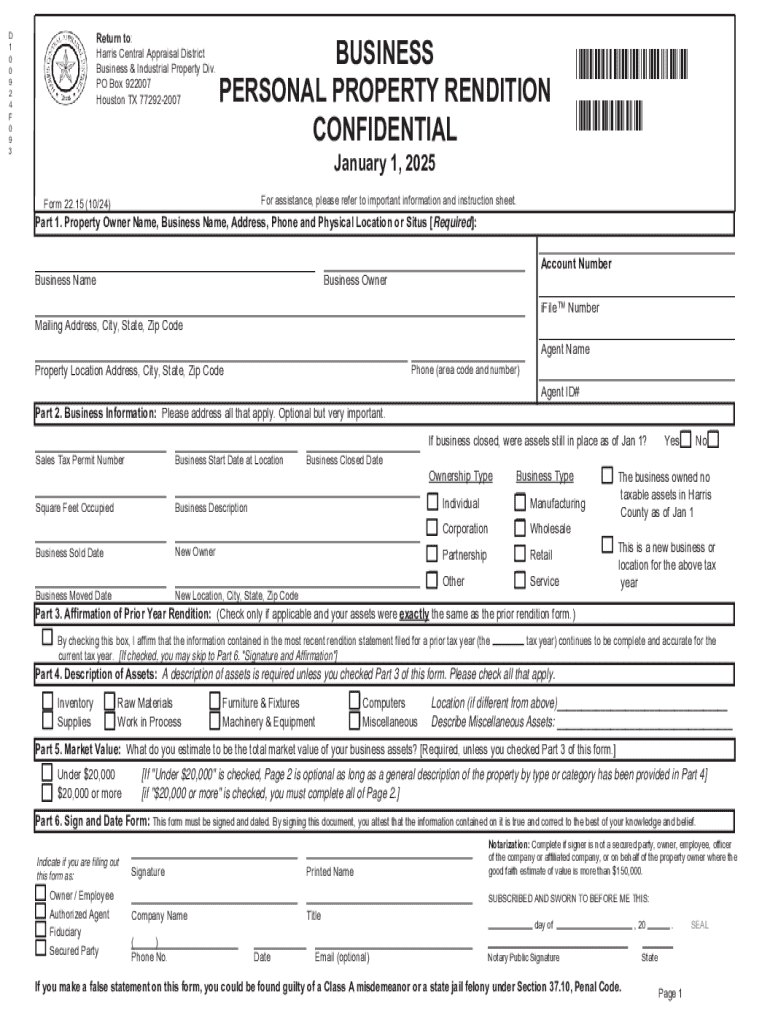

Get the free Personal Property Rendition

Get, Create, Make and Sign personal property rendition

Editing personal property rendition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal property rendition

How to fill out personal property rendition

Who needs personal property rendition?

Understanding the Personal Property Rendition Form: A Comprehensive Guide

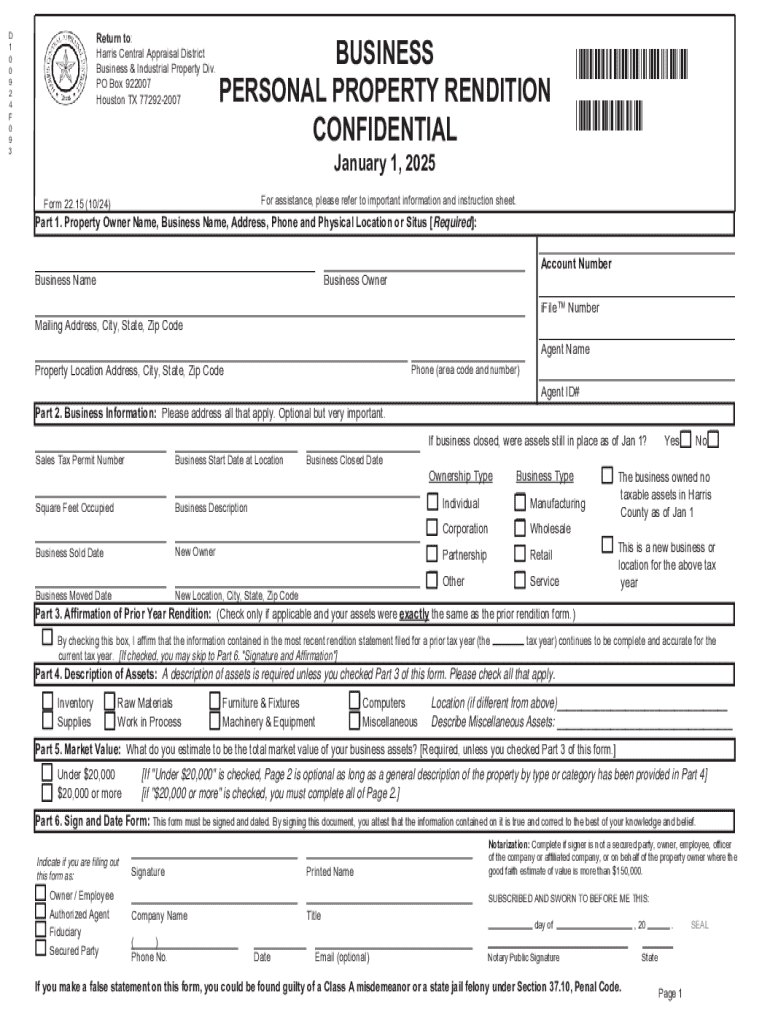

Understanding the personal property rendition form

A personal property rendition form is a critical document required by individuals and businesses to report their personal property to the local appraisal district for tax purposes. This form serves the essential function of enabling taxation authorities to assess the value of personal property, ensuring fair and accurate tax assessments. This process is vital for maintaining proper taxation within a community.

