Get the free Verification Worksheet Dependent V5

Get, Create, Make and Sign verification worksheet dependent v5

Editing verification worksheet dependent v5 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification worksheet dependent v5

How to fill out verification worksheet dependent v5

Who needs verification worksheet dependent v5?

Understanding the Verification Worksheet Dependent V5 Form

Understanding the verification worksheet dependent v5 form

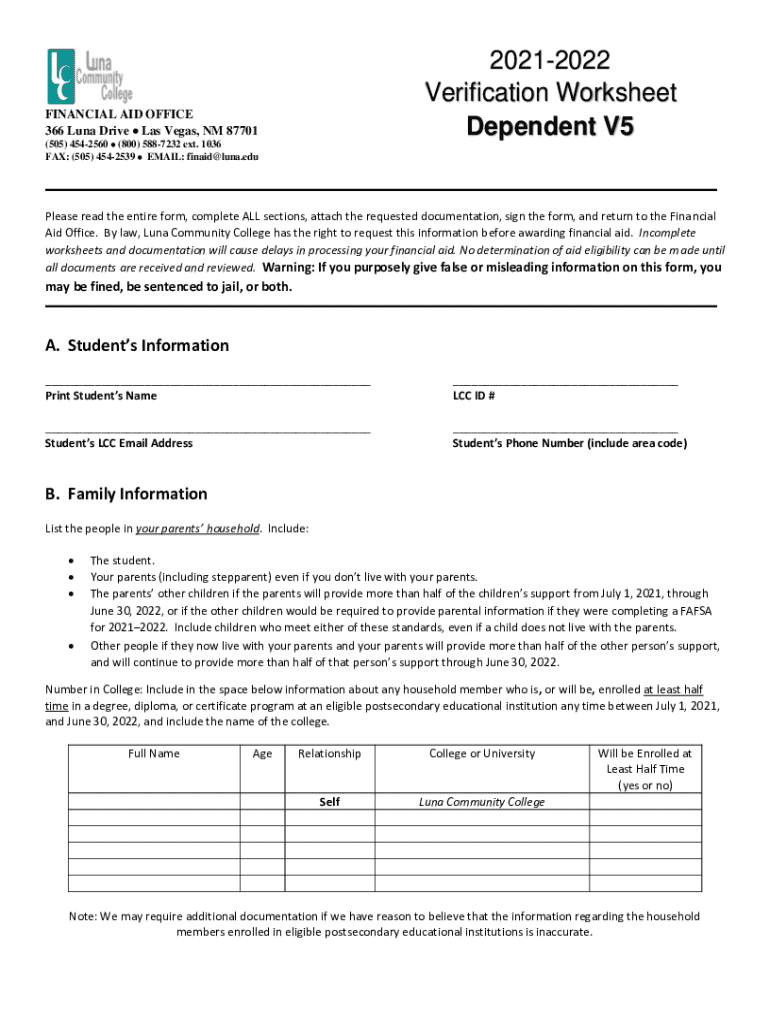

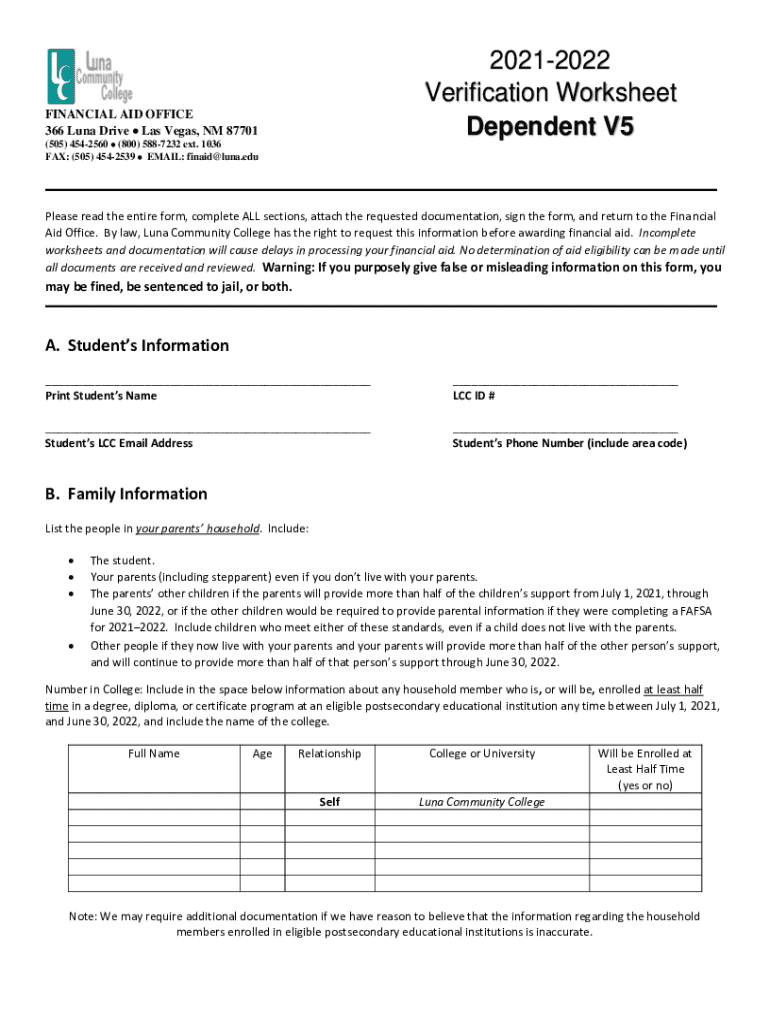

The verification worksheet dependent V5 form is a crucial document used in the financial aid process, specifically for students applying for federal student aid while enrolled in college. Its primary purpose is to collect necessary financial information to verify the accuracy of the data initially submitted in the Free Application for Federal Student Aid (FAFSA). This form helps to ensure that the financial assistance awarded reflects the true financial status of students and their families.

The importance of the V5 form cannot be overstated; it plays a pivotal role in determining eligibility for financial aid programs. Failure to complete or accurately submit this form can result in delays or a decrease in financial aid packages. Key elements include personal information, financial details, and a declaration of household size, all of which contribute to a comprehensive picture of financial need.

Who needs to complete the verification worksheet dependent v5 form?

Typically, the verification worksheet dependent V5 form must be completed by dependent students who have been selected for verification by their college's financial aid office. Common eligibility criteria include attending college at least half-time, being under the age of 24, and having a legal guardian who contributes to their educational expenses. Certain circumstances such as discrepancies in reported income or dependent student status can trigger the need for completing the V5 form.

Students may also be required to fill out this form if they have unusual circumstances affecting their financial situation, like significant changes in income or unexpected family expenses. The V5 form is commonly associated with federal aid programs, including Pell Grants, Work-Study, and Direct Loans, which often require this document for further processing.

Key components of the verification worksheet dependent v5 form

The verification worksheet dependent V5 form includes several critical components that need to be accurately filled out. The personal information section captures essential details about the student and parents, making identification straightforward for the financial aid office. This includes names, Social Security numbers, and contact information, which are foundational for processing application data.

Next, the financial information section requires a breakdown of the family's financial status, including Adjusted Gross Income (AGI) as reported on tax returns. Specific income tax information, including tax filing status and income earned from work, must also be accurately represented. Additionally, there are asset documentation requirements where families may need to disclose savings, investments, and other financial resources that could impact need-based aid.

Step-by-step instructions for completing the v5 form

Filling out the verification worksheet dependent V5 form requires careful attention to detail. Each section plays a vital role in the overall accuracy of financial information reported. Here’s a step-by-step guide to help you complete this form.

Common pitfalls include misreporting AGI or household size, which might lead to delays. It's critical to double-check all entries before submission, ensuring consistency with tax documents.

