Get the free St-8a Resale Certificate

Get, Create, Make and Sign st-8a resale certificate

Editing st-8a resale certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out st-8a resale certificate

How to fill out st-8a resale certificate

Who needs st-8a resale certificate?

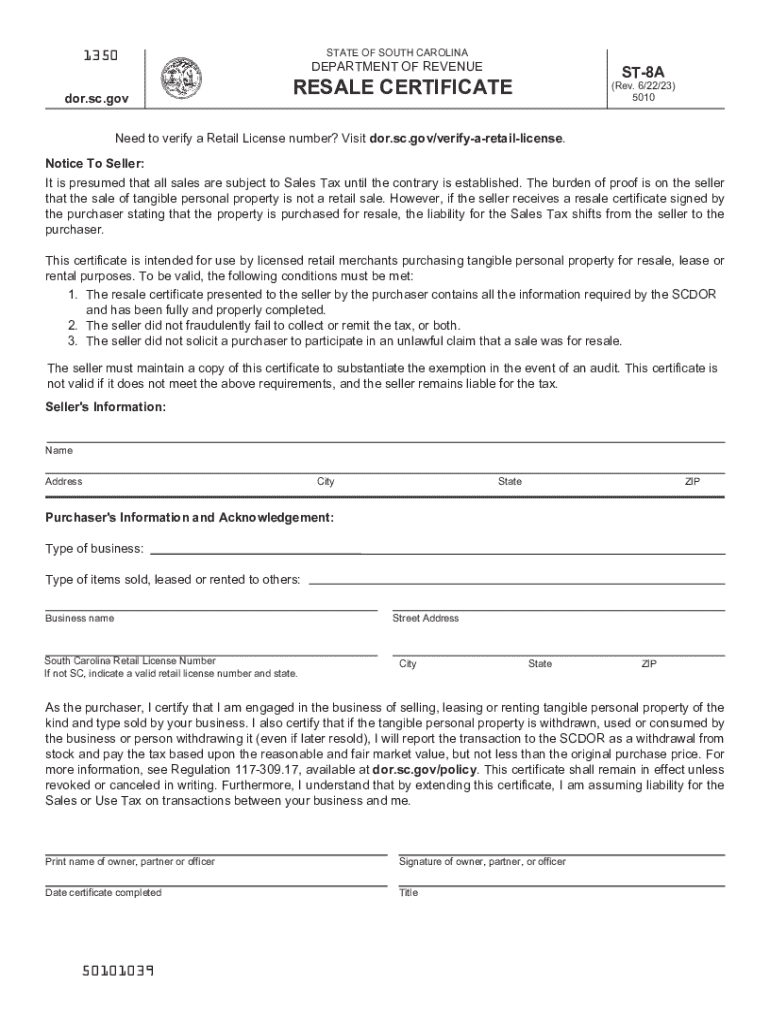

Understanding the ST-8A resale certificate form

Understanding the ST-8A resale certificate

The ST-8A resale certificate is a crucial document for businesses involved in buying and selling goods that are intended for resale. This certificate allows buyers to purchase inventory tax-free, provided that they are reselling these items in their usual business operations. The significance of the ST-8A lies in its ability to streamline tax compliance for both buyers and sellers, ensuring that sales tax is only applied when goods are sold to end consumers.

The importance of the ST-8A resale certificate extends beyond mere tax savings; it fosters a more efficient marketplace. By enabling businesses to avoid double taxation, it contributes to a healthier economy. Understanding how this form functions is vital, as businesses risk incurring penalties if they misuse or improperly manage the certificate.

It's essential to note the difference between a resale certificate and a sales tax permit. A resale certificate permits businesses to buy items without paying sales tax, assuming the purchased items will be resold. Conversely, a sales tax permit allows a business to collect sales tax from customers, thereby acting as the intermediary in the tax transaction process.

Eligibility for the ST-8A resale certificate

Eligibility for obtaining an ST-8A resale certificate primarily includes businesses that regularly engage in the buying and selling of tangible personal property. This encompasses retailers, wholesalers, and any entity that resells products rather than consuming them. Individuals who are purchasing items exclusively for their personal use do not qualify for this certificate.

Common qualifications and requirements for businesses may vary by state but typically include filing for a sales tax permit and maintaining a valid business license. Additionally, businesses must prove their intent to resell the products purchased. A common misconception is that any individual can apply for the ST-8A resale certificate; however, this form is strictly intended for professional and commercial use.

How to obtain the ST-8A resale certificate

Acquiring the ST-8A resale certificate is a straightforward process. The first step involves gathering essential information about your business, including your federal tax ID number, your business name, and the nature of your business activities. This information ensures that the certificate correctly reflects your business operations.

