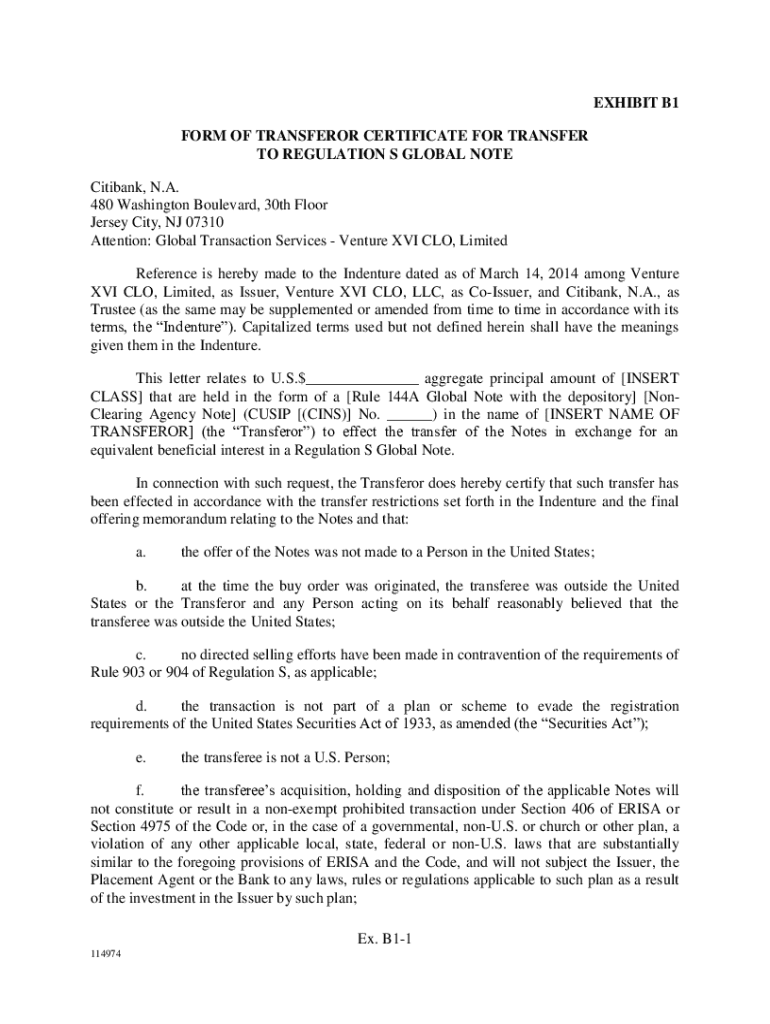

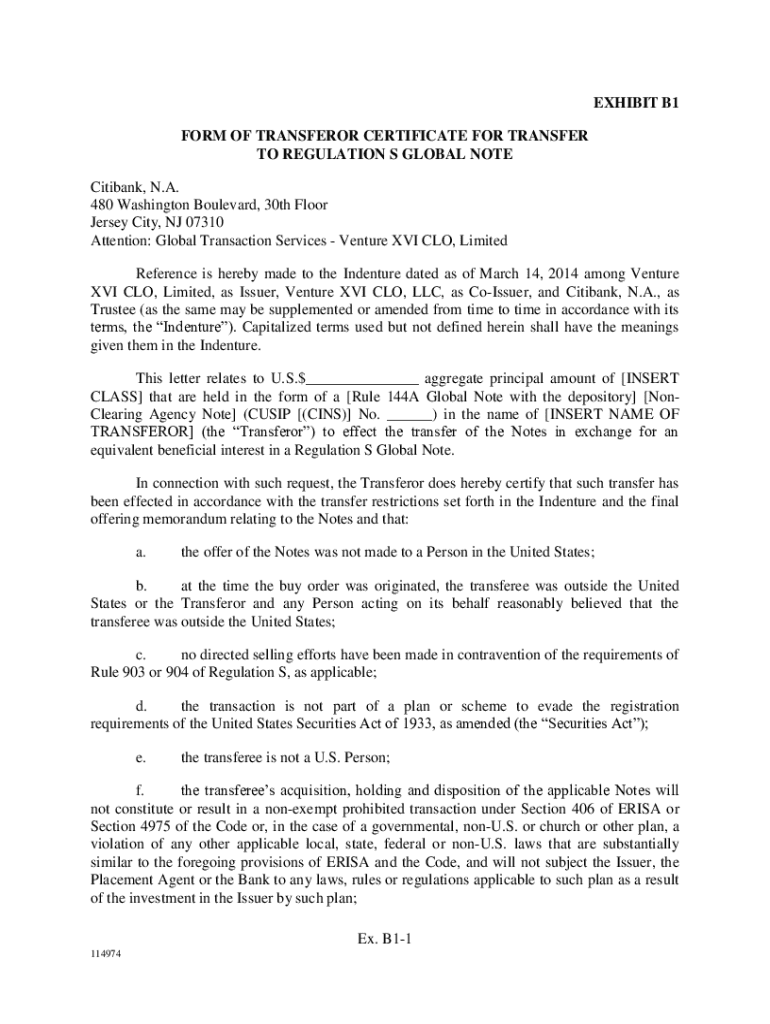

Get the free Form of Transferor Certificate for Transfer to Regulation S Global Note

Get, Create, Make and Sign form of transferor certificate

How to edit form of transferor certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form of transferor certificate

How to fill out form of transferor certificate

Who needs form of transferor certificate?

