Get the free Return of Organization Exempt From Income Tax

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

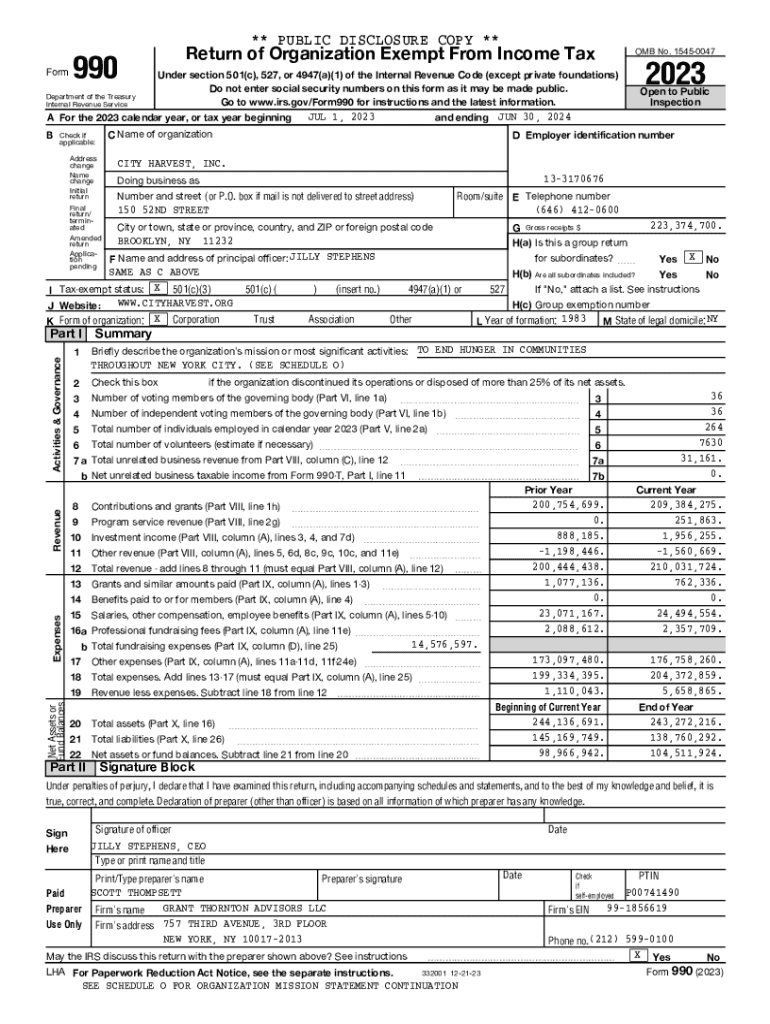

Understanding the Return of Organization Exempt Form (Form 990)

Understanding the Return of Organization Exempt Form (Form 990)

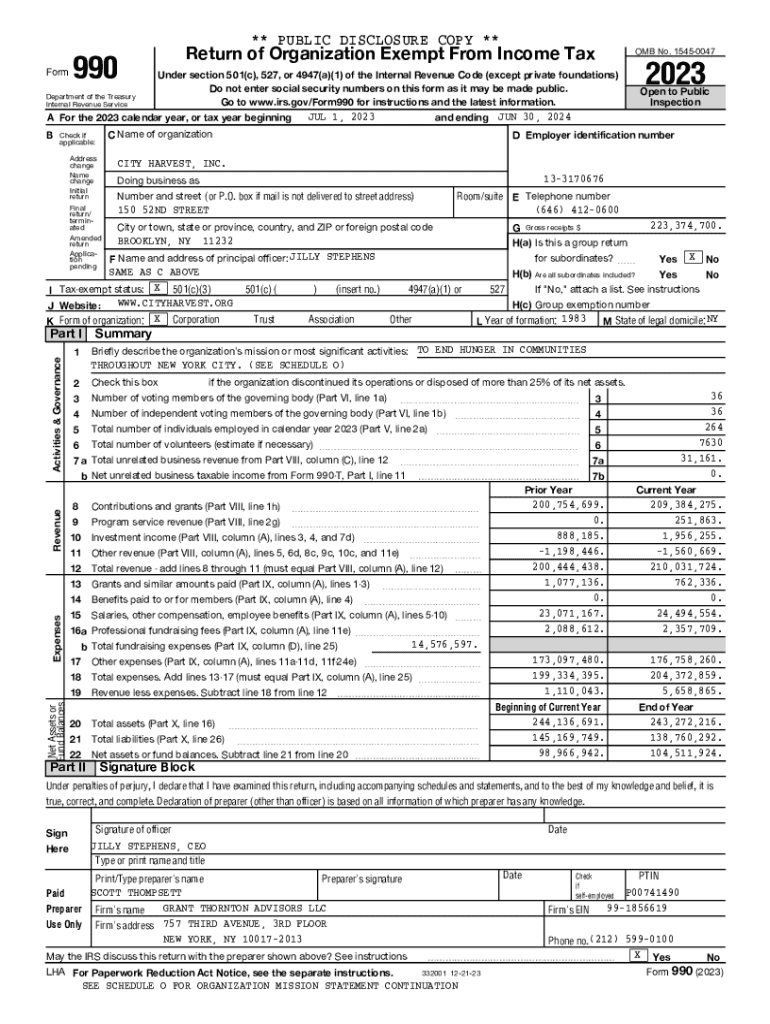

The Return of Organization Exempt Form, commonly referred to as Form 990, serves as a critical document for nonprofit organizations in the United States. This form enables these organizations to report their financial status, governance practices, and compliance with IRS regulations, thereby maintaining their tax-exempt status. Form 990 is not merely a bureaucratic requirement but a vital tool for transparency and accountability in the nonprofit sector.

