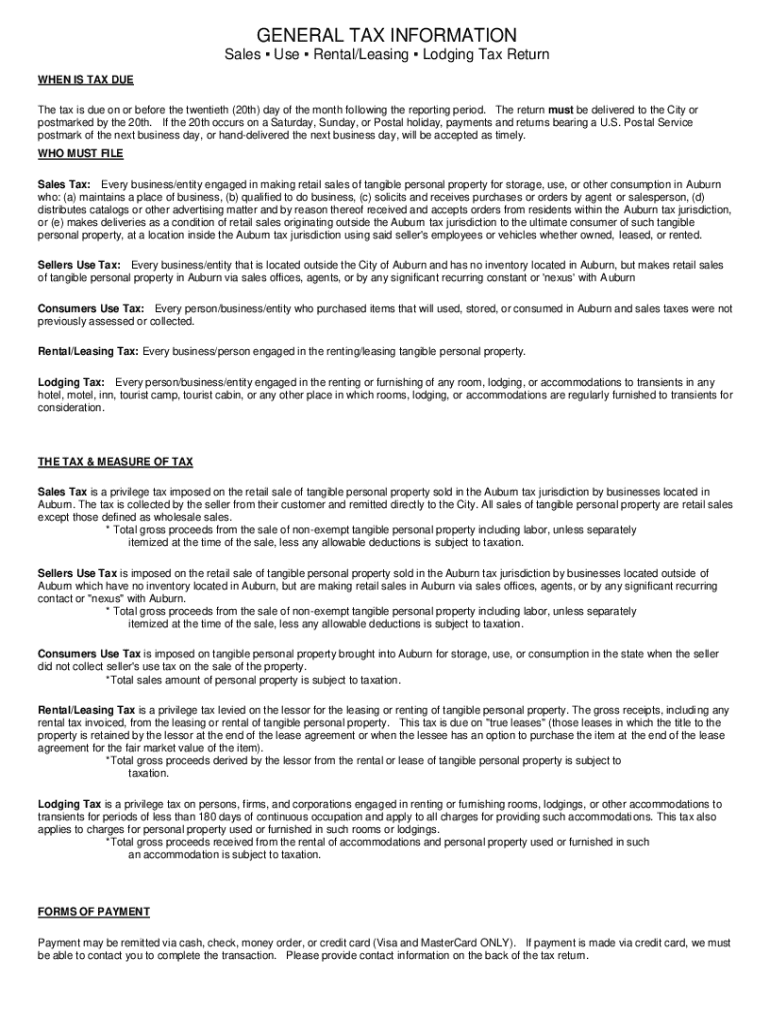

Get the free Sales Use Rental/leasing Lodging Tax Return

Get, Create, Make and Sign sales use rentalleasing lodging

How to edit sales use rentalleasing lodging online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sales use rentalleasing lodging

How to fill out sales use rentalleasing lodging

Who needs sales use rentalleasing lodging?

