Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Your Comprehensive Guide to Form 990

Understanding Form 990: An overview

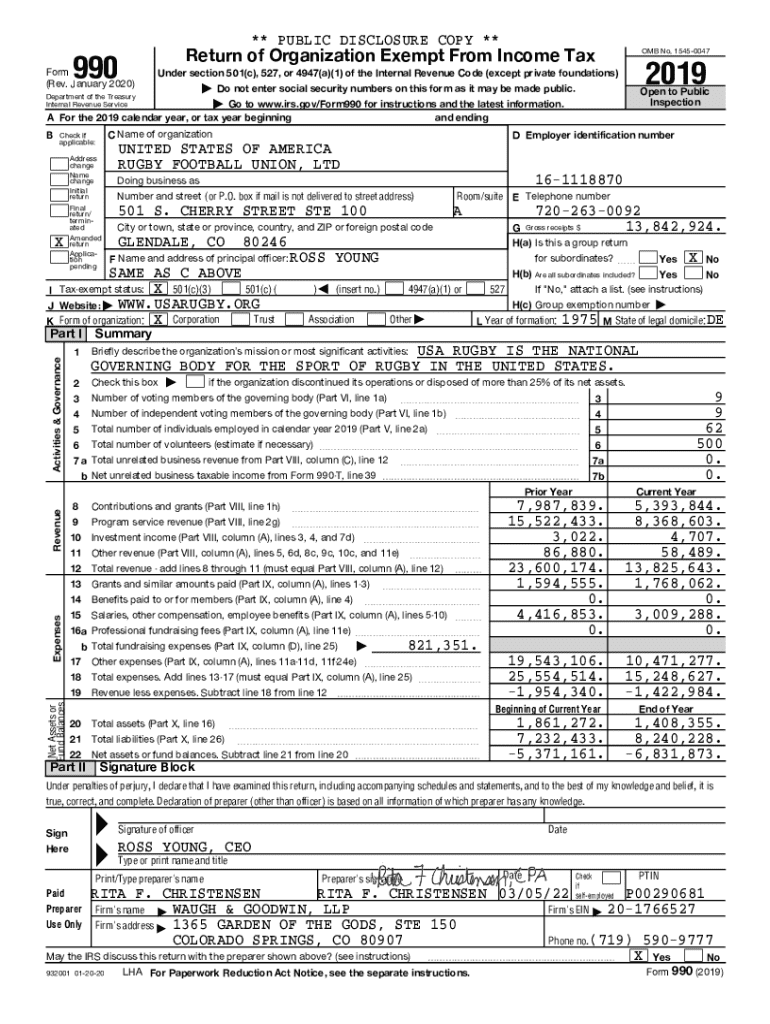

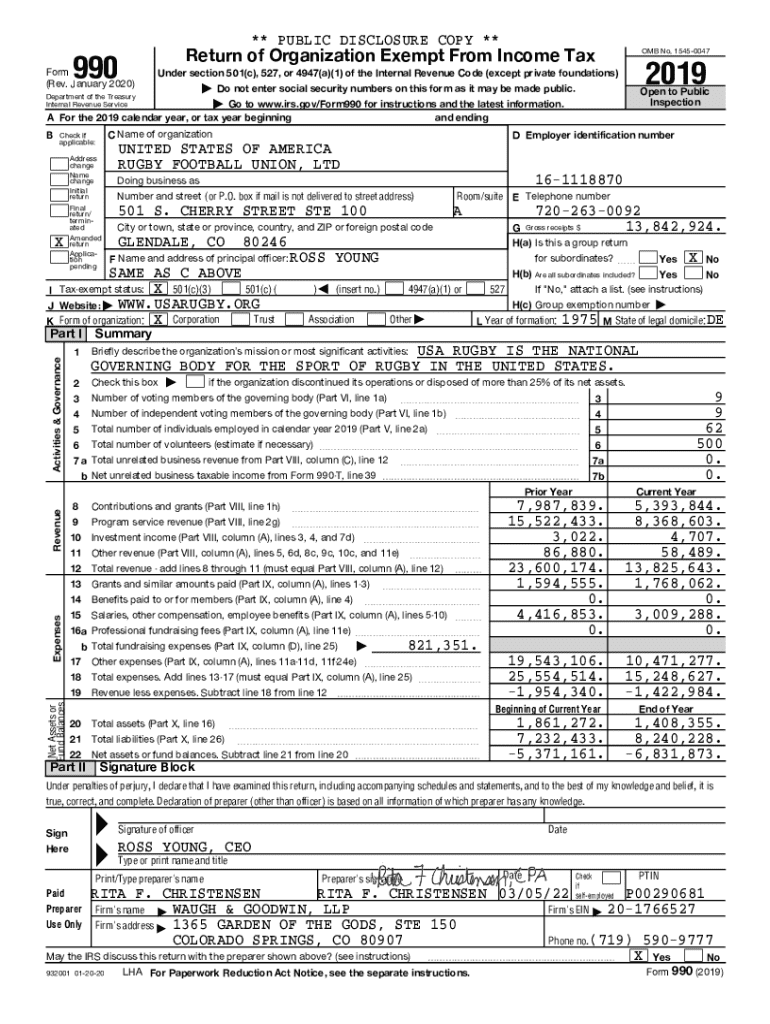

Form 990 is a critical document that tax-exempt organizations in the United States must file annually. It serves as a comprehensive financial report that gives the IRS and the public insight into an organization's activities, financial health, and governance. The significance of Form 990 cannot be overstated; it promotes transparency and accountability within the nonprofit sector, allowing donors, researchers, and the general public to understand how organizations allocate their resources.

There are several variations of the form, including Form 990, Form 990-EZ, and Form 990-PF, each catered to different types of organizations. Form 990 is typically used by larger nonprofits with gross receipts over $200,000. Form 990-EZ is a simplified version for smaller organizations with gross receipts between $50,000 to $200,000, while Form 990-PF is specifically designed for private foundations.

Who needs to file Form 990?

Tax-exempt organizations, as defined by the IRS under section 501(c), are primarily required to file Form 990. This includes charities, religious institutions, educational organizations, and other entities that fall under this umbrella. Categories of organizations required to file vary based on their income level and classification. For instance, all organizations with gross receipts over $50,000 must file some version of Form 990 annually.

However, there are exceptions. For example, religious organizations, certain governmental units, and organizations with gross receipts of less than $50,000 are typically exempt from filing. It's essential for organizations to evaluate their specific situation to understand their filing obligations.

Key components of Form 990

