Get the free Return of Private Foundation 990-pf

Get, Create, Make and Sign return of private foundation

How to edit return of private foundation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of private foundation

How to fill out return of private foundation

Who needs return of private foundation?

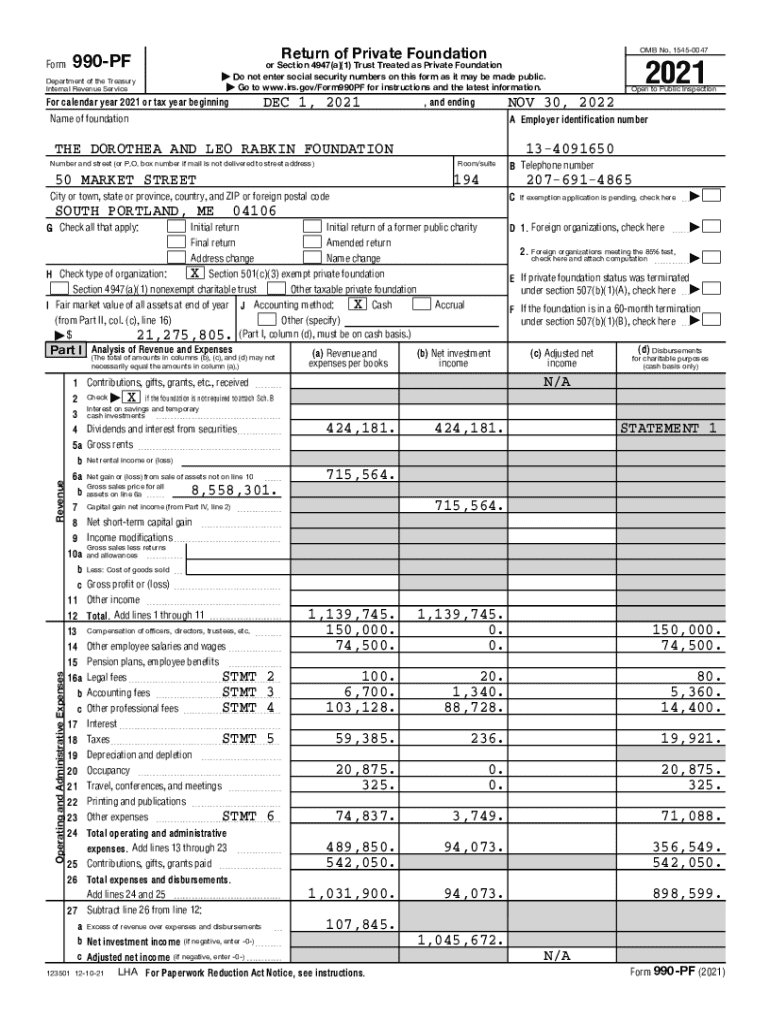

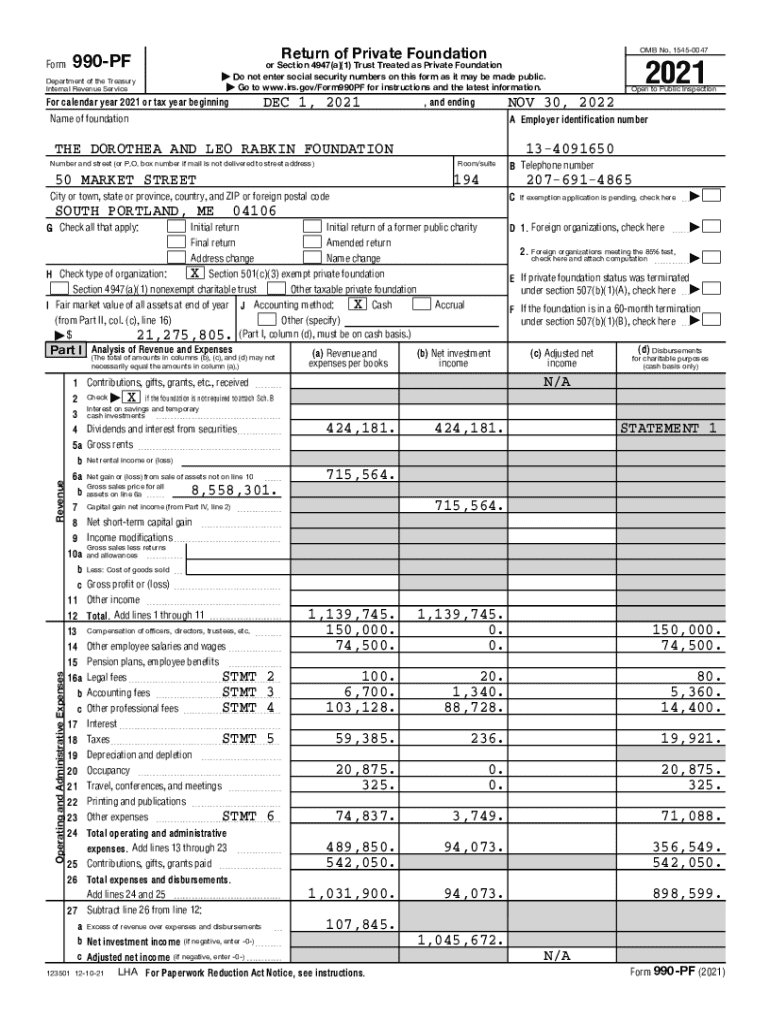

Understanding the Return of Private Foundation Form 990-PF

Understanding the Return of Private Foundation Form

Form 990-PF, the return of private foundation form, plays a critical role in the nonprofit sector by ensuring that private foundations maintain transparency and adhere to compliance regulations. This form is required to be filed annually by most private foundations, and it serves as a public record of the foundation's financial activities, governance, and charitable contributions.

