Get the free Form 8868

Get, Create, Make and Sign form 8868

How to edit form 8868 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868

How to fill out form 8868

Who needs form 8868?

Form 8868: How to Successfully Navigate the Application for Automatic Extension of Time To File an Exempt Organization Return

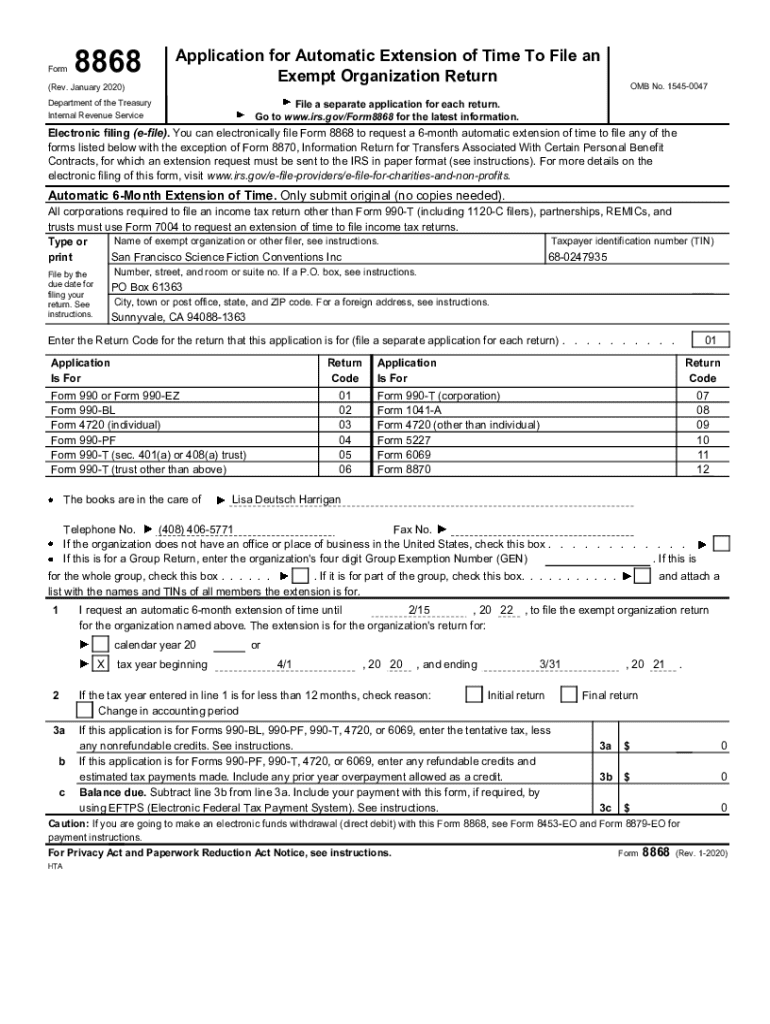

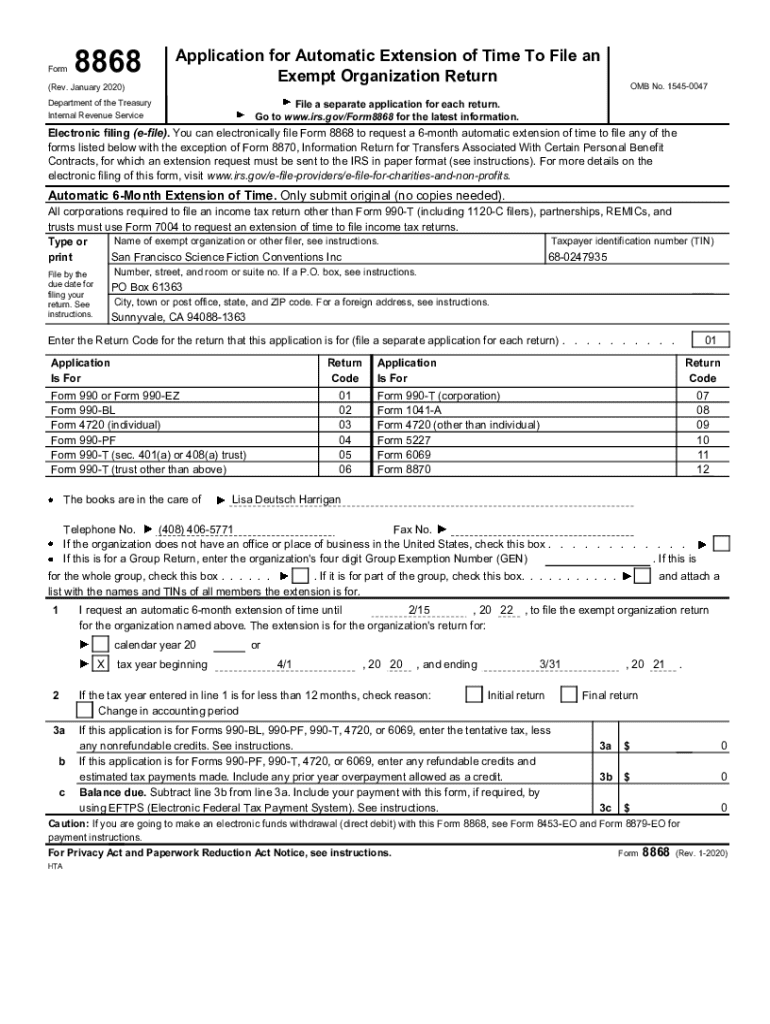

Understanding IRS Form 8868

IRS Form 8868 is an essential document for exempt organizations needing extra time to file their tax returns. This form provides an automatic extension for organizations required to file Form 990, Form 990-EZ, Form 990-PF, and certain other related forms. By applying for Form 8868, organizations can avoid the pressures of tight deadlines while ensuring compliance with the IRS mandates.

Filing Form 8868 is vital as it grants organizations the ability to extend their filing deadlines up to six months. This extension is particularly important for those who may face unexpected hurdles while preparing their financial information. Furthermore, understanding its provisions allows organizations to maintain their tax-exempt status and avoid potential penalties for failure to file.

Purpose of Form 8868

Organizations often need to apply for an extension due to various scenarios such as insufficient preparation time, evolving financial circumstances, or internal organizational changes. Form 8868 mitigates the stress of filing under tight deadlines, providing organizations with essential time to compile their documents accurately.

Moreover, Form 8868 is applicable in cases where other forms, such as Form 5330, which deals with excise taxes, need to be filed. The extension allows organizations breathing room to avoid last-minute submissions that could lead to errors, ensuring all necessary documents are prepared meticulously.

Who can file Form 8868?

Form 8868 is designed predominantly for exempt organizations defined under Section 501(c)(3) of the Internal Revenue Code. This includes charitable, educational, and religious organizations, as well as those designated as private foundations. Other categories of exempt organizations such as social clubs and labor organizations may also qualify if their returns require federal taxation.

