Get the free N.i.t. No.: - 92-e / Eee / Bsnl / Ed / Nsk / 2016-17

Get, Create, Make and Sign nit no - 92-e

Editing nit no - 92-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nit no - 92-e

How to fill out nit no - 92-e

Who needs nit no - 92-e?

A comprehensive guide to the NIT No - 92-E form

Overview of the NIT No - 92-E form

The NIT No - 92-E form serves as a critical document in managing various legal and administrative aspects within organizations. It is essential for maintaining records and ensuring compliance with relevant regulations.

The form is designed to streamline the process of collecting and documenting information necessary for formal submissions, enhancing both accountability and organization in document management.

Key features of the NIT No - 92-E form

The NIT No - 92-E form is endowed with a comprehensive structure that allows for efficient completion and management. Its design includes interactive elements that enhance user experience, making navigation and data entry straightforward.

Moreover, the form integrates well with other digital tools and systems, providing users with the flexibility to streamline workflows and improve productivity.

Understanding the specifics of the NIT No - 92-E form

Each section of the NIT No - 92-E form is deliberately structured to guide users in completing all necessary fields accurately. Understanding these sections helps mitigate common errors and omissions that could lead to delays or rejections.

Correct and comprehensive information in these sections is vital as inaccuracies could lead to significant legal implications, including the potential for penalties or rejection of the document.

Step-by-step guide to filling out the NIT No - 92-E form

Filling out the NIT No - 92-E form can be straightforward when approached systematically. Here’s how to prepare and navigate through the form's sections.

Editing and customizing the NIT No - 92-E form

After the initial completion of the NIT No - 92-E form, users may find it necessary to edit or customize their submissions. This can be done easily using tools available on pdfFiller.

WithpdfFiller, users can utilize editing tools designed for enhanced functionality. These include adding text or signatures and re-arranging document structure without hassle.

Signing the NIT No - 92-E form

Signing the NIT No - 92-E form is made simple with options for eSigning. Digital signatures provide numerous benefits, including security and time efficiency.

The signing process via pdfFiller involves a straightforward series of steps, ensuring that users maintain compliance with legal standards throughout.

Managing your NIT No - 92-E form

Effective document management is vital for ensuring that the NIT No - 92-E form is easily accessible and organized. By utilizing smart storage solutions, users can minimize clutter and enhance efficiency.

Organizing and categorizing the form within a digital filing system increases productivity and facilitates quick retrieval whenever necessary.

Troubleshooting common issues with the NIT No - 92-E form

As with any form submission, users may encounter issues when dealing with the NIT No - 92-E form. Understanding potential pitfalls can streamline the process.

Real-life applications of the NIT No - 92-E form

Organizations have utilized the NIT No - 92-E form in various contexts, yielding effective results in documentation and compliance.

Case studies from different industries demonstrate how teams have leveraged this form to enhance productivity and adhere to regulations.

Legal and compliance considerations surrounding the NIT No - 92-E form

Compliance with legal standards while using the NIT No - 92-E form is paramount. Organizations must be aware of regulations governing the form's usage.

Failure to comply can result in serious consequences ranging from fines to legal disputes.

Conclusion: harnessing the power of the NIT No - 92-E form

The NIT No - 92-E form is an invaluable tool for both individuals and teams aiming to enhance their document management practices. Its various features aim to simplify the process of data collection and regulatory compliance.

By leveraging pdfFiller's capabilities, users can ensure a streamlined approach to filling out, signing, and managing their forms, promoting a more efficient workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit nit no - 92-e straight from my smartphone?

How do I complete nit no - 92-e on an iOS device?

How do I fill out nit no - 92-e on an Android device?

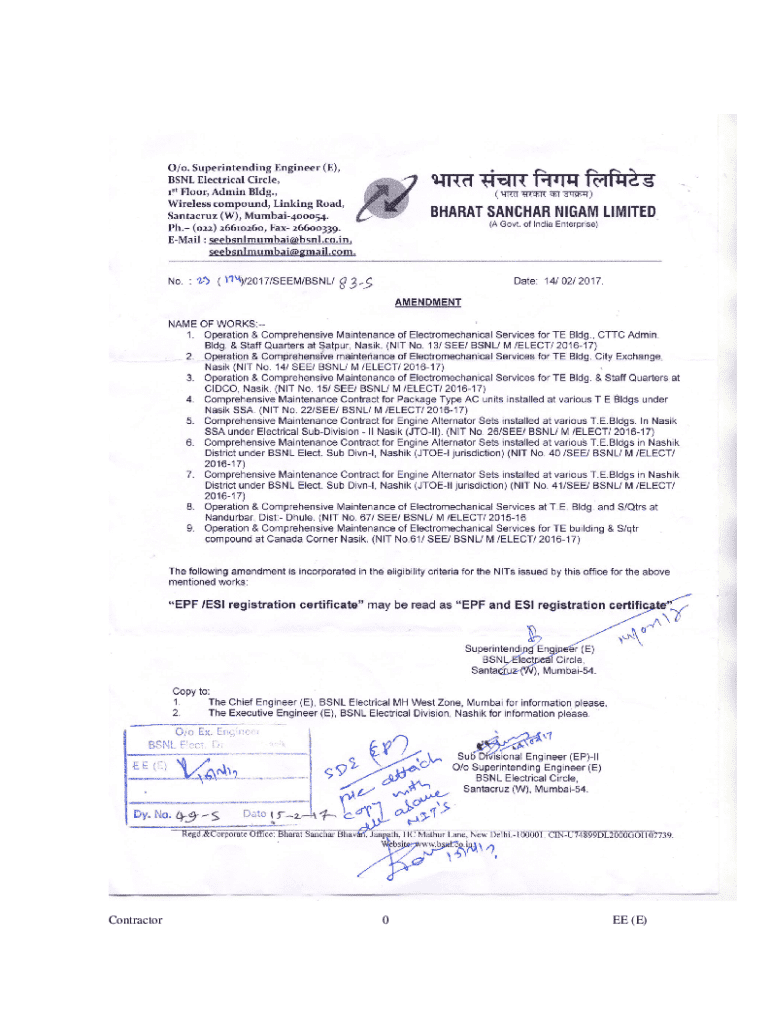

What is nit no - 92-e?

Who is required to file nit no - 92-e?

How to fill out nit no - 92-e?

What is the purpose of nit no - 92-e?

What information must be reported on nit no - 92-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.