Once you have collected this information, the next step is completing the application form. Depending on your state, this may be available online or through local tax offices. After filling out the form, you must submit it to the appropriate tax authority for approval. Be aware that processing times may vary, and certain jurisdictions might impose fees for application submission.

How to fill out the ST-8A resale certificate

Filling out the ST-8A resale certificate involves providing accurate information in several key sections. The first part of the form requires detailed business information, including the legal name of the business, the business address, and the taxpayer identification number. This establishes your identity and assures sellers that you're authorized to make tax-exempt purchases.

Furthermore, it’s essential to include detailed buyer and seller information, specifying the names and addresses of both parties involved in the transaction. When detailing the products being purchased, categorize them accurately and include descriptions that reflect the intended use of these items for resale. To avoid errors, always verify that all information is written legibly and matches official records.

Common mistakes during this process include omitting required fields or incorrectly stating the purpose of purchase. To ensure compliance, always double-check entries before submitting the ST-8A resale certificate.

Using the ST-8A resale certificate

Once you have obtained the ST-8A resale certificate, knowing when and how to present it to sellers is crucial for proper transactions. Generally, the ST-8A should be presented at the time of purchase to avoid paying sales tax on goods you plan to resell. This not only confirms your intent to resell but also ensures that the seller doesn't collect sales tax incorrectly.

Maintaining accurate records of all resale transactions is vital for tax compliance and potential audits. Retain copies of presented resale certificates along with invoices of the purchases made using the certificate. State regulations may have specific guidelines on how long you must keep these records, so consult your local tax authority for details.

Legal considerations and compliance

Compliance with state tax regulations is of utmost importance when handling the ST-8A resale certificate. Failure to adhere to the rules surrounding this document can result in significant penalties, including fines and sales tax liabilities. Businesses must regularly review their use of the resale certificate and keep abreast of changes in state legislation.

Due diligence involves ensuring that resale certificates are valid for the intended purchases. Periodic review of certificates is advisable to confirm that they have not expired or been revoked. Keeping your computation practices transparent and in line with tax laws can mitigate potential legal issues.

FAQs about the ST-8A resale certificate

Understanding common questions regarding the ST-8A resale certificate can help ensure effective use and compliance. One frequent inquiry is about the validity period of an ST-8A resale certificate. Typically, there is no set expiration date; however, some states may require periodic renewal or reapplication, so it's vital to confirm with your local tax authority.

Another question often posed is whether individuals can use a resale certificate. In general, resale certificates are used by businesses; individuals purchasing for personal use are not eligible. If an ST-8A certificate is denied, it’s essential to review the reasons for denial, as it may result from incomplete or incorrect submission of information.

Interactive tools & resources

To enhance your experience with the ST-8A resale certificate form, utilizing interactive tools and resources can significantly streamline the process. PDF editing and management tools are available that allow you to create, edit, and store your ST-8A certificates in a digital format. Using such tools provides a more efficient way to manage and access your documents from anywhere.

Incorporating eSigning features can make the submission process more efficient. Digitally signing your ST-8A eliminates the need for printing and can provide a faster turnaround. Moreover, collaborative options for teams managing resale certificates ensure that everyone is on the same page regarding compliance and record-keeping.

Expert tips for leveraging the ST-8A resale certificate

To maximize the benefits of the ST-8A resale certificate, adopting digital platforms for efficient document management is essential. Utilize tools that enable easy access to forms, seamless collaboration, and advanced tracking to ensure compliance. Such platforms can help prevent oversights and improve overall business efficiency in managing resale certificates.

Business owners and accountants can implement best practices by establishing clear protocols for the use and management of ST-8A certificates. Regular training and updates for staff regarding the proper handling of these documents can mitigate potential mistakes. Also, staying informed about innovations in document management will ensure that you continuously streamline your processes.

Contacting experts for further assistance

When navigating the complexities of the ST-8A resale certificate process, reaching out to experts can provide invaluable assistance. Tax advisory services specialize in ensuring compliance with state regulations and can help resolve any questions or issues you may have regarding the form. If you encounter difficulties managing your ST-8A documents, platforms like pdfFiller offer dedicated support to assist users in managing their forms efficiently.

Utilizing expert resources can help your business stay compliant while ensuring that your documentary processes are streamlined. From obtaining your ST-8A certificate to effectively managing your resale transactions, expert guidance can make all the difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find st-8a resale certificate?

How do I edit st-8a resale certificate online?

How do I make edits in st-8a resale certificate without leaving Chrome?

What is st-8a resale certificate?

Who is required to file st-8a resale certificate?

How to fill out st-8a resale certificate?

What is the purpose of st-8a resale certificate?

What information must be reported on st-8a resale certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.