All tax-exempt organizations, including charitable organizations, foundations, and certain private organizations, must file this form annually. It primarily targets those entities classified under Section 501(c)(3) and other sections of the Internal Revenue Code, revealing essential information that supports the public trust and donor confidence.

Importance of filing Form 990

Filing Form 990 is essential for numerous reasons. Firstly, it directly impacts a nonprofit’s tax-exempt status. The IRS requires annual reporting to ensure compliance with the law. Failure to file can lead to penalties or even loss of tax-exempt status, which can severely hinder an organization's operations.

Moreover, filing Form 990 enhances transparency and public accountability. Stakeholders, including donors, employees, and the general public, can access these reports, providing insight into how funds are utilized and the impact of the organization's work. This transparency is crucial for building trust and credibility, as potential funders often assess this information before committing financial resources.

Overview of Form 990

Form 990 exists in several variations, designated for different types of organizations and their financial situations. The most common forms include the full Form 990, Form 990-EZ, and Form 990-N. Each version caters to organizations based on their annual gross receipts and total assets, simplifying the process to match varying complexity.

Key components of Form 990 include a summary of the organization’s mission and activities, financial data, governance policies, and program accomplishments. Understanding these components is vital for ensuring that the information reported is both accurate and reflective of the organization's status.

Step-by-step guide to completing Form 990

Completing Form 990 can be straightforward when broken down into manageable steps. Here’s a detailed guide to help organizations navigate the filing process efficiently.

Common mistakes to avoid while filing Form 990

To ensure a smooth filing process and avoid penalties, organizations must be vigilant about common mistakes. Errors during the filing can lead to complications that may affect tax-exempt status.

One frequent error is inaccuracies in financial reporting. It's crucial that the income and expense figures reflect the actual financial status of the organization. Additionally, organizations often overlook the need to attach supplemental schedules, which are essential for providing comprehensive reporting to the IRS.

Special considerations when filing Form 990

When filing Form 990, organizations must consider any changes to their status that may impact the filing. This includes mergers, acquisitions, or significant shifts in program focus that might require additional disclosures or new organizational structures.

For instance, if an organization merges with another, the filing must reflect the new entity’s structure and governance policies. Moreover, any special events that generate additional income should be accurately reported, with clear descriptions of how these funds are utilized.

Accessing Form 990 resources on pdfFiller

pdfFiller provides an array of resources to simplify the process of completing and filing Form 990. With its interactive tools for document preparation, users can easily navigate the complexities of the form using guided assistance and templates tailored specifically for nonprofits.

Users can also benefit from pdfFiller’s eSign and collaboration features, allowing multiple stakeholders to engage with the document seamlessly. This capability is critical for non-profit organizations requiring board approval or input from various department leads before finalizing the submission.

Frequently asked questions (FAQs) about Form 990

Navigating the nuances of Form 990 can lead to several questions. Understanding these common inquiries can ease the anxieties around filing.

Final checks before submission

Before submitting Form 990, it’s imperative to conduct thorough final checks. This can save organizations from costly mistakes or delays.

Proofreading the filed document ensures that all information is accurate and free from typographical errors. Additionally, verifying that all required attachments are included and that the proper individuals have signed the document before submission are essential steps to ensure compliance.

Connecting with pdfFiller's services for form management

pdfFiller offers robust solutions designed to support organizations in managing their forms efficiently. With custom printing features, users can create tailored return documents directly from the platform, ensuring that compliance needs are met seamlessly.

Moreover, pdfFiller’s dedicated customer support provides assistance for any document management challenges, allowing organizations to focus on their mission without worrying about administrative burdens.

Industry-specific considerations for nonprofits

Each type of nonprofit may have specific guidelines and requirements applicable to their sector. Educational institutions, for instance, may navigate unique reporting requirements that differ from those of social welfare organizations or religious entities.

It’s critical for organizations to familiarize themselves with these industry-specific rules and forms, as compliance varies depending on the nature of the organization and its activities.

Stay informed on nonprofit regulations and best practices

Continuous education in nonprofit regulations is crucial for organizations to maintain compliance and operational success. Regular updates from the IRS regarding Form 990 and related requirements can prevent legal and financial pitfalls.

Organizations should seek resources that provide insights into best practices for filing, effective governance, and risk management. Remaining informed also enhances the overall credibility and functioning of the organization within its community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my return of organization exempt in Gmail?

How do I make edits in return of organization exempt without leaving Chrome?

How do I fill out return of organization exempt on an Android device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.