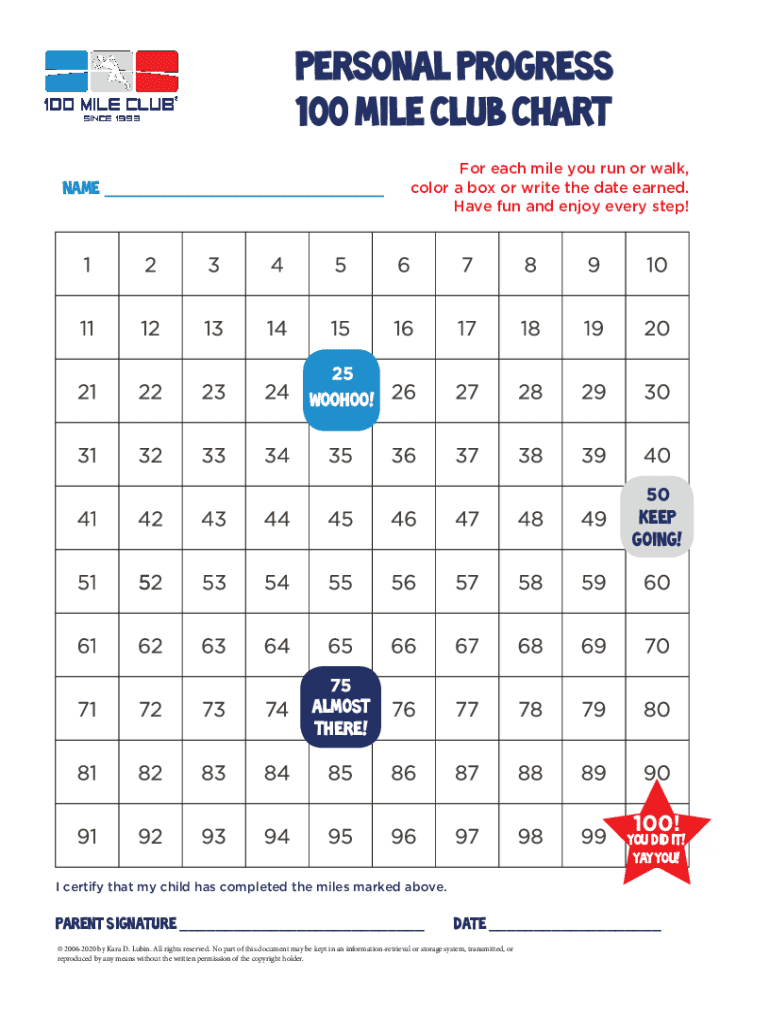

Get the free Miles Tracker Certificate

Get, Create, Make and Sign miles tracker certificate

How to edit miles tracker certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out miles tracker certificate

How to fill out miles tracker certificate

Who needs miles tracker certificate?

Comprehensive Guide to the Miles Tracker Certificate Form

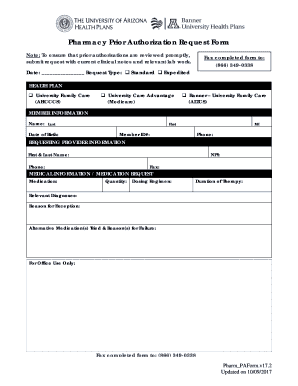

Understanding the miles tracker certificate form

A miles tracker certificate form is an essential document for individuals and businesses who want to maintain accurate records of vehicle usage. This certificate provides a formal declaration of the miles driven for business, tax purposes, or reimbursement claims. Understanding its importance is critical, as it not only serves as evidence for mileage claims but also helps organizations and freelancers keep track of wear and tear on vehicles and manage travel budgets effectively.

When you have a clear record of miles driven, you can substantiate your claims for tax deductions or reimbursements from employers. The miles tracker certificate is particularly valuable when calculating allowable expenses related to vehicle use. Without proper tracking and documentation, you may miss out on significant savings and face potential issues during audits.

Essential components of the miles tracker certificate

To create a miles tracker certificate that serves its purpose effectively, it is essential to include specific key information. This not only ensures a comprehensive understanding of the vehicle's usage but also aids in maintaining transparency and accountability.

For effective use, the miles tracker certificate can be formatted in various ways. Common options include PDF and Excel formats, each serving different needs depending on how you plan to manage your records. Interactive templates available at pdfFiller also make it easy to customize your certificate to ensure all necessary information is captured.

