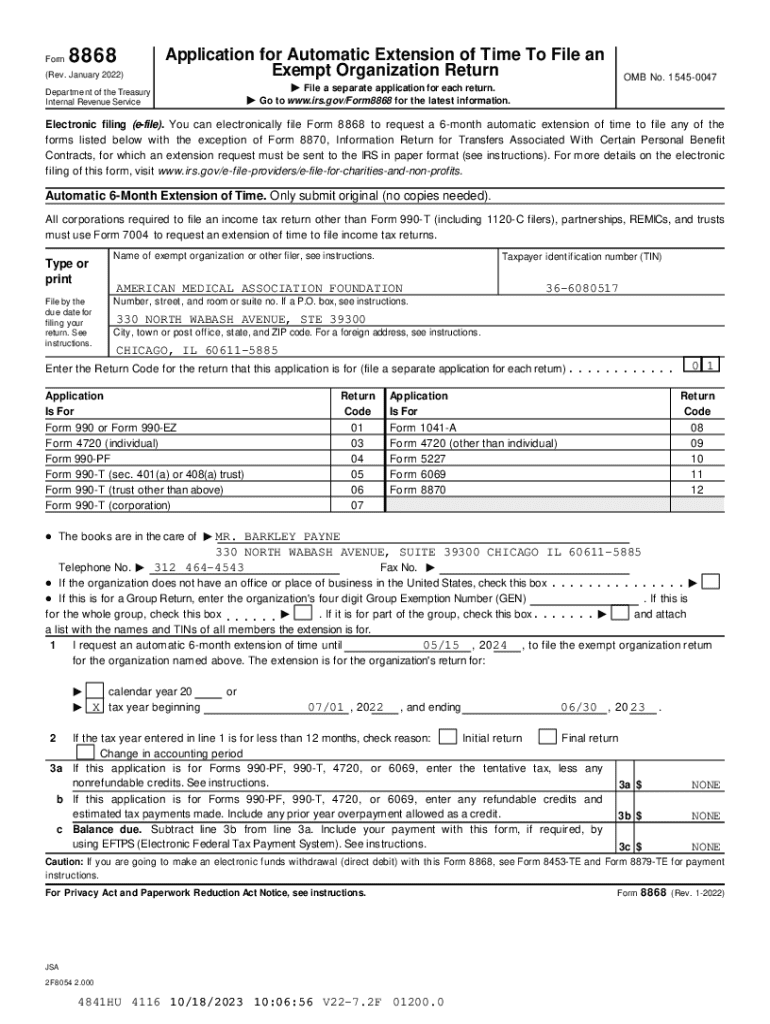

Get the free Form 8868

Get, Create, Make and Sign form 8868

How to edit form 8868 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868

How to fill out form 8868

Who needs form 8868?

