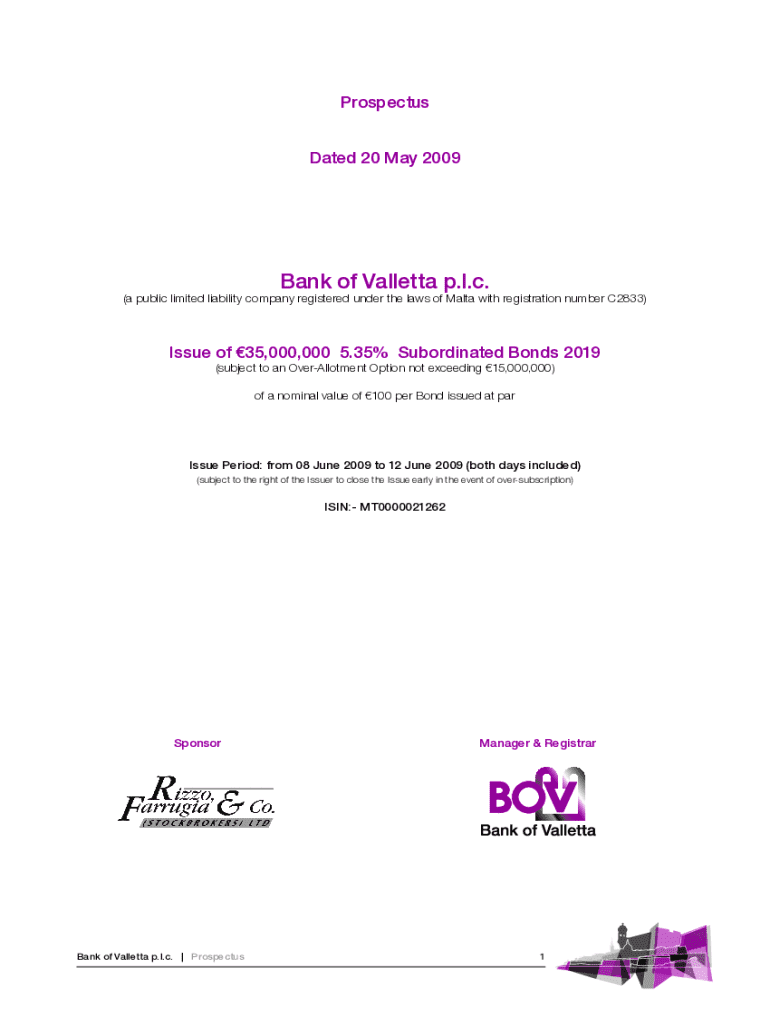

Get the free Prospectus for Bank of Valletta P.l.c.

Get, Create, Make and Sign prospectus for bank of

Editing prospectus for bank of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out prospectus for bank of

How to fill out prospectus for bank of

Who needs prospectus for bank of?

Creating an Effective Prospectus for Bank of Form: A Comprehensive Guide

Understanding the prospectus for bank of form

A prospectus for a bank of form serves as a crucial document that outlines the specifics of banking services offered to potential clients. This document not only presents the services in detail but also portrays the credibility and professionalism of the bank. Essentially, a bank prospectus is a formal declaration, often required by regulatory authorities, providing detailed information about the bank's structure, governance, products, and associated risks.

Key components of a bank prospectus include an overview of services, governance details, financial performance, and risk management strategies. The purpose of a prospectus is twofold: it ensures transparency for prospective clients and satisfies legal obligations, making it a vital tool for any banking institution.

Essential information to include in a bank prospectus

When compiling a bank prospectus, it's essential to provide comprehensive and clear information about the services available. Your overview should detail the types of accounts offered such as checking accounts, savings accounts, loans, investments, and any other services. Additionally, providing clarity on fees and charges associated with each service is crucial as it helps potential customers understand what to expect.

Additionally, elucidating the governance and operational structure is key. This includes short biographies of the management team, which allows potential clients to gauge the leadership's knowledge and experience. Complementing this is an assessment of the bank's financial health, utilizing key performance metrics to demonstrate stability and performance indicators.

Risk management strategies are also pivotal. Providing an overview of risk assessment policies helps instill confidence, while outlining regulatory compliance measures assures clients of the bank's adherence to legal obligations.

