Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

How to edit beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Understanding the Beneficiary Designation Form: A Comprehensive Guide

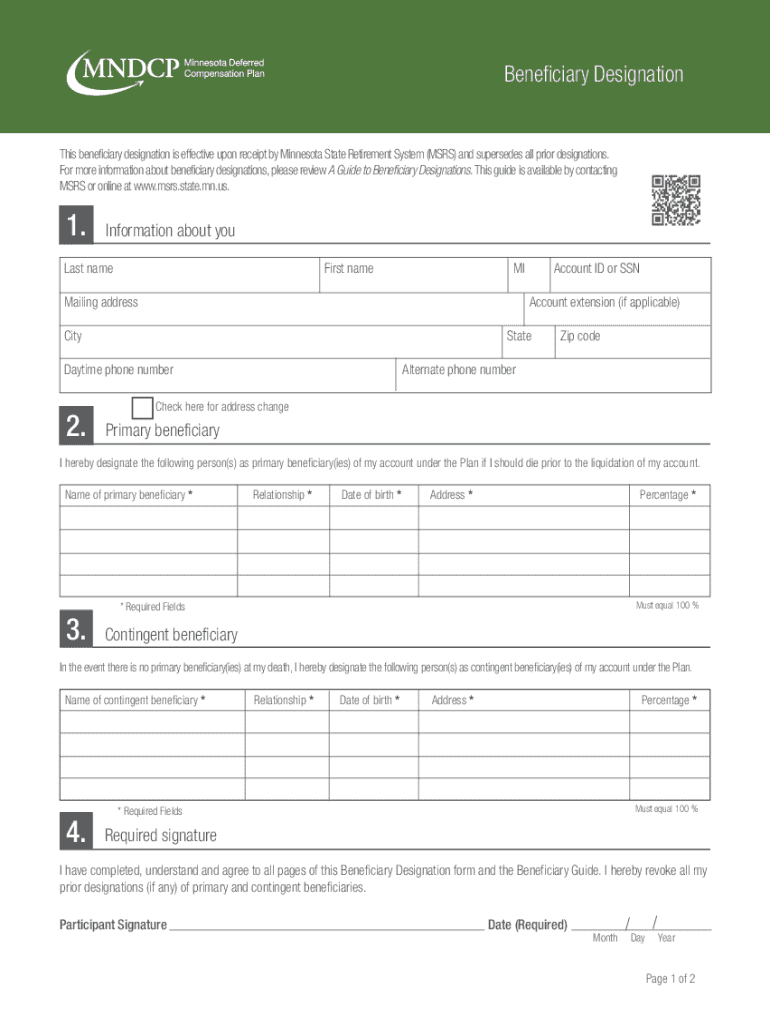

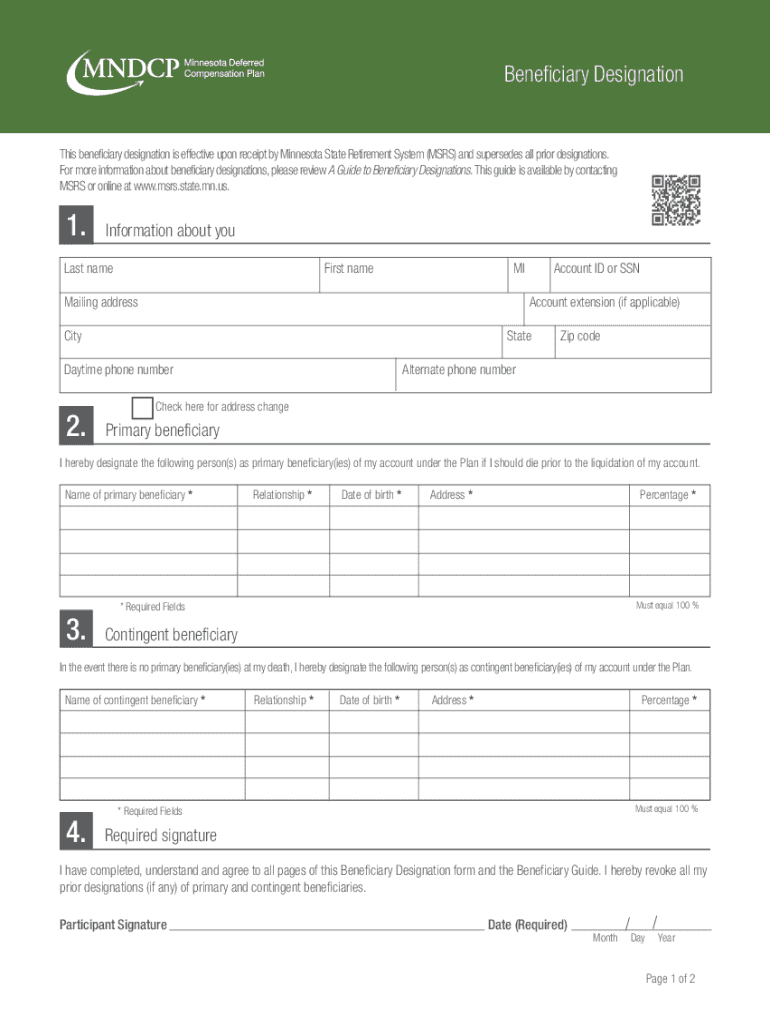

Overview of beneficiary designation forms

A beneficiary designation form is a legally binding document that allows an individual to specify who will receive their assets upon their death. This form plays a crucial role in estate planning, ensuring that the policyholder's wishes are honored without the need for lengthy probate processes. By identifying beneficiaries for specific assets, individuals can streamline the distribution of their estate, making it easier for loved ones during a difficult time.

