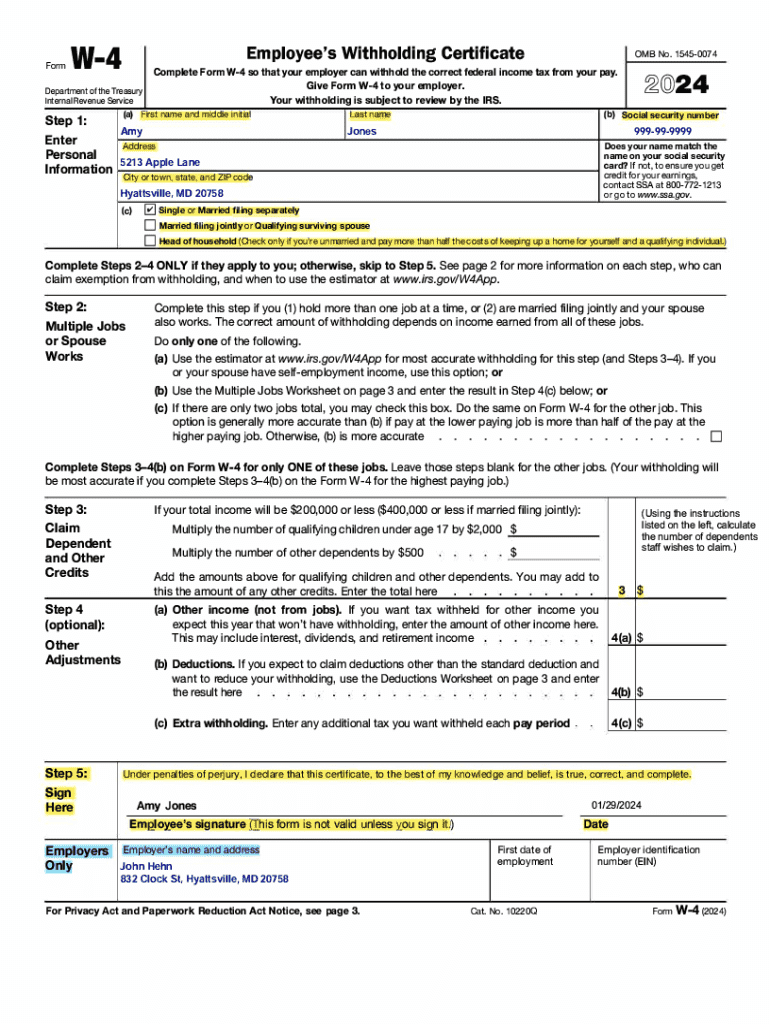

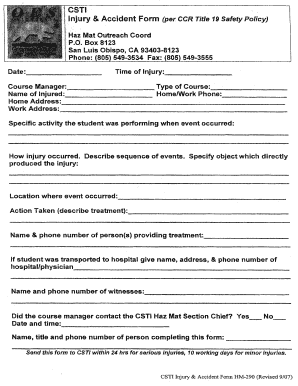

Get the free Employee's Withholding Certificate

Get, Create, Make and Sign employees withholding certificate

How to edit employees withholding certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employees withholding certificate

How to fill out employees withholding certificate

Who needs employees withholding certificate?

