Get the free Commercial Balance Sheet

Get, Create, Make and Sign commercial balance sheet

Editing commercial balance sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial balance sheet

How to fill out commercial balance sheet

Who needs commercial balance sheet?

Your Comprehensive Guide to the Commercial Balance Sheet Form

Understanding the commercial balance sheet

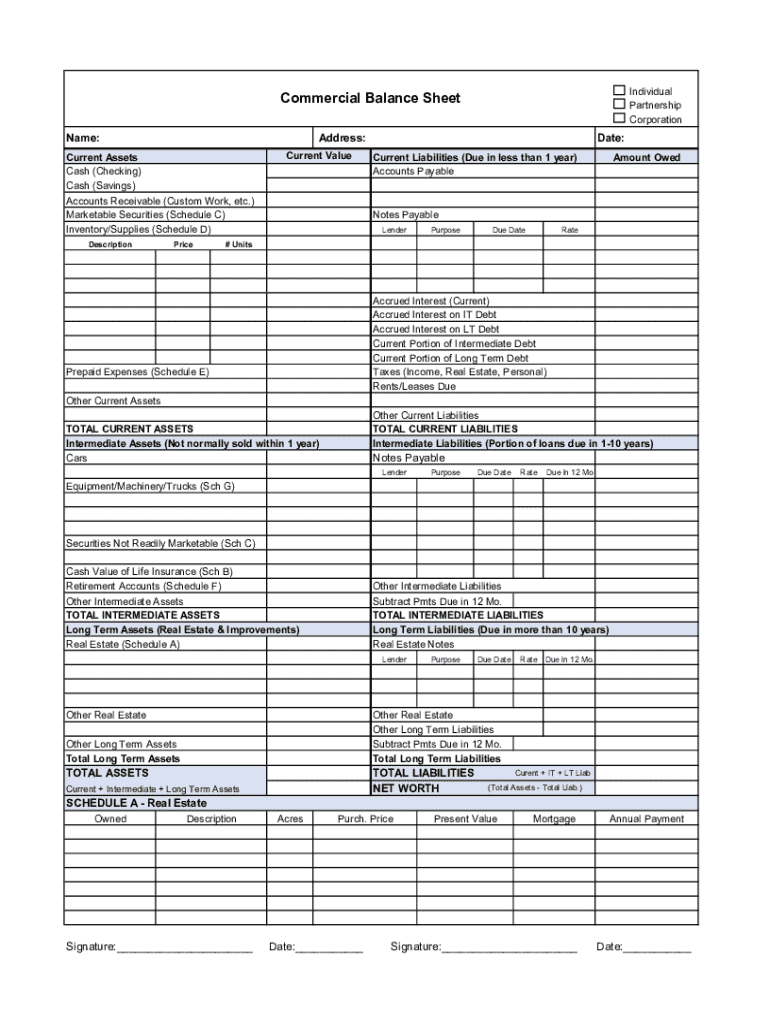

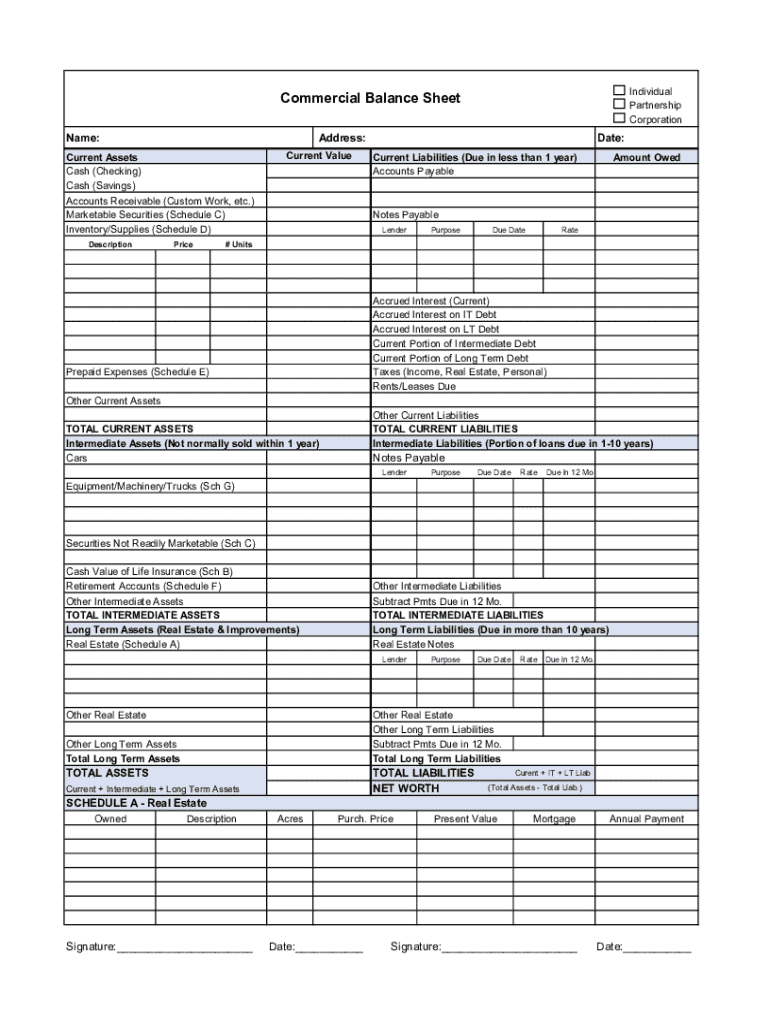

A commercial balance sheet is a crucial financial statement that provides a snapshot of a company's financial position at a specific point in time. It outlines the assets, liabilities, and owner's equity, serving as a foundation for financial analysis and decision-making. For businesses, stakeholders, investors, and lenders, understanding this document is essential, as it reveals the company's operational efficiency and financial health.