Governmental entities have specific provisions that allow them to file Form 8868, expanding the eligible filers beyond standard nonprofit organizations. It’s essential to note that individuals cannot file Form 8868; it is strictly intended for organizations seeking extensions for organizational tax returns.

Which forms does Form 8868 apply to?

Form 8868 can be used to extend multiple key forms typically filed by exempt organizations. The primary forms eligible for extension include Form 990, Form 990-EZ, Form 990-PF, and Form 5330 among others. Understanding which forms are tied to your specific organization is crucial to ensure the extension process is efficiently managed.

Organizations can request a total of two automatic extensions of three months each, resulting in a potential total extension period of up to six months for certain filings. However, it's important to remember that extensions do not apply to filing requirements related to employment taxes, and different forms may have unique implications.

Required information to complete Form 8868

Filing Form 8868 necessitates specific information from the organization to ensure accuracy and compliance. Basic details such as the organization’s name, Taxpayer Identification Number (TIN), and address are fundamental to complete the form. This information serves as the foundation upon which the extension request is built.

Here's a breakdown of critical lines on Form 8868: Line 1 requires the organization's details; Line 2 indicates the type of return being extended; and Lines 3a, 3b, and 3c solicit additional request details including the contact information of the person responsible for filing. Accuracy in filling out these lines is essential to ensure that your extension is processed without unnecessary delays.

Filing timeframes and deadlines

The deadline for filing Form 8868 corresponds with the original due date of the organization’s return, typically the 15th day of the 5th month after the end of the organization’s accounting period. Filing this form on time is crucial to securing an automatic extension. Additionally, the IRS permits extension requests until the due date of the return, reinforcing the importance of timely submission.