Acceptable documentation for verification

When completing the verification worksheet dependent V5 form, referring to the acceptable documentation for income verification is essential. Typically, students must provide documentation that substantiates reported income and other financial resources. This may include copies of Federal tax returns, W-2 forms, or 1099 forms that reflect earnings. In some cases, the financial aid office may request additional documentation based on specific financial circumstances.

Along with financial records, students must submit proof of identity and residency. Acceptable forms of ID can include a driver’s license or passport, while residency can be confirmed through utility bills or lease agreements. Special circumstances, such as custody changes or independent student status, may require additional documentation to verify unique instances.

Submitting the v5 form

Once the verification worksheet dependent V5 form is completed and all documentation is gathered, it’s time to submit it to the appropriate financial institution. Most colleges and universities facilitate online submissions through their financial aid platforms, which makes the process efficient. Alternatively, students can mail the forms, though this could delay processing times depending on mailing and handling times.

Timelines are crucial when submitting the V5 form. Most institutions have specific deadlines for submission, and it's critical to adhere to these timelines to ensure continued eligibility for financial aid. Verify submission deadlines through your institution’s financial aid office to avoid unnecessary complications.

What happens after submission?

After submitting the verification worksheet dependent V5 form, the financial aid office will review the submitted documentation. This review process typically takes several weeks, depending on the institution’s workload and the complexity of the student’s financial situation. During this period, the institution will verify the accuracy of the information provided and determine eligibility for financial aid.

Students are encouraged to track the status of their verification process through their financial aid portal or by contacting the financial aid office directly. Being proactive in checking for updates can help ensure that students meet any additional requirements or provide further documentation if needed.

Updating information on the v5 form

Changes in circumstances after the submission of the verification worksheet dependent V5 form require prompt updates to the financial aid office. Whether this includes changes in family income, household size, or any other relevant information, it is crucial to communicate these modifications as soon as they occur.

To report such changes, students should reach out to their financial aid office and specify what aspects need updating. Providing supporting documentation for these modifications is also essential, as it can facilitate expediting any necessary adjustments to financial aid awards.

Common issues and solutions related to the v5 form

Completing the verification worksheet dependent V5 form can occasionally lead to common issues that students might face. These issues can include delays in processing, discrepancies found during verification, or requests for additional information. Understanding potential problems and their solutions can help mitigate frustrations.

Special cases: Verification for confined or incarcerated individuals

Students who are confined or incarcerated face unique requirements when completing the verification worksheet dependent V5 form. These individuals must provide documentation that reflects their current financial status and might need to submit additional information regarding their incarceration status and contributing financial resources from family or guardian.

Special handling by financial aid offices is often required for confined individuals, so it's advisable to engage directly with an aid advisor familiar with these unique situations.

Frequently asked questions (faqs) about the verification worksheet dependent v5 form

As students navigate the verification worksheet dependent V5 form, several common queries arise. Understanding these can clarify the process and enhance completion efficiency. Questions may include what to do if selected for verification, what types of documentation are necessary, and the implications of failing to verify financial information.

Leveraging pdfFiller for your verification worksheet needs

Using pdfFiller for managing the verification worksheet dependent V5 form can simplify the entire process. This cloud-based platform allows users to edit PDFs seamlessly, eSign documents, and facilitate collaboration with family members or advisors, enhancing efficiency.

With features that support electronic signatures and real-time collaboration, pdfFiller provides an all-in-one solution that empowers users to manage their verification needs effectively. Students can easily fill out, sign, and share the V5 form without worrying about the hassle of physical paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in verification worksheet dependent v5 without leaving Chrome?

Can I create an electronic signature for the verification worksheet dependent v5 in Chrome?

Can I edit verification worksheet dependent v5 on an iOS device?

What is verification worksheet dependent v5?

Who is required to file verification worksheet dependent v5?

How to fill out verification worksheet dependent v5?

What is the purpose of verification worksheet dependent v5?

What information must be reported on verification worksheet dependent v5?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.