The primary purpose of a commercial balance sheet is to ensure that the company's resources are managed effectively. It presents a clear view of what the company owns versus what it owes, which is vital for assessing solvency and liquidity. Consequently, this financial statement aids in attracting potential investors and securing financing from banks.

Key components of a commercial balance sheet

Importance of the commercial balance sheet

The commercial balance sheet plays a pivotal role in financial decision-making within a business. By regularly assessing financial health, companies can identify strengths and weaknesses in their operations. A robust balance sheet may attract investors and lenders, as it demonstrates the company's ability to manage its resources effectively.

In addition to supporting internal decision-making, the balance sheet is crucial for regulatory compliance and reporting. Different business structures—like sole proprietorships, partnerships, and corporations—must adhere to specific financial regulations. Understanding these requirements helps organizations avoid legal complications and maintain good standing with regulatory bodies.

Structure of the commercial balance sheet form

The basic layout of a commercial balance sheet is straightforward but essential for effective communication. Typically, it starts with header information, including the business name and the date of the report. This is followed by distinct sections for assets, liabilities, and owner's equity.

Presenting financial data clearly is vital. Businesses often utilize standard accounting formats, such as vertical or horizontal layouts, based on their audience's preference. Clarity enhances understanding and allows quick assessments of financial status.

How to fill out a commercial balance sheet form

Filling out a commercial balance sheet form requires careful preparation and attention to detail. Following a systematic approach can ensure accuracy and completeness.

Common mistakes to avoid include misclassifying assets or liabilities and making inaccurate data entries. Regular reviews of calculations and consulting with an accountant can help catch errors before finalizing the document.

Interactive tools for creating a commercial balance sheet

Using online templates and resources can significantly ease the process of creating a commercial balance sheet form. These tools often provide customizable formats which can address the specific needs of various businesses. Many websites offer free downloadable templates, ensuring that users can find a solution that fits their style.

pdfFiller enhances this experience by offering seamless PDF editing options, allowing for integrated eSigning capabilities. Collaboration tools enable team members to work together in real time, ensuring that all stakeholders are involved in the updating and management of financial documents.

Best practices for managing your commercial balance sheet

Regular updates and reviews are perhaps the most crucial best practices when managing a commercial balance sheet. For businesses, keeping current records ensures that the information reflects the latest financial position, enabling informed decision-making. It’s advisable to review the balance sheet quarterly, or at least bi-annually, to ensure timely updates.

Leveraging technology for optimization can also enhance efficiency in maintaining the balance sheet. Utilizing accounting software allows for automated tracking and reporting, minimizing the risk of human error. Furthermore, cloud-based access to documents facilitates collaboration with team members, enabling smooth operation across various departments.

Common mistakes in commercial balance sheets

Despite the ease of filling out a balance sheet, common mistakes can significantly affect its reliability. Misclassification of assets and liabilities often occurs when users do not fully understand the definitions or classifications of different account types. Additionally, overlooking specific entries or inputting incorrect figures can lead to misleading conclusions about financial health.

To ensure accuracy, it’s advisable to conduct double-checking of calculations before finalizing the commercial balance sheet. Engaging a professional accountant for periodic reviews can also pinpoint inconsistencies or errors that may go unnoticed during regular updates.

Real-world examples of commercial balance sheets

Reviewing real-world examples of commercial balance sheets from various industries can provide valuable insights. Different sectors may display distinct patterns in asset-liability ratios, reflecting their operational structures and capital needs. For instance, a tech startup may have a high proportion of intangible assets, while a manufacturing company may show significant investments in physical property and equipment.

By studying these cases, entrepreneurs can gain valuable lessons regarding effective balance sheet management and financial strategy. Insights from successful business owners also reveal practical tips on maintaining accurate and informative balance sheets that reflect true financial health.

FAQs on commercial balance sheets

Questions about the commercial balance sheet often arise, especially among new business owners. One common query is the difference between cash and accrual accounting in balance sheets. Understanding this distinction is key, as it affects how revenue and expenses are recognized within the financial statements.

Additionally, business owners frequently wonder how often they should update their commercial balance sheet. Best practices suggest updating the balance sheet at least quarterly. However, certain businesses may benefit from more frequent updates based on their financial activity. When in doubt, it’s often wise to consult a professional accountant to determine the appropriate frequency based on individual circumstances.

Key takeaways for creating effective commercial balance sheets

Crafting effective commercial balance sheets requires diligence, attention to detail, and a commitment to accuracy. By following best practices, such as regular updates and utilizing the right tools, businesses can ensure their financial statements reflect accurate and timely information.

Additionally, understanding the legal and compliance aspects of commercial balance sheets is crucial. Being knowledgeable about financial regulations can help avoid complications and maintain good standing in the business community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit commercial balance sheet from Google Drive?

Can I sign the commercial balance sheet electronically in Chrome?

Can I edit commercial balance sheet on an iOS device?

What is commercial balance sheet?

Who is required to file commercial balance sheet?

How to fill out commercial balance sheet?

What is the purpose of commercial balance sheet?

What information must be reported on commercial balance sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.