Step-by-step guide to filling out a miles tracker certificate form

Filling out a miles tracker certificate form may seem straightforward, but preparation and attention to detail are essential for success. Start by gathering all required documents and information, ensuring that you have everything at your fingertips.

The next step involves completing each section of the certificate methodically. Begin with the vehicle information section, inputting details such as make, model, and year. Follow this by accurately recording your mileage in the tracking section, detailing the start and end dates for each trip. Make sure to include the total mileage in this section. After providing this information, ensure that your signature and the date are present before proceeding.

Lastly, be aware of common mistakes to avoid while filling out this form. Double-check that all information is accurate, and ensure consistency in your records to prevent complications with your claims.

Editing and customizing your miles tracker certificate

Once you have your miles tracker certificate filled out, the next step is to ensure that it meets your requirements. With pdfFiller’s tools for editing PDF forms, you can easily add or remove information as needed. This flexibility is particularly useful when updates to vehicle information or mileage records are necessary.

In addition to correcting details, consider altering the layout or format to better suit your needs. As a user, you can choose to collaborate with team members on certificate completion, allowing for a streamlined process where feedback and revisions can occur in real-time.

Filing and storing your miles tracker certificate

Effective document management is crucial once you have completed your miles tracker certificate. Consider best practices for filing and storing, whether opting for digital or physical storage options. Digital storage is generally more accessible, allowing for easy retrieval and sharing among team members.

In today's fast-paced business environment, having access to your documents from anywhere can significantly enhance efficiency. pdfFiller provides excellent solutions for keeping your documents securely stored while ensuring they remain easily accessible whenever you need them.

Interactive tools and features at pdfFiller for managing your miles tracker certificate

Using pdfFiller not only aids in creating your miles tracker certificate but also enhances how you manage it. One valuable feature is the capability to eSign the document directly within the platform, streamlining the approval process.

Additionally, pdfFiller allows you to share options for team review, ensuring everyone involved can contribute effectively. You will also be able to track changes and revisions made to the document, providing clarity on the certificate's history and evolution.

Real-world applications of a miles tracker certificate

Understanding the practical applications of a miles tracker certificate can help underscore its significance. For individuals and businesses alike, this document is crucial for tax deductions and reimbursements. By maintaining accurate mileage records, you may qualify for deductions that can significantly reduce tax liabilities.

Particularly for freelancers and small business owners, being able to document vehicle usage not only brings financial benefits but also fosters professionalism. Many clients may require detailed records of transportation used for business purposes, and successfully providing a well-organized miles tracker certificate can enhance trust.

Many clients report significant benefits from keeping accurate mileage records, including smoother financial management and improved relationships with employers or clients.

Additional tips and information

Understanding mileage reimbursement policies is crucial to maximizing the benefits of your miles tracker certificate. Companies often have specific guidelines about how mileage is reimbursed, and familiarity with these policies ensures that you’re filing correctly.

Further, keeping accurate records can be simplified with various tools and apps designed specifically for mileage tracking. Leveraging technology to automate tracking processes not only saves time but also reduces errors associated with manual record-keeping.

Accurate mileage tracking can have significant tax implications, leading to potential benefits that positively impact your finances.

Frequently asked questions (FAQs)

As you navigate filling out your miles tracker certificate form, you may have several questions. Here are some of the most commonly asked questions along with their answers for clarity.

By understanding these FAQs, you can navigate the requirements for filling out your miles tracker certificate more effectively, simplifying the process and ensuring compliance.

Related templates and resources

In addition to the miles tracker certificate form, various tools exist to enhance your mileage tracking process. You may want to explore different mileage tracking tools, comparing their features to find the best fit for your needs.

Accessing other relevant templates in pdfFiller can also offer additional support; whether you're looking for expense reports, tax deduction forms, or other documentation, tools available can facilitate comprehensive record-keeping.

Joining the pdfFiller community can provide ongoing support, updates, and further resources, ensuring you utilize this platform to its fullest potential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify miles tracker certificate without leaving Google Drive?

How can I send miles tracker certificate to be eSigned by others?

How do I complete miles tracker certificate on an iOS device?

What is miles tracker certificate?

Who is required to file miles tracker certificate?

How to fill out miles tracker certificate?

What is the purpose of miles tracker certificate?

What information must be reported on miles tracker certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.