The significance of the Form 990-PF extends beyond mere compliance; it allows stakeholders, donors, and the general public to access information about the foundation's operations and impact. By requiring a detailed account of financial activities, the form helps foster trust and accountability within the nonprofit sector.

Who needs to file the return of private foundation form?

A private foundation is typically a nonprofit organization established by a single benefactor or a family, with the primary purpose of making grants to charitable organizations. To gauge whether a foundation is required to file Form 990-PF, one must consider specific criteria such as its tax-exempt status under section 501(c)(3) and whether the foundation has assets exceeding $500,000 at the end of the tax year.

There are exceptions to the filing requirement. Foundations that have less than $500,000 in assets and do not have any taxable activities may not be required to file. However, it is vital for foundations to check with the IRS guidelines, as regulations can frequently change. Failure to file, even when not required, can affect the foundation's standing and credibility.

Key filing dates and deadlines

Understanding the annual due dates for Form 990-PF is crucial for private foundations. The form is typically due on the 15th day of the 5th month after the end of the foundation’s tax year. For most private foundations operating on a calendar year, this means the due date is May 15.

Foundations operating on a fiscal year should calculate their deadlines accordingly. Additionally, there are options for filing an extension. Forms can be extended for up to six months, but it’s essential to file the extension request timely to avoid penalties.

Comprehensive breakdown of Form 990-PF

Form 990-PF consists of various sections that need detailed completion. Here's a breakdown of key components:

Navigating common challenges when filing

Many private foundations encounter challenges when filing Form 990-PF. Common issues include misreporting income, inaccuracies in expenses, and incomplete information regarding grants made. Addressing these challenges requires meticulous attention to detail and thorough documentation.

For accurate reporting, it is advisable to maintain organized financial records throughout the year. Utilizing spreadsheets or accounting software dedicated to nonprofit management can streamline this process. Additionally, the consequences of late or inaccurate filings can include penalties, potential loss of tax-exempt status, and diminished donor trust.

Importance of compliance and best practices

Compliance with Form 990-PF is vital for the reputation of a nonprofit organization. Noncompliance can lead to scrutiny from the IRS and damage the foundation's credibility with the public. Best practices for ongoing compliance include setting a calendar reminder for filing dates, creating checklists for documentation, and regularly reviewing IRS guidelines for updates.

Utilizing insights from Form 990-PF can also lead to strategic planning opportunities. Data from previous years allows foundations to develop strategies for future fundraising and grant-making efforts, enhancing relationships with current and prospective donors.

Tools for efficient completion of the return of private foundation form

Utilizing pdfFiller's interactive tools can simplify the completion of Form 990-PF. The platform allows users to fill out, edit, and sign the form effortlessly from any location, making it ideal for individuals and teams managing multiple documents.

Key features include collaborative tools that enable team members to work together seamlessly. Users can also save time with pre-filled templates and submit the form directly through pdfFiller, ensuring a smooth filing process.

Resources for further guidance and support

For detailed instructions on completing Form 990-PF, users can refer to the IRS’s official guidelines, available on their website. Additionally, engaging with tax professionals or consultants who specialize in nonprofit law can provide crucial support for more complex situations.

Online communities and forums dedicated to nonprofits can also offer invaluable peer support. Many experienced professionals share their insights and strategies for effective compliance, which can be a tremendous help for those new to the process.

Staying informed: Updates and changes to Form 990-PF

It is crucial for private foundations to stay informed about any updates or changes related to Form 990-PF. Frequent modifications to implementation practices, filing requirements, or regulations can occur, often announced by the IRS through official communications.

Setting up alerts or subscribing to relevant newsletters can keep foundations current on important changes. Organizations can also consider attending workshops or webinars to gain insights and best practices from professionals in the field.

Maximizing the use of Form 990-PF beyond filing

Form 990-PF serves a broader purpose than merely fulfilling tax obligations; it can be instrumental in refining grant applications and shaping fundraising strategies. The financial data reported on the form can help in assessing organizational impact and adjusting approaches based on past successes and failures.

Moreover, leveraging Form 990-PF for transparent stakeholder communication enhances relationships with donors and supports future grant growth. By publicly reporting effective financial stewardship, foundations can increase their appeal and credibility, engaging potential funders more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find return of private foundation?

How do I execute return of private foundation online?

How do I make edits in return of private foundation without leaving Chrome?

What is return of private foundation?

Who is required to file return of private foundation?

How to fill out return of private foundation?

What is the purpose of return of private foundation?

What information must be reported on return of private foundation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.