Get the free Nfp Company Non-lodgment Advice

Get, Create, Make and Sign nfp company non-lodgment advice

Editing nfp company non-lodgment advice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nfp company non-lodgment advice

How to fill out nfp company non-lodgment advice

Who needs nfp company non-lodgment advice?

Understanding the NFP Company Non-Lodgment Advice Form

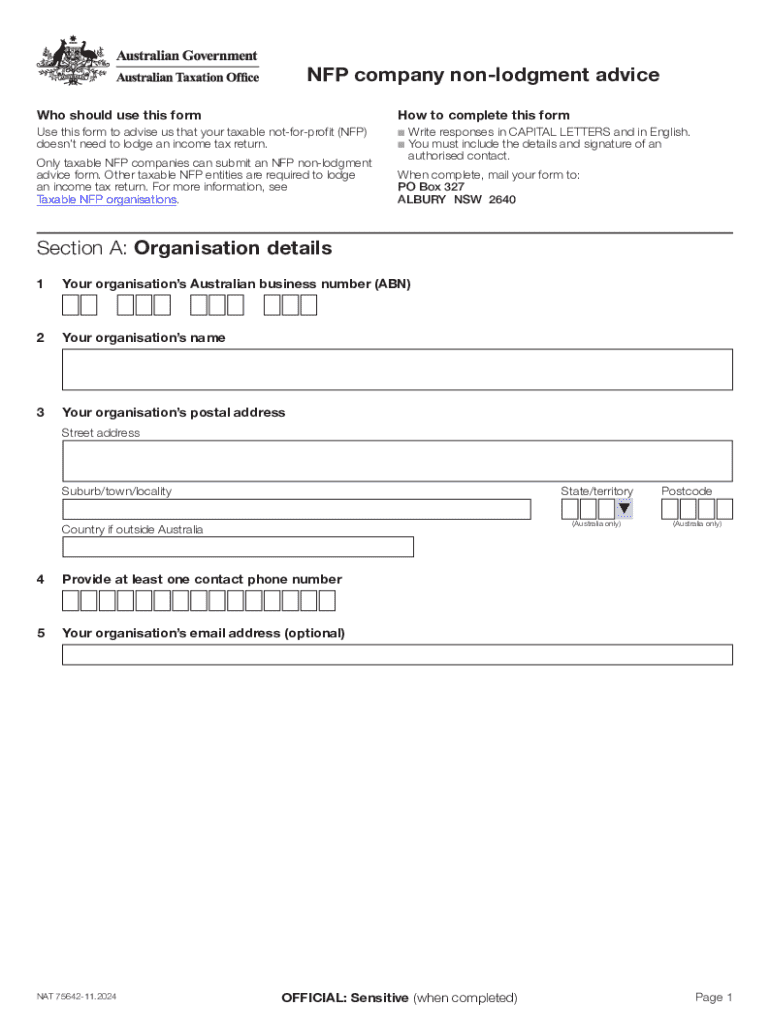

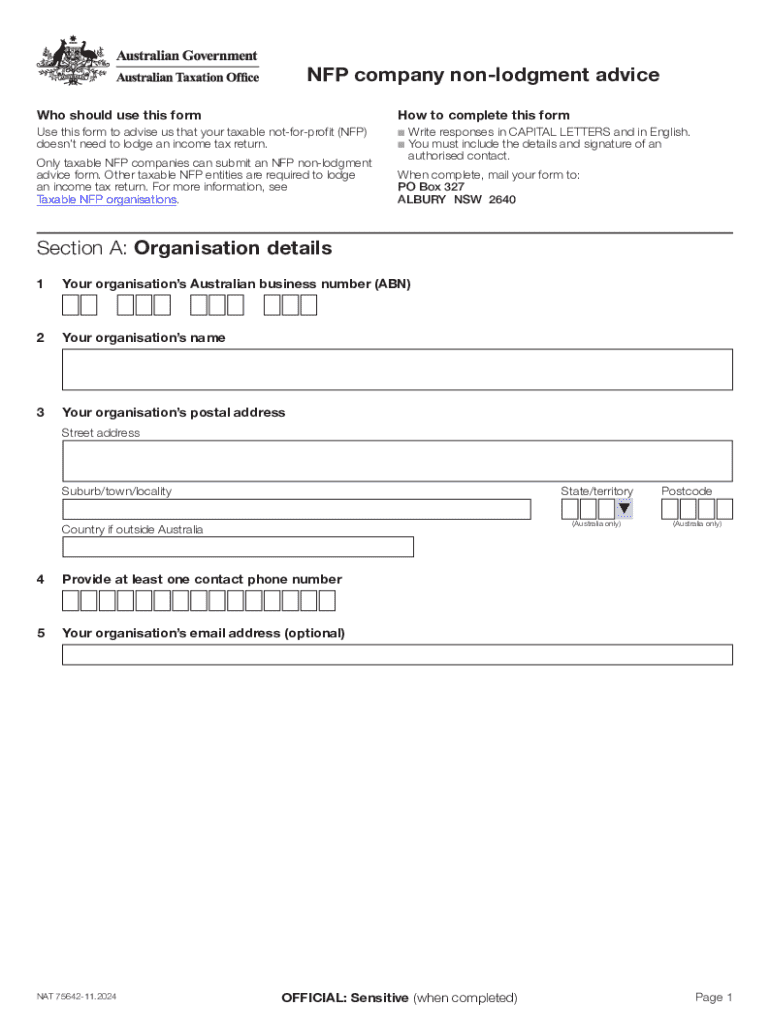

What is the NFP Company Non-Lodgment Advice Form?

The NFP Company Non-Lodgment Advice Form is a vital document for not-for-profit organizations (NFPs) that informs the Australian Taxation Office (ATO) of the intent not to lodge certain tax returns. This form helps clarify the financial reporting obligations of NFPs, especially those that qualify for exemptions or have met specific criteria that render them ineligible for lodgment. By completing this form, organizations prevent unnecessary correspondence from the ATO, thereby streamlining their administrative responsibilities.

For NFP organizations, submitting this form is not just about compliance; it's crucial for maintaining good relationships with regulatory bodies and ensuring their resources are allocated efficiently. This form serves to update the ATO on the company's status, avoiding potential penalties for non-compliance and promoting transparency within the sector.

Who should use this form?

The NFP Company Non-Lodgment Advice Form is intended primarily for organizations classified under the NFP sector that do not need to lodge expected returns due to specific exemptions. This includes smaller NFPs, charities, and organizations with minimal income. Eligibility generally hinges on certain revenue thresholds or operational parameters that exempt these entities from mandatory tax filing.

The benefits of lodging or not lodging this form include clarity regarding tax obligations and reduced risk of administrative fines. NFPs can focus on their core activities, as managing tax obligations becomes simpler. Additionally, submitting this form enhances the credibility of the organization in discussions with potential donors and stakeholders, showcasing responsible governance and compliance.

Key features of pdfFiller for the NFP non-lodgment advice form

pdfFiller is an insightful tool for NFP organizations as it simplifies the handling of the NFP Company Non-Lodgment Advice Form through its robust PDF editing capabilities. Users can seamlessly edit and personalize documents within a user-friendly interface, drastically improving the preparation and submission processes.

