Get the free 2025 Annual Notice of Value

Get, Create, Make and Sign 2025 annual notice of

How to edit 2025 annual notice of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 annual notice of

How to fill out 2025 annual notice of

Who needs 2025 annual notice of?

2025 Annual Notice of Form: A Comprehensive Guide

Understanding the 2025 annual notice of form

The 2025 annual notice of form serves as a critical document for both individuals and organizational teams. This notice outlines important information related to compliance, obligations, and opportunities presented in the upcoming year. Understanding its purpose is essential for ensuring that all parties are aligned with regulatory requirements and business practices.

For individuals, this notice can impact various aspects of life, such as insurance policies, benefits enrollment, and tax implications. Teams in corporate settings must navigate compliance and internal policies, making it a pivotal piece of documentation that provides clarity and guidance.

Key features of the 2025 annual notice

The 2025 annual notice consists of several components that provide essential details regarding reforms, procedures, and actions required. Typically, each notice contains sections that break down essential clauses, deadlines, and stipulations that must be respected.

Understanding the terminology used in this notice is also important. Terms such as 'compliance deadline', 'beneficiary enrollment', and 'penalty clauses' often arise and can significantly affect how recipients respond.

Timeline for receiving the 2025 annual notice

It’s important to be aware of the timeline associated with the 2025 annual notice. Typically, these notices are distributed annually, allowing recipients ample time to review and respond.

Being proactive about these dates ensures that no important requirements are overlooked.

Origin of the 2025 annual notice

Typically, the 2025 annual notice is issued by relevant authorities and organizations, which might include government agencies, insurance companies, or corporate HR departments. The exact issuer usually depends on the nature of the notice itself.

For example, an employer will send out notices that pertain to employee benefits, while tax notices might come from the IRS or local state tax agencies. Each entity plays a unique role in the delivery process; therefore, recipients may have different points of contact depending on the notice type.

Steps to take upon receiving the notice

Upon receiving the 2025 annual notice, it’s essential to verify the accuracy of the information presented. This involves checking personal data for correctness, ensuring all figures align with previous records, and confirming that no important updates have been missed.

These steps not only prep you for compliance but also help in preventing any future misunderstandings or disputes.

Frequently asked questions

Individuals may have numerous questions regarding the 2025 annual notice. It’s common to worry about how changes might impact existing obligations or benefits. Understanding such nuances can eliminate confusion.

By addressing these common queries, individuals can navigate their engagements with these notices more effectively.

