Get the free Ira Transfer Form

Get, Create, Make and Sign ira transfer form

Editing ira transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ira transfer form

How to fill out ira transfer form

Who needs ira transfer form?

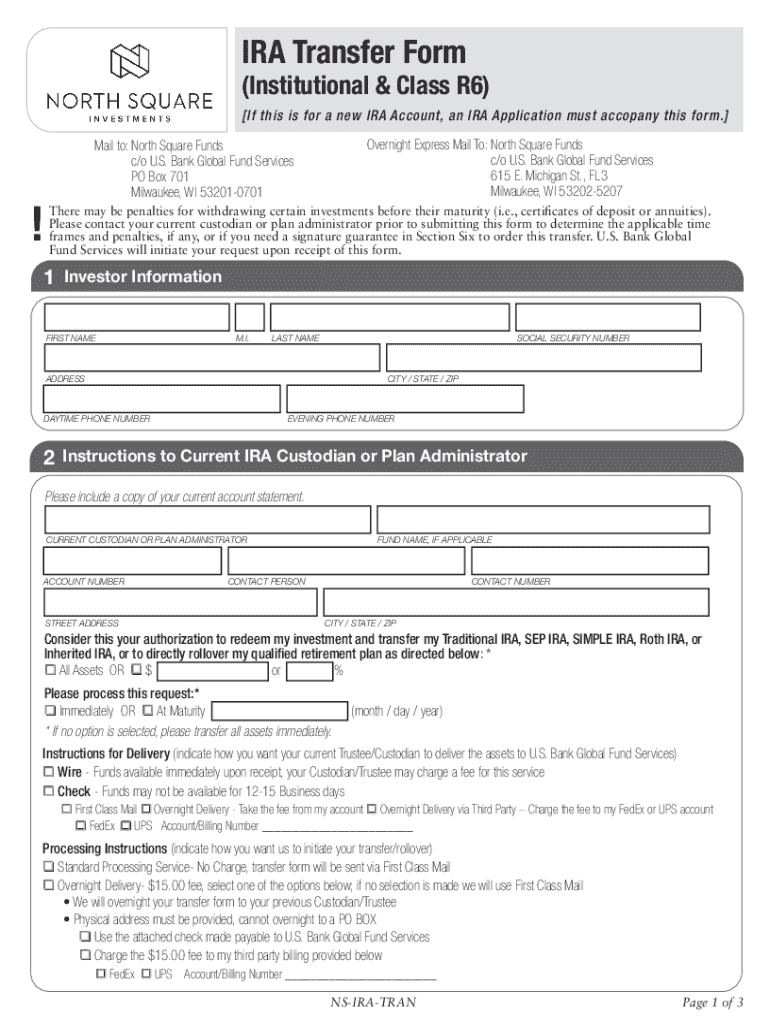

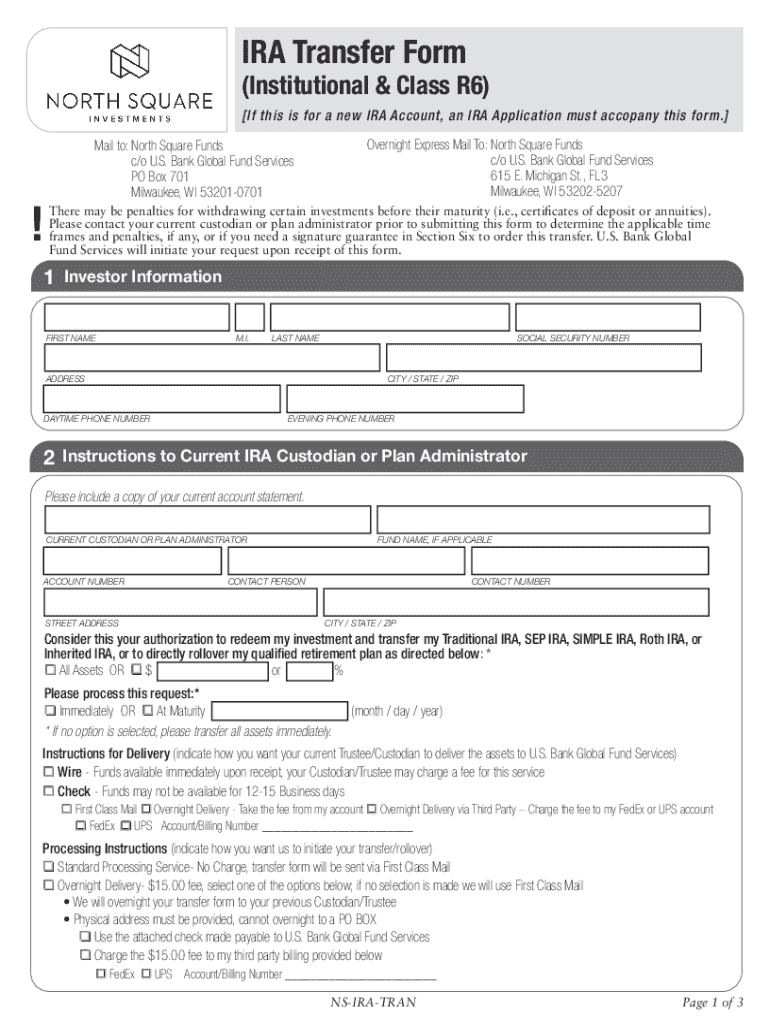

A comprehensive guide to the IRA transfer form

Understanding the IRA transfer form

The IRA transfer form serves as a crucial document for individuals looking to move their retirement funds from one Individual Retirement Account (IRA) to another. This form allows account holders to transfer assets between different IRA custodians without encountering tax implications. Its primary purpose is to ensure a smooth shift of funds, safeguarding the tax-advantaged status of the IRA, thereby allowing capital to grow without immediate taxation.

It's essential to distinguish between an IRA transfer and an IRA rollover. While both processes involve moving retirement funds, the transfer is a direct move between custodians, ensuring compliance with IRS regulations. Conversely, a rollover typically involves the account holder taking personal possession of the funds and redepositing them into a new account within a stipulated timeframe. Understanding these differences is paramount for managing your retirement finances effectively.

Common scenarios necessitating the use of an IRA transfer form include switching financial advisors, consolidating multiple IRAs for ease of management, or finding a new provider with lower fees or better investment options. Each of these situations highlights the importance of a smooth transition process, making the IRA transfer form an essential tool for investors.

Key components of the IRA transfer form

When filling out the IRA transfer form, several essential details need to be provided to ensure the process flows seamlessly. The required information typically includes:

Additionally, you may also need to attach any relevant documentation to verify account details, particularly for larger transfer amounts. Indicating the specific amount to transfer is equally crucial to avoid delays and ensure accuracy.

Step-by-step guide to completing the IRA transfer form

Completing the IRA transfer form requires careful attention to detail. Here’s how to guide you through the process:

Timeline and expectations during the transfer process

Timing is crucial when it comes to IRA transfers. Typically, transfers can take anywhere from a few days to several weeks, depending largely on the institutions involved. It’s essential to know that while most transfers are straightforward, several factors can affect the duration.

Factors influencing the transfer duration include the efficiency of the current and new IRA custodians, the method of submission of the transfer form, and the completeness of the information provided. After you submit the form, expect communication from both the current and new provider to confirm initiation of the transfer, keeping you informed throughout the process.

Common issues and solutions with IRA transfers

