Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

A comprehensive guide to the beneficiary designation form

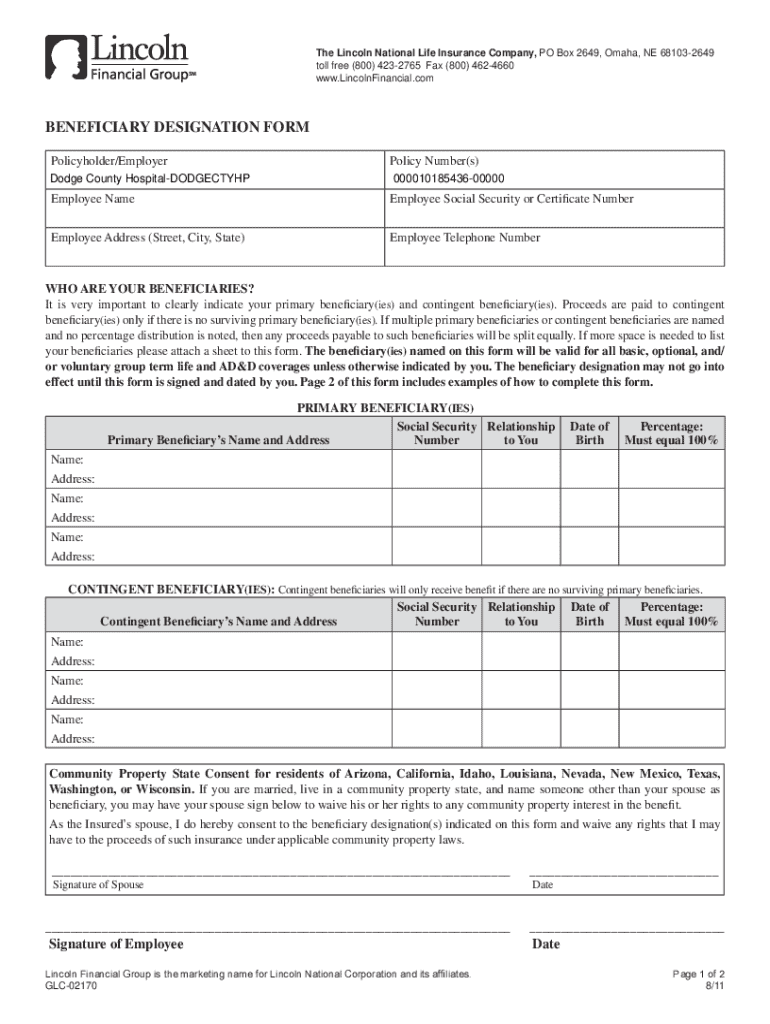

Understanding the beneficiary designation form

A beneficiary designation form is a crucial document that outlines who will receive your assets upon your passing. This form plays a pivotal role in estate planning, ensuring that your wishes are respected and followed.

Designating beneficiaries not only provides clarity on asset distribution but also helps avoid potential disputes among surviving relatives. By completing this form, you can indicate your preferences for various accounts and policies, thus simplifying the transfer process.

Key elements of the beneficiary designation form

Filling out a beneficiary designation form requires specific details to ensure that your wishes are accurately reflected. Essential elements include personal information such as your name, address, and contact details, along with your intended beneficiaries' names and their relationship to you.

If you have multiple beneficiaries, you also need to allocate the percentage of the asset each person will receive. This allocation should total 100%, ensuring clear instructions are provided.

Additional options can also be included in the form, such as designating contingent beneficiaries who would inherit your assets if the primary beneficiary cannot or does not survive you.

Step-by-step guide to completing the beneficiary designation form

Completing a beneficiary designation form can be straightforward if you follow a structured approach. Start by gathering the necessary documentation, including your identification and any relevant account information. This preparation can streamline the process.

Many financial institutions provide online platforms for submitting these forms, simplifying the process. It's important to inquire about the timeline for processing your designation to ensure your wishes are executed as planned.

Editing and managing your beneficiary designation form

Life changes can prompt the need to update your beneficiary designations. Significant events such as marriage, divorce, or the birth of a child are all reasons to reconsider your beneficiaries and make timely updates.

Editing the designation form is often a straightforward process. Many platforms, like pdfFiller, provide user-friendly interfaces for making changes quickly. Regular reviews of your forms can help maintain accurate records, ensuring your estate plan reflects your current situation.

Signing and finalizing your beneficiary designation form

Once the beneficiary designation form is filled out accurately, it requires a signature to be legally binding. E-signature options offer a convenient way to finalize your documents without the need for physical presence.

Utilizing tools like pdfFiller, you can easily e-sign your document, ensuring it remains secure and valid. It's essential to consider state-specific regulations regarding electronic signatures, as some areas may have different requirements for the validity of electronic contracts.

Managing your documents with pdfFiller

pdfFiller ensures that your document management needs are met efficiently and securely. Collaborate with family members and legal advisors by sharing your beneficiary designation form via the platform, fostering transparency and ease of communication.

The cloud storage feature provides access to your forms from virtually anywhere, ensuring that all your important documents are just a click away. This convenience is complemented by strong data security measures, keeping sensitive information protected.

Frequently asked questions about the beneficiary designation form

Many individuals have questions regarding the beneficiary designation form. One common query is about the role of contingent beneficiaries. Contingent beneficiaries are secondary individuals who will receive benefits if the primary beneficiary passes away or is unable to accept them.

Another common concern is what happens if a beneficiary predeceases the account holder. In most cases, if no contingent beneficiary is designated, the asset may revert to the estate, which can lead to complications. Clarifying such nuances is vital to effective planning.

Tools and resources available on pdfFiller

In addition to providing a comprehensive platform for managing your beneficiary designation form, pdfFiller offers interactive tools that simplify the process of form creation and editing. The user-centric features make it easy to navigate through necessary steps, ensuring users can effectively manage their documents.

Additionally, support is readily available for users needing assistance with forms. Tutorials and how-to videos are accessible, guiding you through your document management tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdffiller form from Google Drive?

How do I edit pdffiller form straight from my smartphone?

How do I complete pdffiller form on an iOS device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.