Get the free Form 8868

Get, Create, Make and Sign form 8868

How to edit form 8868 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868

How to fill out form 8868

Who needs form 8868?

Comprehensive Guide to IRS Form 8868

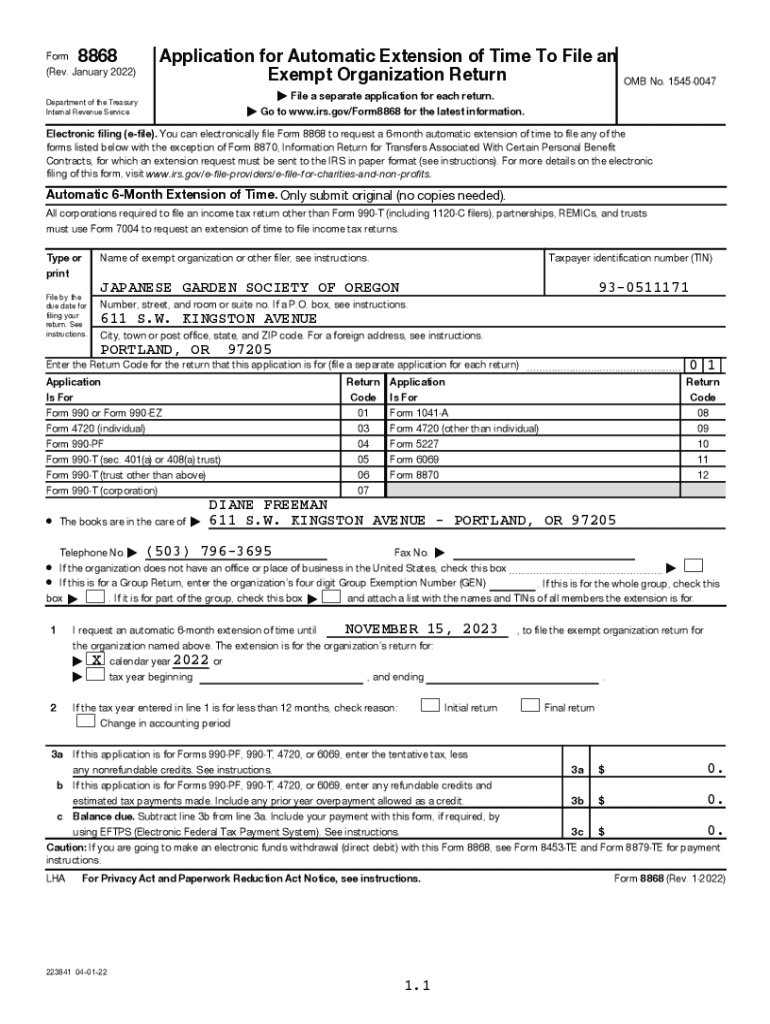

Understanding IRS Form 8868

IRS Form 8868 is a critical document used by exempt organizations to apply for an automatic extension of time to file their annual returns. Specifically designed for organizations such as charities and nonprofits, the form allows these entities to extend their filing deadline without penalties as long as certain conditions are met.

Filing Form 8868 is essential for exempt organizations as it safeguards their tax-exempt status. The Internal Revenue Service (IRS) requires these entities to submit annual returns (like Forms 990, 990-EZ, or 990-PF), and failure to file can lead to undesirable consequences, including revocation of tax-exempt status.

Eligibility for filing Form 8868

Not every organization qualifies for an extension using Form 8868. Primarily, the form is designed for tax-exempt organizations recognized under section 501(c) of the Internal Revenue Code. This includes charities, foundations, and educational institutions, among others.

In addition to tax-exempt organizations, the form is also applicable to private foundations and certain nonprofits that need more time to prepare their annual returns. To qualify, organizations must ensure that they are current on all required filings and adhere to the rules set forth by the IRS.

Application overview of Form 8868

Form 8868 is primarily an application for an automatic six-month extension of time to file specified tax returns. This includes Forms 990, 990-EZ, and 990-PF. Organizations can use Form 8868 to request one automatic extension, but they must file the return before the extension period expires.

Related forms to Form 8868 include Form 990 and its variants. If an organization has multiple types of returns due, it can use Form 8868 to request extensions for several of them, provided it meets all eligibility requirements.