Step-by-step guide to creating your bank prospectus

Creating a detailed prospectus involves a systematic approach. The first step is to gather all necessary information. Each piece of data should be verified to ensure accuracy, including obtaining documents from legal, compliance, and operational teams. Sources may vary from internal reports to market analysis.

Next, structure your document to enhance clarity. A logical flow, starting from the overview to specific details allows readers to follow along without confusion.

When writing the content, abiding by best practices is crucial. Use clear, concise language tailored to your target audience’s understanding. Graphics and charts can enhance comprehension of financial data.

Lastly, design considerations are important. Utilize tools that emphasize visual aesthetics to make the document engaging, ensuring that critical information stands out and that such elements translate well across various formats.

Editing and reviewing your bank prospectus

Once your draft is complete, the importance of proofreading cannot be overstated. This step aids in catching typographical and factual errors, which could undermine credibility. Having multiple reviewers can assist in providing varied perspectives; consideration of collaborative tools facilitates this process.

Common mistakes to avoid include factual inaccuracies, overstated benefits, and unclear language. Each component of the prospectus must accurately reflect the services and values of the bank to foster trust with prospective clients.

Interactive features and tools for bank prospectus management

The advent of cloud-based document management systems has revolutionized how financial institutions create and manage their prospectuses. Utilizing tools offered by platforms like pdfFiller provides significant advantages in terms of accessibility and collaboration.

Additionally, real-time collaboration tools allow teams to work simultaneously, ensuring updates and revisions are captured instantly. Version tracking is essential in maintaining the document’s integrity, allowing you to revert to earlier versions if necessary.

Tips for distributing your bank prospectus

Distributing your bank prospectus effectively requires strategic planning. Utilizing channels such as email distribution lists and newsletters helps reach a broad audience quickly. Online banking platforms and the bank’s website can also serve as vital touchpoints for prospective clients.

After distribution, it’s imperative to collect feedback and analyze responses. This data can inform necessary adjustments, leading to continuously refined versions of the prospectus. Ongoing management also includes regular updates to keep the content current as policies and services evolve.

Regulatory considerations and compliance

Compliance with federal and state regulations is a cornerstone of creating a bank prospectus. Institutions must stay informed of changing legal requirements that govern financial disclosures to avoid potential liabilities. Understanding the specific aspects of the law that pertain to your banking services is fundamental.

Legal compliance not only protects the bank but also builds trust among clients. Regular audits of both the prospectus and associated processes can help identify areas for improvement, ensuring that the institution remains within legal bounds.

Leveraging your prospectus for business growth

A well-crafted bank prospectus can serve as a powerful marketing tool. It not only informs potential clients about available services but also builds credibility and trust. Using appealing case studies and success stories within the prospectus can effectively showcase the bank's achievements and attract interest from new clients.

Furthermore, employing strategic marketing initiatives tied to the prospectus can enhance visibility and engagement. An effective prospectus can act as a storybook of the bank's values and successes, helping to convert inquiries into solid customer relationships.

Advanced techniques for customization and integration

To maximize the effectiveness of your bank prospectus, consider integration with other financial and CRM tools. This enables a seamless flow of data and analytics, ensuring that every client interaction is informed by a comprehensive understanding of their needs.

Employing advanced editing techniques through pdfFiller tools allows for unique customizations that resonate with individual client needs. Personalization enhances client engagement and fosters a deeper connection with your offerings.

Frequently asked questions (FAQs)

Creating and managing a prospectus raises numerous inquiries, especially regarding content requirements, legal compliance, and distribution strategies. Addressing these common questions helps demystify the process, paving the way for effective utilization of the prospectus.

Consider putting together a resource or FAQs section on your website for user reference. This handy guide can serve as a point of contact for clarifying uncertainties and guiding users through the prospectus creation process.

Community and support

Engaging with professionals in the document management field can provide valuable resources for further learning. Participating in forums and user groups can foster learning and collaboration, while accessing support resources from pdfFiller can enhance your ability to maximize its features effectively.

Building a community around bank prospectus management will not only aid in more successful document creation but will also grow your professional network within the finance industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in prospectus for bank of without leaving Chrome?

How do I complete prospectus for bank of on an iOS device?

Can I edit prospectus for bank of on an Android device?

What is prospectus for bank of?

Who is required to file prospectus for bank of?

How to fill out prospectus for bank of?

What is the purpose of prospectus for bank of?

What information must be reported on prospectus for bank of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.