CA DHCS 6168 2025-2026 free printable template

Get, Create, Make and Sign CA DHCS 6168

Editing CA DHCS 6168 online

Uncompromising security for your PDF editing and eSignature needs

CA DHCS 6168 Form Versions

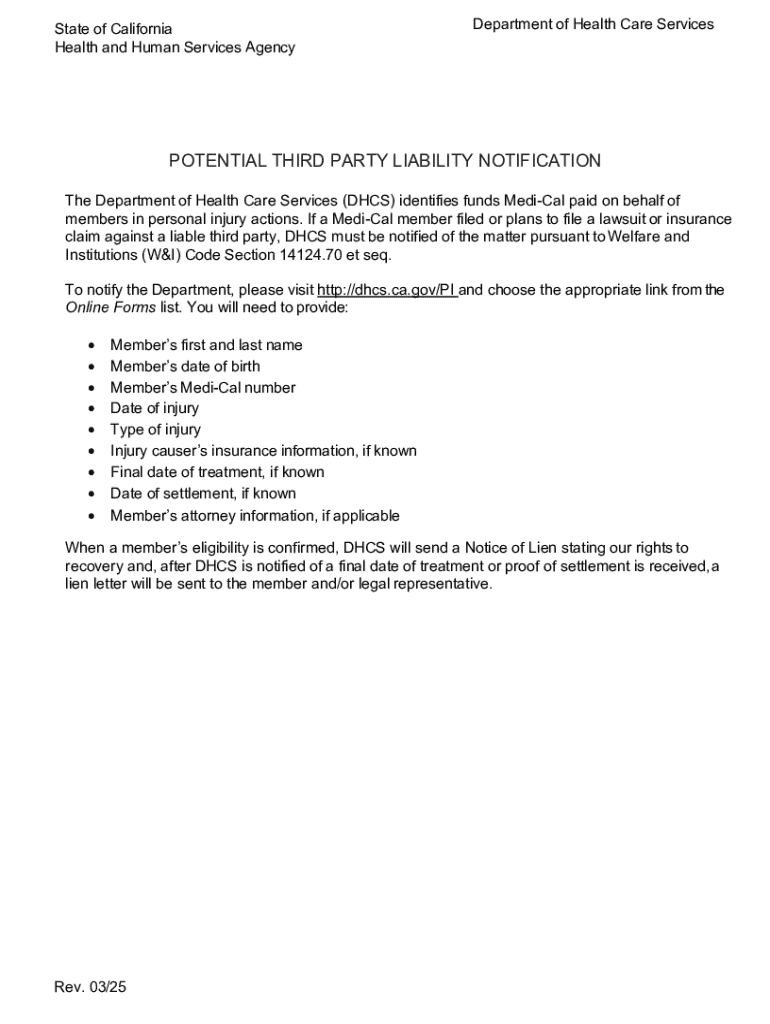

How to fill out CA DHCS 6168

How to fill out potential third party liability

Who needs potential third party liability?

Comprehensive Guide to the Potential Third Party Liability Form

Understanding potential third party liability

Potential third party liability refers to situations where an individual or organization may be held accountable for damages suffered by another party due to their negligence or actions. This legal concept is crucial in various contexts, particularly in personal injury and professional situations. Understanding this liability is essential, as it can significantly impact one's financial and legal responsibilities.

Common scenarios that require a potential third party liability form include personal injury cases, property damage situations, and professional liability claims. In personal injury cases, a victim may seek compensation from a responsible party if injuries sustained were due to negligence. Property damage situations arise when someone's actions, whether intentional or accidental, cause harm or loss to another's property. Professional liability claims typically occur when services provided by professionals, such as doctors or lawyers, result in harm due to failure in duty.

Legally, the consequences of third party liability can lead to significant financial implications, including compensatory damages for medical expenses, lost wages, property repair, and emotional suffering. Understanding the legal implications can help individuals navigate the complexities of liability claims effectively.

Features of the potential third party liability form

The potential third party liability form is designed to collect pertinent information to support a claim. Key components include sections for personal information, incident descriptions, damages and compensation details, and witness information. The personal information section usually requires details such as the names, addresses, and contact information of all parties involved. Accurate incident description is critical for establishing the context of the claim and identifying responsible parties.

Details regarding damages and compensation should outline the financial impact, including medical bills and property repairs, while the witness information section can provide corroborating accounts that strengthen a claim. Each part of the form plays a vital role in protecting rights, ensuring that all relevant details are recorded for potential legal proceedings.

Step-by-step guide to filling out the potential third party liability form

Filling out the potential third party liability form requires careful attention to detail and several steps. First, gather all necessary information, including identification documents like driver's licenses or insurance cards and evidence such as photographs of the incident scene, medical records, and witness statements. Having this information readily available will simplify the process and enhance the accuracy of your submission.

Next, follow detailed instructions for each section of the form. Begin with personal information, ensuring accuracy to avoid delays. When describing the incident, focus on clarity and specificity, outlining the sequence of events and contributing factors. For assessing damages, provide a thorough calculation backed by evidence, and ensure it logically connects to your claims. It's essential also to avoid common mistakes, such as leaving fields blank or providing vague descriptions.

Editing and signing the form

Once the potential third party liability form is filled out, it's time to review and edit. pdfFiller makes it easy to access the form online. Within their platform, users can make changes seamlessly without the need for physical copies. This cloud-based approach not only saves time but also reduces the likelihood of errors.