Understanding the structure of Form 990 is crucial for accurate reporting. The form is divided into several key sections that collectively provide a detailed financial picture of the organization. The Summary Section introduces the reader to the organization’s mission, significant policies, and overall financial status. This section sets the tone for the rest of the document and is critical for auditors and the public alike.

Following this, the Revenue and Expenses section details the organization's financial health, revealing how much income was generated and how funds were spent. The Assets and Liabilities section assesses the organization's value and solvency, while the Functional Expenses section classifies spending into categories like program services, management, and fundraising. Additionally, attachments like Schedule A and Schedule B are essential for demonstrating public charity status and documenting contributions.

Accuracy in reporting is pivotal; misrepresentation can lead to severe penalties, making thoroughness indispensable during the completion of the form.

Filing requirements and deadlines

All organizations required to file Form 990 must adhere to specific deadlines. The standard due date for Form 990 falls on the 15th day of the fifth month after the end of the organization’s fiscal year. For instance, if the fiscal year ends on December 31, the Form 990 will be due on May 15 of the following year. It’s important to note that organizations can apply for a six-month extension, allowing them to file by November 15 if additional time is necessary.

Filing can be done electronically through approved platforms, making the process smoother. It’s important to keep track of internal compliance calendars to prevent late filings, which can incur penalties.

Penalties for non-compliance

Non-compliance with Form 990 filing requirements can lead to substantial penalties. Failing to file can result in a penalty of $20 per day, up to a maximum of $10,000, depending on the organization’s size. Additionally, if organizations provide misleading or inaccurate information, they may face further scrutiny from the IRS, possibly jeopardizing their tax-exempt status.