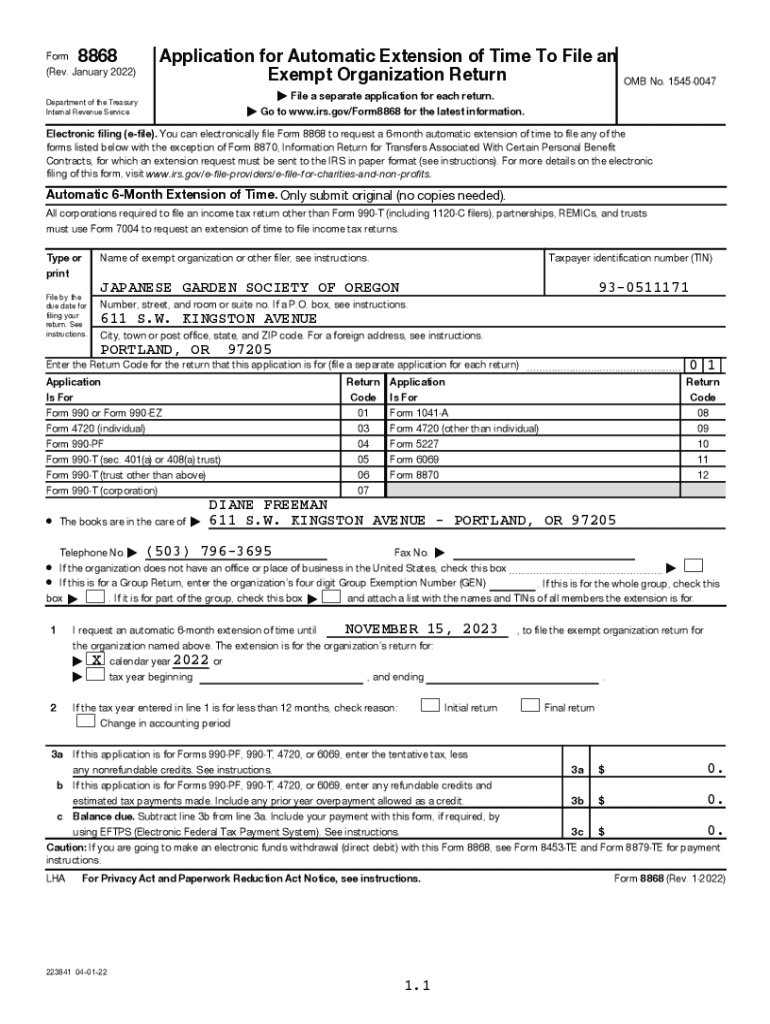

Key information required for filing

Filing Form 8868 requires careful attention to detail, as incomplete information can delay the processing of your application. Mandatory fields include the organization’s name, address (city, state, zip code), and Taxpayer Identification Number (TIN).

Each line in the form is crucial; for instance: 1. **Line 1**: Enter the exact name of the organization. 2. **Line 2**: Provide the address details, including state and zip code. 3. **Line 3a, 3b, 3c**: Indicate the type of return you are filing and the fiscal year for which you are requesting an extension. Ensuring accuracy in these fields is vital for a successful application.

Important updates for the 2024 tax year

For the 2024 tax year, the IRS has made a few notable updates to Form 8868. Organizations should review any recent changes to ensure compliance. New instructions and guidelines may also influence how the form is completed, particularly if there are shifts in eligibility requirements or changes in related forms.

It is important for organizations to stay informed about upcoming deadlines and potential changes in tax legislation that could affect their filings and extensions.

How to submit Form 8868

Submitting Form 8868 can be done either by paper or electronically. For simplified and efficient handling, many organizations choose to e-file. To file electronically, organizations must use IRS-approved software or platforms like pdfFiller, which facilitate the smooth preparation, signing, and management of forms.

When filing by mail, ensure you send it to the appropriate IRS address based on your location and the type of return you are submitting. This helps avoid unnecessary delays.

Deadlines for Form 8868 submission

Understanding the deadlines for filing Form 8868 is crucial for compliance. The form must be submitted before the original filing deadline of the return you are seeking to extend. For most organizations, this means the deadline is typically the 15th day of the 5th month after the end of their fiscal year.

Missing this deadline can result in significant penalties, including late filing fees and potentially the loss of tax-exempt status. Therefore, organizations should prioritize submitting Form 8868 on time to prevent complications.

Addressing filing penalties and late payments

Organizations that fail to file Form 8868 by the deadline may face late payment and filing penalties. The IRS imposes penalties based on the size of the organization and the length of time the return remains unfiled.

Understanding these penalties empowers organizations to take proactive measures, such as utilizing pdfFiller’s efficient tools for preparation and submission.

Mailing details for Form 8868

The location to mail Form 8868 depends on whether the organization is enclosing a payment. If no payment is made, forms should be sent to the address specified by the IRS, typically found in the form instructions. For those sending a payment, a different address will apply.

It's crucial for organizations to obtain confirmation of receipt, whether filing electronically or by mail, to ensure that their submission is processed, thus safeguarding their tax-exempt status.

Additional instructions and advisory notes

Completing Form 8868 requires attention to specific detailed instructions. Each part of the form has distinct instructions that organizations should follow to ensure accurate completion.

Additionally, organizations should be aware of the Privacy Act and Paperwork Reduction Act Notices associated with completing Form 8868 to understand their rights and obligations.

Frequently asked questions (FAQs)

Organizations often have numerous questions regarding Form 8868. Some of the most common include:

Need help? Contact information

For tailored assistance, organizations can contact the IRS directly. They provide guidance on various tax-related queries, including specific concerns about Form 8868. Additionally, utilizing professional resources can offer insight into proper filing practices.

pdfFiller also provides resources and support for organizations looking to navigate the complexities of document management, ensuring they can efficiently handle Form 8868 and more. Always stay informed and seek assistance when needed for smooth processing and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 8868?

How do I edit form 8868 on an Android device?

How do I complete form 8868 on an Android device?

What is form 8868?

Who is required to file form 8868?

How to fill out form 8868?

What is the purpose of form 8868?

What information must be reported on form 8868?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.