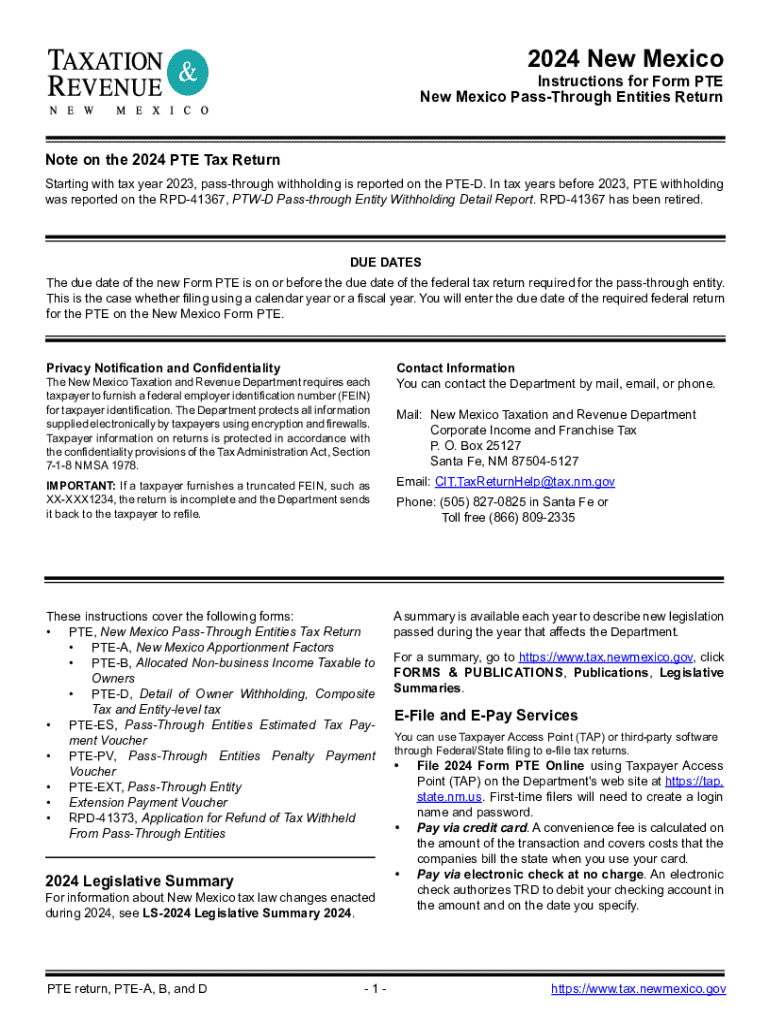

Get the free New Mexico Pass-through Entities Return

Get, Create, Make and Sign new mexico pass-through entities

How to edit new mexico pass-through entities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new mexico pass-through entities

How to fill out new mexico pass-through entities

Who needs new mexico pass-through entities?

A Comprehensive Guide to the New Mexico Pass-Through Entities Form

Understanding pass-through entities in New Mexico

Pass-through entities (PTEs) serve as an essential component of New Mexico’s business landscape, allowing owners to bypass double taxation. Instead of being taxed at the corporate level, profits and losses are passed directly to the owners or shareholders. This structure not only fosters entrepreneurship but also encourages reinvestment in the local economy.

In New Mexico, multiple types of PTEs exist, including Limited Liability Companies (LLCs), partnerships, and S-corporations. Each type has its unique advantages and disadvantages depending on the business goals and tax situations of the owners.

The importance of PTEs cannot be overstated in New Mexico's economy, where small businesses compose a significant portion of the market. They enable entrepreneurs to start and grow their businesses while contributing to job creation and tax revenue.

