Get the free Business Entity Affiliation Form

Get, Create, Make and Sign business entity affiliation form

Editing business entity affiliation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business entity affiliation form

How to fill out business entity affiliation form

Who needs business entity affiliation form?

A comprehensive guide to the business entity affiliation form

Understanding the business entity affiliation form

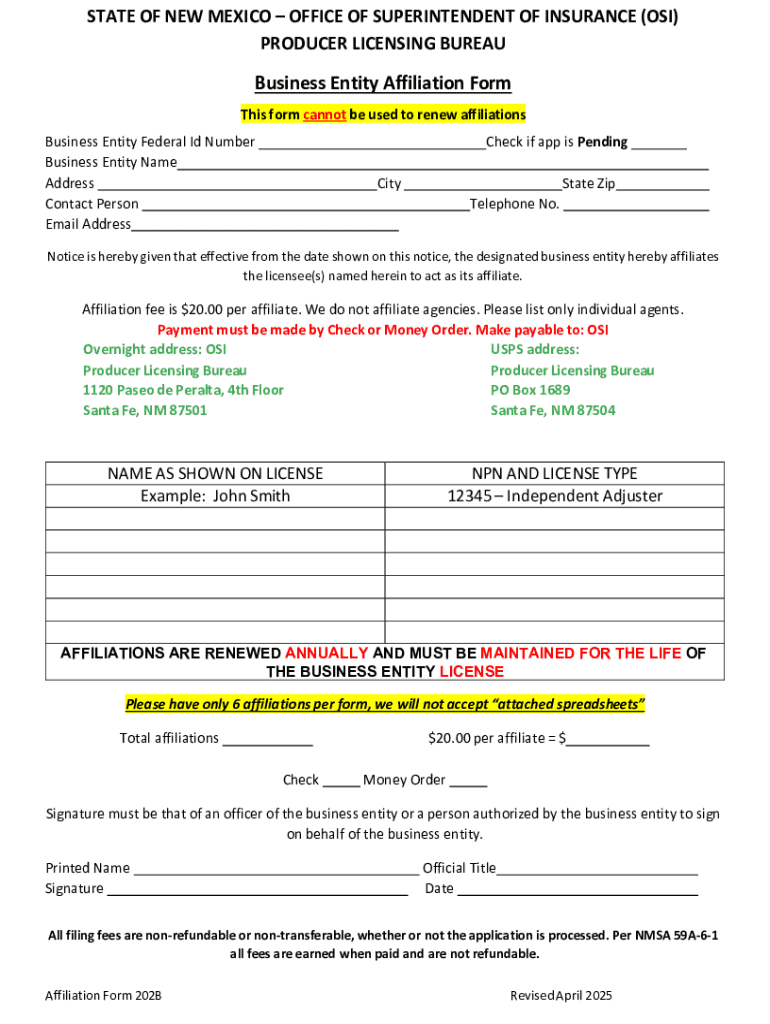

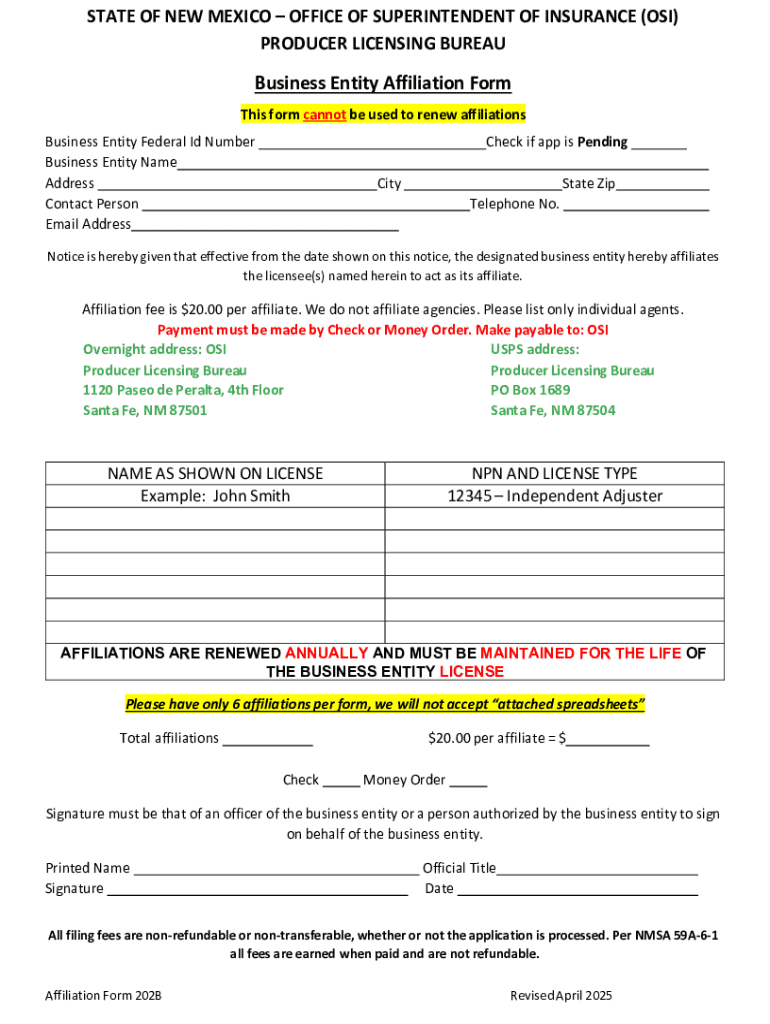

The business entity affiliation form is a crucial document designed to disclose the relationship between various affiliated business entities. Its primary purpose is to provide transparency to regulatory authorities and ensure compliance with legal standards. Companies are often required to complete this form when seeking licenses, permits, or funding, as it serves as a declaration of business relationships that can affect their operational integrity.