To edit the form, users can upload the document, modify text fields, add images if necessary, and even customize layout elements for clear communication of their information. Moreover, the eSigning feature ensures that documents are securely signed, speeding up approval processes while maintaining legal validity.

Collaboration tools for teams

pdfFiller also equips teams with advanced collaboration tools. Multiple users can simultaneously access the form, contribute to editing, and share feedback, fostering an environment of collective input that enhances accuracy and completeness. These collaboration features are especially beneficial for NFP teams that may involve volunteers and board members who need to contribute to the document.

Best practices for team collaboration include setting clear roles and responsibilities for each team member and scheduling regular check-ins to discuss progress on form filling. Leveraging pdfFiller’s cloud-based platform ensures that everyone is updated in real-time, negating the pitfalls of version control issues.

Step-by-step instructions for completing the form

Completing the NFP Company Non-Lodgment Advice Form requires careful attention to detail. The first step involves gathering the necessary information and documents. NFP organizations should have their financial records, evidence of income thresholds, and details about their operational status ready before they begin filling out the form.

Common documents required include the organization's ABN, income statements, and any relevant correspondence from the ATO. Once all information is collected, users can start the filling out process. Each section of the form should be thoroughly reviewed; even minor inaccuracies can lead to delays or complications in processing.

Filling out the form

While filling out the form, sections typically include organizational details, declarations regarding revenue, and justifications for non-lodgment. It's crucial to avoid common mistakes such as omitting required fields or misrepresenting income amounts, as these can lead to rejection of the submission.

After filling out the form, individuals should utilize pdfFiller’s built-in review tools to cross-check all input information. This feature helps ensure that no critical data is missed, enabling a smoother submission process.

