Get the free Access Loan Application

Get, Create, Make and Sign access loan application

How to edit access loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out access loan application

How to fill out access loan application

Who needs access loan application?

Access Loan Application Form - How-to Guide Long-Read

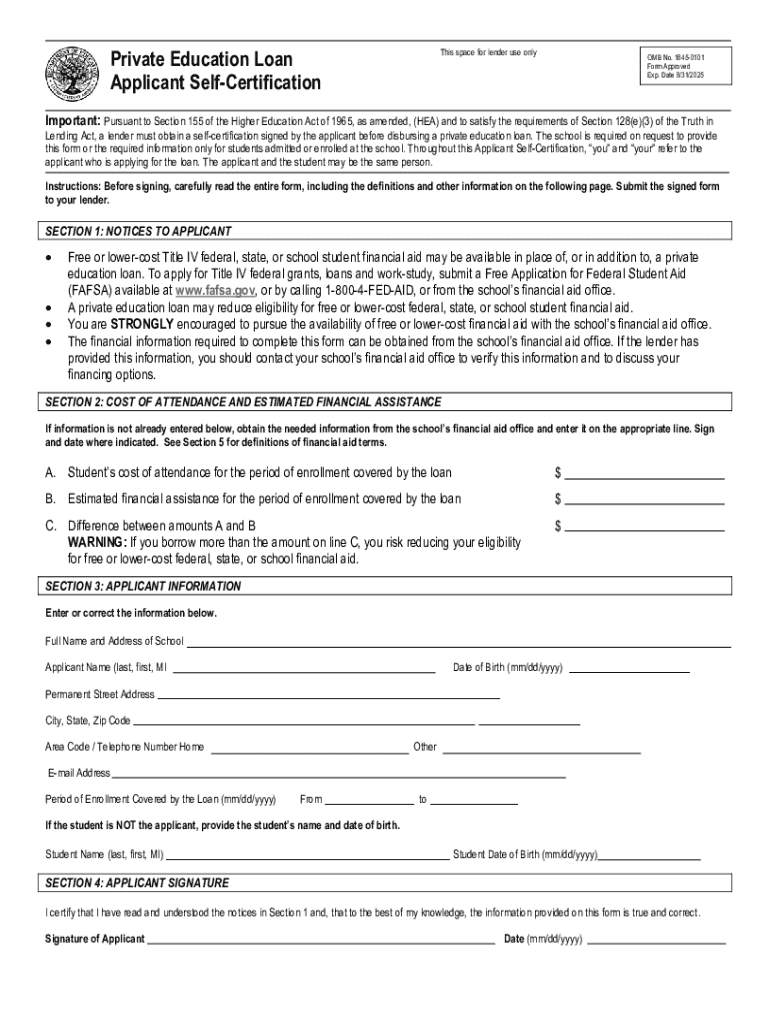

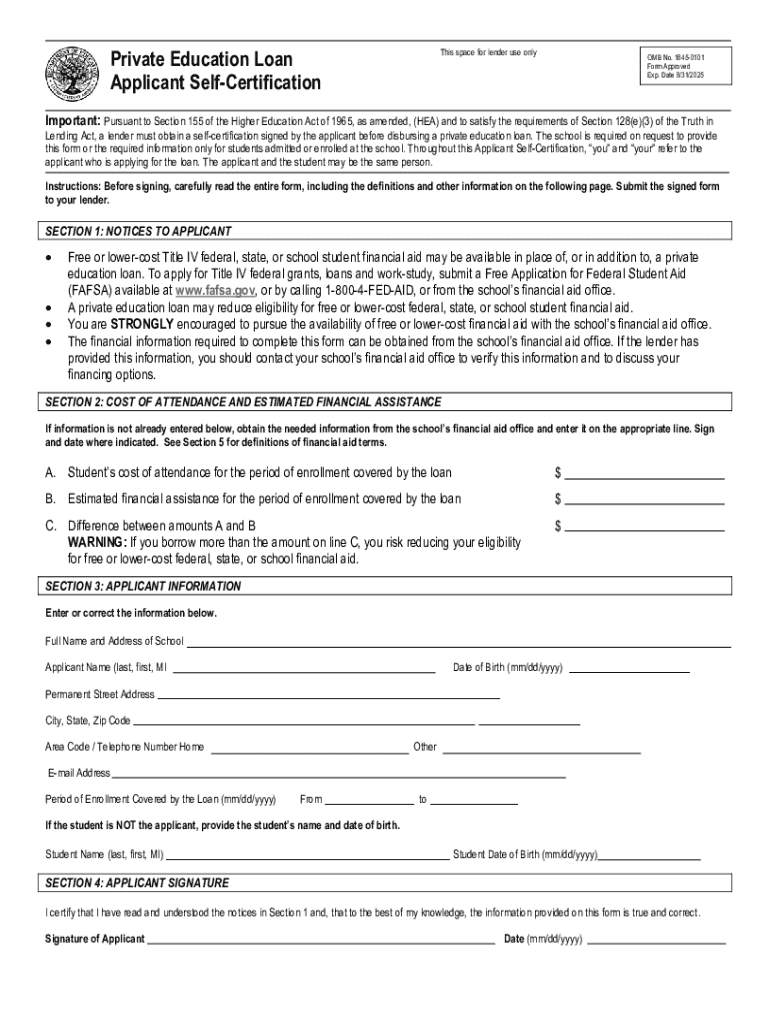

Understanding the access loan application form

The access loan application form serves as the cornerstone of the borrowing process for individuals seeking financial assistance. This dedicated form is crucial for those looking to secure needed funds through various lending options, including personal loans, education financing, or business capital. It provides lenders with necessary information to assess the applicant's eligibility and risks involved in granting a loan.

The importance of the access loan application form cannot be overstated. It acts as a formal request for funds and fosters a transparent line of communication between lenders and borrowers. By compiling all necessary applicant details, lenders can make informed decisions quickly. The types of loans commonly associated with this application form vary widely, ensuring it meets the needs of varied borrowers—be it individuals seeking personal loans or businesses looking for capital.

Essential information needed for the application

Completing the access loan application form accurately ensures a smoother approval process. Understanding the required information is key. Applicants must provide personal identification information, financial details, and loan specifics to build a comprehensive profile.

Step-by-step guide to filling out the access loan application form

Filling out the access loan application form can appear daunting, but following a simple process can make it efficient and manageable. Here’s a structured way to navigate through the procedure:

Submitting your application

After meticulously filling out the access loan application form, it's time to submit it. Understanding submission options is vital for ensuring timely processing of your application.

After submission, be aware of what to expect. Processing times can vary by lender, so prepare for communication regarding your application status, which may take anywhere from a few days to several weeks.

Troubleshooting common issues

When filling out an access loan application form, it’s essential to be prepared for potential hurdles that may arise. Here’s a help guide for common issues you might face:

Tips for improving your approval chances

Enhancing your chances of loan approval involves strategic preparation. Follow these tips to strengthen your application:

