Get the free Authorization for Automatic Bank Draft

Get, Create, Make and Sign authorization for automatic bank

Editing authorization for automatic bank online

Uncompromising security for your PDF editing and eSignature needs

How to fill out authorization for automatic bank

How to fill out authorization for automatic bank

Who needs authorization for automatic bank?

Understanding the Authorization for Automatic Bank Form

Understanding the Authorization for Automatic Bank Form

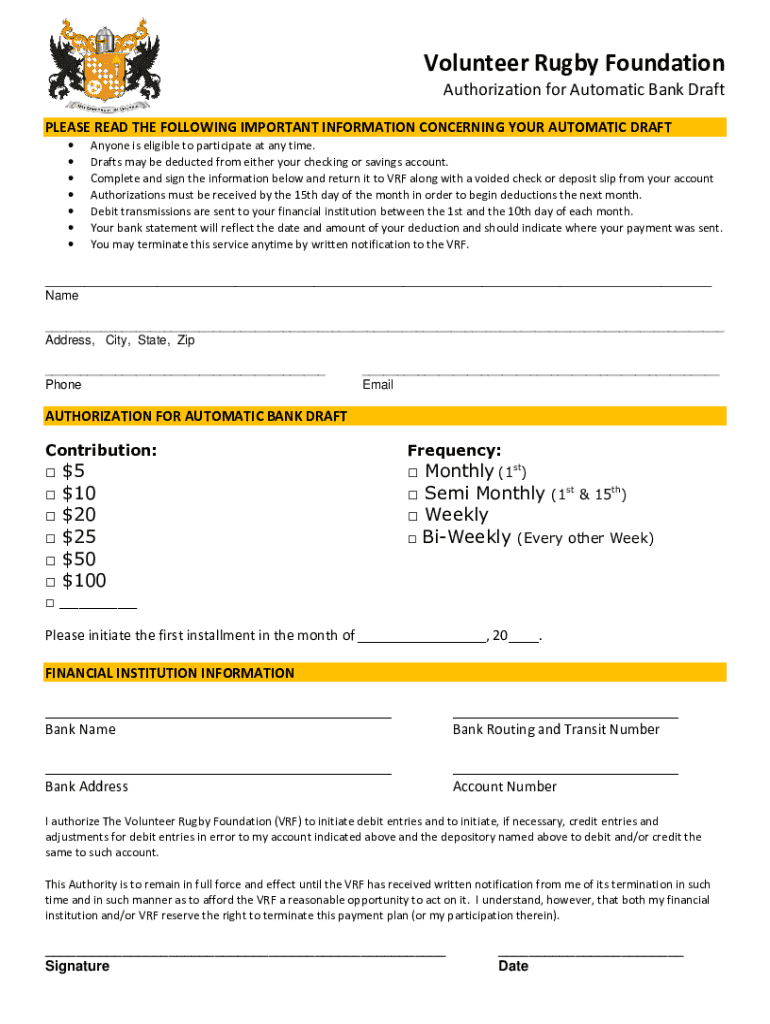

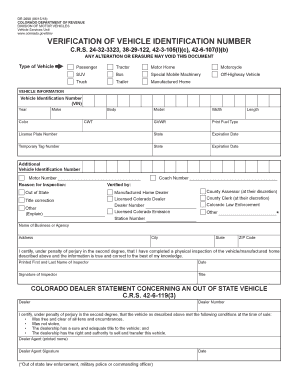

The Authorization for Automatic Bank Form facilitates seamless banking transactions by allowing individuals and businesses to manage recurring payments efficiently. This form, often required for setting up direct deposits, automated withdrawals, or payment arrangements, provides a clear written consent for banks to execute transactions on behalf of the account holder. It streamlines financial operations, ensuring timely payments without the need for manual intervention.

Key components of the Authorization for Automatic Bank Form include the account holder's personal details, the bank's information, and the specific transactions that are authorized. Additionally, it specifies the duration of authorization and any conditions tied to it. Understanding these elements is crucial for effectively managing your banking transactions.

Submitting this form ensures that payments, such as bills or salary deposits, occur without delays, benefiting both individual users and teams that rely on timely transactions for smooth operations. By understanding the intricacies of the form, users can enhance their financial management strategies.

Importance of authorization in banking

Authorization in banking is a critical process that governs automatic transactions like direct debits or salary deposits. It serves to protect account holders from unauthorized transactions, providing a safety net against fraudulent activities. When a customer submits an Authorization for Automatic Bank Form, they are essentially granting permission to the bank to withdraw or deposit funds as specified in the document.

Understanding the implications of granting or withdrawing authorization is essential. Once a user submits their authorization, the bank acts based on the provided instructions, and modifications can take time. On the flip side, revoking authorization requires prompt action and may lead to unforeseen delays in transactions. Therefore, it's important for users to maintain regular communication with their financial institutions.

In essence, utilizing the Authorization for Automatic Bank Form is beneficial for both personal and business finances, paving the way for organized financial management.

Preparing to fill out the authorization for automatic bank form

Before diving into the Authorization for Automatic Bank Form, it is vital to gather all necessary information. Personal details like your name, address, and account number lay the foundation of the document, ensuring the bank can accurately process your requests. Furthermore, include your bank's information, such as the bank name and routing number, which are essential for establishing direct links to your financial resources.