Understanding the Form of Transferor Certificate Form

Understanding the transferor certificate form

A Transferor Certificate is a legal instrument used to document the transfer of assets, rights, or interests from one party, known as the transferor, to another party, the transferee. This document plays a crucial role in various sectors such as real estate, corporate transactions, and asset management, ensuring a clear legal framework for the transfer process.

The legal significance of a transferor certificate cannot be overstated. It serves not only as proof of transfer but also as a foundational document that may be required for further legal processes, including tax implications, title changes, and liability assignments. This form is integral in preventing disputes between the involved parties by providing clear evidence of the agreement. Understanding its structure and requisite elements is essential for anyone engaging in asset transfer.

Step-by-step guide to completing the transferor certificate form

Completing the transferor certificate form can seem daunting at first. However, by following a systematic approach, the process becomes manageable. Here’s a detailed step-by-step guide to assist you.

Gather required information

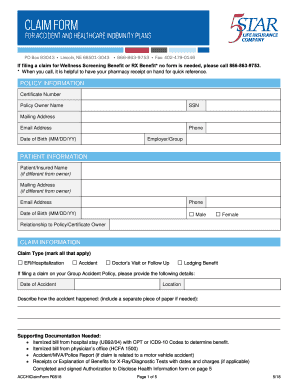

Before diving into the form, collect the necessary personal information and specifics about the asset being transferred. Start with primary details such as:

Filling out the form

Once you have gathered all relevant information, it’s time to fill out the certificate. The form typically consists of several sections, each dedicated to specific information:

Common mistakes to avoid

As straightforward as it may seem, there are common pitfalls that can occur during form completion. To ensure your transferor certificate is valid and enforceable, be wary of these typical mistakes:

Editing and customizing your form

After completing the form, you may wish to refine its content or adjust its format to suit your specific situation. Utilizing pdfFiller's editing tools can simplify this process significantly.

To access and utilize these editing features, follow these easy steps:

By enhancing your form with additional pages or crucial attachments, you ensure that all necessary information is readily available, which can be beneficial for both record-keeping and future reference.

eSigning the transferor certificate form

In today’s digital age, the convenience of electronic signatures has transformed the way documents are executed. An electronic signature is a legally recognized way to signify your acceptance of the terms outlined in the transferor certificate.

Here's how to seamlessly eSign your transferor certificate using pdfFiller:

It’s important to note that electronic signatures are legally valid in numerous jurisdictions. However, it’s always wise to confirm the legality of eSignatures for transferor certificates in your specific area.

Collaborating with teams

When working as part of a team, collaboration becomes key in effectively finalizing the transferor certificate. pdfFiller offers robust features enabling seamless cooperation among team members.

Here are some steps you can take to enhance collaboration:

This collaborative approach not only enhances the quality of the transferor certificate but also fosters accountability and transparency among all parties involved.

Managing your transferor certificate form

Once the transferor certificate is complete, managing your document becomes crucial. Storing it securely and ensuring easy access when needed is essential for maintaining records and fulfilling legal obligations.

Consider the following best practices for managing your form:

Effective management not only simplifies your workflow but also ensures you're prepared for any future queries or requirements related to the transferred asset.

Frequently asked questions (FAQs)

As you navigate through the process of completing a transferor certificate, you may have questions regarding its nuances. Here are some frequently asked queries that may help clarify your concerns:

Special considerations for different states

It's essential to be aware that the requirements for completing and filing a transferor certificate may vary by state. Each jurisdiction can have differing rules in regard to aspects such as notarization, form requirements, and submission processes.

To ensure compliance, take the time to research state-specific regulations. Here are tips for navigating these requirements effectively:

Additional features of pdfFiller for form management

One of the standout benefits of using pdfFiller is the extensive array of features designed for comprehensive document management. Beyond just filling out forms, you can utilize advanced functionalities to track document status and enhance your experience.

Consider these additional features:

By leveraging these advanced features, you streamline not just the completion of the transferor certificate but also its lifecycle management, from creation to final filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form of transferor certificate from Google Drive?

How can I send form of transferor certificate for eSignature?

Can I create an electronic signature for signing my form of transferor certificate in Gmail?

What is form of transferor certificate?

Who is required to file form of transferor certificate?

How to fill out form of transferor certificate?

What is the purpose of form of transferor certificate?

What information must be reported on form of transferor certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.