Overview of the New Mexico Pass-Through Entities Form

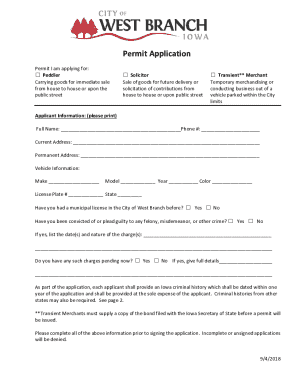

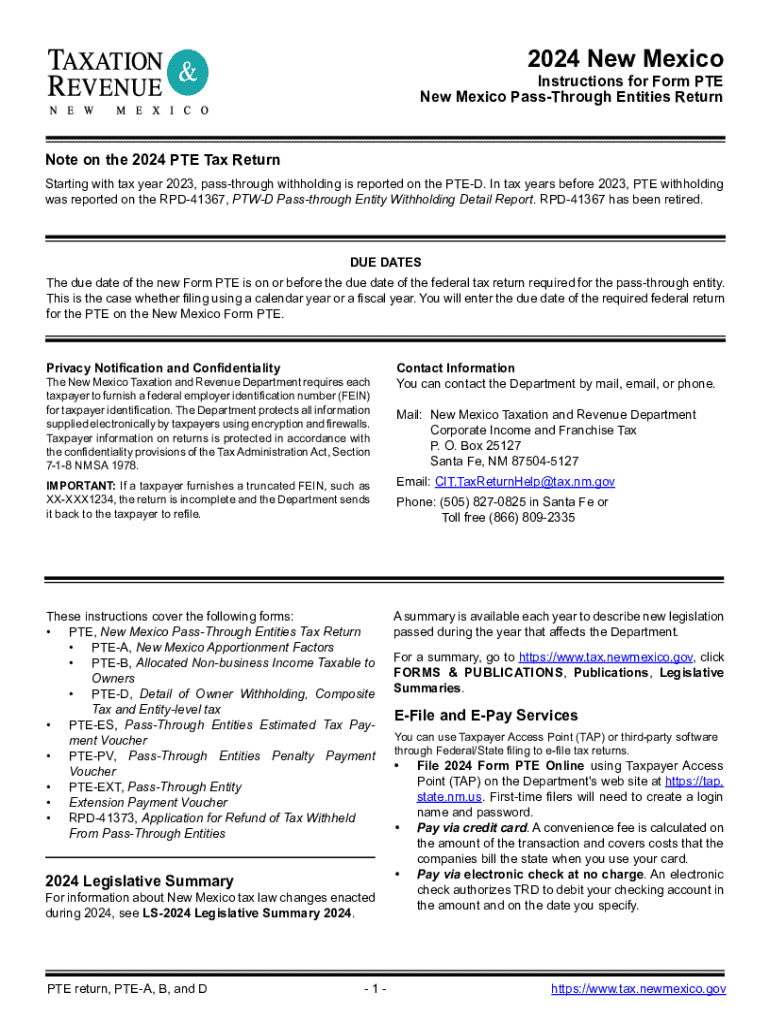

The New Mexico Pass-Through Entities Form is primarily designed for businesses that elect to be taxed as pass-through entities. Its key purpose is to facilitate the proper reporting of income, deductions, and credits associated with these entities, ensuring compliance with state tax laws.

Recent state tax legislation has created specific requirements and guidelines for how PTEs must operate and report their taxes. Understanding the nuances of these laws is critical for business owners.

Detailed steps for filling out the New Mexico Pass-Through Entities Form

Completing the New Mexico Pass-Through Entities Form accurately is crucial for avoiding penalties. The form consists of several sections, each requiring specific information about the entity and its owners.

Section 1: Basic information

This section requires foundational details about the entity, including its legal name, address, and type. Ensure you have the correct legal entity name as it appears on the registration documents.

Section 2: Owner information

In this section, detail each owner’s information. Differentiate between individual owners and corporate owners as their taxation situations differ. Each owner/member must be reported accurately with social security numbers for individuals or tax identification numbers for corporations.

Section 3: Income reporting

It's vital to categorize income correctly—ordinary income, capital gains, and other types must be distinctly reported. If the entity incurred losses, properly document these alongside any deductions taken.

Section 4: Calculation of entity-level tax

This section guides how to compute the entity-level tax owed. Businesses must determine taxable income and apply the highest tax rate specific to PTEs, ensuring compliance.

Section 5: Credits and deductions

Several credits may benefit the PTE, including those for job creation, research, and development. Understand the treatment of net operating losses (NOLs) as they can offset taxable income in future years.

Section 6: Signatures and submission

Finally, ensure that the form is signed and dated by all required parties. Electronic filing is encouraged, and options exist for submitting the form through platforms like pdfFiller, streamlining the submission process.

Exploring online tools for efficient completion of the form

Utilizing pdfFiller’s interactive tools simplifies the process of completing the New Mexico Pass-Through Entities Form. The cloud-based platform allows users to access documents from anywhere, making it highly convenient for individuals and teams.

Features such as real-time editing and collaboration facilitate seamless interactions among team members and accountants. Users can edit fields directly, ensuring that the most up-to-date information is available for filing.

Common mistakes to avoid when completing the New Mexico Pass-Through Entities Form

Small errors can lead to significant complications when filing the New Mexico Pass-Through Entities Form. Reviewing common mistakes can help ensure accurate submissions. One frequent error involves misidentifying entities or owners, which can lead to mismatches in reported data.

Additionally, inaccurate income reporting, either through omission or incorrect categorization, poses another risk. Accountability and verification of all figures are essential to avoid penalties.

FAQs about New Mexico pass-through entities

Navigating the nuances of New Mexico’s tax laws surrounding pass-through entities can be challenging. Here are essential FAQs to clarify common concerns.

Key considerations for all partners and members of pass-through entities

Partners and members should recognize the implications of tax elections on their individual tax obligations. Understanding these impacts can shape business strategies and operational decisions.

Effective communication among partners is essential to navigate the complexities of the tax landscape. This prevents misunderstandings and ensures compliance with all regulations. Failing to adhere to tax obligations may result in significant consequences, including penalties and potential audits.

Resources for further assistance

For questions and additional guidance, business owners can contact the New Mexico taxation offices. Their trained staff can provide clarity on the passing and reporting procedures relevant to PTEs.

Beyond direct contact, various online resources are available, including templates and filing guides on pdfFiller. Utilizing these resources can streamline the filing process and help ensure comprehensive compliance with state requirements.

User testimonials and success stories

Many users have successfully navigated the complexities of the New Mexico Pass-Through Entities Form using pdfFiller. Their experiences highlight the platform's efficiency in document management and the ease of collaborative editing.

These testimonials underline the importance of a seamless process in filing taxes, emphasizing that the right tools can significantly reduce stress and confusion. Utilizing a cloud-based platform like pdfFiller empowers teams to manage their documentation effectively and focus on growing their business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new mexico pass-through entities in Gmail?

How do I make edits in new mexico pass-through entities without leaving Chrome?

How do I edit new mexico pass-through entities on an Android device?

What is new mexico pass-through entities?

Who is required to file new mexico pass-through entities?

How to fill out new mexico pass-through entities?

What is the purpose of new mexico pass-through entities?

What information must be reported on new mexico pass-through entities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.