Get the free Trade Credit Trader Whole Turnover Proposal Form

Get, Create, Make and Sign trade credit trader whole

How to edit trade credit trader whole online

Uncompromising security for your PDF editing and eSignature needs

How to fill out trade credit trader whole

How to fill out trade credit trader whole

Who needs trade credit trader whole?

Understanding Trade Credit: A Comprehensive Guide to Trade Credit Trader Whole Form

Understanding trade credit

Trade credit represents a crucial component of business-to-business transactions, allowing companies to buy goods or services on account and delay payment. Primarily utilized by suppliers and buyers in various industries, trade credit enables businesses to manage cash flow while maintaining operational stability.

Its flexibility is vital in modern business scenarios, allowing companies to invest in growth while ensuring financial liquidity. By providing short-term financing, trade credit can help businesses navigate seasonal fluctuations, unexpected expenses, or expansion plans without immediate cash outlay.

Types of trade credit

Trade credit can be categorized in various ways, depending on the duration and structure of the credit offered. Typically, it can be split into short-term and long-term categories, influencing how businesses approach their financing strategies.

Trade credit financing

Trade credit financing refers to the arrangements made between buyers and suppliers to facilitate purchasing without immediate cash exchange. Businesses leverage this financing option to bolster liquidity and operational efficiency.

Essentially, trade credit functions as a financial lifeline, permitting companies to acquire necessary inventory without a large upfront cost. This adds flexibility to their cash flow and enables them to allocate resources to other investments or contingencies.

Recording trade credit

Accurate recording of trade credit transactions is imperative for operational clarity and financial reporting. Businesses should follow structured procedures to maintain transparency regarding their trade credit activities.

A systematic approach includes documenting the trade credit agreements, transaction details, and payment terms while ensuring compliance with accounting standards.

Cost of trade credit

The cost of trade credit is an essential consideration, as it affects both the buyer and seller within the transaction. While trade credit itself does not incur direct interest like traditional loans, there can be hidden costs, including potential late fees or reduced discounts for early payments.

Businesses must calculate the overall cost of trade credit carefully, including understanding payment terms and any associated penalties.

Advantages and disadvantages of trade credit

Trade credit provides several benefits and opportunities for buyers while posing certain risks for sellers. Understanding these dynamics is vital for all parties involved in the trade credit process.

Best practices for extending and utilizing trade credit

Best practices are instrumental in ensuring that trade credit processes work effectively for both buyers and sellers. Establishing strong credit policies and consistently monitoring them can help mitigate risks.

Real-world examples of trade credit scenarios

Case studies illuminate the practical application of trade credit in various industries. Businesses that effectively utilize trade credit often achieve enhanced operational dynamics and improved supplier relationships.

FAQs about trade credit

Understanding trade credit necessitates addressing common inquiries about its processes and implications. Knowing what trade credit encompasses can assist organizations in optimizing their financial strategies.

Making smarter vendor choices to minimize credit risk

Choosing the right vendors is pivotal in minimizing credit risk associated with trade credit. By evaluating vendor credibility diligently, businesses can safeguard their financial interests.

Enhancing your credit management strategy

A robust credit management strategy is essential for optimizing the benefits of trade credit. Effective collections management and cash application processes streamline operations and enhance liquidity.

Integrated solutions for trade credit management

In the digital age, technology plays a pivotal role in trade credit management. Leveraging integrated solutions enhances operational efficiency through streamlined processes and enhanced communication.

Educational offerings

Continuous education is paramount in navigating the complexities of trade credit. Valuable resources like articles, whitepapers, and templates can significantly enhance understanding and implementation of best practices.

Corporate policies influencing trade credit

Corporate policies play a significant role in defining how trade credit is managed within an organization. Having a clear code of ethics and considering human rights can reinforce integrity in trade relationships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find trade credit trader whole?

How do I fill out the trade credit trader whole form on my smartphone?

How do I complete trade credit trader whole on an iOS device?

What is trade credit trader whole?

Who is required to file trade credit trader whole?

How to fill out trade credit trader whole?

What is the purpose of trade credit trader whole?

