Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding Form 10-Q: A Comprehensive Guide

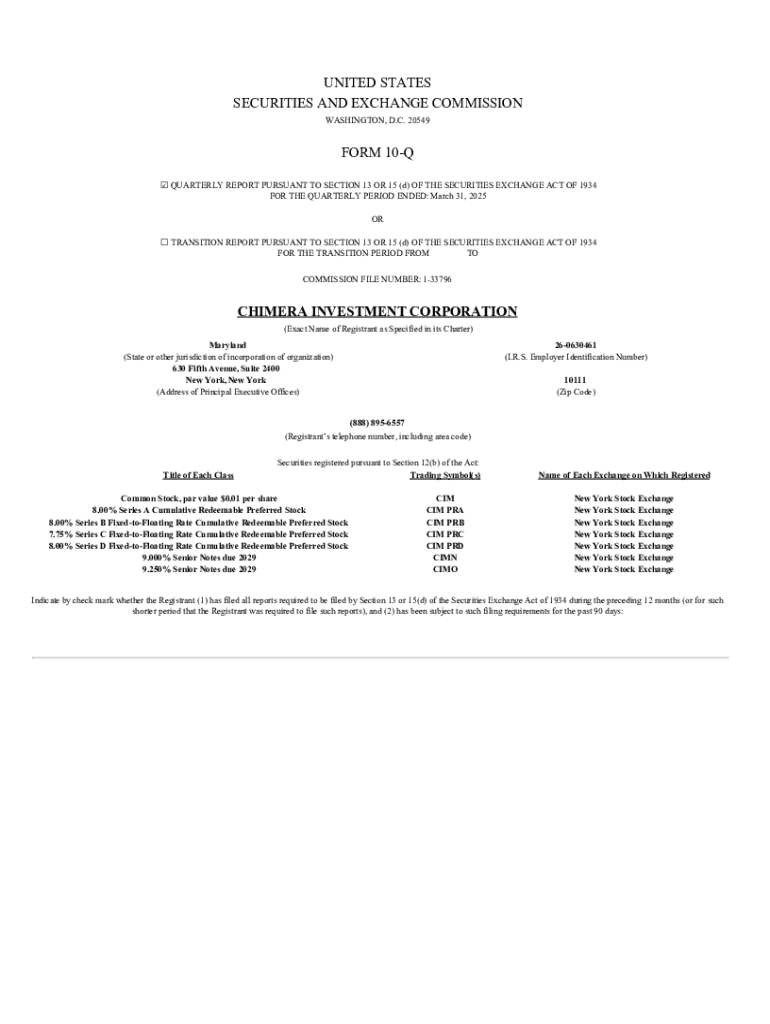

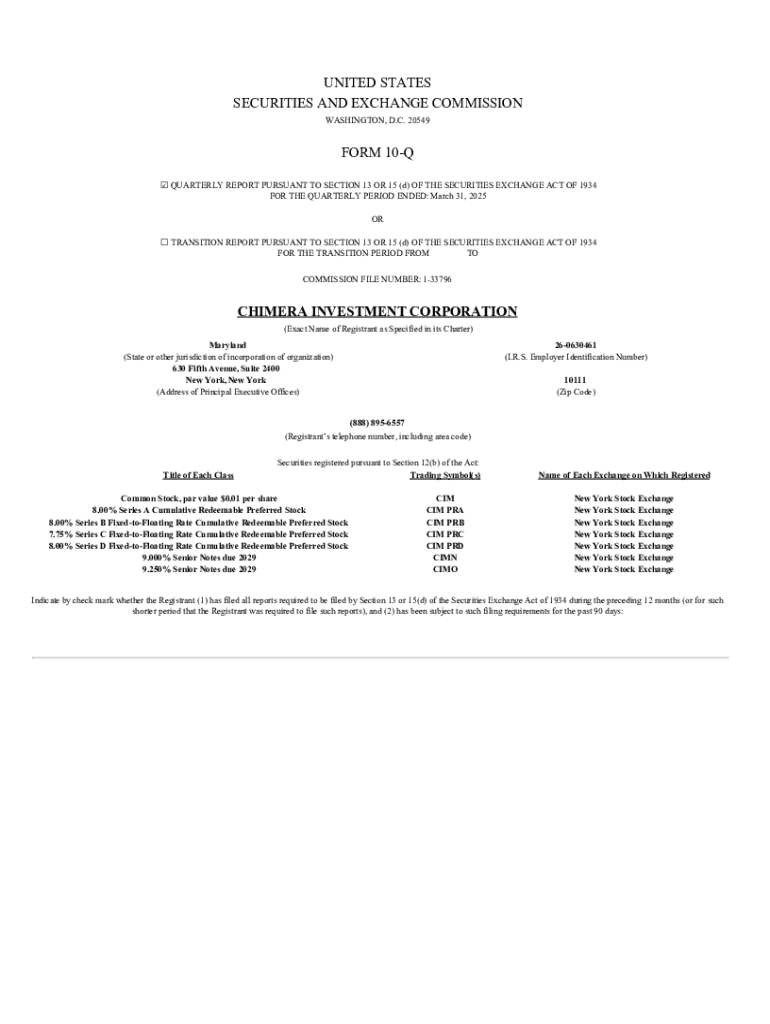

What is a Form 10-Q?

A Form 10-Q is a quarterly financial reporting document that publicly traded companies are required to file with the Securities and Exchange Commission (SEC). Its primary purpose is to provide a comprehensive overview of a company's financial performance during the preceding fiscal quarter. This document includes key financial statements and management's discussions, enhancing transparency for investors and stakeholders.