Frequently asked questions (FAQs)

To further assist you in navigating the access loan application form, here are responses to some common queries applicants typically have:

Additional tools and resources

Leveraging the features available on pdfFiller can significantly streamline your document management processes when dealing with financial applications.

Real-life case studies

Numerous individuals have effectively navigated through the access loan application process, leading to successful funding.

One engaging example includes Emily, who utilized pdfFiller to submit her access loan application form for funding her small business. With clear documentation and strategic finishing touches using pdfFiller’s tools, she received approval within five days.

Similarly, Mark, a college student, sought financial assistance for his education. His meticulously filled application through pdfFiller led to timely loan processing, demonstrating the platform’s impact on achieving successful outcomes.

Engaging with the pdfFiller community

The pdfFiller community offers a vibrant space for users to engage, learn, and share experiences. By participating in forums, users can gain invaluable advice from peers on effective document submission.

Additionally, pdfFiller often hosts workshops and webinars, providing insights into financial documentation and how to maximize the platform’s features, ensuring users are equipped with practical knowledge to navigate the loan application process more effectively.

Final thoughts on the access loan application process

Utilizing the access loan application form correctly opens the door to financial opportunities. By leveraging the advantages of pdfFiller, applicants can experience a more streamlined application process. With robust editing features, easy documentation management, and collaborative tools, pdfFiller empowers users to take control of their financial futures.

Embracing technology can alleviate typical application challenges, ensuring users navigate the necessary steps with confidence and precision. With the right preparation and resources, securing an access loan can be an achievable goal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get access loan application?

Can I sign the access loan application electronically in Chrome?

Can I edit access loan application on an Android device?

What is access loan application?

Who is required to file access loan application?

How to fill out access loan application?

What is the purpose of access loan application?

What information must be reported on access loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.