The importance of beneficiary designation cannot be overstated. This form serves not only as a directive for financial institutions and insurance companies but also as a tool for minimizing potential disputes among heirs. Common assets requiring a beneficiary designation include life insurance policies, retirement accounts like IRAs and 401(k)s, and sometimes even bank accounts.

Key components of a beneficiary designation form

Understanding the structure of a beneficiary designation form is key to completing it correctly. The form typically includes several crucial sections. First is the personal information of the policyholder, which includes essential details like name, address, and date of birth. This information verifies the identity of the person designating the beneficiaries.

Next is the beneficiary information, where individuals designate primary and contingent beneficiaries. Primary beneficiaries are the first in line to receive the assets, while contingent beneficiaries are the backups if the primary beneficiaries are deceased. This section requires detailed information, including full names, their relationship to the policyholder, and the percentage each beneficiary will receive.

Finally, the form generally includes fields for the policyholder's signature and the date of signing. Some forms may allow optional provisions, accommodating special requests or conditions concerning the distribution of assets.

Steps to fill out a beneficiary designation form

Filling out a beneficiary designation form correctly is essential to ensure that your assets are distributed according to your wishes. Start with gathering necessary information, which includes the essential documents like identification, policy numbers, and other pertinent data. This preparation not only makes completion easier but also minimizes the risk of errors.

Step two involves choosing your beneficiaries wisely. Consider family dynamics, dependents, and any financial obligations that might affect your decision. Selecting the right individuals can help prevent disputes or misunderstandings in the future.

Next, complete the form accurately, paying close attention to each field. Commonly missed details could lead to delays in the distribution process, so ensure all information is correct. Following this, review and confirm the details. Double-checking your entries is crucial for compliance with legal requirements.

Finally, submit the form via the preferred method, whether physical mail or through an online platform. Utilizing an online solution like pdfFiller makes submission convenient and efficient, ensuring that your document is securely stored.

Common mistakes to avoid

Even a minor error on a beneficiary designation form can lead to significant complications. One of the most common mistakes is failing to update the form after major life changes, such as marriage, divorce, or the birth of children. Keeping your beneficiary designations current is critical as life circumstances evolve.

Another frequent oversight is neglecting to include contingent beneficiaries. These are essential as they ensure that your assets are allocated according to your wishes, even if your primary beneficiaries are no longer available. Additionally, omitting required signatures or dates can invalidate your designation, making it essential to pay attention to every detail before submission.

Frequently asked questions about beneficiary designation forms

Many individuals have questions regarding beneficiary designation forms. A frequently asked question is, 'What happens if I don’t designate a beneficiary?' In such cases, the asset may be distributed according to state laws, which may differ significantly from the policyholder’s wishes. It is essential to make a designation to have control over the distribution.

Another common query is whether one can change their beneficiary designation. The answer is yes; most institutions allow policyholders to update their designations at any time as long as they follow the correct process. Other questions often include what to do if a beneficiary passes away before the policyholder and what the state-specific regulations are regarding beneficiary designations, as these can vary significantly.

Managing and updating your beneficiary designation form

Managing beneficiary designation forms is an ongoing responsibility. It's crucial to make changes whenever there are significant life events, such as marriage or divorce, that could affect who you want to inherit your assets. Regular reviews of your designations can help ensure they remain aligned with your current wishes.

Keeping thorough records is also essential. Maintain copies of all beneficiary designations made, including any updates or changes. This practice can provide clarity and protect against disputes later on, simplifying the inheritance process for your beneficiaries.

Tools and resources for efficient management

Leveraging technological tools can make managing your beneficiary designation form more efficient. Interactive tools available on pdfFiller allow users to edit, e-sign, and collaborate on documents from anywhere, enhancing the convenience of managing important forms.

Additionally, templates for different types of beneficiary designation forms can help users save time while ensuring all necessary components are included. Utilizing these tools ensures that no critical information is overlooked, making the process of managing your beneficiary designations seamless and effective.

Legal considerations of beneficiary designation forms

Understanding your rights and obligations as a policyholder is vital when filling out a beneficiary designation form. Legalities vary by state, and knowing these can help avoid complications in the future. The role of attorneys in reviewing your designations can be invaluable, especially when dealing with complex family situations or significant assets.

When in doubt, seek professional help to ensure that your designations comply with current laws and accurately reflect your intentions. Engaging a legal expert can clarify your responsibilities and help prevent future disputes that could arise during the asset distribution process.

Real-life scenarios and case studies

Real-life scenarios underscore the importance of properly completing and managing beneficiary designation forms. For instance, a case study of a policyholder who neglected to update their beneficiary following a divorce highlights how the ex-spouse inadvertently received the policy benefits due to a lack of proper documentation.

Conversely, another case demonstrates the effectiveness of designated contingent beneficiaries. In this case, a parent who named a contingent beneficiary ensured their assets were distributed to their intended recipient despite the unfortunate passing of their primary beneficiary. These examples serve to illustrate the potential ramifications of both proper and improper designation management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get beneficiary designation?

How do I execute beneficiary designation online?

How can I edit beneficiary designation on a smartphone?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.