Understanding IRS Form 8868: A Comprehensive How-To Guide

Understanding IRS Form 8868

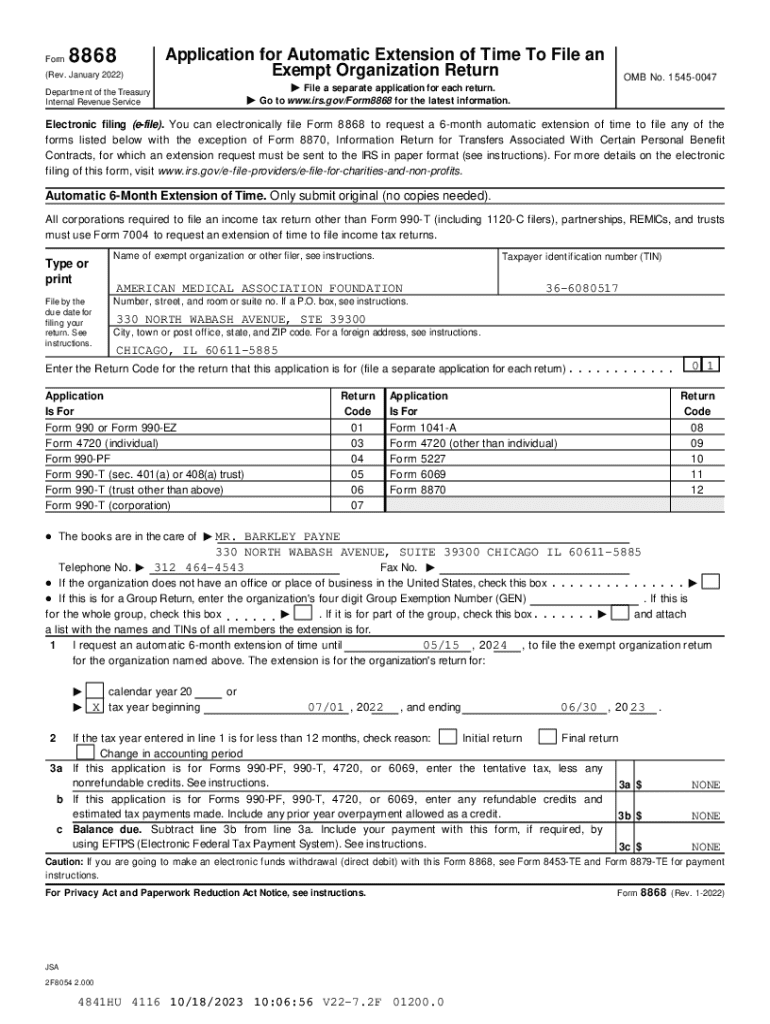

IRS Form 8868 is a crucial document for tax-exempt organizations seeking an extension of time to file their annual returns. Specifically designed for exempt organizations, Form 8868 allows these entities an additional six months to complete their tax obligations. This proactive measure is essential for compliance, preventing any lapses that could lead to penalties or complications.

The importance of Form 8868 cannot be overstated. Non-profit organizations, charities, and other exempt entities often face unique operational challenges that can affect their ability to meet standard filing deadlines. By utilizing this form, organizations can better manage their reporting responsibilities, ensuring they remain transparent and compliant with IRS regulations.

Purpose of Form 8868

The primary purpose of Form 8868 is to apply for an automatic extension of time to file Form 990, Form 990-EZ, or Form 990-PF. By submitting Form 8868 before the original filing deadline, organizations can secure an extension without needing to provide a detailed explanation for their request.

The impact of filing Form 8868 extends beyond just meeting deadlines; it also ensures that organizations maintain good standing with the IRS, protecting their tax-exempt status. Neglecting the filing could lead to undesirable consequences, such as penalties and the potential loss of exemption status.

Eligibility to file Form 8868

Not all organizations can file for an extension using Form 8868. Eligibility is specifically designated for tax-exempt organizations recognized under Section 501(c) of the Internal Revenue Code, including charitable organizations, religious entities, and other non-profits.

It's crucial for organizations to understand the difference between exempt and non-exempt entities. While both can be involved in community service and nonprofit work, only exempt organizations are entitled to the tax benefits associated with filing Form 8868.

Forms associated with Form 8868

Form 8868 is directly associated with several other forms that exempt organizations must file, primarily Form 990, Form 990-EZ, and Form 990-PF. Each of these forms serves different reporting needs and requirements based on the size and type of the organization.

Understanding these forms and how they interconnect with Form 8868 is vital for organizations as they navigate the complexities of non-profit financial reporting.

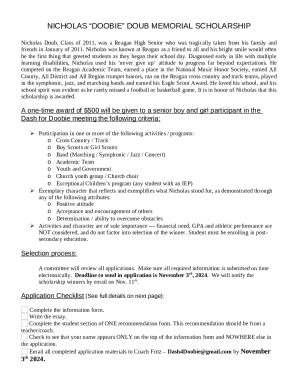

Detailed instructions for completing Form 8868

Completing Form 8868 requires specific information that organizations must gather carefully. The first requirement is the organization's name and address, which must match exactly with the IRS records. Additionally, organizations need their Taxpayer Identification Number (TIN) and details about their tax exemption status.

