Get the free trust account opening form

Get, Create, Make and Sign trust bank account opening form

Editing trust account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out trust account opening form

How to fill out trust account opening form

Who needs trust account opening form?

Comprehensive Guide to Trust Account Opening Form

Understanding trust accounts

Trust accounts represent a form of fiduciary relationship where one party (the trustee) holds and manages assets for another party (the beneficiary). These accounts are pivotal in ensuring that funds are documented, separated, and utilized specifically for a designated purpose, safeguarding the interests of beneficiaries. Commonly utilized in various sectors, trust accounts are essential for managing funds, particularly in legal, real estate, and financial advisory settings.

The importance of trust accounts in financial management cannot be understated. They provide a level of organization and trust in financial transactions, ensuring that funds are used per the trust's specifications. For individuals and entities involved in transactions requiring third-party oversight, trust accounts offer necessary protection and peace of mind.

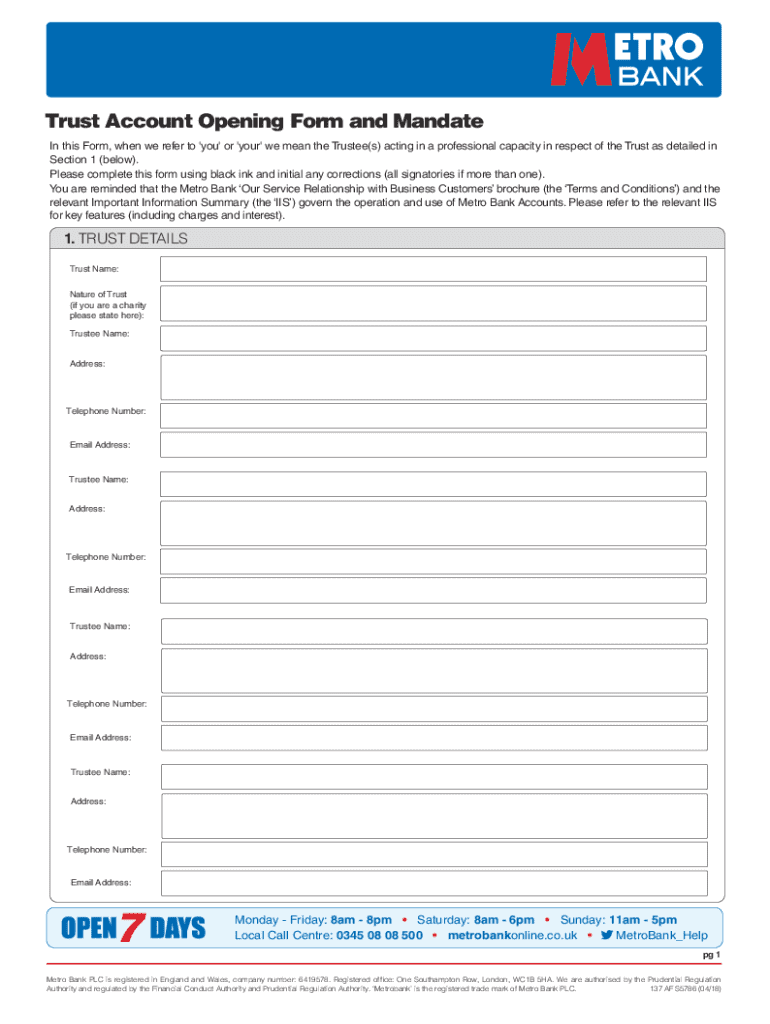

Trust account opening form overview

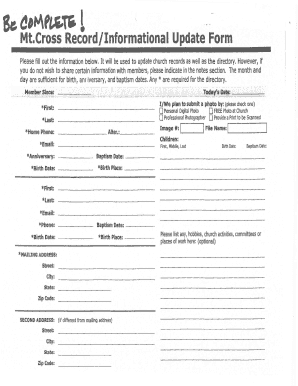

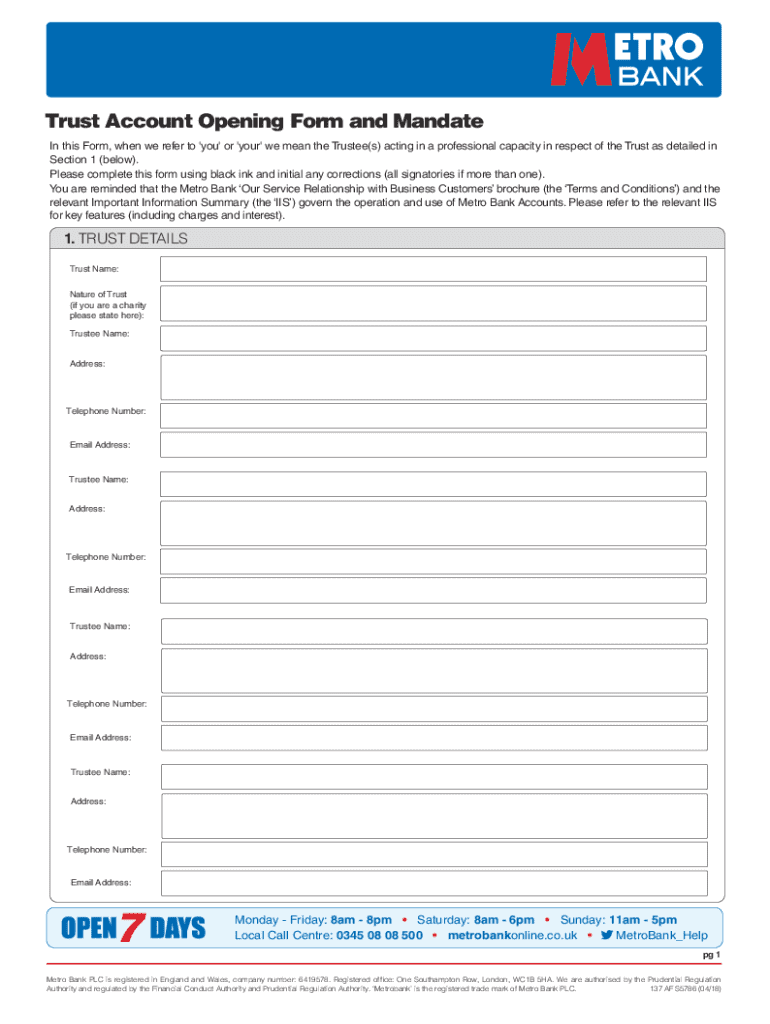

The Trust Account Opening Form is designed to streamline the process of establishing a trust account. This form captures essential information required by financial institutions to set up and manage trust accounts effectively. It serves both as a regulatory compliance tool and a means to ensure that all necessary party details are collected accurately.

Individuals who are setting up a trust account, including trustees, beneficiaries, and legal representatives, must fill out this form. It is crucial for anyone who is establishing trust arrangements, such as parents opening custodial accounts for their children or business entities forming employee benefit trusts.

Preparing to fill out the trust account opening form

Before filling out the Trust Account Opening Form, it is crucial to gather the essential information needed to avoid delays. Personal identification, including your Social Security number or driver's license, is mandatory. Additionally, provide financial information detailing the source of funds for the trust and the intended use of the account. This transparency ensures compliance and eases the processing of the application.

A robust documentation checklist will help ensure all necessary materials are in place. Be prepared to submit proof of identity and address verification documents. Such documents could include recent utility bills, bank statements, or government-issued ID.

Step-by-step guide to completing the form

To begin, access the Trust Account Opening Form through pdfFiller. Navigate to the platform and search for the form to easily download or fill it out digitally. The platform offers user-friendly interactive features, making the form-filling process straightforward.

When filling out your personal information, accuracy is key. Double-check all names, dates, and identification numbers to prevent potential issues during processing. Common mistakes include transposing numbers or misspelling names, which can lead to unnecessary delays.

Next, provide specific details regarding the type of trust. This may involve answering questions about the nature of the trust and including any additional terms that should be outlined clearly. It’s crucial to understand and articulate these specifications as they dictate how the trust operates.

Once you have filled in your details, take a moment to review all information meticulously. Engaging in a thorough review not only helps catch any errors but ensures accuracy in the details you’ve provided. Should you need to make edits, pdfFiller allows for easy corrections to be made at any stage of the process.

Finally, proceed to sign and submit the form. Utilize digital signing options available on pdfFiller for a secure transaction. Ensure that you have submitted the form through the advised secure channels for processing.