Understanding the Employees Withholding Certificate Form: A Comprehensive Guide

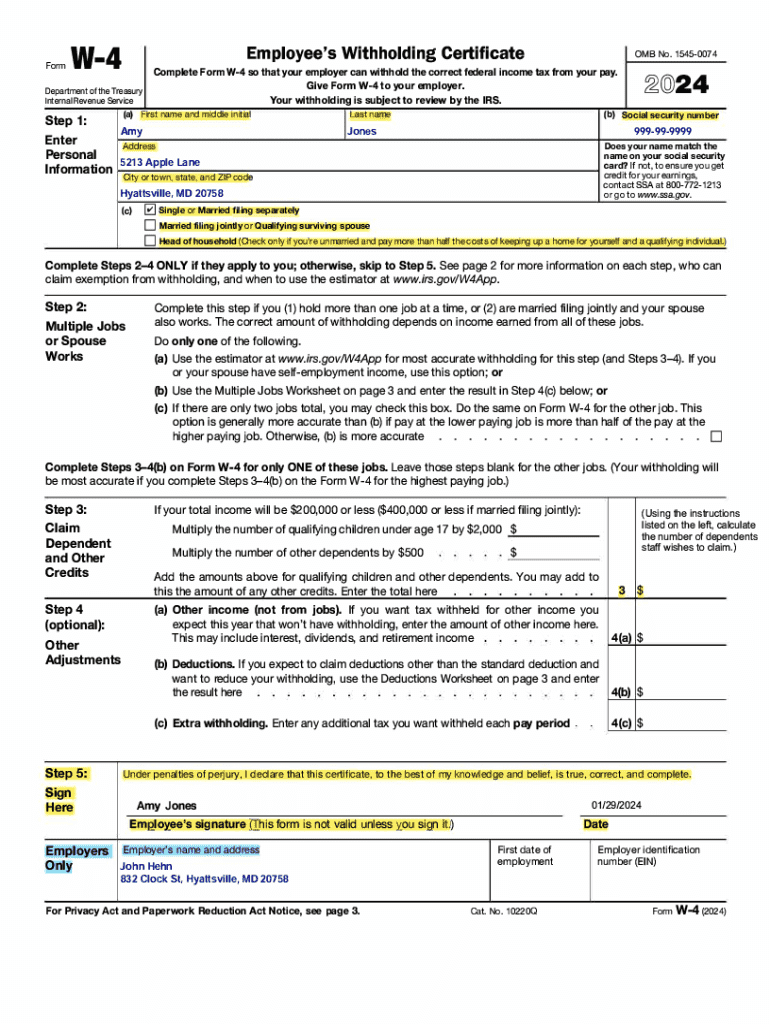

Overview of the Employees Withholding Certificate Form

The Employees Withholding Certificate Form, commonly referred to as Form W-4 in the United States, is crucial for any employee. This form enables you to indicate your filing status and the number of allowances you are claiming, directly influencing how much tax is withheld from your paycheck. Completing this form accurately is essential because it helps you manage your tax obligations effectively and avoid underpayment penalties during tax season.

Understanding the implications of this form is crucial as it directly impacts your take-home pay and your annual tax return.

Who needs to complete the Employees Withholding Certificate?

Primarily, new hires must complete the Employees Withholding Certificate Form during their onboarding process. This requirement helps the employer determine the correct amount of federal income tax to withhold from the employee's paychecks. However, current employees may also need to update this form if they experience significant life changes—such as marriage, divorce, or the birth of a child—that could affect their tax situation.

Certain exemptions apply, including those who qualify for exemption from income tax withholding based on previous tax filings. Generally, to qualify for this exemption, an employee must have had no tax liability in the previous tax year and expects none in the current year. Understanding these parameters is vital for anyone to ensure they’re correctly adhering to tax regulations.

Step-by-step guide to completing the Employees Withholding Certificate Form

Completing the Employees Withholding Certificate effectively requires careful attention to detail. Follow these steps to ensure accuracy:

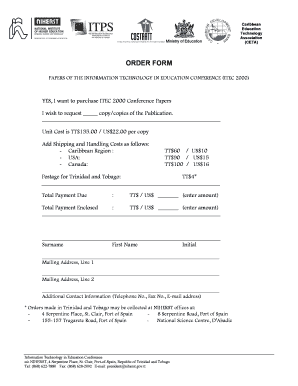

Tools and resources for managing your withholdings

Managing your withholdings can be simplified using various online tools and resources. Online calculators can help you determine the appropriate withholding amount based on your financial situation and anticipated tax liabilities. pdfFiller offers downloadable templates and forms specifically designed for ease of use, ensuring you have the right documents at your fingertips.