Failing to file Form 8868 before the deadline can lead to steep penalties and complications with the organization’s tax status. Therefore, it is imperative for organizations to mark their calendars and set reminders to avoid missing out on this punctual opportunity.

Changes to Form 8868 for the upcoming tax year 2024

For the tax year 2024, there are several significant modifications to Form 8868 that organizations must be aware of. These changes include updates to the language for clarity, adjustments in the requirements for attaching additional documentation, and a revised format intended to streamline the filing process.

The rationale behind these changes is to enhance understanding and compliance for organizations filling out the form. By simplifying the structure and clarifying language, the IRS seeks to reduce errors that can lead to delays or penalties, benefiting the filing organizations significantly.

Step-by-step instructions for filing Form 8868

Filing Form 8868 involves a few systematic steps to ensure that everything is done accurately and efficiently. Start by gathering the necessary information pertaining to your organization, such as TIN, name, and address details. Next, complete each relevant section of the form, paying careful attention to the accuracy of your entries.

After completing the form, review it thoroughly to avoid any mistakes that might incur penalties. Choose a filing method, either through traditional mailing or electronically, and remember that e-filing offers distinct benefits such as immediate confirmation of receipt and potentially reduced processing times. Submitting the form before the deadline will secure your extension.

How to file Form 8868: Detailed process

Organizations can file Form 8868 through either traditional mailing or online methods. If opting to mail the form, it must be sent to the appropriate IRS service center based on the organization’s principal address. For online submissions, organizations may use various authorized e-filing platforms, which often simplify the submission process.

After submission, organizations should receive confirmation regarding their request for an extension. Tracking the submission can also help to ensure that everything is processed correctly. Maintaining records of submissions can serve as protection against potential disputes or inquiries from the IRS.

Potential penalties for late filing

Late filing of Form 8868 can culminate in stiff penalties which organizations must be aware of to avoid pitfall. Penalties range from a flat fee to higher sums depending on the organization’s size and revenue. Factors such as the length of the delay and whether the organization has a history of late filings can influence the severity of the penalties imposed by the IRS.

To avoid penalties, organizations should prioritize their filing deadlines, ensuring form 8868 is submitted timely. Simple measures such as using reminders and employing thorough internal document management practices can serve as effective strategies for staying compliant.

Frequently asked questions about Form 8868

Addressing common inquiries can clarify the nuances surrounding Form 8868. For instance, many organizations wonder whether multiple returns can be extended at once. While it is permissible to extend multiple returns, organizations must ensure they complete a separate Form 8868 for each return they wish to extend.

Another common question is about the potential penalties associated with not paying taxes by the original due date. Organizations risk accumulating interest and additional taxes for late payments. If an extension isn’t filed before its deadline, repercussions may include complications with state filings and potential loss of tax-exempt status.

Comprehensive insights on document management with pdfFiller

Utilizing pdfFiller can simplify the completion and management of IRS Form 8868 significantly. The platform offers tools that streamline form filling, enabling organizations to enter necessary information with ease, and understand the requirements without overwhelming effort. Additionally, features for signing and submitting forms electronically enhance efficiency.

Furthermore, pdfFiller’s cloud-based document management system ensures that all filled forms are accessible from anywhere, allowing teams to collaborate and work on document preparations efficiently—critical for maintaining compliance with filing deadlines. This empowerment turns time-consuming tasks into straightforward ones.

Final thoughts on using Form 8868

In summary, understanding Form 8868 can alleviate filing stress for many exempt organizations. By utilizing automatic extensions effectively, organizations can manage their paperwork without unnecessary urgency. Emphasizing the use of technology, such as pdfFiller, can facilitate timely submissions and enhance accuracy, ensuring a compliant filing history.

As you prepare to file, remember the importance of adhering to deadlines and maintaining thorough records. With proper management and the aid of user-friendly platforms, filing Form 8868 need not be a daunting task but rather a straightforward part of organizational management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8868 without leaving Google Drive?

Can I sign the form 8868 electronically in Chrome?

How do I edit form 8868 straight from my smartphone?

What is form 8868?

Who is required to file form 8868?

How to fill out form 8868?

What is the purpose of form 8868?

What information must be reported on form 8868?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.