Frequently asked questions (FAQs)

Many common queries arise concerning the Trust Account Opening Form. Users often inquire about the necessary additional documentation that may differ based on account type and jurisdiction, and it's essential to familiarize yourself with these nuances.

Troubleshooting tips are invaluable for navigating potential issues during the application process. Regularly consult the support resources provided by pdfFiller and stay informed about common pitfalls, which include not providing adequate detail on funding sources or neglecting required signatories.

Trust services: A broader perspective

Understanding the broader landscape of trust services is essential for appreciating the functionality of trust accounts. Additional services can range from asset management to estate planning, providing clients with comprehensive solutions tailored to their needs.

Trust services work in conjunction with trust accounts to ensure that financial holdings are managed efficiently and effectively. Real-life applications can be seen in industries such as real estate, where funds are held in trust during transactions to protect buyers and sellers until all conditions are satisfied.

Jurisdictions and regulatory considerations

Trust account operations are governed by regulations that vary by jurisdiction. Understanding these local compliance requirements is critical for any entity looking to establish a trust account. Each state or region may impose different obligations in terms of documentation, account maintenance, and reporting.

Resources for state-specific regulations can often be found through local government websites or financial institutions; ensuring you have access to accurate information about the legal framework in your area can empower you to navigate the complexities of trust management successfully.

Engaging with pdfFiller’s tools for document management

pdfFiller enhances trust account management through an array of tools designed for efficient document handling. The features allow users to edit PDFs effortlessly, ensuring that you can make any necessary changes to the Trust Account Opening Form swiftly without needing to start from scratch.

Notably, pdfFiller also provides eSigning capabilities for secure transactions and allows for collaboration on trust account forms among different team members, ensuring that all parties are kept in the loop throughout the process. With cloud-based solutions, accessing your forms from anywhere becomes a reality.

Expertise and support

pdfFiller offers robust support for clients navigating the complexities of trust account openings. With dedicated teams ready to assist, users can schedule consultations for intricate trust account setups. It’s beneficial to utilize these services, particularly if your trust account involves multiple parties or complex terms.

Sharing success stories from users who have successfully established their trust accounts can offer insights and motivate new clients. Learning from others who have navigated similar processes can equip you with the knowledge needed to avoid common pitfalls.

Connecting with pdfFiller

Accessing the client portal provided by pdfFiller is straightforward and offers immense benefits for ongoing document management. Users can manage all their forms and documents securely, ensuring they remain organized and accessible.

For personalized assistance, pdfFiller offers various contact options, allowing individuals to connect regarding any inquiries or support needs. Staying informed about future features and updates ensures users maximize the utility of the pdfFiller platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send trust account opening form for eSignature?

How do I make edits in trust account opening form without leaving Chrome?

Can I sign the trust account opening form electronically in Chrome?

What is trust account opening form?

Who is required to file trust account opening form?

How to fill out trust account opening form?

What is the purpose of trust account opening form?

What information must be reported on trust account opening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.