Signing the form electronically is straightforward with pdfFiller. To ensure the legal validity of your eSignature, follow the built-in instructions on the platform. Remember that eSignatures are recognized in most jurisdictions, providing a secure and efficient way to finalize your submission.

Managing your third party liability claim

After completing and signing the form, you must submit it. Knowing exactly where to send the form is crucial. Typically, this involves submitting it to an insurance company or legal department related to the claim. Keeping a copy of the submission and obtaining a confirmed receipt can help you track the status of your claim.

Following up on your claim is essential. Understand what to expect after submission, such as timelines for responses or further investigations. Maintain thorough records of all communications regarding your claim, as these can be vital in case of disputes.

Collaborative options for teams

For teams filing a potential third party liability claim, collaboration is key. Sharing the form with legal advisors allows for professional input on the details provided. pdfFiller offers collaborative editing features that simplify this process, enabling legal counsel to provide feedback directly on the document.

Additionally, involving other stakeholders in reviewing the form can enhance accuracy and completeness. Team members can be invited to ensure no critical information is overlooked and to manage feedback effectively. With the cloud-based functionality, multiple individuals can work on the form simultaneously, streamlining the entire procedure.

Frequently asked questions (FAQs)

Addressing common concerns regarding the potential third party liability form can help demystify the process. If you encounter issues with the form, seeking clarification from the relevant legal authority or insurance provider is crucial. Costs associated with filing third party claims vary; it's advisable to check with your provider for any potential fees.

Another consideration is the jurisdictional applicability of the form. Generally, while the basic structure remains the same, specifics can differ based on local laws. Lastly, timelines for processing claims can vary; therefore, staying informed by following up post-submission is recommended.

Advantages of using pdfFiller for your potential third party liability form

Utilizing pdfFiller for your potential third party liability form has multiple benefits. Its accessibility allows users to access their forms from anywhere, whether at home, in the office, or on the go. This flexibility is essential for those needing to manage incidents swiftly.

Moreover, pdfFiller streamlines document management, providing features that enhance organization and ensure all paperwork is consistently updated. Security is a top priority; with robust security measures in place, users can rest assured that their sensitive information is protected. Additionally, wealth of support and resources available through pdfFiller can guide users in effectively navigating the complexities of potential third party liability forms.

People Also Ask about

What is a notice of lien for Medi-Cal?

How long does Medi-Cal take to process a claim?

How do I report a claim to Medi-Cal?

What is the form for adding a person for Medi-Cal?

How do I submit a claim to Medi-Cal?

Do I have to report a settlement to Medi-Cal?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA DHCS 6168 in Gmail?

How can I edit CA DHCS 6168 from Google Drive?

How can I send CA DHCS 6168 to be eSigned by others?

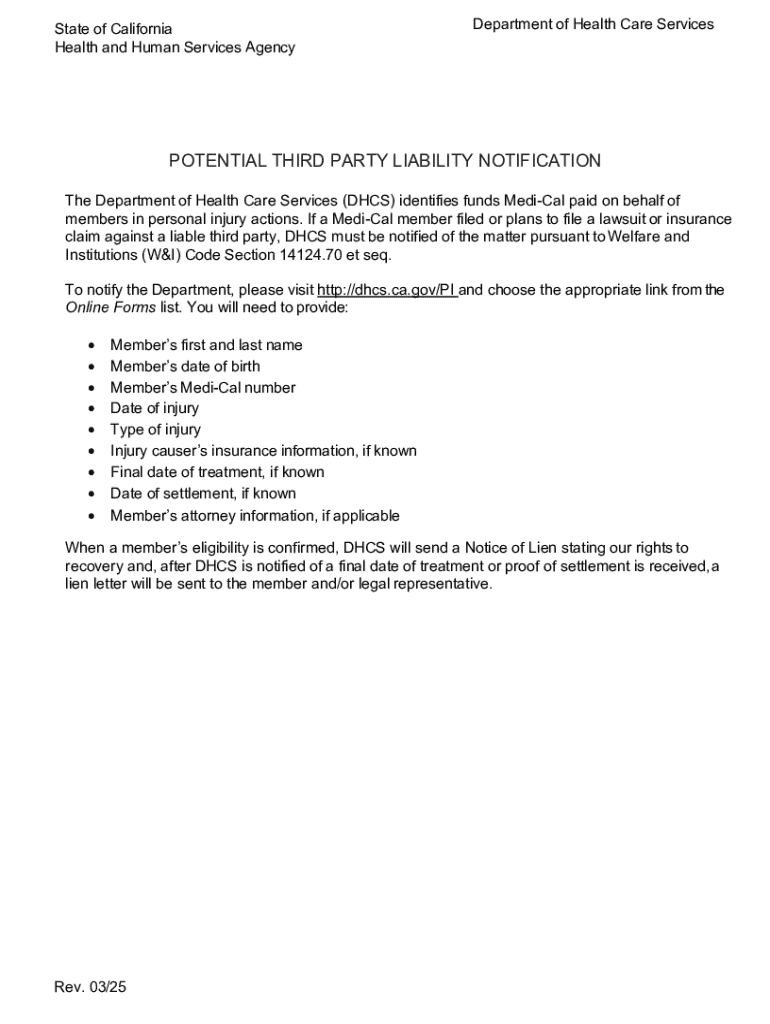

What is potential third party liability?

Who is required to file potential third party liability?

How to fill out potential third party liability?

What is the purpose of potential third party liability?

What information must be reported on potential third party liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.