Reviewing your submission

As a final step, reviewing the submission is key. Organizations should verify that every line item reflects accurate information before proceeding with the submission. Tips for ensuring correctness include reading through the entire document, checking against gathered data, and confirming adherence to any ATO guidelines related to non-lodgment them.

Managing your form after completion

After completing the NFP Company Non-Lodgment Advice Form, diligent management of the document is essential for maintaining compliance and organization. pdfFiller provides options for secure saving and cloud storage, allowing NFPs to access their documents from anywhere, which is especially beneficial for teams that operate remotely or in various locations.

Best practices for document storage include organizing files by fiscal year or category, ensuring easy retrieval during audits or regulatory reviews. Additionally, utilizing pdfFiller’s tagging system aids in categorizing documents for expedited access.

Submitting the form

Submitting the NFP Company Non-Lodgment Advice Form can be accomplished through several methods, depending on preferences and organizational protocols. Users can opt to file electronically via the ATO’s online portal or mail in a hard copy. Each method includes tracking options that can be beneficial for verifying submission statuses.

Keeping records of submissions using pdfFiller’s tracking tools will enable organizations to follow up if necessary, ensuring that NFPs remain proactive in their compliance efforts.

Common scenarios and FAQs

Organizations face various situations regarding whether to lodge or apply for non-lodgment. Specific scenarios include instances where NFPs derive minimal income or are undertaking projects without any revenue. Understanding these contexts is crucial for compliance.

Common NFP scenarios revealing non-lodgment often involve charity events with no taxable revenue. In these cases, organizations must take decisive action by filling out and submitting the non-lodgment advice form accurately to avoid any ATO penalties.

What to do if you’ve made a mistake

Mistakes can occur despite the best preparatory efforts. If an organization realizes an error post-submission, immediate steps should be taken to address it. Correction processes entail filling out a new form or contacting the ATO directly to rectify the information.

Awareness of the implications of mistakes is vital; organizations may face penalties if errors are not rectified in a timely manner. Thus, keeping thorough records and open lines of communication with the ATO can help mitigate potential issues.

FAQs about the NFP Company Non-Lodgment Advice Form

There are numerous queries surrounding the NFP Company Non-Lodgment Advice Form. Key questions include: 'When is the form due?', 'What are the qualifications for non-lodgment?', and 'How do I know if my submission was successful?'. Addressing these concerns is vital to ensure a smooth experience for NFPs.

Staying compliant and informed

Timely deadlines and compliance are essential for NFP organizations. Important dates for non-lodgment submissions typically align with fiscal year end dates and submission requirements as outlined by the ATO. Organizations must keep these dates marked on their calendars to avoid lapsing into non-compliance.

Regulatory changes affecting NFPs also warrant continuous monitoring to remain compliant. Utilizing resources such as ATO updates, consultation with accountants, and participation in NFP forums can provide insights into relevant changes in legislation.

Additional insights and related articles

Beyond understanding the NFP Company Non-Lodgment Advice Form, pdfFiller facilitates the administrative tasks relating to various other forms and templates, catering specifically to the unique needs of NFP organizations. This can significantly ease the burden on NFPs when managing multiple documents.

For organizations considering pdfFiller subscriptions, the benefits include enhanced document security, unlimited eSigning, and access to a wide array of templates designed for NFP needs, thereby improving operational efficacy.

Accounts and support services for NFPs

pdfFiller's support services are particularly beneficial for NFPs that may not have extensive administrative resources. The straightforward, accessible support structure aids organizations in navigating document management challenges effectively.

For further learning, organizations are encouraged to consult related articles and resources on NFP documentation on the pdfFiller website, ensuring they have all the tools needed for seamless document handling.

Contact and support

For any inquiries related to the NFP Company Non-Lodgment Advice Form, organizations can reach out to pdfFiller's customer support team. They are equipped to provide assistance and guidance tailored to NFP circumstances.

Additionally, engaging with the growing community of NFPs can yield valuable insights. Opportunities to share experiences and strategies for managing documents effectively exist on various online platforms and social media, enhancing overall organizational operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nfp company non-lodgment advice?

How do I make changes in nfp company non-lodgment advice?

How do I edit nfp company non-lodgment advice straight from my smartphone?

What is nfp company non-lodgment advice?

Who is required to file nfp company non-lodgment advice?

How to fill out nfp company non-lodgment advice?

What is the purpose of nfp company non-lodgment advice?

What information must be reported on nfp company non-lodgment advice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.