Maintaining compliance is crucial for protecting an organization's reputation and tax-exempt status, reinforcing the importance of accurate documentation and timely filings.

How to fill out Form 990: Step-by-step guide

Filling out Form 990 can seem daunting, but a structured approach makes the process manageable. Start with preparation by gathering all necessary documents, including financial statements, records of compensation, and donor lists. This foundational step ensures you have all relevant information at your fingertips, streamlining the completion process.

Next, follow a section-by-section guide: begin with the Summary Section and move methodically through each area of the form. Take time to review the instructions provided by the IRS as they are designed to clarify common ambiguities. Utilizing interactive tools, such as those available on pdfFiller, helps complete and edit forms efficiently.

How to edit and manage your Form 990

Efficient document management is fundamental after completing Form 990. Using tools such as pdfFiller ensures that your Form 990 can be edited seamlessly from anywhere, optimizing collaboration efforts among team members. Features like electronic signatures facilitate quicker approvals and processing, improving overall efficiency.

This cloud-based platform allows users to store their documents securely, granting access to specific team members only. Utilizing such features protects sensitive information while enabling organizations to manage their administrative duties effectively.

Public inspection regulations

Transparency is a hallmark of nonprofit organizations, and Form 990 plays a key role in maintaining this transparency. The IRS requires that organizations make their Form 990 available for public inspection, underscoring the public's right to know how donations and funds are managed. This regulation is not merely a bureaucratic formality; it encourages trust and accountability amongst stakeholders.

To adhere to these guidelines, organizations should maintain a clear and accessible policy for making Form 990 available to the public, whether through their website or by direct request. This approach fosters a culture of accountability, reinforcing the organization’s reputation and donor confidence.

Form 990 data: utilizing it for research and evaluation

The data gleaned from Form 990 is a treasure trove for researchers, policymakers, and grant-seekers alike. Accessing this information allows interested parties to analyze trends within the nonprofit sector, gaining insights into funding flows and resource allocation. Best of all, this data can be accessed online via various platforms, facilitating its use in strategic decision-making.

Organizations can utilize Form 990 data to strengthen grant applications by providing evidence-based insights into their operations, thus increasing the likelihood of receiving funding. By leveraging this data responsibly, nonprofits can develop strategies that enhance program effectiveness and contribute to mission fulfillment.

Frequently asked questions about Form 990

When it comes to Form 990, many organizations have common inquiries. Frequently asked questions often relate to who is required to file, deadlines, and what information is necessary to complete the form accurately. Addressing these questions helps clarify the filing process, reducing confusion and enhancing compliance.

Additionally, queries about how to document contributions and the potential implications of filing errors are common. Resources such as the IRS website or professional tax advisors can provide further insights and guidance, ensuring organizations can navigate the complexities surrounding Form 990.

Checking the status of your Form 990

Once your Form 990 has been submitted, it's prudent to check its status. Organizations can track their filings through the IRS website or by direct inquiry. Understanding how to check your submission status is critical to ensuring your filing is processed without issues.

Post-submission, organizations may receive feedback or notices from the IRS. Staying vigilant regarding any correspondence ensures that potential questions or issues can be addressed promptly, safeguarding the organization’s tax-exempt status.

Additional considerations

Navigating Form 990 is intricate and may involve additional considerations such as amendments for previously filed forms or complexities related to fiscal sponsorships. Organizations must stay updated about changes in tax laws that may impact their filing requirements. For instance, recent changes in tax legislation can introduce new regulations that require modifications in how Form 990 is completed and submitted.

Engaging with resources, including professional tax advisors or legal counsel, can help organizations remain compliant and address any specific issues related to their circumstances, ensuring they can adapt to changes effectively.

Appendix

To aid organizations further, the following glossary of terms related to Form 990 can help clarify jargon and ensure clear understanding across stakeholders. Additionally, links to important IRS resources are outlined below for immediate access but are subject to regular updates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990 in Gmail?

How do I execute form 990 online?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.