Accurate reporting through the personal property rendition form allows local governments to allocate resources based on actual property value, impacting public services such as education, infrastructure, and emergency services. Therefore, understanding how to complete and file this form accurately is paramount for both businesses and individuals subject to property tax.

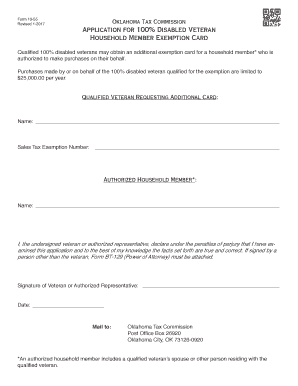

Eligibility and requirements

Most individuals and businesses that own personal property are required to file a personal property rendition form annually. This includes any entity that holds personal property within the jurisdiction. Notably, small or certain low-value personal properties may qualify for exemptions; however, verifying eligibility with local appraisal districts is crucial.

Documentation plays a key role in the completion of the personal property rendition form. You’ll need to gather essential documents demonstrating ownership and value of the reported personal property. Commonly requested items include purchase receipts, business records, and asset valuation reports. Acquiring these documents ahead of time will streamline the filing process.

Filling out the personal property rendition form

Completing the personal property rendition form involves several steps that ensure accuracy and compliance. Start by downloading the necessary form from your state's appraisal district website or utilizing platforms like pdfFiller, which provides editable document templates.

Once you have the form, begin by entering your personal information, including the name, address, and contact details of the property owner. Next, report property valuations, where evaluating personal property value is crucial. Be honest and precise in reporting, as discrepancies can lead to penalties or increased scrutiny.

Depending on the nature of your personal property, you may need to include additional schedules or information. Always double-check the form for accuracy, ensuring all sections are filled out completely to avoid delays in processing.

Filing deadlines and submission methods

Filing deadlines for the personal property rendition form vary by jurisdiction, but they typically need to be submitted annually by a specified deadline, often aligning with the local tax year. Missing this deadline can lead to penalties or a default valuation by the appraisal district, which may not be in your favor.

Submitting the form can be done through various methods. Many appraisal districts now offer online filing options via platforms like pdfFiller, allowing for a streamlined process that includes electronic signatures, document editing, and secure submissions. Alternatively, the form can also be submitted via email or traditional mail, depending on your preference.

Frequently asked questions (FAQs)

Individuals often have common questions regarding the personal property rendition form due to its specific nature and implications. Knowing when to file and understanding the consequences of missing deadlines is essential. As a general guideline, renditions are typically due on a set date, often January 1 or April 15, depending on local regulations.

Failure to file on time can lead to penalties, an estimated tax, or missed exemptions, significantly impacting your overall tax liability. Many appraisal districts are now accommodating electronic filings, making it easier for businesses to comply with taxation requirements. Furthermore, individuals may wonder about public access to business records and what happens if circumstances, such as a business relocation, occur within the year.

Special situations and considerations

It’s essential to recognize that new businesses have unique newcomer requirements when filing the personal property rendition form. Startups must navigate regulations and deadlines carefully to avoid pitfalls that could impede their growth. As such, seeking assistance from seasoned professionals or local appraisal districts can provide clarity and guidance.

Additionally, businesses may experience changes in property value throughout the year due to expansion, downsizing, or market fluctuations. Reporting significant changes accurately ensures compliance, helping you avoid penalties or assessments that are not aligned with your actual property value. In cases where personal and business property are mixed-use, specific tax considerations must also be taken into account, ensuring the correct handling of all properties in the rendition.

Resources and tools for managing your personal property rendition

Utilizing pdfFiller’s interactive tools simplifies seeking and managing your personal property rendition form. With features allowing users to edit documents, collaborate with team members, securely e-sign, and store files easily online, pdfFiller delivers an efficient filing experience.

Additionally, accessing local appraisal district contact information is crucial for clarifying specific requirements or addressing unique situations regarding your filings. Keeping essential forms and related documents organized will facilitate timely submissions and accuracy in your tax reporting.

Conclusion: The importance of filing your personal property rendition form

Filing the personal property rendition form accurately and on time is not just a legal obligation but also a significant factor influencing your financial standing. Compliance with tax regulations ensures fairness in the assessment process, allowing local governments to function effectively.

By utilizing tools like pdfFiller, you can navigate the complexities of this process with ease, ensuring your submissions are correct and timely. The ease of electronic submission and collaboration makes it simpler than ever to stay compliant while taking control of your personal property management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal property rendition for eSignature?

How do I make edits in personal property rendition without leaving Chrome?

Can I create an electronic signature for the personal property rendition in Chrome?

What is personal property rendition?

Who is required to file personal property rendition?

How to fill out personal property rendition?

What is the purpose of personal property rendition?

What information must be reported on personal property rendition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.