Beyond personal and bank details, it's crucial to understand your rights and responsibilities when completing this form. You're entitled to know how your information will be used and maintained by the bank. Read the fine print regarding any fees related to automatic transactions and the timelines for processing your requests. This understanding empowers you to manage your banking activities with confidence.

Step-by-step instructions for filling out the form

Filling out the Authorization for Automatic Bank Form can seem daunting, but with proper guidance, the process becomes straightforward. Start by accessing the form via pdfFiller, known for its user-friendly interface. Once you locate the right template on pdfFiller's website, click to begin editing.

Next, fill out your personal and banking information in the designated fields. Each section has its requirements; ensure you input accurate data to avoid processing delays. For instance, make sure to enter the correct account number to link your transactions properly. One common mistake is leaving out important bank identifiers like the routing number, so double-check this detail.

Once the personal and banking information is complete, focus on authorizing transactions. Specify the nature of each transaction you wish to authorize explicitly. For example, indicate if the authorization is for recurring bill payments or salary deposits. After you’ve outlined which transactions are authorized, set the duration for the authorization—will it be open-ended, or should it have a specified ending?

Finally, it's critical to review your form before submission. Accuracy is paramount, and using pdfFiller’s editing tools can help verify your entries. Take a moment to double-check names and account numbers for typos that can jeopardize your transactions.

Signing the authorization form electronically

The rise of electronic signatures has transformed how we manage documents, including the Authorization for Automatic Bank Form. eSignatures are legally recognized in many jurisdictions, offering a valid alternative to traditional pen-and-paper signatures. Signing electronically saves time and enhances convenience, allowing you to complete the authorization in a matter of minutes.

To eSign using pdfFiller, follow the prompts displayed after completing your form. You will be guided to create your electronic signature, either by drawing it or typing your name in a stylized format. Ensure that your signature reflects your authentic handwriting, as this adds to the legitimacy of the document.

Enhancing security is also crucial. Utilize pdfFiller’s features to protect your documents, which may include password protections or encryption options.

Submitting the authorization for automatic bank form

After completing and signing the Authorization for Automatic Bank Form, the next step is submitting it. There are multiple methods to consider for submission, depending on your bank's procedures. You can typically choose between in-person delivery at your bank branch, mailing it to the appropriate department, or opting for an electronic submission through your bank's online platform or via pdfFiller.

For electronic submissions, make sure to follow the platform’s instructions closely to ensure that the form reaches the intended department. If mailing the document, consider using a trackable service to monitor its delivery status. Likewise, if submitting in person, obtaining a receipt or confirmation from the bank's staff is recommended to maintain records.

Managing your authorization: Changes and cancellations

Knowing how to manage your authorization following submission is essential. If at any point you need to amend your authorization details, contact your bank directly. Each bank has specific procedures for making changes, which may involve submitting a new Authorization for Automatic Bank Form or using an internal modification process.

To securely cancel an existing authorization, promptly notify your bank using the channel they recommend. Document your communication to keep records of the request, especially if the cancellation pertains to critical payments or accounts. Following up with your bank can ensure that the cancellation has been enacted promptly.

Troubleshooting common issues

Although the process of filling out and submitting the Authorization for Automatic Bank Form is generally straightforward, issues can arise. Common hurdles include providing inaccurate information, which can cause delays or rejections from the bank. If you encounter problems, consult the instructions provided by your bank or pdfFiller for assistance.

For additional help, pdfFiller offers dedicated support. You can contact their customer service team for tailored guidance on utilizing their tools effectively. Also, refer to their FAQs to find answers to common queries regarding the Authorization for Automatic Bank Form; these resources can offer quick solutions before needing direct support.

Using pdfFiller for enhanced document management

pdfFiller not only simplifies the process of filling out the Authorization for Automatic Bank Form but also offers a suite of features that enhance document management. Its platform allows users to edit PDFs, collaborate in real-time, and secure documents through various authentication measures. This is particularly valuable for teams that require collaborative input to finalize banking transactions.

Collaboration features enable team members to share documents, offer feedback, and finalize approvals seamlessly—all from one cloud-based platform. Furthermore, pdfFiller ensures compliance and security in your document handling by providing encrypted storage and access controls, addresses critical concerns for both individuals and organizations managing sensitive financial data.

Conclusion: The power of automated transactions

The Authorization for Automatic Bank Form serves as a powerful instrument for managing automated transactions in today’s fast-paced financial landscape. By submitting this form, individuals and teams can benefit from timely payments, enhanced organization, and reduced stress surrounding financial responsibilities. Using tools like pdfFiller, users can simplify every aspect of document management, making the overall experience more efficient.

As the demand for streamlined banking processes continues to grow, understanding and utilizing the Authorization for Automatic Bank Form remains critically important. Emphasize accurate completion and informed decision-making to maximize the advantages of automatic transactions. Moreover, pdfFiller positions itself as a vital partner for users, empowering them to navigate document management from anywhere, anytime.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my authorization for automatic bank directly from Gmail?

How do I make changes in authorization for automatic bank?

How do I fill out authorization for automatic bank on an Android device?

What is authorization for automatic bank?

Who is required to file authorization for automatic bank?

How to fill out authorization for automatic bank?

What is the purpose of authorization for automatic bank?

What information must be reported on authorization for automatic bank?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.