While transferring an IRA is often a straightforward process, common challenges may arise. Delays can happen due to incomplete forms or other issues. If this occurs, contacting your current IRA provider promptly for clarification can help resolve issues before they escalate.

Incorrect information is another frequent problem. If you notice any discrepancies after submission, reach out to customer support immediately to rectify the issue. Maintaining open communication with both IRA providers ensures a more efficient transition.

Benefits of using pdfFiller for IRA transfer forms

Utilizing pdfFiller enhances the overall experience of managing IRA transfer forms significantly. The platform allows users to edit documents easily, ensuring accuracy. The eSigning feature is particularly beneficial for expediting approvals, while collaboration tools support team-based efforts, streamlining the transfer process.

Accessing forms from any device, anywhere, means you can manage your IRA transfer on your own schedule. pdfFiller empowers you through a seamless cloud-based experience, making it simpler to stay organized during your transitions.

Interactive tools to simplify the transfer process

pdfFiller also offers interactive tools designed to ease the transfer process further. Digital templates for IRA transfer forms save time and ensure compliance with guidelines, while step-by-step checklists facilitate efficient form completion.

Moreover, an FAQ section directly addressing common concerns related to IRA transfers can provide valuable insights and assist users in navigating the process effectively. By leveraging these tools, you can manage your IRA transfer confidently and efficiently.

Maintaining your IRA after the transfer

Once your IRA transfer is complete, it's vital to keep your account well-organized and accessible. Regularly monitoring your investment performance can help you make timely adjustments to your strategy based on market conditions or personal goals.

Implementing periodic reviews is crucial. Life changes may necessitate adjustments to your investment plan, and ensuring your IRA aligns with your financial aspirations will help you navigate retirement with greater ease.

Conclusion: Streamlining your IRA transfer experience

In conclusion, understanding the IRA transfer form is key to a smooth financial transition. By following the outlined steps and utilizing resources provided by pdfFiller, you can significantly simplify your IRA transfer experience.

Investing time in mastering this process ensures that you maintain control over your retirement funds while capitalizing on opportunities that arise. Empower yourself today with pdfFiller for your essential document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ira transfer form without leaving Google Drive?

Where do I find ira transfer form?

How do I complete ira transfer form on an Android device?

What is ira transfer form?

Who is required to file ira transfer form?

How to fill out ira transfer form?

What is the purpose of ira transfer form?

What information must be reported on ira transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.