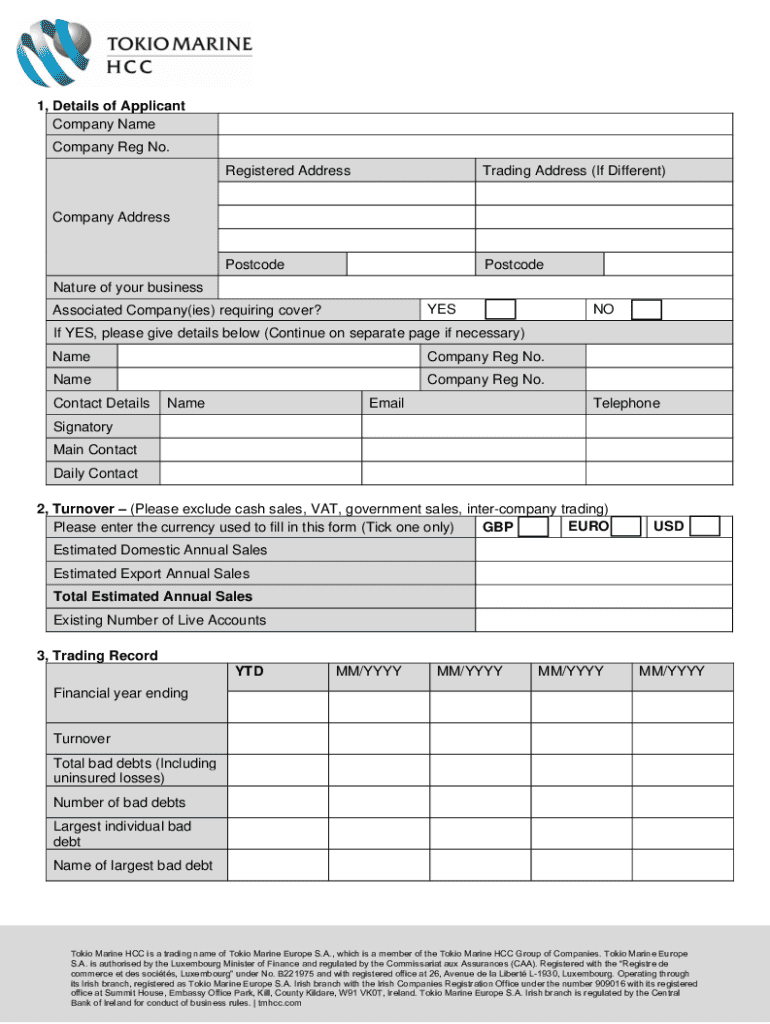

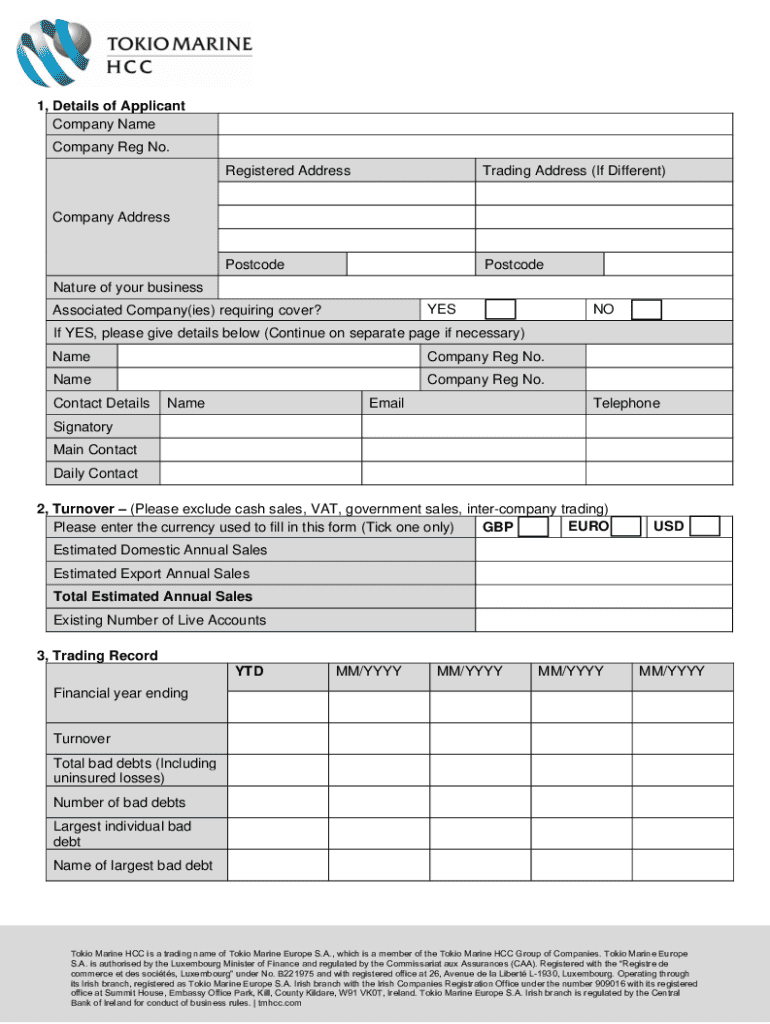

What information must be reported on trade credit trader whole?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.