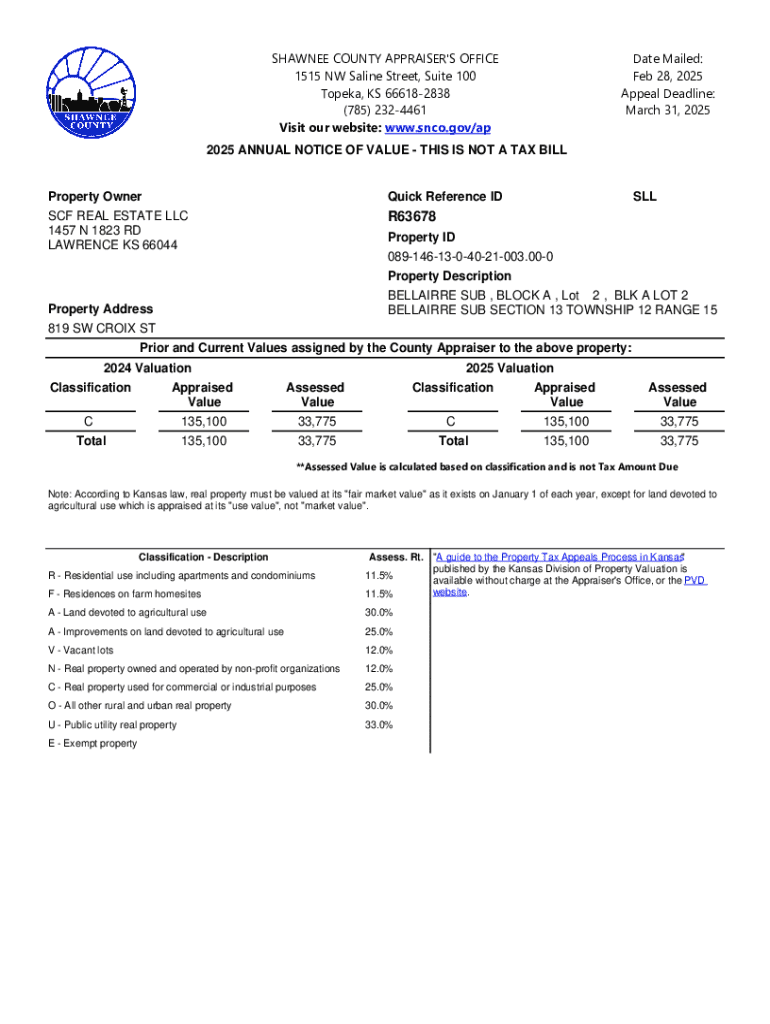

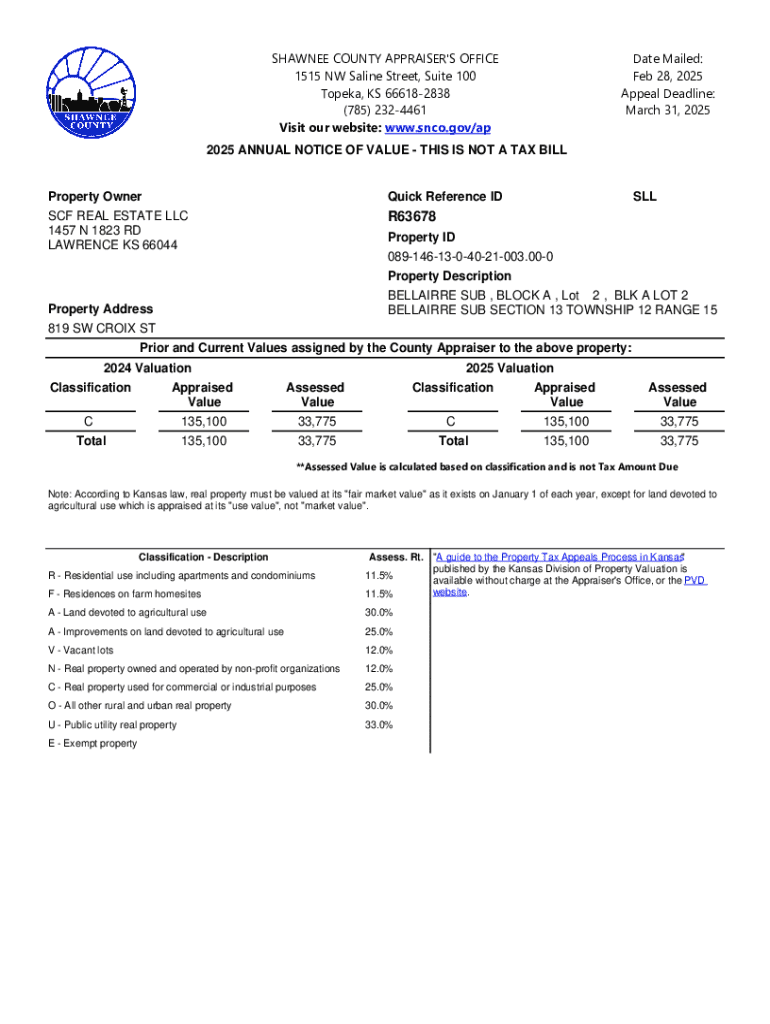

Sample 2025 annual notice

Having a sample of the 2025 annual notice can be exceptionally beneficial. A template or example allows users to visualize what to expect and how to interpret various sections.

You can find downloadable templates on platforms like pdfFiller, where examples are available for reference. This resource makes it easier to fill out your own notice accurately while using the correct formatting and language.

Tools for managing your annual notice

pdfFiller offers interactive tools designed to enhance your experience in managing documents such as the 2025 annual notice. With features for editing, eSigning, and collaborative review, users can handle their documents from anywhere.

Collaboration features allow for teams to work together seamlessly; you can assign tasks, track changes, and ensure every team member is on the same page regarding compliance and procedure.

Resources for further assistance

For anyone needing extra support related to the 2025 annual notice, seeking assistance from knowledgeable professionals can be invaluable. Contact information provided in the notice or through the issuing bodies is a fundamental step in obtaining clarifications.

Moreover, online guides, webinars, and helpful articles can provide additional context and information to guide users through related complexities. Engaging with these resources can enhance understanding and ease of compliance.

Sign up for updates

Staying informed about updates can significantly enhance financial management. Sign up for notifications related to the 2025 annual notice and receive alerts about crucial changes or timelines directly in your inbox.

Getting involved is straightforward. Most organizations will provide a subscription option, offering an easy path to remain aware and up-to-date.

Best practices for managing your annual notices

Organizational tips are vital for ensuring effective management of annual notices. Create a dedicated workspace within pdfFiller to systematically catalog notices and mark important deadlines on a shared calendar so that everyone remains informed.

In conclusion, leveraging the powerful features built into pdfFiller will significantly simplify the process of managing your 2025 annual notice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2025 annual notice of in Gmail?

How do I fill out the 2025 annual notice of form on my smartphone?

Can I edit 2025 annual notice of on an Android device?

What is 2025 annual notice of?

Who is required to file 2025 annual notice of?

How to fill out 2025 annual notice of?

What is the purpose of 2025 annual notice of?

What information must be reported on 2025 annual notice of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.