Comprehensive Guide to the Sales Use Rental/Leasing Lodging Form

Understanding the sales use rental/leasing lodging form

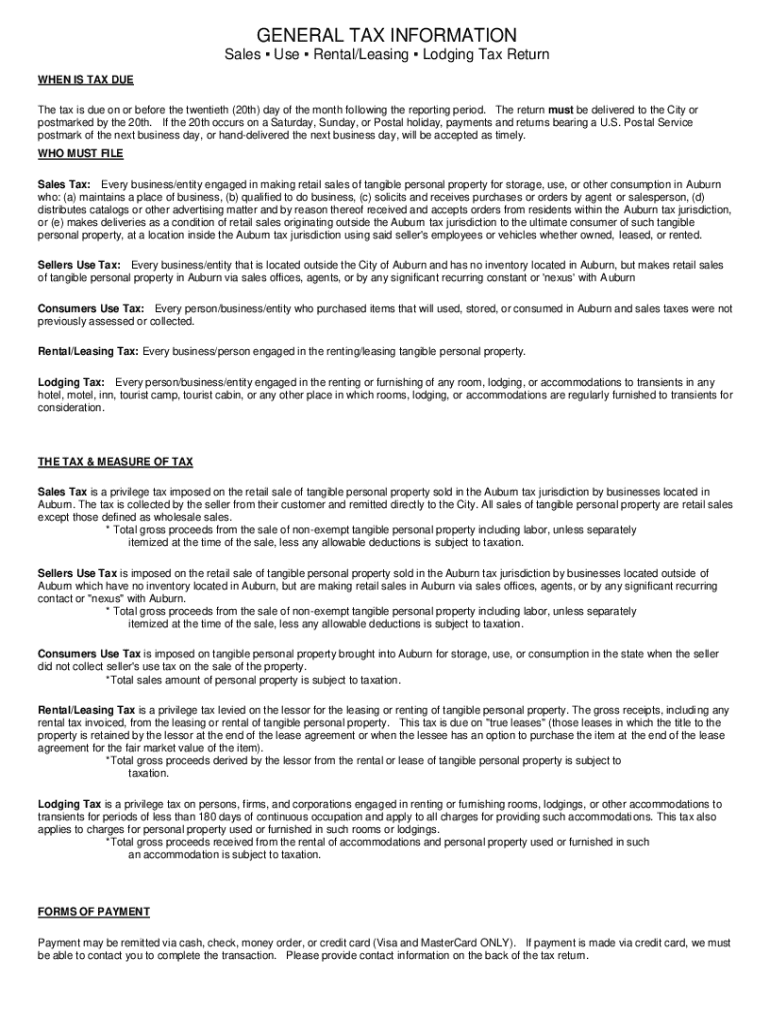

The Sales Use Rental/Leasing Lodging Form is a crucial document utilized primarily for tax compliance in the rental and leasing industry. This form serves to report the rental income generated from the use of lodging properties, ensuring that the proper sales tax is collected and remitted to tax authorities. Its importance in maintaining compliance cannot be overstated, as failure to properly report sales can result in significant penalties and legal issues.

It is essential for landlords, property managers, and businesses involved in lodging operations to understand their responsibilities under state and local tax laws. The Sales Use Rental/Leasing Lodging Form is not merely a paperwork exercise; it's an instrument that ensures fair contributions to public resources and services funded by these taxes.

Who should use this form?

The target demographics for the Sales Use Rental/Leasing Lodging Form primarily include landlords, property owners, and companies that provide accommodation services. This encompasses both short-term vacation rentals, such as those listed on popular platforms like Airbnb, and long-term leasing arrangements for apartments and hotels.

Any of these situations necessitates the use of the Sales Use Rental/Leasing Lodging Form to ensure proper reporting and compliance with tax regulations.

Key features of the sales use rental/leasing lodging form

The Sales Use Rental/Leasing Lodging Form requires specific personal and business details to be accurately filled out. This includes the property owner's name, contact information, and business identification numbers such as the Employer Identification Number (EIN) or Social Security Number (SSN).

Understanding the various sections of this form is crucial. Typically, the form is divided into different parts, each requiring unique information:

Each field on the form has corresponding significance that ensures proper tax assessment and compliance, making it essential for accuracy.

Filling out the sales use rental/leasing lodging form

Filling out the Sales Use Rental/Leasing Lodging Form might seem daunting, but following a structured approach can simplify the process. Here’s a step-by-step guide.

Common mistakes to avoid include misreporting rental days and errors in tax calculations, both of which can lead to penalties or lengthy audits.

Editing and enhancing the sales use rental/leasing lodging form

One of the convenient features of the Sales Use Rental/Leasing Lodging Form is the ability to edit it using pdfFiller’s advanced editing tools. Users can easily make necessary changes, such as correcting typos or updating information after initial input.

In addition to editing, users can add notes or additional information as needed to provide clarity or context to specific entries on the form. This can be particularly useful when collaborating with team members.

Signing and managing the sales use rental/leasing lodging form

Once the Sales Use Rental/Leasing Lodging Form is completed, signing it is the next step. Using pdfFiller, users can electronically sign the document securely.

The advantages of cloud storage include easy access and increased security, making it an excellent choice for managing important documents.

Troubleshooting common issues

While using the Sales Use Rental/Leasing Lodging Form, users may encounter some common issues. These typically include technical errors, especially when submitting the form online or interactions with tax submission systems.

By being proactive and prepared, many potential difficulties can be addressed before they become serious complications.

Related forms and resources

In addition to the Sales Use Rental/Leasing Lodging Form, there are several other relevant tax forms that users may need to become acquainted with. Understanding the nuances between these forms can streamline the filing process.

Additionally, frequently asked questions can provide clarity on common concerns regarding the Sales Use Rental/Leasing Lodging Form, enabling users to source essential information quickly and effectively.

Featured categories and resources on pdfFiller

pdfFiller offers a diverse range of tax forms and documents, ensuring users have access to everything needed for effective document management. Users can explore additional categories to find relevant tax resources tailored to their requirements.

User experiences and testimonials

Feedback from users of pdfFiller’s Sales Use Rental/Leasing Lodging Form has been overwhelmingly positive. Many users appreciate the user-friendly interface and the ease of filling out and managing complex tax forms.

Switching to a cloud-based solution has allowed individuals and teams to enhance their productivity significantly. Users often highlight the ability to access documents from anywhere and to collaborate in real time as transformative.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sales use rentalleasing lodging directly from Gmail?

How do I edit sales use rentalleasing lodging in Chrome?

How do I fill out sales use rentalleasing lodging using my mobile device?

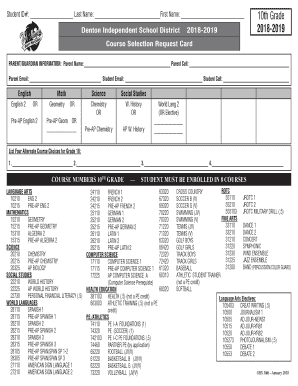

What is sales use rentalleasing lodging?

Who is required to file sales use rentalleasing lodging?

How to fill out sales use rentalleasing lodging?

What is the purpose of sales use rentalleasing lodging?

What information must be reported on sales use rentalleasing lodging?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.