entry before submission. Moreover, consider employing sample scenarios to understand how various scenarios influence flood insurance needs and requirements.

Resources for assistance and verification

Navigating the elevation form can be daunting, but numerous resources are available to assist you. Accessing official guidelines and frequently asked questions about the elevation form will clarify many uncertainties. The Federal Emergency Management Agency (FEMA) provides comprehensive resources online, including tutorials and examples.

Submitting the elevation form

Once you've meticulously filled out the national flood insurance elevation form, the next step is submission. There are typically two primary methods for submitting this vital document; digital submissions can often be made via cloud-based platforms or directly to your insurance provider’s website.

If opting for a mail-in procedure, be sure to send copies that are fully signed and certified. Keeping a tracking record is advisable; use registered mail services or delivery confirmation options to ensure your form reaches the intended recipient.

After the submission: Next steps

Following the submission of your completed elevation form, it’s essential to understand what to expect. Typically, the insurance company will review your submission and may reach out for any additional information or clarification. Promptly responding to such requests is vital for expediting your policy activation.

Special considerations and updates

Flood insurance regulations are subject to change, and it’s essential to stay updated on any new guidelines that may affect the elevation form. FEMA frequently revises its policies and protocols, particularly in response to feedback from affected communities and evolving climate conditions.

Leveraging the pdfFiller platform for document management

Using a cloud-based platform like pdfFiller can significantly streamline the process of managing the national flood insurance elevation form. With its comprehensive tools, users can edit PDFs, eSign, collaborate, and securely manage all necessary documentation from any location.

Real-life examples and case studies

Numerous property owners have optimized their flood insurance premiums through diligent completion of the elevation form. Take, for instance, a homeowner in Florida who accurately reported their home’s elevation during a rainstorm incident. By demonstrating that their home was above the BFE, they managed to avoid significant claims and reduced future premium costs.

Conversely, cases of property owners who submitted inaccurate information often find themselves burdened with higher premiums or faced delays in claims processing. Analyzing the nuances between these scenarios illustrates the impact that correct elevation data can have on flood insurance outcomes.

FAQs about the national flood insurance elevation form

Addressing common points of confusion can help demystify the process of filling out the national flood insurance elevation form. Many individuals ask about the necessary documentation and the qualifications required for surveyors or engineers to certify their elevation data. Others seek clarification on the implications of inaccurate submissions.

Engaging with the community: Support and knowledge sharing

Engagement with local and online communities can significantly enhance your understanding of the elevation form. Several forums, social media groups, and community workshops provide platforms to share experiences, insights, and guidance. Participating in these dialogues can provide answers to specific questions regarding unique situations you may face.

About pdfFiller

pdfFiller is dedicated to simplifying the document management process, especially for crucial forms like the national flood insurance elevation form. Our mission is to empower individuals and teams to navigate document creation seamlessly while promoting collaboration and efficiency.

By offering innovative solutions for editing, signing, and managing important documents, pdfFiller ensures that users have the tools they need to handle complex forms and serve their flood insurance needs effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit national flood insurance elevation in Chrome?

How can I edit national flood insurance elevation on a smartphone?

Can I edit national flood insurance elevation on an iOS device?

What is national flood insurance elevation?

Who is required to file national flood insurance elevation?

How to fill out national flood insurance elevation?

What is the purpose of national flood insurance elevation?

What information must be reported on national flood insurance elevation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.