This form holds significant importance for businesses as it helps in validating their legitimacy and operational structure. By providing detailed information about affiliations, businesses can avoid potential legal issues and enhance their compliance with federal and state regulations. In a world where corporate governance is under scrutiny, having a properly filled out business entity affiliation form is essential for any company seeking to maintain credibility.

Key components of the business entity affiliation form

Every business entity affiliation form consists of several key components that collectively provide insight into the business’s structure and its affiliated entities. First and foremost, the essential details section captures crucial information about the business such as its name, contact information, and business structure (e.g., LLC, corporation, partnership).

The affiliation information section requires disclosures about individuals and entities that are affiliated with the main business. This includes detailing names, roles of affiliated individuals, and explaining the nature of the relationships between the entities. Such disclosures are significant in helping regulators understand interconnected business operations and the potential influence they might have on one another.

Step-by-step guide to completing the business entity affiliation form

Completing the business entity affiliation form is a detailed process, but with careful attention, it can be managed seamlessly. The first step is to gather all necessary information and documentation needed for this form. This typically includes business licenses, tax ID numbers, and any official records that reflect the structure of the business and its affiliations.

Once you have gathered the required documents, the next step is to fill out the business entity information section, which captures fundamental details about your business. Ensure that the information aligns with official documents to avoid any discrepancies. Common mistakes in this section include inaccurately spelling the business name or providing incorrect contact information, which can lead to delays in processing.

Following the business identification, you will need to disclose affiliation details. This step is pivotal; ensure that you accurately report all affiliations, including any financial or managerial ties to other entities. It’s important to understand what constitutes an affiliation, as overlooking any connections may lead to compliance issues later.

Before finalizing the form, allocate time to review and validate your inputs. Accuracy is paramount, so consider using tools such as compatibility checkers to validate form entries. After making sure everything is in order, you are ready to sign and submit the form. You can use eSigning options available through platforms like pdfFiller, which not only facilitate digital signing but also streamline the submission process, whether you choose to submit digitally or via physical mailing.

Managing your business entity affiliation form

Once the business entity affiliation form has been submitted, you may need to edit or update the information at some point due to changes in your business structure or affiliations. Utilizing the pdfFiller tools allows for efficient editing, helping you keep your records up to date. Regularly reviewing and updating this information is crucial as maintaining accurate business records not only demonstrates compliance but also reflects positively on your business's credibility.

Tracking the status of your submission is also an essential part of managing your form. Through pdfFiller, you can easily check the status of your submission. Understanding response times and knowing how to follow up can significantly reduce the anxiety often associated with regulatory compliance.

Common issues and frequently asked questions

Despite the clear guidelines, users often face common problems when dealing with the business entity affiliation form. Typical errors include missing required information or submitting the form without proper signatures. To troubleshoot these problems, it's advisable to keep a checklist of required elements before final submission. If issues persist, seeking assistance through designated contact points can provide clarity.

Many queries arise regarding deadlines and specific submission guidelines for the business entity affiliation form. Businesses should familiarize themselves with these aspects to optimize compliance. Information related to when to submit updates, what to disclose, and best practices is crucial for ensuring smooth operations.

The benefits of using pdfFiller for form management

Employing pdfFiller for managing your business entity affiliation form has multiple advantages. Its all-in-one platform for document creation and management streamlines the entire process, allowing you to edit, eSign, and collaborate effectively. This not only saves time but also ensures that all team members have access to the latest information and can contribute to the document with ease.

Security is a paramount concern when managing sensitive business data. pdfFiller provides robust security measures to protect your documents, ensuring compliance with relevant legal standards for document management. This gives businesses the confidence that their information is safeguarded while remaining readily accessible when needed.

Additional tips for successful form management

To ensure success in managing your business entity documents, consider implementing best practices for organization. Establishing effective strategies for document storage, retrieval, and regular updates keeps your business profile accurate and up to date. This proactive approach can significantly enhance operational efficiency while reducing the risks associated with outdated information.

Additionally, leveraging pdfFiller’s wide array of features, including templates, workflows, and integrations can further improve team productivity. Utilizing these advanced functionalities can transform how your team collaborates on documents while maintaining clarity and coherence across all communications.

Real-life examples of successful use cases

Numerous businesses have navigated the affiliation process successfully due to diligent management of their business entity affiliation form. For example, a local partnership that needed to obtain funding for expansion efficiently utilized the form to outline its structure and affiliations, resulting in a smooth approval process. Case studies like this illustrate the diverse applications of this form and impart valuable lessons regarding the importance of having all necessary information organized.

These real-world scenarios reinforce how crucial the business entity affiliation form is to a business’s operational success and legal standing. Each example showcases the need for businesses to remain vigilant about their affiliations and the integrity of the information they provide.

Final recommendations for working with business entity affiliation forms

In summary, businesses must approach the business entity affiliation form with meticulous attention to detail. From gathering necessary information through accurate reporting of affiliations, each step plays a pivotal role in regulatory compliance and the overall success of a business. It's highly recommended to take full advantage of tools provided by pdfFiller to enhance document management processes, ensuring efficiency and accuracy.

Finally, don’t overlook the importance of regularly reviewing and updating your form to reflect any changes within your business structure or affiliations. This continuous engagement will keep your operations compliant and foster a transparent relationship with regulatory bodies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business entity affiliation form in Chrome?

Can I create an electronic signature for the business entity affiliation form in Chrome?

Can I create an electronic signature for signing my business entity affiliation form in Gmail?

What is business entity affiliation form?

Who is required to file business entity affiliation form?

How to fill out business entity affiliation form?

What is the purpose of business entity affiliation form?

What information must be reported on business entity affiliation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.