The form is divided into parts: Part I asks for identification information, Part II requests the automatic extension, and Part III allows for an extension request for other forms. Organizations need to navigate these sections carefully to ensure accuracy and completeness.

Changes and updates for tax year 2024

As tax regulations evolve, it's critical for organizations to stay informed about changes that could impact Form 8868. For tax year 2024, there may be updates to filing requirements, deadlines, and specific criteria that organizations must adhere to.

Organizations should consult the IRS website or tax professionals to be aware of any implications that changes may have for their specific circumstances.

Filing process for Form 8868

Filing Form 8868 can be done either through traditional mail or electronically. For those who prefer the online method, utilizing the IRS e-File system can significantly streamline the process. However, if organizations choose to file by mail, it’s vital to send the form to the correct IRS address based on their organization's location.

Regardless of the method selected, submitting Form 8868 on time is crucial to maintain compliance and avoid penalties or complications with the IRS.

Deadlines for filing Form 8868

Organizations must be aware of key deadlines associated with Form 8868. Typically, the form must be filed by the original due date of the return for which the extension is being requested. Failing to meet this deadline can lead to automatic denial of the extension request.

Understanding and adhering to deadlines is paramount for organizations aiming to maintain their tax-exempt status and avoid unnecessary penalties.

Handling penalties for late filing

Organizations facing penalties for late filing have several options for mitigation. The IRS enforces late payment penalties and late filing fees that can add up quickly if not addressed. Understanding these penalties allows organizations to take proactive measures.

By addressing filing issues promptly and maintaining open communication with the IRS, organizations can significantly reduce the impact of penalties.

E-filing Form 8868

Choosing to e-file Form 8868 has distinct advantages that many organizations find appealing. Digital filing typically results in faster processing times and immediate confirmations of receipt, enhancing overall efficiency.

E-filing is a streamlined process that allows for better tracking of submissions, making it an ideal choice for organizations focused on efficiency.

Special considerations

Organizations considering filing for multiple extensions must navigate specific regulations concerning their eligibility. Additionally, governmental entities may have different stipulations when applying for extensions. It's critical to review IRS guidelines or consult with a tax professional to ensure compliance and understanding of the nuances involved in these cases.

By remaining aware of these factors, organizations can efficiently manage their extension requests while avoiding unnecessary complications.

FAQs about Form 8868

Many organizations have questions surrounding the intricacies of Form 8868, especially regarding filing methods and deadlines. Here are some commonly asked questions:

By addressing these questions, organizations can navigate the complexity of filing and make informed decisions regarding their tax obligations.

Understanding IRS compliance and privacy concerns

When submitting Form 8868 or any IRS documentation, organizations must be mindful of compliance and privacy laws that govern information handling. The Privacy Act and Paperwork Reduction Act notice inform organizations about their responsibilities in safeguarding sensitive information.

By recognizing these legal frameworks, organizations can maintain adherence to best practices in data protection and reporting.

Using pdfFiller for Form 8868

Managing IRS Form 8868 can be made significantly more efficient with tools like pdfFiller. This cloud-based platform empowers users to seamlessly edit, sign, and collaborate on documents from anywhere, simplifying organizational processes.

By leveraging pdfFiller’s capabilities, organizations can streamline their form management, reducing stress while ensuring compliance.

Conclusion

Filing IRS Form 8868 is a necessary step for many tax-exempt organizations aiming to maintain compliance and meet their tax reporting obligations. This comprehensive guide provides the essential information needed to navigate the process effectively.

Utilizing tools like pdfFiller for efficient document management ensures organizations can focus on their core missions while maintaining good standing with the IRS. With clear guidance and the right resources, organizations can confidently approach their tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8868 from Google Drive?

How do I execute form 8868 online?

How do I fill out form 8868 on an Android device?

What is form 8868?

Who is required to file form 8868?

How to fill out form 8868?

What is the purpose of form 8868?

What information must be reported on form 8868?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.