Moreover, cloud-based document management systems allow you to access and edit your forms from anywhere, making it easy to keep your information up-to-date and organized. Leveraging these resources ensures you maintain accurate documentation and compliance with tax regulations.

Frequently Asked Questions about the Employees Withholding Certificate

Many individuals have questions about their responsibilities regarding the Employees Withholding Certificate Form. Here are answers to some common queries:

Benefits of using pdfFiller to manage your Employees Withholding Certificate Form

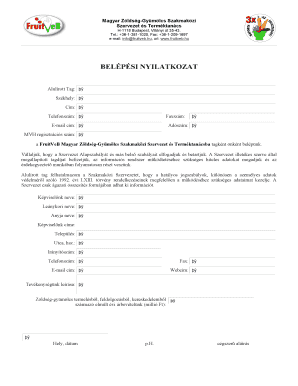

Using pdfFiller to handle your Employees Withholding Certificate Form offers various notable benefits. The platform's seamless PDF editing capabilities allow you to make necessary changes to the form easily, ensuring that the document reflects your current situation.

Furthermore, pdfFiller features advanced eSignature capabilities, enabling quick and secure signing without dealing with physical documentation. For teams, collaboration tools allow multiple users to work on forms, which streamlines the management of HR paperwork and improves efficiency across departments.

Troubleshooting common issues

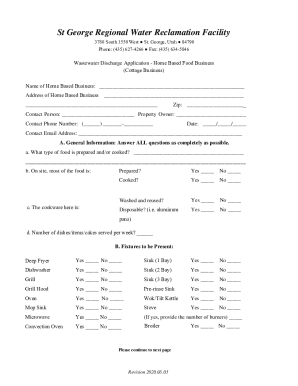

If you encounter issues with your Employees Withholding Certificate Form, there are steps you can take to resolve them. For discrepancies in withholdings, first review your form and pay stub to ensure the information matches. If you find errors, promptly contact your employer’s HR department to correct the submitted form.

For mistakes made on the original form, notify your employer immediately and provide the corrected information. Knowing how to navigate these troubleshooting steps can save you time and mitigate any potential changes in your appreciated tax outcome for the year.

Legal and compliance considerations

Understanding the legal and compliance considerations regarding the Employees Withholding Certificate is paramount. Various federal and state requirements govern how and when to complete this form. It is crucial to stay updated on changes in tax laws, especially as they can affect your withholdings significantly.

Maintaining proper records is also a key compliance aspect. Ensure you keep copies of your submitted forms and any notices from your employer regarding withholdings. This diligence will go a long way during tax time and in case of audits.

Next steps after submitting the Employees Withholding Certificate

After you’ve submitted your Employees Withholding Certificate Form, it’s important to monitor your paycheck to ensure that the correct amounts are being withheld. Keep an eye on your deductions, and if you notice discrepancies, address them right away. Additionally, it’s good practice to evaluate your withholdings annually or after major life changes, such as moving to a different state or changing your marital status, to ensure your withholdings reflect your current financial situation.

Regular review and adjustment can help you avoid surprises during tax season, ensuring that your financial goals remain on track.

Testimonials: Success stories from pdfFiller users

Many users have found pdfFiller not just advantageous but transformational in managing their Employees Withholding Certificate Form and other documentation. For instance, HR teams have reported immense time savings due to the platform's collaborative features, allowing multiple stakeholders to work together seamlessly.

Additionally, individuals have shared how pdfFiller simplified their document management tasks, reducing the hassle of physical paperwork and enabling them to access their forms from any device. These real-life experiences highlight pdfFiller's role in enhancing efficiency for both individuals and teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find employees withholding certificate?

How do I edit employees withholding certificate straight from my smartphone?

How do I complete employees withholding certificate on an iOS device?

What is employees withholding certificate?

Who is required to file employees withholding certificate?

How to fill out employees withholding certificate?

What is the purpose of employees withholding certificate?

What information must be reported on employees withholding certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.