Get the free Stock and Securities Transfer

Get, Create, Make and Sign stock and securities transfer

Editing stock and securities transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stock and securities transfer

How to fill out stock and securities transfer

Who needs stock and securities transfer?

Understanding the Stock and Securities Transfer Form

Overview of stock and securities transfer forms

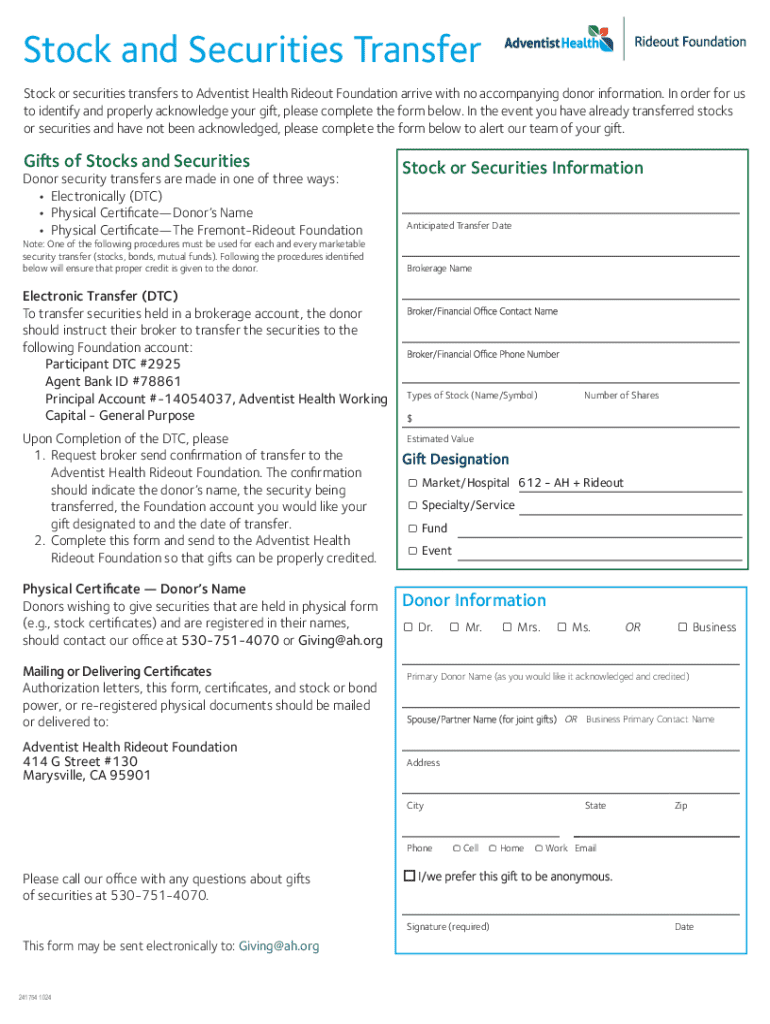

A stock and securities transfer form is a legal document used to transfer ownership of stocks and other securities from one party to another. This form serves as a vital piece of evidence in ownership transactions, ensuring that ownership rights are formally recognized and documented.

These transfer forms play a crucial role during transactions, particularly in maintaining clarity and protecting both the buyer and seller's rights. They are essential for complying with legal and regulatory requirements, as transferring ownership without proper documentation can lead to disputes and complications.

Various types of securities may require transfer forms, such as corporate stocks, government bonds, mutual funds, and other financial instruments. Understanding the specific requirements for each type of security ensures a smooth transfer process.

Common scenarios for utilizing stock transfer forms

Stock dividend transfers and estate planning often necessitate the use of stock and securities transfer forms. Individuals may transfer ownership between friends or family, facilitating more personal transactions.

Step-by-step guide to completing a stock and securities transfer form

Completing a stock and securities transfer form can be straightforward if you follow a structured process. Here's a step-by-step guide to ensure you get it right.

Managing stock and securities transfers online with pdfFiller

With the digital age simplifying paperwork, managing stock and securities transfer forms online has become increasingly beneficial. pdfFiller provides an easy-to-use platform that allows users to edit, eSign, and manage their documents.

Users can access interactive features for editing and signing forms, making it ideal for individuals and teams who need a comprehensive solution for document management. Collaboration options further enhance its functionality, allowing multiple stakeholders to complete necessary steps efficiently.

Frequently asked questions (FAQ) about stock transfer forms

Related templates for enhanced document management

In addition to the stock and securities transfer form, pdfFiller provides numerous related templates that assist in maintaining organized financial and legal records.

Special considerations in stock transfers

Handling stock transfers involves various scenarios that may require special attention. One significant area is the transfer of stocks from deceased individuals. In such cases, the estate executor must follow specific legal processes, which may include obtaining a grant of probate.

Furthermore, restrictions related to securities transfers can impact how and when securities can be moved. Investors must be aware of any regulatory business provisions or company bylaws that may impose restrictions on stock transfers, especially in a corporate setting.

For companies undergoing mergers or acquisitions, understanding how stock transfers work in these contexts is crucial. Shareholders may need to fill out specific forms, and the stock's valuation can significantly change, which necessitates careful legal and financial considerations.

Useful resources and tools

Individuals engaging in stock and securities transfers should familiarize themselves with various resources to ensure compliant and efficient transactions.

Disclaimer about stock and securities transfers

It's essential to consult with a financial advisor or legal expert when handling stock and securities transfers. This area of law can be complex and varies by jurisdiction, so professional guidance would help in avoiding potential liabilities and pitfalls.

The information provided here is intended for educational purposes and should not be considered legal advice. Understanding your local regulations and requirements is crucial in managing your stock and securities assets optimally.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit stock and securities transfer from Google Drive?

How do I edit stock and securities transfer online?

Can I sign the stock and securities transfer electronically in Chrome?

What is stock and securities transfer?

Who is required to file stock and securities transfer?

How to fill out stock and securities transfer?

What is the purpose of stock and securities transfer?

What information must be reported on stock and securities transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.