Unlike the Form 10-K, which is an extensive annual report, the Form 10-Q offers a more concise snapshot of a company's financial health. While the 10-K covers a complete year’s performance and detailed disclosures, the 10-Q is focused specifically on quarterly updates, allowing investors to keeps tabs on trends and developments in shorter time frames.

Importance of filing Form 10-Q

Filing a Form 10-Q is crucial for ensuring corporate transparency with investors and the public. It plays a vital role in fostering trust and confidence among stakeholders. By providing timely updates on financial performance, companies can keep investors informed about operational shifts, potential risks, and strategies for future growth.

Legal compliance is another critical aspect of filing a Form 10-Q. The SEC mandates that all publicly traded companies adhere strictly to these reporting requirements. Failure to comply can lead to significant penalties, including fines and potential legal repercussions, which can diminish investor confidence and harm the company's reputation.

Contents of a Form 10-Q

A Form 10-Q typically includes several essential sections that provide a comprehensive view of the company's quarterly performance. These sections are structured to facilitate easy understanding of financial health and business operations.

Moreover, a Form 10-Q may include other significant items, such as risk factors, controls and procedures, and updates on legal proceedings that may impact the company.

Key filing elements of Form 10-Q

Understanding the specific elements included in a Form 10-Q is essential for both companies and investors. Each section is designed to provide critical insights, allowing stakeholders to gauge the company's performance effectively.

Filing requirements for Form 10-Q

Publicly traded companies are required to file a Form 10-Q for each of the first three quarters of their fiscal year. The specific deadlines for filing vary based on the company's public float (i.e., the total value of its shares available for public trading).

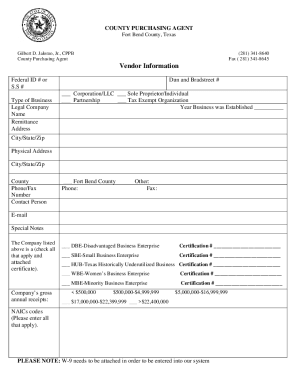

Additionally, companies must follow specific format and submission guidelines outlined by the SEC, submitting documents electronically via the EDGAR system to ensure efficiency and accuracy.

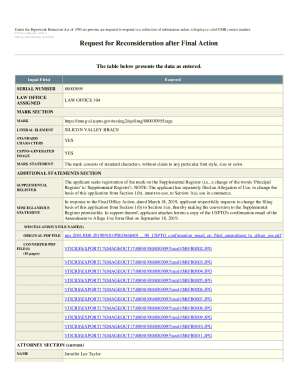

How to locate filed Form 10-Qs

Investors and stakeholders can easily access filed Form 10-Qs through the SEC’s EDGAR database, where all public filings are stored. The database allows for straightforward navigation through the company's name or ticker symbol.

Utilizing these strategies will lead to efficient retrieval of necessary Form 10-Q filings, enabling informed decision-making.

Understanding 10-Q filing deadlines

Filing deadlines for the Form 10-Q are designed to maintain investor awareness and market stability. The importance of adhering to these timelines cannot be overstated, as they ensure that investors receive timely information regarding a company's financial condition.

By understanding and adhering to these deadlines, companies can maintain investor trust and streamline their compliance processes.

Frequently asked questions about Form 10-Q

Many individuals and teams have various queries regarding the Form 10-Q. Here are some of the most frequently asked questions.

Related documents and forms

In addition to Form 10-Q, several other essential SEC filings provide crucial insights into corporate operations. Understanding these documents can enhance comprehension of a company’s overall performance.

These forms collectively paint a comprehensive picture of a company, allowing investors to make informed decisions.

The role of pdfFiller in managing Form 10-Q

pdfFiller plays a pivotal role in simplifying the process of preparing and filing Form 10-Q. This cloud-based platform empowers users to edit PDFs and manage documents seamlessly, making the filing process more efficient.

Moreover, the ability to access forms from anywhere on the cloud significantly enhances the flexibility and efficiency of managing essential financial documents.

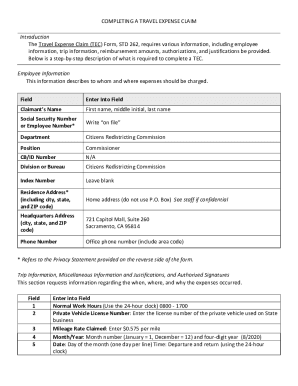

Maintaining compliance and best practices

To avoid issues with Form 10-Q filings, it’s essential to establish a thorough preparation process. This involves internally coordinating to prepare data in advance of filing deadlines.

By adhering to these best practices, companies can mitigate risks and improve the accuracy of their filings.

Contacting experts for assistance

Navigating the complexities of Form 10-Q filings can be challenging. Seeking professional guidance can provide additional clarity and expertise in the filing process.

Accessing expert advice not only aids in filing Form 10-Q but also enhances overall corporate governance.

Popular content and additional insights

Several case studies and insightful articles provide context on best practices and lessons learned regarding Form 10-Q filings.

These resources not only provide practical guidance but also enhance understanding of the broader ramifications of timely and accurate financial disclosures.

Stay connected with pdfFiller

Engaging with pdfFiller opens pathways to streamline document management and enhances understanding of filing processes. The community and resources available can enhance skills in document handling and compliance.

By becoming part of the community, you can leverage collective experiences to improve your own skills and solutions in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 10-q in Gmail?

How do I edit form 10-q straight from my smartphone?

How do I edit form 10-q on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.